Respiratory Monitoring Devices Market Size & Industry Outlook

The shift to telemedicine and home care has boosted the demand for continuous, remote, and user-friendly monitoring solutions, accelerating the market for respiratory monitoring equipment. As more patients manage chronic respiratory disorders at home, the need for portable wearables, wireless sensors, and AI-enabled platforms that allow for real-time surveillance and professional supervision has grown. Reliable physiological data is required for telemedicine consultations, prompting hospitals and providers to employ linked respiratory monitors. This trend promotes early diagnosis of problems, reduces hospital workload, and allows for personalized long-term treatment.

Key Highlights

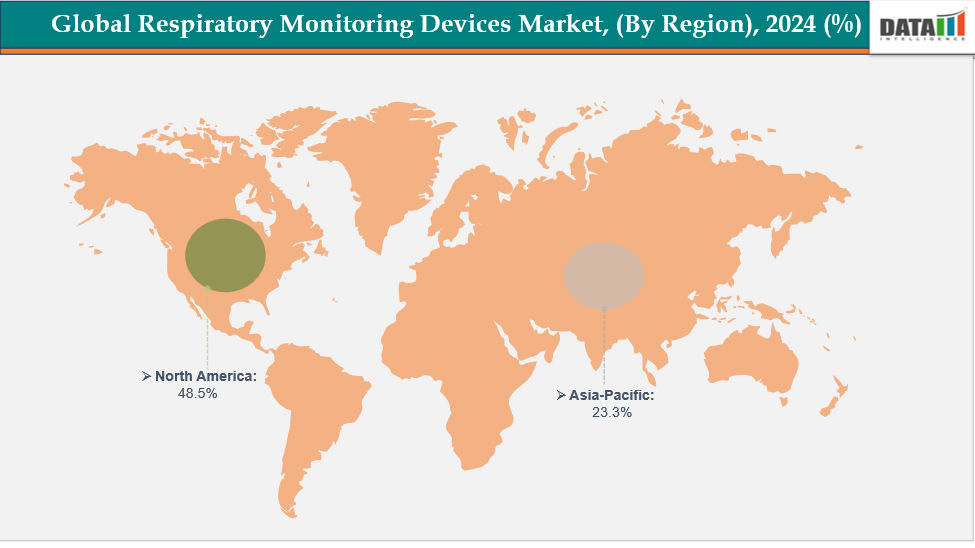

- North America is dominating the global respiratory monitoring devices market with the largest revenue share of 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global respiratory monitoring devices market, with a CAGR of 7.7% in 2024

- The pulse oximeters segment is dominating the respiratory monitoring devices market with a 37.8% share in 2024

- The chronic obstructive pulmonary disease segment is dominating the respiratory monitoring devices market with a 39.3% share in 2024

- Top companies in the respiratory monitoring devices market are GE Healthcare, Nonin, Medtronic, ndd Medical Technologies, Tri-anim, Nox Medical, ResMed, Masimo, Safey Medical Devices Inc., and Koninklijke Philips Electronics N.V., among others.

Market Dynamics

Drivers: Rising prevalence of chronic respiratory diseases is accelerating the growth of the respiratory monitoring devices market

The market for respiratory monitoring devices is growing at a rapid pace as chronic respiratory illnesses become more common. This is due to an increasing number of patients require constant, accurate, and easily accessible respiratory assessments. Smoking, urban pollution, aging populations, and lifestyle changes have all contributed to the growth in illnesses such as COPD, asthma, and sleep apnea. The expanding patient population increases the demand for pulse oximeters, spirometers, capnographs, and sleep-monitoring devices for diagnosis and ongoing illness care.

Owing to factors like chronic respiratory diseases, for instance, in May 2025, Oxford Academic reported that 80.6 million Americans lived with OSA in 2024, highlighting high prevalence across genders and substantial cases of mild to severe disease, and in May 2024, GINA reported that asthma affected over 260 million people globally, underscoring its significant global burden.

Restraints: Device accuracy and equity concerns are hampering the growth of the respiratory monitoring devices market

The respiratory monitoring device industry is facing challenges owing to accuracy and equity concerns. Inconsistent performance across patient groups undermines clinician confidence and reduces adoption. According to research and regulatory reviews, some pulse oximeters and monitoring sensors perform less accurately in people with darker skin tones, poor blood flow, or other physiological characteristics. This can result in unrecognized low blood oxygen levels, misdiagnoses, or delayed care, prompting healthcare experts and regulatory organizations to call for more stringent validation criteria.

As a result, manufacturers face higher testing costs, longer approval timelines, and pressure to redesign devices to ensure equitable performance.

For more details on this report, see Request for Sample

Respiratory Monitoring Devices Market, Segmentation Analysis

The global respiratory monitoring devices market is segmented based on device type, indication, end user, and region

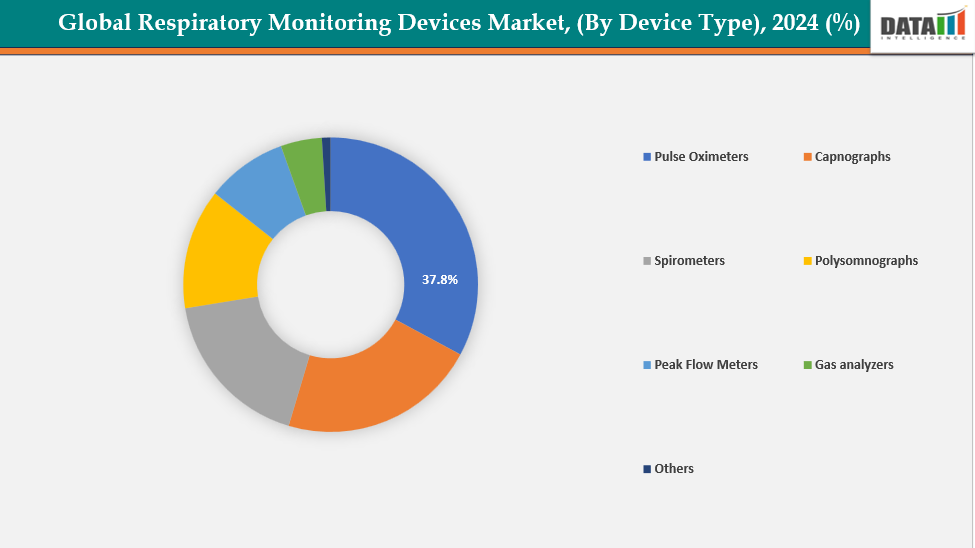

By Device Type: The pulse oximeters segment is dominating the respiratory monitoring devices market with a 37.8% share in 2024

Pulse oximeters are the most used type of respiratory monitoring instrument. This is due to they are necessary, easy to use, and frequently employed in hospitals and households. They can swiftly and non-invasively detect oxygen saturation and pulse rate, making them an important tool for monitoring breathing in illnesses such as COPD, asthma, sleep apnea, and infectious infections. The COVID-19 pandemic pushed their usage furthermore, with continuous oxygen monitoring becoming common practice in hospitals and at home.

Moreover, technological advances, including compact designs, wireless connectivity, FDA approvals, and integration with remote patient-monitoring platforms, have expanded their usability. For instance, in February 2024, Masimo announced that the FDA had cleared its MightySat Medical, making it the first and only OTC medical-grade fingertip pulse oximeter. The company stated that all other consumer pulse oximeters lacked FDA clearance and had been reported to provide unreliable or erroneous readings.

By Indication: The chronic obstructive pulmonary disease segment is dominating the respiratory monitoring devices market with a 39.3% share in 2024

The chronic obstructive pulmonary disease (COPD) category dominates the respiratory monitoring device market. This is due to COPD is a common and increasing respiratory ailment over the world, necessitating persistent need for accurate lung function measurement and continuing monitoring. COPD patients rely extensively on diagnostic and monitoring technologies because to frequent flare-ups, decreased lung capacity, and the requirement for regular spirometry, pulse oximetry, and gas exchange assessments.

Moreover, technological advancements in COPD management devices and ease of use in home settings further boost the market. For instance, in January 2024, NuvoAir Medical received 510(k) clearance for its Air Next Spirometer, enabling full in-home spirometry. The approval allowed NuvoAir to expand remote care, giving COPD and other respiratory patients convenient at-home lung monitoring without needing in-person visits.

Respiratory Monitoring Devices Market, Geographical Analysis

North America is dominating the global respiratory monitoring devices market with 48.5% in 2024

North America dominates the market for respiratory monitoring devices due to its sophisticated healthcare infrastructure, quick adoption of digital respiratory technology, and high prevalence of chronic lung disorders. Favorable reimbursement, robust regulatory standards, a trained clinical staff, and ongoing product innovation all contribute to the region's leading position in respiratory monitoring systems.

The respiratory monitoring devices market in the USA is expanding due to advanced healthcare infrastructure, frequent product launches, innovative respiratory technologies, and supportive FDA approvals and 510(k) clearances that improve diagnostic accuracy and critical care efficiency. For instance, in May 2024, Sempulse received FDA 510(k) clearance and launched its Halo Vital Signs Monitoring System. The miniature wearable enabled non-invasive, real-time monitoring of key vitals, including respiratory rate, supporting RPM, telemedicine, and chronic disease management during rest or movement.

Europe is the second region after North America, which is expected to dominate the global respiratory monitoring devices market with 34.5% in 2024

The market for respiratory monitoring devices in Europe is expanding due to enhanced healthcare systems, an aging population, and an increase in respiratory and surgical cases. Continuous product introductions, supporting reimbursement policies, and consistent EU MDR and CE Mark approvals are fueling innovation, improving patient safety, and increasing the region's market development.

Owing to factors like continuous EU and CE mark approvals, for instance, in August 2025, RESPINOR received the EC Certificate from TÜV SÜD, granting CE marking for its Class IIa device, RESPINOR DXT, under the EU MDR. This approval enabled the European market launch of its advanced noninvasive diaphragm monitoring technology.

Moreover, in July 2024, SIVA Health AG received EU MDR certification for its AI-based continuous ambulatory cough monitoring system, marking the first fully automated device approved for objective, real-time cough tracking to support chronic cough treatment in clinical and trial settings.

The Asia Pacific region is the fastest-growing region in the global respiratory monitoring devices market, with a CAGR of 7.7% in 2024

The respiratory monitoring devices market in Asia-Pacific is rapidly developing, due to increased healthcare expenditure, technological developments, improved hospital infrastructure, and supporting government initiatives. Asthma, COPD, and infectious respiratory disorders are on the rise, driving use of sophisticated monitoring systems in hospitals, home care settings, and point-of-care contexts.

In China, respiratory monitoring devices are advancing as companies partner with hospitals on AI-driven diagnostics, remote monitoring, and critical-care solutions, supported by increasing NMPA approvals that accelerate innovation and broaden clinical adoption across healthcare settings. For instance, in February 2024, Monitored Therapeutics, Inc. received NMPA approval for its GoSpiro spirometer, enabling local manufacturing and distribution through its partnership with Shenzhen-based Spiritumtec, strengthening access to advanced respiratory monitoring solutions across China.

Respiratory Monitoring Devices Market, Competitive Landscape

Top companies in the respiratory monitoring devices market are GE Healthcare, Nonin, Medtronic, ndd Medical Technologies, Tri-anim, Nox Medical, ResMed, Masimo, Safey Medical Devices Inc., and Koninklijke Philips Electronics N.V., among others.

GE HealthCare: GE HealthCare is a leading global provider of respiratory monitoring technologies, offering advanced solutions such as capnography systems, SpO₂ sensors, ventilator monitoring tools, and integrated patient-monitoring platforms. The company focuses on improving clinical decision-making, enhancing critical-care efficiency, and supporting continuous respiratory assessment through innovation, AI-enabled analytics, and strong hospital partnerships across diverse care settings.

Key Developments:

- In August 2025, Respiree received its second FDA 510(k) clearance, expanding the RS001 cardio-respiratory wearable for home use and approving its 1Bio connected-care platform. This milestone strengthened the company’s ability to support remote monitoring and AI-driven disease management across diverse care settings.

- In April 2025, Makani Science received FDA 510(k) clearance for its Makani Respiratory Monitor, enabling the company to market and distribute its innovative wearable device designed for continuous, noninvasive respiratory monitoring and improved patient assessment.

- In March 2025, the N-Tidal Diagnose system received CE marking as a breakthrough point-of-care COPD diagnostic tool, combining precise respiratory physiology measurement with AI-driven interpretation to deliver accurate diagnosis and severity staging in as little as five minutes.

Market Scope

| Metrics | Details | |

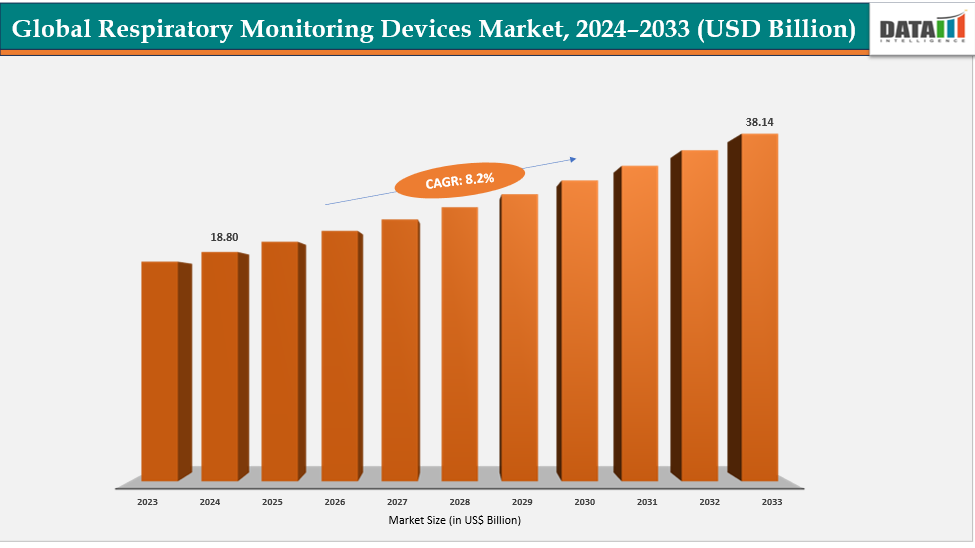

| CAGR | 8.2% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Device Type | Pulse Oximeters, Capnographs, Spirometers, Polysomnographs, Peak Flow Meters, Gas analyzers, Others |

| By Indication | Chronic Obstructive Pulmonary Disease, Sleep Apnea, Asthma, Infectious Diseases, Others | |

| By End‑User | Hospitals and Clinics, Home Care Settings, Ambulatory Surgical Centers, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global respiratory monitoring devices market report delivers a detailed analysis with 62 key tables, more than 59 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here