Algae Omega-3 Ingredients Market Size

The Algae Omega-3 Ingredients Market was US$850.5 million in 2024 and is expected to reach US$1,471.3 million in 2032, growing at a CAGR of 7.4% during the forecast period (2025-2032).

The omega-3 fatty acid is an essential fatty acid required by the human body for normal functioning and brain development. Ongoing research and development on omega-3 fatty acids have become vital to the food, pharmaceutical, and feed industries. The algae omega-3 application is growing at a faster rate than the infant food fortification as it provides the same benefit as that of the fish oil but with no taste or odor. Also, the increased consumption of omega-3 supplements is responsible for market growth. Globally, algae omega-3 ingredients are gaining prominence and becoming a part of the consumer’s daily diet.

One of the most important nutrients in the human diet is omega-3 fatty acids. Omega-3 fats have strong, positive health effects. For instance, observational studies have connected inflammation and depression with higher omega-6 and lower omega-3 fats.

A recent study found that omega-3 supplementation could lower inflammation and anxiety even among healthy young adults. Further, in another study published in the Journal of the International Society of Sports Nutrition, 44 women and men who supplemented their diets with either safflower oil or omega-3 fatty acids were examined. After 6 weeks of supplementation, the omega-3 supplemented group saw a decrease in body fat and an increase in fat-free mass compared to the safflower oil group. The study found a significant correlation between these changes and a decline in salivary cortisol, a stress hormone. Another study discovered that consuming omega-3 fatty acids during rigorous wrestling training can enhance athletes' lung function during and after exercise.

An individual's omega-3 status and the quantity of EPA and DHA needed for optimal cellular health depend on various factors. A supplement consisting of 3000 to 4000 mg of EPA and DHA daily should be sufficient support for the majority of healthy adults and, more importantly, act as a buffer against the competitive effects of factors impeding omega-3 metabolism.

Algae Omega-3 Ingredients Market Sope

| Metrics | Details |

| Market CAGR | 7.4% |

| Segments Covered | By Type, By Application, By Form Type, and By Region |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, and Other key insights. |

| Fastest Growing Region | Asia Pacific |

| Largest Market Share | North America |

For More Insights Request Free Sample

Algae Omega-3 Ingredients Market Dynamics

Increased demand for infant formula products

Infant formula grew 86% in Feb 2020 in China while baby food demand grew by 98% after the Covid-19 impact due to the high demand for baby products. China accounts for 30% of the global consumption of Infant formula which is followed by other Asian countries holding 28% of the market. About 65% of the growth in the Infant formula market comes from China. In 2015, china imported 180 Kilo Tones of Infant formula from the world which is valued to be USD 2.4 billion. Europe accounts for about 90% of the import share. In addition, due to a recent scandal of domestically produced low-quality products, consumers of baby formula products are moving towards imported formula in the market. DHA and EPA are essential for infant brain development and immunity strength. DHA has well-established legal strains for incorporation into infant formula products in different regulations and WHO recommendations.

According to a Norwegian study, omega-3 demonstrates a positive effect on a child's brain and enhances a child’s problem-solving abilities. According to recent research studies, high doses of DHA in baby formula or breast milk can have a positive effect on the growth of preterm infants, such as an increase in height. In countries such as China, where both the adult population and infant population are on the rise, the demand for infant nutrition and baby food is constantly increasing. The demand for infant nutrition fortified with omega-3 is increasing among parents who have busy lifestyles and less time to prepare meals.

However, the rising cost of raw materials, especially natural ingredients, has made a dent in the profit margins of many small-scale suppliers. This situation is more precarious for suppliers who are sourcing from China, India, and the U.S. Furthermore, fluctuating input costs and labor costs have also influenced the profitability margin of the suppliers and distributors and continue to surge. Additionally, the lack of consistent standards and guidelines in the global EPA/DHA (Omega3) ingredients market is also one of the defining factors that restrain the market growth. Regulations vary from country to country regarding the use of EPA / DHA (Omega 3) and its inclusion under the food category. Lack of regulations could lead to misuse of claims indicating health benefits.

Algae Omega-3 Ingredients Market Segmentation

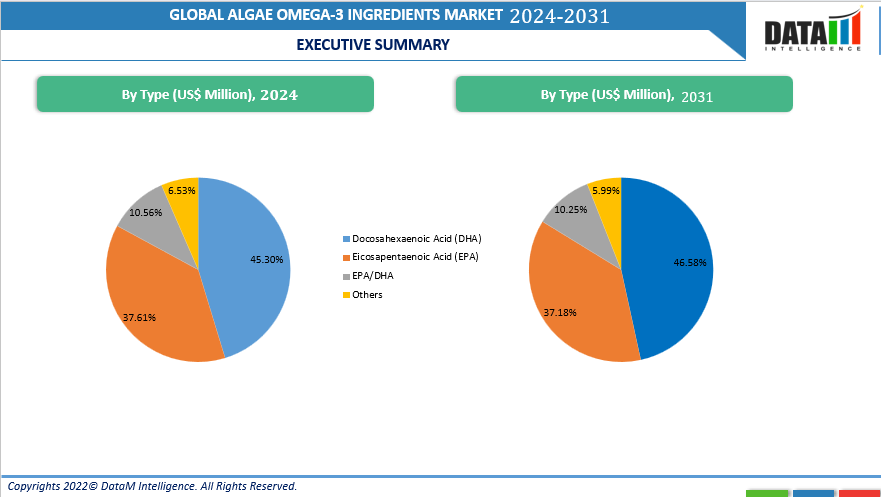

The docosahexaenoic Acid (DHA) segment is expected to dominate the global algae omega-3 ingredients market, by type

The Docosahexaenoic Acid (DHA) in Global Algae Omega-3 Ingredients Market has reached US$ 325.46 Million in 2020 and is expected to reach US$ 538.04 Million by 2029. DHA is a fatty acid rich in Omega-3 and is a major component of the human brain's cerebral cortex, the skin and the retina. The chemical formula of DHA is C₂₂H₃₂O₂. DHA has a carboxylic acid structure with a 22-carbon chain and six cis-double bonds. DHA accounts for up to 97% of the total omega-3 fats in the brain and up to 93% of the omega-3 fats in specific parts of the eye retina. The human body can't make its omega-3 fatty acids and therefore requires external supplementation.

Regular intake of DHA is shown to have a beneficial impact on cardiovascular health. DHA is widely used in medications used to treat excessive blood cholesterol or other lipids (fats) (hyperlipidemia). Phosphatidylserine (PS), which has high DHA content, is found to have roles in neuron signaling and neurotransmission. DHA supplementation is used to improve thinking and memory skills, promote newborn and child development, treat some eye abnormalities and treat various other ailments. Research is ongoing to ascertain DHA's concrete benefits on the human body. The mentioned advantages of DHA are the prime cause of the product's market growth in recent times.

Foods and supplements high in omega-3 are recommended for the diets of pregnant and lactating women. The International Society for the Study of Fatty Acids and Lipids (ISSFAL) recommends the intake of 300mg/day of DHA for pregnant and breastfeeding women.

Ethyl Esters in Algae Omega-3: Driving Innovation in Nutrition and Biofuels

The with smllest share, ethyl esters segment in the global algae omega-3 ingredients market is witnessing robust growth. Valued at US$ 18.47 million in 2024, it is projected to reach US$ 28.72 million by 2029. This growth reflects the increasing demand for omega-3 fatty acids in dietary supplements, pharmaceuticals, and functional foods due to their established role in cardiovascular health and overall wellness.

Microalgae serve as an indispensable food source during various growth stages of mollusks, crustaceans, and numerous fish species. Beyond nutrition, eukaryotic microalgae have been found to contain a diverse range of bioactive compounds such as carotenoids, pigments, polyphenols, and lipids. These compounds are not only valuable in aquaculture but also hold immense potential in nutraceutical and pharmaceutical applications.

Lipids extracted from microalgae biomass present a sustainable resource with multiple applications. These lipids can be converted into fatty acid ethyl esters, bioethanol, biohydrogen, and thermochemical products like bio-oil and bio-crude. Importantly, omega-3-acid ethyl esters play a critical role in reducing high blood triglyceride levels when used with a proper diet. By lowering the risk of clogged blood vessels, these compounds help prevent severe medical conditions, including heart attacks and strokes.

Research and technological advances are further supporting the adoption of ethyl ester forms. A significant study conducted in 2020 by the Fraunhofer IGB research institute demonstrated successful cultivation of algal cells using mineral salts, artificial light, and CO₂ in photobioreactors. Within these systems, Eicosapentaenoic Acid (EPA) is formed in the chloroplast membranes of microalgae as Monogalactosyldiglycerol (MGDG). To be used in dietary supplements, EPA must be separated from galactolipids and enzymatically esterified with ethanol, resulting in EPA ethyl ester, which is a stable and bioavailable form.

In addition, a July 2021 study published in The Journal of Food Science and Nutrition highlighted the benefits of Docosahexaenoic Acid (DHA) in ethyl ester form, showing that daily supplementation with 850–1000mg can provide measurable improvements in cardiovascular health. These findings emphasize the importance of ethyl esters in advancing clinical and consumer applications of algae-derived omega-3.

Algae Omega-3 Ingredients Market Geographical Share

North America is the largest market for algae omega-3 ingredients with a share of nearly 45.21% in 2024

North America algae omega-3 ingredients market is valued at US$ 383.20 Million in 2024 and is estimated to reach US$ 523.29 Million by 2029. Essential fatty acids called omega-3 oils have a variety of health advantages, including improved heart, eye and brain function. A growing number of vegans and others seeking a source of long-chain omega-3 fatty acids are turning to algae oil (EPA and DHA). Pollutant contamination with substances like polychlorinated biphenyls is not a concern.

The main driver of market growth is innovation, both in terms of products and technologies. Furthermore, the government has put a strong system in place for the food labeling regulations for nutritious goods. U.S. holds the biggest proportion of North America's algal omega 3 ingredients market. It results from rising Omega 3 supplements, food intake and public knowledge of the substance's health advantages. Additionally, the top businesses' domestic expansion and regular product launches with improved formulas have stoked the regional market's growth.

Docosahexaenoic acid (DHA) is a crucial component of newborn feeding in U.S. Almost all of the companies selling infant formula in the nation include DHA as an ingredient, raising the price of the formula and contributing to the market expansion for algae-based omega-3 components. The American Heart Association compared deaths brought on by coronary illnesses using data from U.S. and Japan. The statistics for 2021 showed more deaths from coronary disease in U.S. than in Japan. Consumers are compelled to reconsider their eating habits due to the rising prevalence of numerous chronic diseases.

Algae Omega-3 Ingredients Companies and Competitive Landscape

The global algae omega-3 ingredients market is fragmented, as key players, like Koninklijke DSM N.V, Corbion, BASF, Polaris S.A., and Neptune Wellness Solutions Inc. are facing competition from local players across various regions. Partnerships remained the most common strategy. Key players, like ADM, Koninklijke DSM N.V, and Neptune Wellness Solutions Inc. are focusing on partnerships and joint ventures to increase their production capabilities and consumer base across various regions.

Moreover, other small players are also showing keen interest in the market due to the virtue of its wider array of applications in the pharmaceutical, nutraceutical, and food & beverage industries. For instance, in January 2019, Epax committed to investing 35 million USD to expand its omega-3 production capacity at its main facility in Norway allowing it to increase by 50% by 2021. In May 2020, DSM has expanded its nutrition portfolio with ARA and DHA powder which is especially for infant nutrition. This powder contains a minimum of 110 mg DHA and ARA.

Furthermore, it is sourced from sustainable vegetarian DHA omega-3 and ARA omega-6 which aid to meet the global sustainable demands. In March 2020, Wiley companies introduced its first omega-3 concentrate in powdered form which has been designed for dietary supplements, food, and beverages. The product has been developed without a fishy smell or taste to appeal to consumers looking for attractive sensorial products.

COVID-19 Impact: Positive impact on Market

The impact of COVID-19 resulted in the generation of opportunities for manufacturers of health-oriented products, especially dietary supplements. The respective market has been prompted by the increase in consumer perception of these products to help maintain immunity and their efficiency in fighting the deadly virus. This, in turn, surges the demand for associated ingredients, including algae omega-3. Recently, the CEO of omega-3 brand Wiley’s Finest has projected robust growth for supplement oils sales with high demand for vitamins, minerals, and the supplements category. Companies with sound sourcing and efficient supply-chain principles will emerge resilient in the post-COVID economy.