Global Flax Protein Market is Segmented By Nature (Organic, Conventional), By Source (Golden Flaxseed, Brown Flaxseed), By Application (Food Processing, Animal Feed, Nutraceuticals, Sports Nutrition, Personal Care Products, Infant Nutrition, Others), By Distribution Channel (Supermarket/Hypermarket, Specialty Stores, Convenience Stores, Online Sales, Others), and By Region (North America, Europe, South America, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2024-2031

Flax Protein Market Size

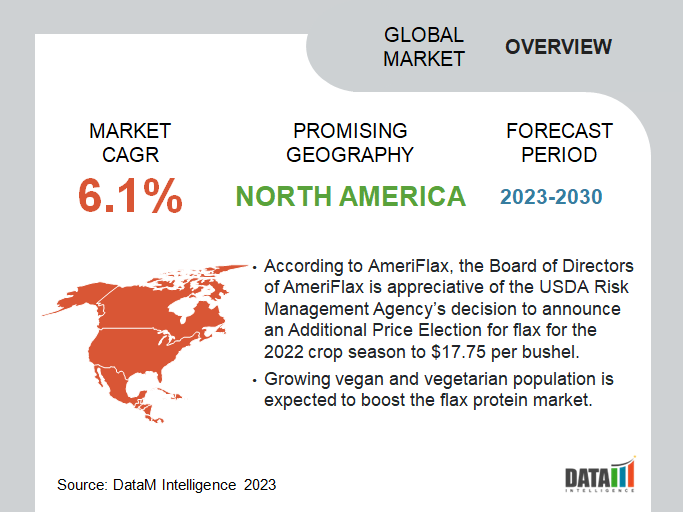

Global Flax Protein Market reached USD 32.1 billion in 2022 and is expected to reach USD 47.7 billion by 2030 growing with a CAGR of 5.1% during the forecast period 2024-2031.

Flax is an oilseed crop that has been cultivated over centuries. Currently, the seeds of flax are experiencing popularity as a functional food ingredient rich in oil containing α-linolenic acid, soluble polysaccharide mucilage, and mammalian lignin precursors.

Although flaxseed contains about 22% protein that consists of nutritionally balanced levels of amino acids and can release physiologically beneficial bioactive peptides upon digestion, it is undervalued as a source of protein. Flaxseed oil extraction generates protein-rich, deoiled flaxseed meal, which is primarily used in animal feed or a fertilizer, and to very limited extent incorporated in food formulations.

The global shift toward plant-based diets, driven by health, environmental, and ethical concerns, has significantly increased the demand for plant-based protein sources. Flax protein, being a high-quality, complete protein with essential amino acids, has emerged as a favorable option in this market.

Flax Protein Market Scope

|

Metrics |

Details |

|

CAGR |

5.1% |

|

Size Available for Years |

2022-2031 |

|

Forecast Period |

2024-2031 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Nature, Source, Application, Distribution Channel, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, and Middle East & Africa |

|

Fastest Growing Region |

Asia Pacific |

|

Largest Region |

North America |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis, and Other key Insights. |

To Know More Insights - Download Sample

Flax Protein Market Dynamics

Growing Vegan and Vegetarian Population to Drive the Global Market Trends

The adoption of plant-based diets has been steadily rising globally. According to Vegan Society, there are currently over 9.7 million American vegans and 2% of Americans are vegetarian. A similar trend has been observed in other parts of the world. A growing body of research and media attention has highlighted the health and environmental benefits of plant-based diets. Concerns about animal welfare, climate change, and sustainable food production have led more people to explore plant-based alternatives, including flax protein.

Consumer preferences have been shifting towards healthier and more sustainable food choices. According to the Plant Based Foods Association, in 2020, 57% of all U.S. households purchased plant-based foods (that’s over 71 million households), up from 53% in 2019. The total plant-based market value was $7 billion in 2020.

Sports and Fitness Industry Adoption is Expected to Drive The Flax Protein Market Growth

Athletes and individuals engaged in fitness activities have higher protein requirements to support muscle repair, growth, and recovery. Flax protein, being a plant-based source with a good amino acid profile, can be an attractive option for meeting these protein needs. Many athletes and fitness enthusiasts choose to follow vegan or vegetarian diets for various reasons, including ethical, environmental, and health concerns.

Omega-3 fatty acids present in flax protein have been linked to reduced inflammation and improved muscle recovery. For athletes and fitness enthusiasts, these benefits can be especially valuable in enhancing performance and minimizing post-workout fatigue. The sports nutrition industry has been witnessing a shift towards clean label products with natural and recognizable ingredients. Flax protein, being a minimally processed and natural plant-based protein source, fits well within this trend.

Digestibility and Anti-Nutritional Factors is Restraining the Flax Protein Market

Flax protein, like flaxseed, is rich in omega-3 fatty acids. However, these fatty acids are prone to oxidation, especially when exposed to heat, light, or air during processing or storage. Oxidation can lead to rancidity and negatively impact the taste and nutritional quality of flax protein products.

Some consumers may not be aware of the potential challenges associated with the digestibility of flax protein and the importance of proper processing and storage to maintain its nutritional integrity. Lack of awareness can be a restraint in the market as consumers may choose other plant-based protein sources with perceived higher digestibility.

Flax Protein Market Segment Analysis

The global flax protein market is segmented based on nature, source, application, distribution channel, and region.

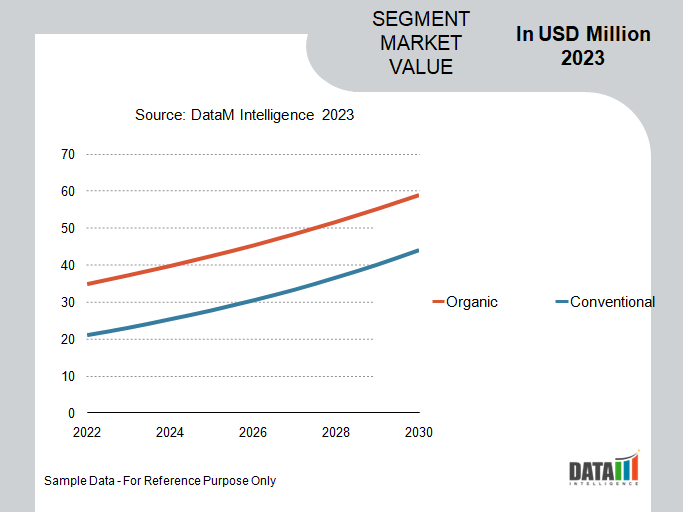

The Organic Segment Holds the Largest Market Share in the Flax Protein Market

Consumers are increasingly seeking products with transparent and natural ingredients. Organic flax protein aligns well with this clean label trend as it is produced without synthetic chemicals, pesticides, or genetically modified organisms (GMOs). According to National Centre For Organic And Natural Farming, all the organic areas together summed up to 107.4 million hectares globally.

Organic flax protein is produced using sustainable and eco-friendly agricultural practices. As consumers become more aware of the environmental impact of conventional farming methods, they are more likely to choose organic products, contributing to the market share of the organic segment.

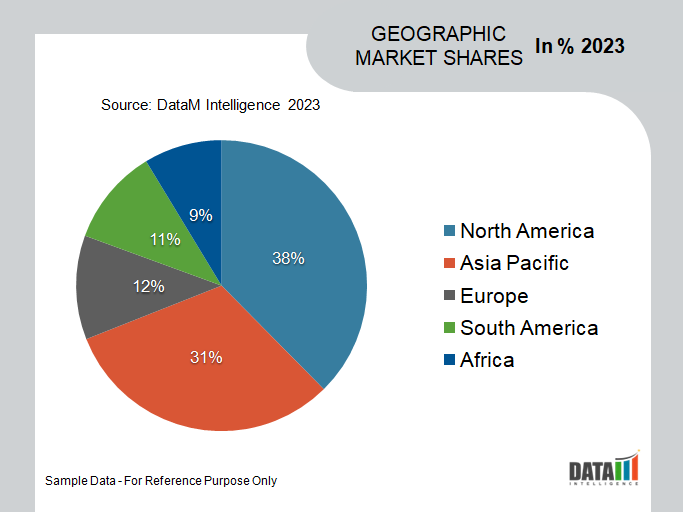

Global Flax Protein Market Geographical Share

North America is Dominating the Flax Protein Market

North America has witnessed a significant increase in the demand for plant-based protein sources in recent years. Factors such as the rise in vegan and vegetarian lifestyles, health consciousness, and environmental concerns have contributed to the popularity of flax protein as a plant-based alternative. The region's strong focus on health and wellness has led consumers to seek out nutritious and natural food options. Flax protein, with its high protein content, omega-3 fatty acids, and other essential nutrients, aligns with these trends, driving its adoption.

North America's food industry has been quick to embrace plant-based alternatives, including flax protein. According to AmeriFlax, the Board of Directors of AmeriFlax is appreciative of the USDA Risk Management Agency’s decision to announce an Additional Price Election for flax for the 2022 crop season to $17.75 per bushel. Major food and beverage companies have incorporated flax protein into a variety of products, such as plant-based milk, meat substitutes, energy bars, and smoothies, expanding its market presence.

Flax Protein Market Companies

The major global players in the market include Glanbia, Organica Vita Ltd., Clearspring Ltd., THINKITDRINKIT, Quadra Vita Ltd, Austrade Inc., Omega Protein Corporation, Natunola, Leader Foods OY, and All Organic Treasures GmbH.

COVID-19 Impact on Flax Protein Market

Global Recession/Ukraine-Russia War/COVID-19, and Artificial Intelligence Impact Analysis:

Covid-19 Impact:

The COVID-19 pandemic led to disruptions in global supply chains, affecting the production and distribution of various goods, including flax protein. Restrictions on international trade, transportation delays, and labor shortages at processing facilities could have impacted the availability and pricing of flax protein. During the pandemic, there was a shift in consumer behavior towards health and wellness. Many people became more conscious of their dietary choices, leading to increased interest in plant-based and nutritious food options like flax protein.

By Nature

- Organic

- Conventional

By Source

- Golden Flaxseed

- Brown Flaxseed

By Application

- Food Processing

- Animal Feed

- Nutraceuticals

- Sports Nutrition

- Personal Care Products

- Infant Nutrition

- Others

By Distribution Channel

- Supermarket/Hypermarket

- Specialty Stores

- Convenience Stores

- Online Sales

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Germany

- The U.K.

- France

- Italy

- Spain

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In December 2022, Nutrilitius, an online platform that offers the best quality nuts and dry fruits in India, has expanded its product portfolio foraying into nutraceuticals. The range of nutraceutical products has been formulated to promote good health and immunity.

- In July 2023, DSM and Firmenich announced that they have entered into a business combination agreement to establish the leading creation and innovation partner in nutrition, beauty and well-being. The combination will bring together Firmenich's unique leading Perfumery and Taste businesses, its world-class science platforms and associated co-creation capabilities with DSM's outstanding Health and Nutrition portfolio and renowned scientific expertise.

Why Purchase the Report?

- To visualize the global flax protein market segmentation based on nature, source, application, distribution channel, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities in the market by analyzing trends and co-development.

- Excel data sheet with numerous data points of flax protein market-level with all segments.

- The PDF report consists of cogently put-together market analysis after exhaustive qualitative interviews and in-depth market study.

- Product mapping is available as Excel consists of key products of all the major market players.

The global flax protein market report would provide approximately 69 tables, 67 figures, and 190 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies