Omega 6 Market Size

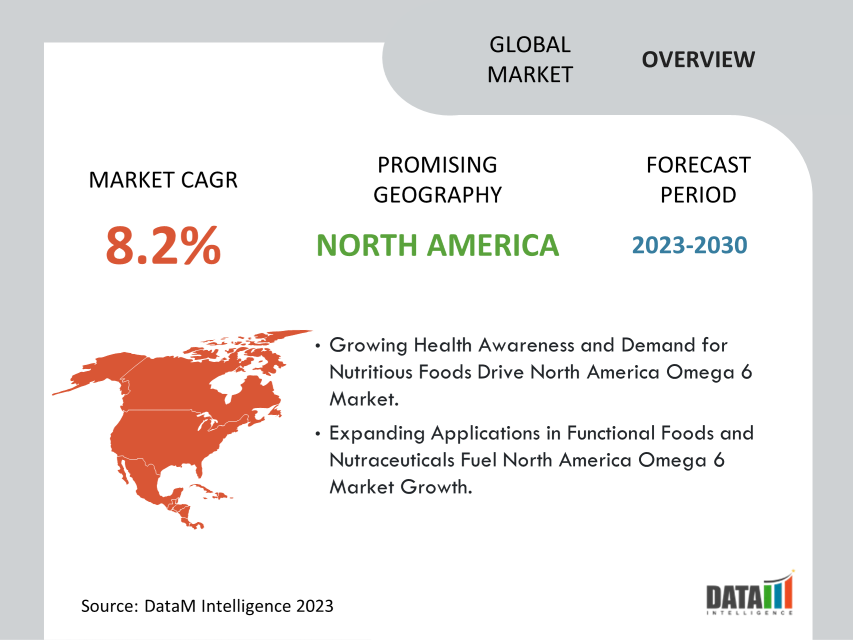

Global Omega 6 Market reached USD 5.6 billion in 2022 and is expected to reach USD 10.5 billion by 2030 growing with a CAGR of 8.2% during the forecast period 2024-2031. The market trend for omega-6 is witnessing a rise in demand for functional food products enriched with essential fatty acids like Linoleic Acid (LA).

As consumers prioritize health and well-being, products with balanced omega-6 to omega-3 ratios are gaining popularity.

The omega-6 market is characterized by a prominent global presence due to its essential role in human health. With a dominating market share of around 80%, Linoleic Acid (LA) is the primary omega-6 fatty acid driving the industry. Growing consumer awareness of healthier dietary fats and expanding applications in functional foods and nutraceuticals are key drivers of the market's growth.

One key market driver for omega-6 is the increasing consumer awareness of the health benefits associated with essential fatty acids like Linoleic Acid (LA). For example, the demand for cooking oils containing high levels of omega-6 has surged as consumers recognize their significance in supporting heart health. This growing consumer preference is encouraging food manufacturers to introduce new omega-6-fortified products, thereby propelling market growth.

Market Scope

| Metrics | Details |

| CAGR | 8.2% |

| Size Available for Years | 2021-2030 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (US$) |

| Segments Covered | Type, Source, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa |

| Largest Region | North America |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For More Insights about the Market Download Sample

Market Dynamics

Growing Consumer Awareness and Demand for Healthier Dietary Fats Driving the Market Growth

The omega-6 market trend is pushed through a surge in consumer consciousness and demand for healthier nutritional fats. As humans come to be greater health-aware, they are actively searching for merchandise with crucial nutrients, including omega-6 fatty acids like Linoleic Acid (LA). The growing occurrence of continual diseases related to bad dietary conduct has sparked a shift towards more healthy consuming alternatives.

Omega-6 fatty acids are recognized for their position in helping cardiovascular fitness, promoting mind features, and assisting immune gadget law. This rising demand has resulted in an expanding omega-6 market share, with manufacturers incorporating LA-rich sources in various food products and supplements. As a result, the omega-6 market size is experiencing significant growth as consumers embrace the benefits of these essential fatty acids.

Expanding Applications in Functional Foods and Nutraceuticals Driving the Market Growth

Another predominant driver of the omega-6 market is the increasing packages of these fatty acids in purposeful meals and nutraceuticals. Manufacturers are incorporating omega-6-rich components, consisting of oils and extracts containing Linoleic Acid (LA), right into a huge variety of useful meal products and nutritional supplements. The growing popularity of those products, which offer health benefits past simple nutrition, is contributing to the increase of the omega-6 market share.

Consumers are looking for convenient and powerful approaches to contain essential vitamins in their everyday routines, similarly boosting the demand for omega-6-rich products. The versatility of omega-6 fatty acids in improving various functional homes of meals merchandise and selling standard nicely-being is fueling the boom of the omega-6 marketplace length, making it an outstanding player in the useful meals and nutraceutical industry.

Imbalanced Omega-6 to Omega-3 Ratio Poses Challenge for Omega-6 Market Growth

One restraint of the omega-6 market is the growing issue of the imbalanced ratio of omega-6 to omega-3 fatty acids within the contemporary food regimen. The present-day Western weight-reduction plan is characterized by a substantially higher consumption of omega-6 fatty acids in comparison to omega-three fatty acids, resulting in an adverse omega-6 to omega-three ratio, regularly estimated at around 15:1 to 20:1.

Health experts recommend an extra balanced ratio, preferably around 4:1 or lower, for the highest quality fitness advantages. The imbalanced intake has been linked to various health issues, such as continual infection and an extended hazard of cardiovascular sicknesses. As customers come to be extra informed about this issue, a few may additionally show off reluctance closer to incorporating additional resources of omega-6 in their diets, probably affecting the omega-6 market boom for a long time.

Market Segment Analysis

The global omega-6 market is segmented based on type, source, application, and region.

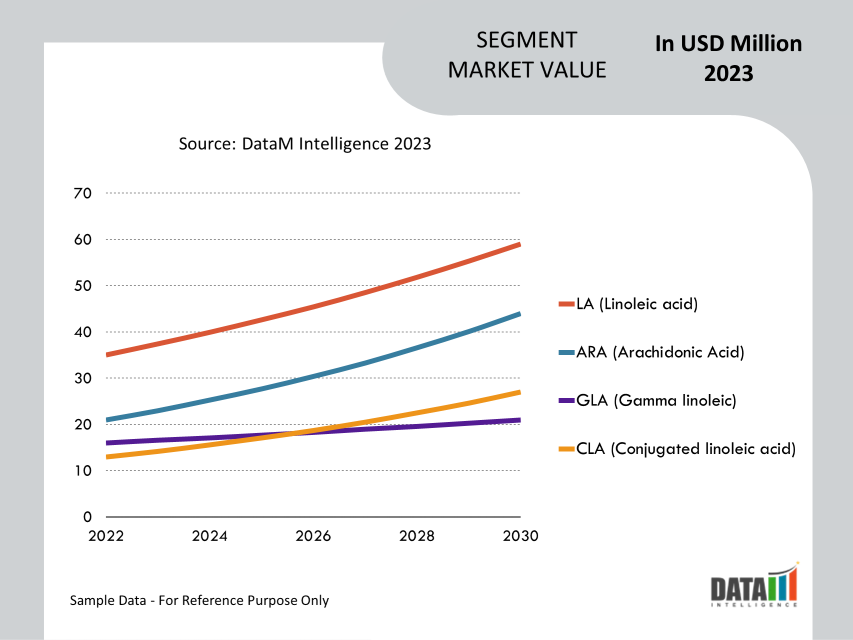

Linoleic Acid (LA) Dominates Global Omega-6 Market with a 80% Share

The global omega 6 market has been segmented by type into LA (Linoleic acid), ARA (Arachidonic Acid), GLA (Gamma linoleic), and CLA (Conjugated linoleic acid).

Linoleic Acid (LA) is dominating the global omega-6 market, with a 80% market share. Linoleic Acid (LA) is an important omega-6 polyunsaturated fatty acid (PUFA) determined in numerous dietary fat. As an important fatty acid, our bodies can't produce LA, necessitating its consumption from food sources. It plays an essential role in maintaining standard health and well-being.

LA serves as a constructing block for mobile membranes, aids in hormone manufacturing, and helps the proper functioning of the immune device. It is likewise a precursor for different omega-6 fatty acids, like ARA and GLA. Rich resources of LA encompass vegetable oils (including corn, soybean, and sunflower oil), seeds, nuts, and sure grains. Achieving a balanced consumption of omega-6 and omega-3 fatty acids is vital for promoting surest health.

