Soy Protein Market Size

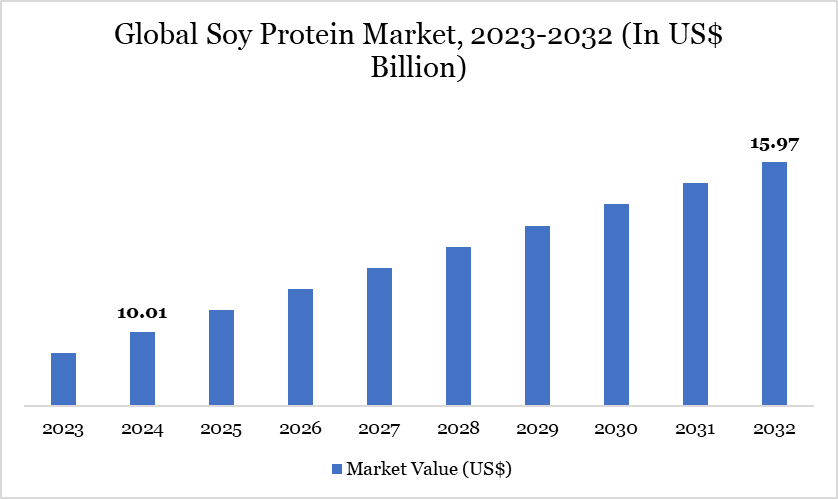

Soy Protein Market reached US$ 10.01 billion in 2024 and is expected to reach US$ 15.97 billion by 2032, growing with a CAGR of 6.01% during the forecast period 2025-2032.

The global soy protein market is witnessing significant growth driven by health-conscious consumer trends, an expanding vegetarian and vegan population and a rising demand for meat alternatives. As consumers increasingly seek healthier dietary options, soy protein’s complete amino acid profile becomes more appealing. Additionally, heightened environmental awareness plays a crucial role, as plant-based proteins like soy typically have a lower carbon footprint.

Manufacturers are expanding their product offerings, contributing to market-wide distribution. In March 2022, Otsuka Pharmaceutical launched SOYJOY Plant-Based bars, featuring 100% plant-based ingredients in white chocolate and banana flavors. This addition caters to health-conscious consumers and aligns with the growing demand for plant-based snacks, boosting Otsuka's presence in the expanding soy protein market.

Soy Protein Market Trend

The increase in veganism and flexitarian diets is creating strong tailwinds for plant-based protein sources. According to data from the World Animal Foundation in 2023, there are over 15.5 million vegans in the US, reflecting a significant shift towards plant-based diets. This growing consumer awareness about health and nutrition has spurred demand for plant-based proteins, with soy emerging as a popular choice due to its complete amino acid profile.

Market Scope

Metrics | Details |

By Type | Soy Protein Isolates, Soy Protein Concentrates, Soy Flours, Others |

By Form | Powder, Bars, Ready to Drink, Capsules & Tablets, Others |

By Distribution Channel | Supermarkets/Hypermarkets, Convenience Store, E-Commerce, Other |

By Application | Food, Pharmaceuticals, Animal Feed, Others. |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Soy Protein Market Dynamics

Growing Demand For Plant-Based Protein

As consumers become more health-conscious, they are increasingly turning to plant-based options and soy protein stands out due to its high protein content and complete amino acid profile. Its potential health benefits, including supporting heart health and weight management, further enhance its appeal. With around 88 million vegans worldwide as of 2022, the shift towards plant-based diets is gaining momentum.

Many flexitarians and health-oriented consumers are also incorporating more plant-based proteins into their diets. As a result, soy protein is becoming a key ingredient in various food products, from meat alternatives to snacks and protein powders. The rising demand for these products creates new opportunities for soy protein as a key ingredient in these products, driving the market growth.

Expansion of the Product Productions

As consumer interest in plant-based diets continues to rise, manufacturers are planning expansion to meet the needs of consumers and consumers alike. For instance, in December 2022, Bunge, a global leader in agribusiness, food, and ingredients, announced plans to invest around $550 million in constructing a fully integrated facility for soy protein concentrate and textured soy protein concentrate. The significant investment drives growth by enhancing production capabilities.

Accordingly, in February 2022, Benson Hill, Inc. introduced TruVail, a line of non-GMO plant-based proteins sourced from ultra-high protein soybeans. These ingredients, including high-protein soy flour and texturized proteins, are less processed than traditional soy protein concentrate, using up to 70% less water and 50% less CO2 emissions. The company emphasizes sustainability through regenerative agriculture practices, ensuring eco-friendly benefits from farm to fork.

Allergies Related to Soy

The global soy protein market faces significant restraint due to the prevalence of soybean allergies. Despite the numerous health benefits of soybeans, they are recognized as an allergenic food, posing serious risks for sensitive individuals. Symptoms of soybean allergy can range from hives and itching to severe respiratory issues and life-threatening anaphylaxis.

With the prevalence of soybean allergies estimated between 0.3% and 3% in the general population and around 0.4% of children affected, the growing awareness and caution surrounding soy consumption are impacting market dynamics. The increased incorporation of soy products in both food and non-food applications has heightened the risk of allergic reactions, further deterring consumers and influencing manufacturers to seek alternative protein sources.

Soy Protein Market Segment Analysis

The global soy protein market is segmented based on type, form, distribution channel, application and region.

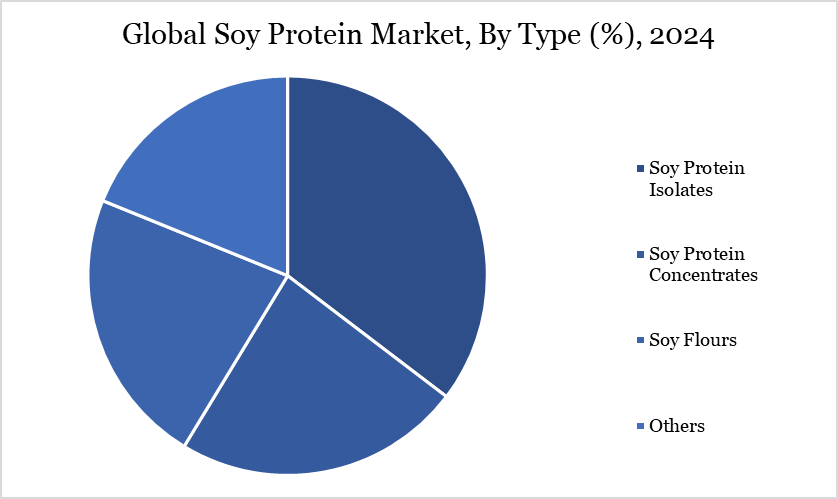

High Protein Content of Soy Protein Isolates

The global soy protein market is segmented based on type into soy protein isolates, soy protein concentrates and soy flours. The soy protein isolates dominate the market primarily due to their high protein content, typically around 88.3 g in 100 gr. This makes them an attractive option for health-conscious consumers and athletes seeking to increase their protein intake. As consumer awareness of plant-based diets continues to grow, the demand for soy protein isolates is likely.

The versatility of soy protein isolate allows for various applications, including meat alternatives, dairy substitutes, protein bars and baked goods. They possess excellent functional properties, such as emulsifying, foaming and water-binding capabilities. These characteristics enhance the texture and mouthfeel of food products, making them particularly valuable in the development of plant-based meats and dairy alternatives.

Soy Protein Market Geographical Share

Leading Role of North America as Soybean Producers

North America, particularly the US, stands at the forefront of the global soy protein market, driven by greater production levels and strategic agricultural practices. In the 2023/2024 production season, the US is projected to contribute a significant 29% of the world’s soybean production, amounting to around 113.34 million metric tons, as reported by the USDA. This dominance not only highlights the US’s critical role in domestic supply but also its substantial impact on international trade.

Valued at US$ 60.7 billion, the US soybean crop is a cornerstone of the agricultural economy, with exports making up a remarkable 52% of total production. This export capability ensures a steady flow of high-quality soybeans to global markets, essential for the manufacturing of soy protein products. As demand for plant-based proteins continues to rise, North America’s robust production capacity and commitment to sustainable farming practices position it as a key player in meeting this growing need.

Sustainability Analysis

The soy protein market demonstrates strong sustainability potential due to its lower environmental footprint compared to animal-based proteins. Producing soy protein requires significantly less water, land, and energy, and generates fewer greenhouse gas emissions. As a plant-based source, soy aligns with growing consumer demand for eco-conscious and ethical food choices. Sustainable farming practices and advancements in non-GMO and organic soy cultivation are also boosting its appeal.

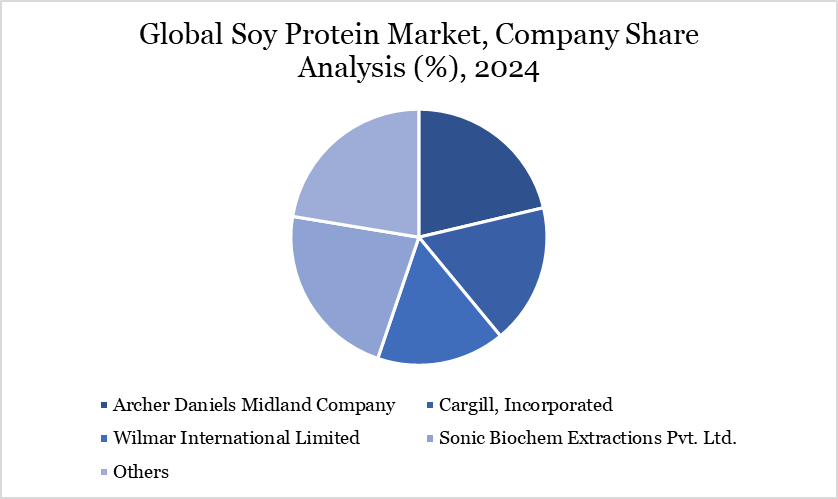

The soy protein market is experiencing significant investment and expansion activities, driven by the growing demand for sustainable and plant-based protein alternatives. For instance, in April 2022, Archer Daniels Midland (ADM) invested approximately US$300 million to enhance soy protein concentrate production at its Decatur, Illinois, facility and has established a new Protein Innovation Center to develop alternative protein solutions.

Soy Protein Market Major Players

The major global players in the market include Archer Daniels Midland Company, Cargill, Incorporated, Wilmar International Limited, Sonic Biochem Extractions Pvt.Ltd., Bunge Limited, FUJI OIL HOLDINGS INC., International Flavors & Fragrances Inc., Benson Hill, Inc., Shandong Saigao Group Corporation and Xinrui Group.

Key Developments

In May 2025, Bunge unveiled a new line of soy protein concentrates at IFFA, featuring a clean taste, neutral color, and cost-effective formulation for food manufacturers. The products, containing around 70% protein and 17% fiber, will be available in powdered and textured formats for diverse applications.

In November 2024, ICL Food Specialties and DAIZ Engineering announced the launch of ROVITARIS SprouTx, a next-generation textured soy protein, at Food Ingredients Europe 2024. Developed using DAIZ’s patented germination technology, SprouTx™ aims to overcome taste and texture challenges in the plant-based meat and seafood sector. The innovative solution offers superior sensory and nutritional performance, enabling manufacturers to create more appealing plant-based alternatives.

In February 2024, Amfora launched its first commercial line of ultra-high protein soy products, including soy flour, texturized vegetable protein, and crisps. Made from proprietary soybeans developed through conventional breeding, these products contain approximately 25% more protein than standard soybeans, with the soy flour offering over 60% protein content.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies