Smart Pulse Oximeters Market Size

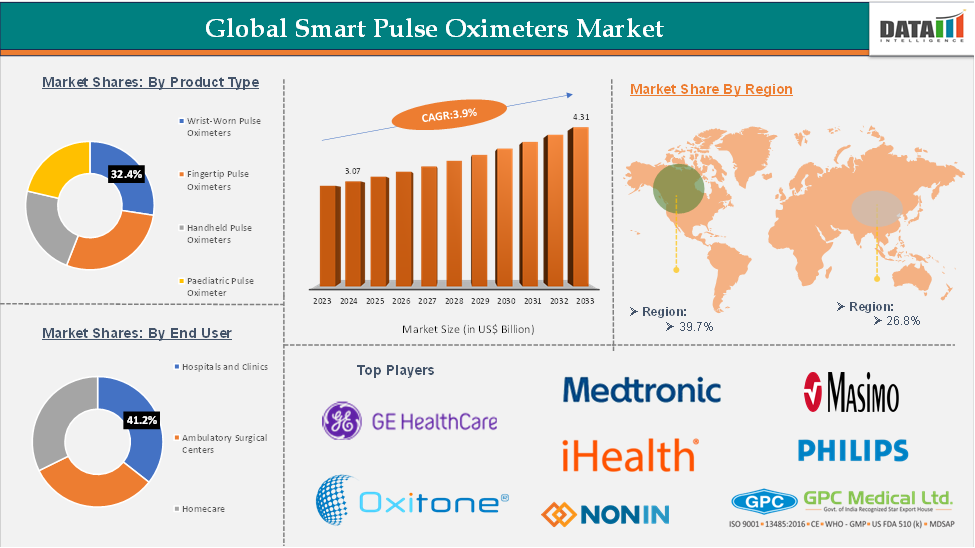

Smart Pulse Oximeters Market size reached US$ 3.07 Billion in 2024 and is expected to reach US$ 4.31 Billion by 2033, growing at a CAGR of 3.9% during the forecast period 2025-2033.

A smart pulse oximeter is a non-invasive clip-like medical device, also known as a probe, used to measure the oxygen saturation level and heart rate in humans. It uses infrared light to measure the oxygen level and heart rate. The measurement of oxygen level and heart rate while performing surgeries and injecting anesthesia is very important because the changes in the oxygen level in such a condition might cause life-threatening effects.

The smart pulse oximeters market is driven by the increasing prevalence of respiratory diseases, the growing demand for remote patient monitoring, and the rising awareness of health and wellness among consumers. Technological advancements, such as the integration of Bluetooth connectivity, data analytics, and AI-driven features, have further accelerated market growth by enabling more accurate and real-time monitoring.

Expanding use of smart pulse oximeters in telemedicine, home healthcare, and fitness sectors, as well as the potential for innovations in non-invasive measurement and wearable technology, are expected to create lucrative growth opportunities for the market.

North America remains the dominant region in the market, driven by a strong healthcare infrastructure, increasing product launches, high adoption of advanced medical technologies, and a rising geriatric population. However, regions such as Europe and Asia-Pacific are also seeing substantial growth due to increasing healthcare investments and the growing popularity of health-focused consumer devices.

Executive Summary

For more details on this report – Request for Sample

Smart Pulse Oximeters Market Dynamics: Drivers & Restraints

Technological advancement of pulse oximeters is expected to drive the smart pulse oximeters market

Technological advancements are significantly propelling the smart pulse oximeters market by enhancing device accuracy, connectivity, and user experience. Innovations such as wireless connectivity, integration with health apps, and continuous monitoring capabilities are transforming these devices into essential tools for remote patient care, chronic disease management, and personal wellness tracking.

These advancements not only improve the reliability of oxygen saturation and pulse rate measurements but also facilitate real-time data sharing with healthcare providers, leading to more informed clinical decisions and better patient outcomes.

Recent product launches underscore this technological evolution. In February 2024, Masimo introduced the FDA-cleared MightySat Medical, an over-the-counter fingertip pulse oximeter utilizing Masimo SET technology for accurate SpO2 and pulse rate measurements. This device caters to consumers with respiratory conditions, offering hospital-grade accuracy without the need for a prescription.

Similarly, in August 2024, Prevounce Health launched the Pylo OX1-LTE, a cellular-connected pulse oximeter designed for remote patient monitoring, particularly for individuals with chronic respiratory conditions like COPD and asthma. This device ensures reliable data transmission over cellular networks, integrating seamlessly with Prevounce's remote care management platform. These innovations highlight the industry's commitment to advancing pulse oximeter technology, catering to the growing demand for efficient, accurate, and user-friendly health monitoring solutions.

The high cost of smart pulse oximeters is expected to hinder the smart pulse oximeters market

The high cost of smart pulse oximeters is expected to be a significant barrier to the growth of the market, particularly in price-sensitive regions and among lower-income populations. While these advanced devices offer enhanced features such as real-time monitoring, data connectivity, and increased accuracy, their premium pricing often makes them inaccessible for many consumers and healthcare providers. This cost discrepancy can limit adoption, especially in developing markets where affordability is a key consideration.

Additionally, the high price point may also slow down widespread usage in home healthcare settings and among individuals who only require basic pulse oximetry for occasional monitoring, further hindering the overall market expansion.

Smart Pulse Oximeters Market Segment Analysis

The global smart pulse oximeters market is segmented based on product type, end user, and region.

Product Type:

The fingertip pulse oximeters are expected to hold 41.8% of the global smart pulse oximeters market

The fingertip pulse oximeter segment is expected to continue dominating the smart pulse oximeter market due to its compact size, ease of use, and affordability. These devices, which measure blood oxygen saturation through a sensor placed on the finger, offer significant advantages such as portability and the ability to be used in various settings without the need for external probes.

Their lower cost compared to other types of smart pulse oximeters also contributes to their widespread adoption, especially in price-sensitive markets. The increasing demand for convenient and cost-effective monitoring solutions, especially for individuals managing chronic respiratory conditions, ensures that fingertip pulse oximeters will maintain a strong market presence. For instance, in February 2024, Nonin Medical launched the TruO2 OTC, the first over-the-counter (OTC) fingertip pulse oximeter to receive FDA clearance. This innovative device is designed to provide accurate blood oxygen saturation readings for adults of all skin tones, offering a reliable and accessible option for individuals to make informed healthcare decisions. As healthcare continues to emphasize remote patient monitoring and personal health management, the fingertip pulse oximeter segment is poised to remain a dominant force in the market.

Smart Pulse Oximeters Market Geographical Analysis

North America is expected to hold 39.7% of the global smart pulse oximeters market

North America is expected to dominate the smart pulse oximeters market due to its well-established healthcare infrastructure, high adoption of advanced medical technologies, and increasing prevalence of respiratory diseases such as COPD, asthma, and sleep apnea. The region’s growing focus on telemedicine, remote patient monitoring, and personal health management also contributes to the rise in demand for these devices.

Recent product launches and regulatory approvals in the U.S. highlight the market's strong growth. For instance, in December 2024, Movano Health recently received 510(k) clearance from the Food and Drug Administration (FDA) for the pulse oximeter feature integrated into its Eviemed smart ring. This clearance marks a significant step in Movano’s strategy to market the wearable device to organizations conducting clinical trials and healthcare companies focused on chronic disease management.

The high prevalence of conditions requiring oxygen saturation monitoring, coupled with a strong regulatory environment and technological advancements, ensures that North America will continue to lead the smart pulse oximeter market in the coming years.

Smart Pulse Oximeters Market Top Companies

The top companies in the smart pulse oximeters market include Medtronic, iHealth Labs Inc., Nonin, Medtronic, Koninklijke Philips N.V., Masimo, GE HealthCare, CONTEC MEDICAL SYSTEMS CO., LTD, Oxitone, Masimo, GPC Medical Ltd., among others.

Key Developments

In December 2024, Movano Health recently received 510(k) clearance from the Food and Drug Administration (FDA) for the pulse oximeter feature integrated into its Eviemed smart ring. This clearance marks a significant step in Movano’s strategy to market the wearable device to organizations conducting clinical trials and healthcare companies focused on chronic disease management.

Market Scope

Metrics | Details | |

CAGR | 3.9% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Wrist-Worn Pulse Oximeters, Fingertip Pulse Oximeters, Handheld Pulse Oximeters, Paediatric Pulse Oximeter |

End User | Hospitals and Clinics, Ambulatory Surgical Centers, Homecare | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global smart pulse oximeters market report delivers a detailed analysis with 57 key tables, more than 46 visually impactful figures, and 168 pages of expert insights, providing a complete view of the market landscape.