Mechanical Ventilators Market Size and Trends

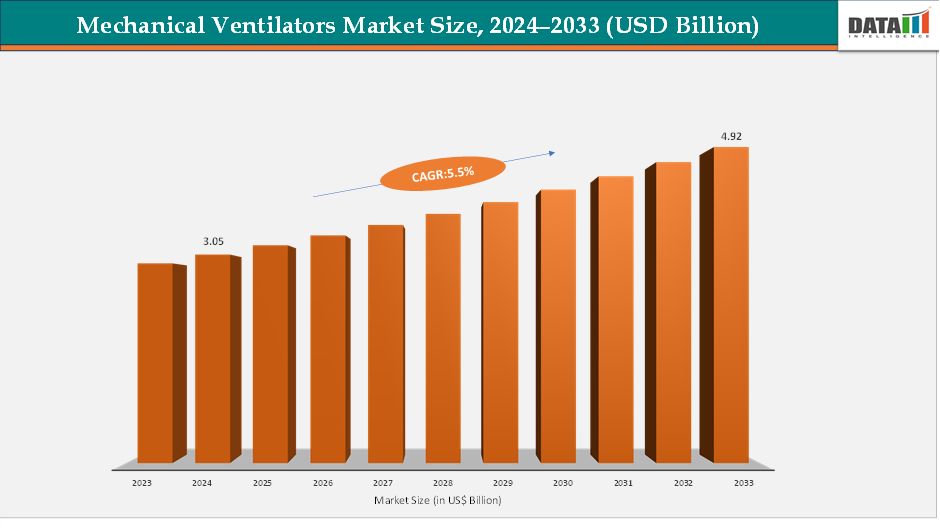

The global mechanical ventilators market is projected to grow from US$ 3.05 billion in 2024 to US$ 4.92 billion by 2033, registering a CAGR of 5.5% during the forecast period. Market growth is driven by the rising prevalence of chronic respiratory diseases such as COPD and asthma, coupled with an increasing need for advanced critical care infrastructure. In addition, technological advancements in portable, non-invasive, and home-care ventilators are enhancing adoption rates and improving patient outcomes.

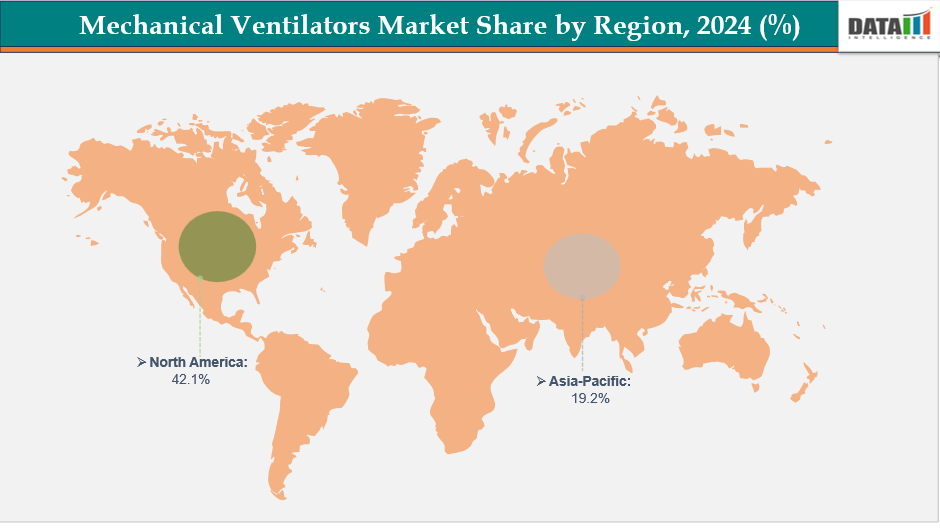

While North America expected to dominate the market due to advanced healthcare facilities, high ICU capacity, and strong adoption of innovative ventilator technologies, Asia-Pacific is set to witness the fastest growth. Factors such as a growing geriatric population, increasing pollution-related respiratory disorders, and rapid improvements in healthcare infrastructure across countries like China and India are fueling demand.

Despite challenges including high equipment costs and risks of complications such as ventilator-associated pneumonia, the market remains highly attractive with strong opportunities in emerging economies and the development of next-generation ventilators designed to deliver safer, more efficient respiratory support.

Mechanical Ventilators Market Size, 2024–2033 (USD Billion)

Key Highlights from the Report

North America leads the mechanical ventilators market, holding 42.1% share in 2024, driven by strong healthcare systems, major pharmaceutical players like Medtronic

Philips Healthcare, and active clinical research backed by FDA approvals.

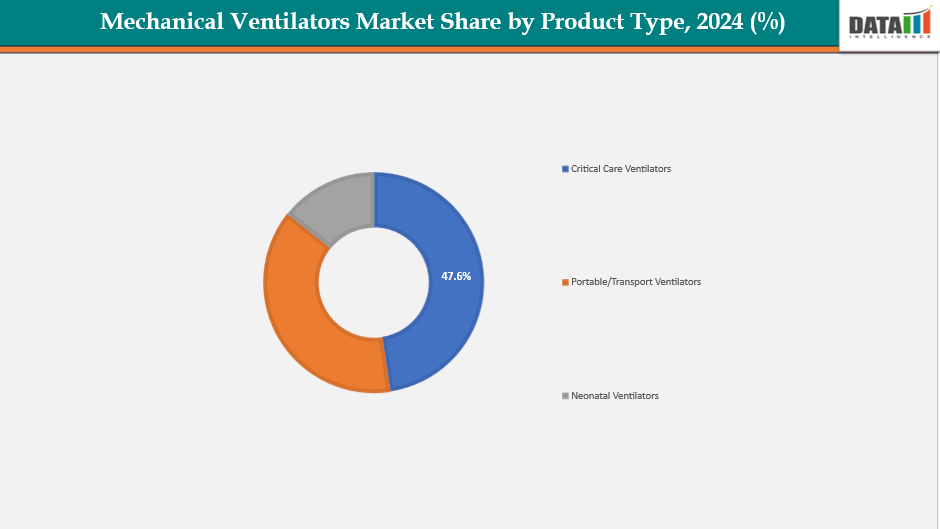

Critical care ventilators expected to be the leading product type, capturing 47.6% share in 2024, supported by product launches, collaborations, and partnerships that strengthen its dominance.

Market Dynamics

Drivers - Rising Prevalence of Chronic Respiratory Diseases

The market is driven by the increasing prevalence of respiratory diseases, such as COPD, asthma, and interstitial lung disease, which often require long-term or emergency ventilation. This pressure on healthcare systems to adopt more efficient and technologically advanced ventilators is aimed at improving patient survival rates and overall care outcomes, particularly in severe cases treated within intensive care units.

For instance, according to the World Health Organization (WHO), COPD is the third leading cause of death worldwide, affecting an estimated 390 million people. Similarly, asthma impacts over 260 million individuals globally, with a significant proportion experiencing severe exacerbations that require hospitalization and ventilatory support. This rising prevalence across both developed and developing regions is directly contributing to the growing need for mechanical ventilators, reinforcing their critical role in modern healthcare.

Restraints: High Cost of Mechanical Ventilators and Maintenance

The market faces challenges due to high costs associated with purchasing, installing, and maintaining these devices. Advanced ventilators, with microprocessor controls and real-time monitoring systems, are expensive and less accessible for small hospitals and developing regions. Regular servicing, calibration, and component replacement add to the financial burden on healthcare providers, limiting widespread adoption in low- and middle-income countries, creating disparities in access to life-saving respiratory support.

Opportunities: Growing Adoption of non-invasive Ventilation Technologies

The market is experiencing significant growth due to the increasing adoption of non-invasive ventilation (NIV) technologies. NIV offers respiratory support through external interfaces like masks, reducing the risk of infections and improving patient comfort. It is particularly beneficial for managing conditions like COPD, sleep apnea, and acute respiratory failure without intubation. The demand for NIV is increasing due to healthcare systems' focus on reducing ICU stays and improving cost efficiency.

Segmentation Analysis

By Product Type - Critical Care Ventilators segment is expected to lead the market

Critical care ventilators segment is expected to dominant the mechanical ventilators market, accounting for nearly 47.6% share in 2024. The critical care ventilators segment is experiencing significant growth due to the rise in severe respiratory conditions like ARDS, pneumonia, and COVID-19 complications. These conditions require continuous ventilatory support in ICUs, making them essential. Technological advancements, such as microprocessor-controlled systems, adaptive ventilation modes, advanced sensors, and real-time patient monitoring, have improved patient safety, optimized therapy, and reduced clinical complications. Increased awareness among healthcare professionals and ongoing training programs have led to wider deployment of these ventilators.

For instance, in July 2024, Air Liquide Medical Systems has introduced a new ICU ventilator, designed and manufactured in France, aimed at improving ventilatory care for patients with acute respiratory failure. The ventilator was developed in collaboration with the intensive care unit of Angers University Hospital, aiming to enhance the company's history in mechanical ventilation.

Mechanical Ventilators Market Share by Product Type, 2024 (%)

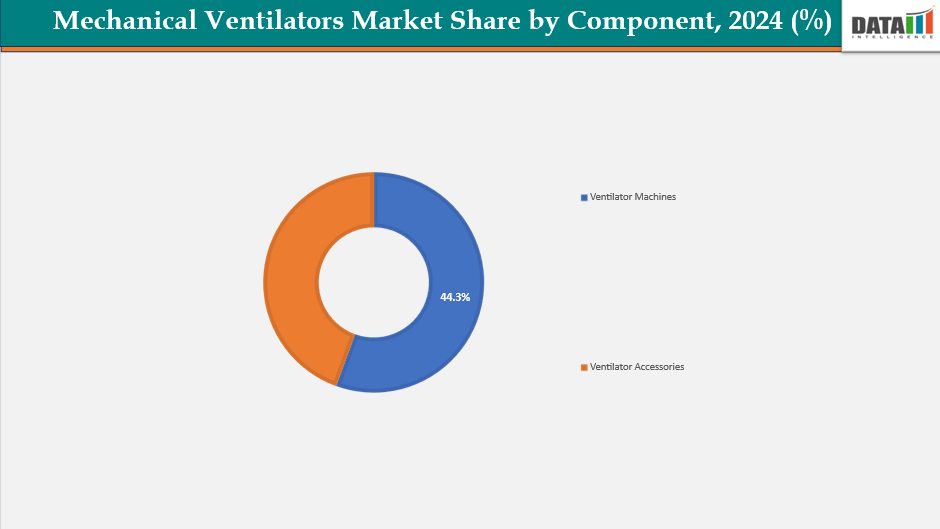

By Component- Ventilator Machines is expected to lead the market with strong growth potential

The ventilator machines segment is projected to register the lucarative growth, with a CAGR of 4.5% from 2024 to 2033. The ventilator machines segment is experiencing significant growth due to increased healthcare infrastructure investments and government initiatives to improve critical care. The growing burden of chronic respiratory diseases, such as COPD, asthma, and interstitial lung diseases, necessitates ventilatory support in acute hospitals and long-term care facilities. The geriatric population, more susceptible to respiratory ailments, drives demand for ventilator machines for prolonged, reliable assistance.

Moreover, technological innovations, including portable and non-invasive options, user-friendly interfaces, and integration with digital health monitoring systems, are enhancing their utility and adoption. Rising awareness among healthcare providers and patients about timely respiratory intervention is driving the segment's growth in global markets.

Mechanical Ventilators Market Share by Component, 2024 (%)

Regional Insights

Mechanical Ventilators Market Share by Region, 2024 (%)

North America Mechanical Ventilators Market Trends

The North American mechanical ventilators market is experiencing significant growth due to the rise in chronic respiratory disorders like COPD, asthma, and sleep apnea. The region's advanced healthcare infrastructure, ICU availability, and focus on critical care management contribute to market expansion. High healthcare expenditure and government support for technology adoption further drive market growth. Technologically advanced mechanical ventilators, such as portable and smart models, are being adopted to improve patient outcomes and operational efficiency. The growing awareness of respiratory health and pandemic-related measures further reinforces demand for mechanical ventilators.

For instance, in March 2025, IMT Innovations unveiled its new mechanical ventilator, "box," designed for critical and subacute hospital environments. The ventilator is user-friendly, adaptable, and prioritizes patient safety. The company plans to refine performance, ensure regulatory compliance, and optimize usability before bringing the ventilator to market.

Asia-Pacific Mechanical Ventilators Market Trends

The Asia-Pacific mechanical ventilators market is experiencing rapid growth due to rising respiratory diseases, pollution, smoking, and lifestyle changes. Countries like China, India, Japan, and South Korea are seeing a surge in patients requiring mechanical ventilation due to chronic and acute conditions. The region's geriatric population, more susceptible to respiratory disorders, also contributes to market demand. Improvements in healthcare infrastructure, investments in modern ICUs, and government initiatives to enhance critical care services are significant growth enablers. Adoption of portable and non-invasive ventilators in hospital and home-care settings also presents opportunities for market expansion.

For instance, in February 2024, Getinge has launched its Servo-c mechanical ventilator in India, designed to cater to the diverse respiratory needs of both pediatric and adult patients.

Competitive Landscape:

The following are the major companies operating in the mechanical ventilators market. These players hold a significant share and play an important role in shaping market growth and trends.

Philips Healthcare

Hamilton Medical AG

GE Healthcare

Drägerwerk AG & Co. KGaA

Vyaire Medical, Inc

Smith’s Medical

ResMed Inc

Fisher & Paykel Healthcare Corporation Limited

Allied Healthcare Products, Inc

Key Developments

In January 2025, Shvabe holding launched the first Russian portable mechanical ventilator, AIVL-D, in 2025. The 5 kg ventilator, powered by a built-in battery, can operate independently for several hours and has been registered with the Federal Service for Supervision in Healthcare for full fitness.

In December 2024, Tesai Care, a spin-off, has initiated a clinical study on the heecap device to assess its safety in preventing respiratory muscle atrophy in patients requiring mechanical ventilation during ICU admission, a condition affecting over 3 million people annually.

Suggestions for Related Report

For more medical devices-related reports, please click here