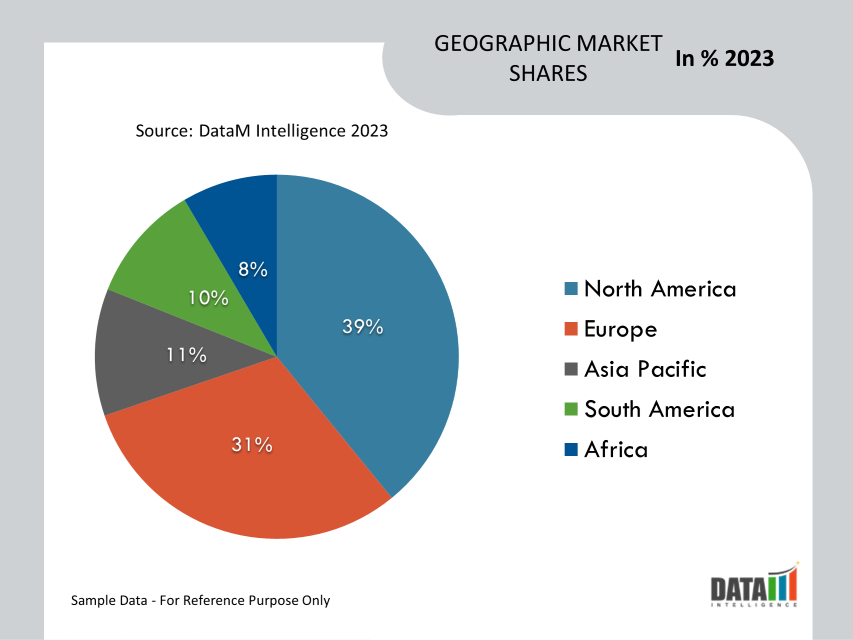

Market Geographical Share

North America Dominates Omega-6 Market Fueled by Rising Demand for Nutritional Benefits and Health-Conscious Choices

North America holds a 40% market share in the Omega-6 market, boasting its dominant market share and substantial market size. The region's significant emphasis on leading healthy lifestyles has influenced the rise in demand for products that include omega-6 fatty acids. Customers are aware of omega-6's nutritional advantages, including how it promotes heart health, brain function, and overall well-being.

Key omega-6 sources, such as vegetable oils and seed oils, including popular options like sunflower oil, continue to be preferred choices for cooking and food processing in the region. With growing awareness of the importance of balanced nutrition, North America remains at the forefront of the omega-6 market, driving its sustained growth and significance.

Omega 6 Market Companies

The major global players in the market include Cargill, Inc., Archer Daniels Midland (ADM), Bunge Limited, BASF, DSM, Omega Protein Corporation, Croda International, Omegavia, Aker Biomarine, and Polaris Nutritional Lipids.

COVID-19 Impact Analysis

Global Recession/Ukraine-Russia War/COVID-19, and Artificial Intelligence Impact Analysis:

Covid-19 Impact:

The COVID-19 pandemic significantly impacted the omega-6 market. As lockdowns and restrictions disrupted global supply chains and restricted consumer movement, demand for omega-6-rich products, such as cooking oils and processed foods, fluctuated. While some regions experienced increased home cooking, others faced decreased restaurant consumption, affecting product sales.

Additionally, economic uncertainties led to price fluctuations and reduced purchasing power. The supplement market, however, saw a mixed impact as health-conscious individuals sought immune-boosting supplements. Overall, the Omega-6 market faced challenges due to shifting consumption patterns and economic pressures during the pandemic.

By Type

- LA (Linoleic acid)

- ARA (Arachidonic Acid)

- GLA (Gamma linoleic)

- CLA (Conjugated linoleic acid)

By Source

- Plant

- Marine

By Application

- Dietary Supplements

- Animal Feeds

- Pharmaceuticals

- Food and Beverages

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Germany

- The U.K.

- France

- Italy

- Spain

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On May 4, 2023, Bold Botanica launched Bold Botanica Bold Plan Omega 3-6-9, which provides plant-based omega-3s from Ahiflower oil. According to the company, it is the most biologically advanced plant-based source of omega-3 and omega-6, with the highest naturally occurring Stearidonic acid (SDA) content in non-GMO plant oil. The supplement supports joint, heart, and immune health. It also provides omega 6 GLA for skin and women’s health.

- On October 28, 2022, CoreFX Ingredients, U.S. based company, and Natures Crops partnered to launch a new plant-based Omega powder, 70GA Dry Ahiflower Oil. The product is a propriety seed oil of Nature Crops that it says contains more biologically advanced omegas than any other natural plant source.

- On October 18, 2022, Algarithm Ingredients Inc., Canada, and Natures Crops International partnered to produce two entirely new omega oil blends for supplement, food, and beverage ingredient usage. These new blends, Ahiflower 80DHA and 150DHA represent the only vegan omega source and partnership offering the broadest array of omegas with great sensory properties.

Why Purchase the Report?

- To visualize the global omega 6 market segmentation based on type, source, application, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities in the market by analyzing trends and co-development.

- Excel data sheet with numerous data points of omega 6 market-level with all segments.

- The PDF report consists of a cogently put-together market analysis after exhaustive qualitative interviews and an in-depth market study.

- Product mapping is available as Excel consists of key products of all the major market players.

The global omega 6 market report would provide approximately 61 tables, 58 figures, and 190 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies