Cell Therapy Market Size

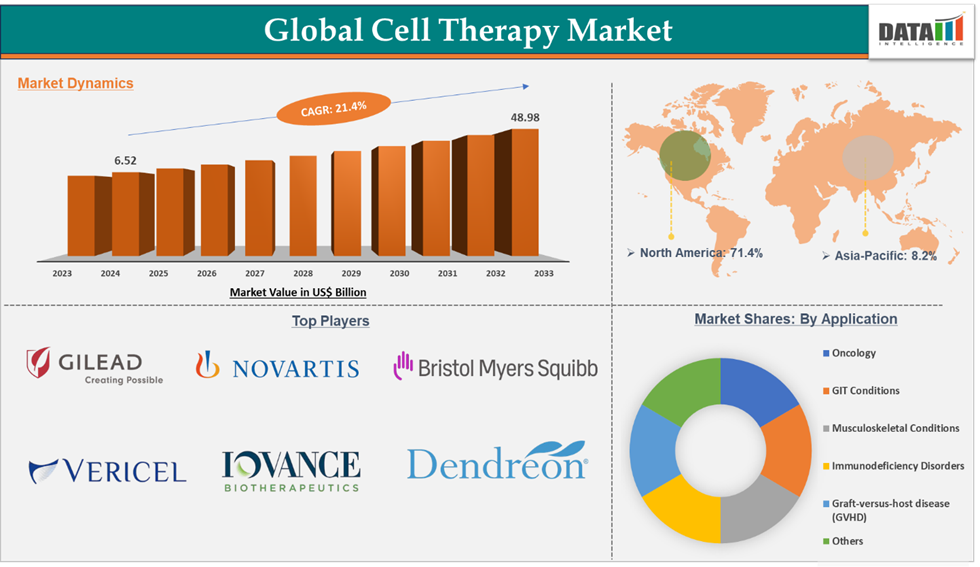

Cell Therapy Market reached US$ 6.52 Billion in 2024 and is expected to reach US$ 48.98 Billion by 2033, growing at a CAGR of 21.4% during the forecast period 2025-2033.

The cell therapy market is experiencing significant growth due to the rising research and development activities for developing novel cell therapies, rising regulatory support and approvals, rising demand for alternatives to traditional drugs for the treatment of life-threatening chronic diseases, and technological advancements and development of novel delivery methods. However, the high cost of cell therapies and efficacy issues can significantly hinder their adoption. The expanding applications of cell therapies are a key opportunity for market expansion in the forecast period.

Executive Summary

For more details on this report – Request for Sample

Cell Therapy Market Dynamics: Drivers & Restraints

The Rising R&D Activities and Product Approvals are driving the market growth

The cell therapy market is rapidly expanding, fueled by the rising research and development activities. With the growing unmet needs in the chronic disease landscape, there has been a rising demand for disease-modifying treatment options like cell therapies. These therapies have established themselves as a promising option for untreatable conditions, and unlike traditional drugs, cell therapies offer personalized, targeted, and potentially curative treatment options in areas such as oncology, autoimmune disorders, and rare genetic diseases. Hence, the established players and emerging players in the biopharmaceutical industry are investing heavily in developing these cell therapies. Consequently, they are receiving regulatory approvals by proving their efficacy and safety in clinical trials.

For instance, in December 2024, the U.S. Food and Drug Administration (FDA) approved Ryoncil (remestemcel-L-rknd) developed by Mesoblast, Inc. Ryoncil is the first allogeneic bone marrow-derived mesenchymal stromal cell (MSC) therapy approved till now, and is indicated for the treatment of steroid-refractory acute graft versus host disease (SR-aGVHD) in pediatric patients 2 months of age and older.

In September 2024, Aurion Biotech announced the commercial launch of Vyznova (neltependocel) in Japan to treat bullous keratopathy of the cornea. With this launch, Vyznova became the first cell therapy approved in Japan to treat corneal endothelial disease. This novel cell therapy received both regulatory and reimbursement approval in Japan.

These approvals reflect the success story of each cell therapy and pave the way to market entry for emerging cell therapies that are in clinical development stages. In their forecast period, several cell therapies are expected to be launched commercially, and boost the overall market growth.

High Cost of Approved Cell Therapies may restrain the market growth

Cell therapies, although providing promising and potentially curative options for many untreatable chronic conditions, are often priced extremely high. For instance, a very popular CAR-T cell therapy, i.e., Yescarta, is priced at US$ 424,000 in the United States. This price may vary from country to country, and can only be affordable by patients with appropriate reimbursement coverage. The reimbursement policies across the world are not well-established, and patients in some countries have to spend out of their pockets to afford these expensive cell therapies. In such cases, affordability plays a crucial role and may lead to decreased adoption, thereby hindering the market growth.

Cell Therapy Market Segment Analysis

The global cell therapy market is segmented based on source, cell type, application, and region.

Oncology in the application type segment accounted for 72.5% of the market share in 2024 in the global cell therapy market

Cell therapies, particularly the Chimeric Antigen Receptor (CAR) T-cell therapy, has emerged as a revolutionary strategy for the treatment of different diseases, particularly hematological malignancies such as leukemia and lymphomas. This novel treatment uses the patient's immune system by genetically altering T cells to better recognize and destroy cancer cells. The method consists of several important steps, each of which is meant to improve the effectiveness of the immune response against malignancies.

The majority of the cell therapies that are currently approved are for various oncology indications. Based on their sales value, market share, and respective indication, the oncology application is designated as dominating, with the highest market share. For instance, below are the top selling cell therapies, their sales and indication.

Cell Therapy | Manufacturer | Indication | Sales (2024) US$ Billion |

Yescarta | Gilead Sciences, Inc. | Refractory B-Cell Lymphoma, Large B-Cell Lymphoma, Diffuse Large B-cell Lymphoma (DLBCL) | 1,570.00 |

Carvykti | Johnson & Johnson Services, Inc. & Legend Biotech USA Inc. | Relapsed or Refractory Multiple Myeloma | 963.00 |

Breyanzi | Bristol-Myers Squibb Company | B-Cell Lymphoma (LBCL), Diffuse B-Cell Lymphoma (DLBCL) | 747.00 |

Kymriah | Novartis AG | Acute Lymphoblastic Leukemia (ALL), Relapsed or Refractory (R/R) Large B-Cell Lymphoma, Diffuse Large B-Cell | 443.00 |

Tecartus | Gilead Sciences, Inc. | Relapsed or Refractory Mantle Cell Lymphoma (MCL), Relapsed or Refractory B-Cell Precursor Acute | 403.00 |

Amtagvi | IOVANCE Biotherapeutics, Inc. | Unresectable or Metastatic Melanoma | 104.00 |

Cell Therapy Market Geographical Analysis

North America dominated the cell therapy market with the highest share of 71.4% in 2024

North America is well known for its advanced biotechnology industry. The increasing prevalence of chronic diseases, recent launches and approvals, advanced research and development activities, the presence of major players, and increasing investments and funds by organizations across the region are the main factors contributing to the region's dominance.

The increasing prevalence of chronic diseases, such as cancer, increases the need for cell therapy, which drives the market. For instance, according to an article published by the National Institute of Health, in January 2024, 2,001,140 new cancer cases and 611,720 cancer deaths are projected to occur in the United States. Moreover, according to the Zerocancer Organization, in 2024, the United States is facing an alarming rise in cancer incidence, set to surpass 2 million new cases. Prostate, breast, endometrial, pancreatic, kidney, and melanoma cancers contribute to this surge.

The investment for the establishment of cell therapeutics is increasing in this region, which contributes to advanced cell therapy research and development and drives the market in this region. For instance, in February 2024, AstraZeneca extended its manufacturing footprint in the United States to accelerate next-generation cell therapy discovery and development. AstraZeneca has invested $300 million in a revolutionary laboratory in Rockville to launch its vital cell therapy platforms in the United States for key cancer studies and long-term commercial supplies. AstraZeneca is developing a cell treatment portfolio to empower and equip the immune system's T-cells to better combat cancer. The company's research teams are researching new ways to target and arm CAR-Ts to improve their efficacy in solid tumors by overcoming the immune-suppressive tumor microenvironment.

Cell Therapy Market Major Players

The major players in the Cell therapy market are Gilead Sciences, Inc., Novartis AG, Vericel Corporation, CO.DON GmbH, Bristol Myers Squibb company., IOVANCE Biotherapeutics, Inc., Dendreon Pharmaceuticals LLC., Enzyvant Therapeutics GmbH., CellTrans., and Gamida Cell Inc., among others.

Key Development

In April 2025, Abeona Therapeutics Inc. announced that the U.S. Food and Drug Administration (FDA) approved ZEVASKYN (prademagene zamikeracel) for the treatment of recessive dystrophic epidermolysis bullosa (RDEB). Zevaskyn is the first and only autologous cell-based gene therapy.

In March 2025, Bristol Myers Squibb Company announced that the European Commission (EC) has approved the use of CAR T Cell Therapy Breyanzi in Relapsed or Refractory Follicular Lymphoma after two or more lines of systemic therapy.

Market Scope

Metrics | Details | |

CAGR | 21.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Source | Autologous and Allogenic |

Cell Type | Stem Cells and Non-Stem Cells | |

Application | Oncology, GIT Conditions, Musculoskeletal Conditions, Immunodeficiency Disorders, Graft-versus-host disease (GVHD), and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |