Global Hemp Protein Market is segmented By Nature (Organic, Conventional), By Application (Food and Beverages, Pharmaceuticals, Dietary Supplements, Personal Care, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2024-2031

Report Overview

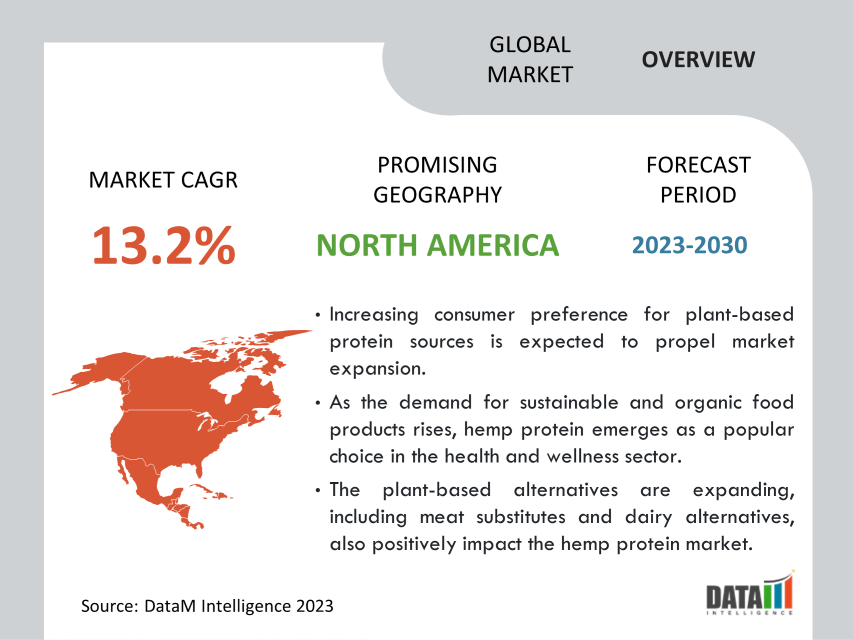

Hemp Protein Market reached USD billion in 2022 and is expected to reach USD billion by 2030 growing with a CAGR of 14.1% during the forecast period 2024-2031. The global hemp protein market is projected to experience significant growth in the coming years.

The increasing consumer preference for plant-based protein sources is expected to propel market expansion. As the demand for sustainable and organic food products rises, hemp protein emerges as a popular choice in the health and wellness sector.

The plant-based alternatives are expanding, including meat substitutes and dairy alternatives, also positively impact the hemp protein market. As consumers shift towards plant-based diets for ethical, environmental, and health reasons, the demand for hemp protein-based products continues to rise and drive market growth.

Market Scope

|

Metrics |

Details |

|

CAGR |

14.1% |

|

Size Available for Years |

2022-2031 |

|

Forecast Period |

2024-2031 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Nature, Application, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, and Middle East & Africa |

|

Fastest Growing Region |

Asia-Pacific |

|

Largest Region |

North America |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis, and Other key Insights. |

For More Insights about the Market Download Sample

Market Dynamics

Increasing Demand for Plant-Based Protein Drives Market Growth

The rising awareness about the health benefits of vegan diets is driving consumer interest in plant-based proteins. The hemp protein demand as consumers become more conscious of their dietary choices is expected to surge. Hemp protein is containing essential amino acids required by the human body. This nutritional profile makes it for health-conscious consumers looking for a well-rounded protein option.

Health and wellness with a focus on nutritious and sustainable food options is driving the plant-based protein market, including hemp protein. Consumers are increasingly seeking protein-rich, plant-based alternatives to conventional animal-derived products, contributing to hemp protein market growth.

Manufacturers are also developing new products to meet the demand in the market. For instance, on February 17, 2022, Vejii Holdings Ltd. introduced innovative hemp-protein products from Planet Based Foods to its US platform. These product ranges include the HEMP Burger, HEMP Crumble, and the HEMP Sausage Patty.

Growing Hemp Protein Application in Food and Beverage Industry Drive Market Growth

The incorporation of hemp protein into various food and beverage products, such as protein bars, shakes, smoothies, plant-based milk, yogurt, and snacks, diversifies the market offerings. This diversity attracts a broader consumer base seeking nutritious and plant-based hemp protein food options, driving its market growth.

The food and beverage industry's focus on health and wellness promotes the use of nutritious and functional ingredients like hemp protein. As the industry expands, the demand for hemp protein increases, contributing to market growth. Hemp protein's use in vegan and vegetarian food products caters to the preferences of this growing consumer segment. The rising popularity of plant-based diets further drives market demand for hemp protein.

Manufacturers are also investing, collaborating, and developing new hemp protein products in the hemp protein market and driving the market growth. For instance, on July 5, 2023, Burcon NutraScience Corporation, renowned for its pioneering work in plant-based proteins for the food and beverage industry, partnered with HPS Food and Ingredients Inc., a prominent player in hempseed-based food ingredients. This strategic partnership aims to explore the commercial potential of Burson's – soluble hempseed protein isolate.

Regulatory Uncertainty of Hemp Protein Hamper the Market Growth

Regulatory uncertainty is creating confusion and hesitation among manufacturers and retailers, leading to limited market access for hemp protein products. Unclear guidelines deter companies from entering certain regions and markets, hindering overall market growth. Regulatory uncertainty is creating concerns among consumers regarding the safety and legality of hemp protein products. This uncertainty lower consumer confidence and adoption, leading to reduced market demand.

The lack of regulatory clarity deters potential investors and manufacturers from making significant investments in hemp protein products. This could result in limited research and development efforts to improve product quality and innovation, impacting the market's expansion.

Market Segment Analysis

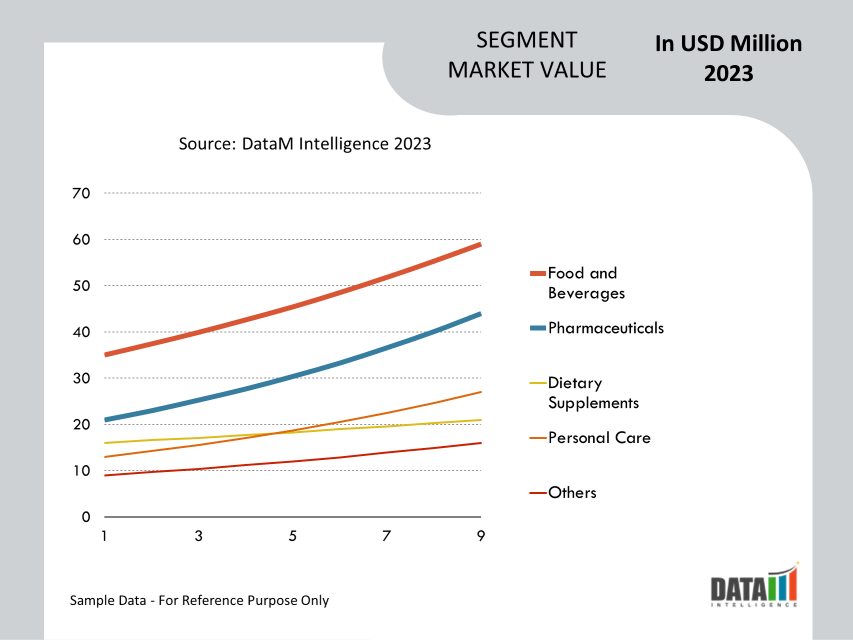

The global hemp protein market is segmented based on nature, application, and region.

Increasing Use of Hemp Protein in the Food and Beverage Industry

The food and beverage segment holds the largest share of the global hemp protein market. The food and beverage segment is witnessing a significant shift towards health and wellness with consumers seeking nutritious and functional food options and driving the market growth.

Hemp protein is used in a wide range of food and beverage products such as protein bars, shakes, smoothies, plant-based milk, and baked goods. This versatility in food applications expanded its market presence in the food and beverage industry. The increasing consumer preference for plant-based diets, driven by health and environmental concerns, positively impacted the demand for hemp protein in the food and beverage market. Consumers sought protein-rich alternatives to traditional animal-derived products, making hemp protein a sought-after option.

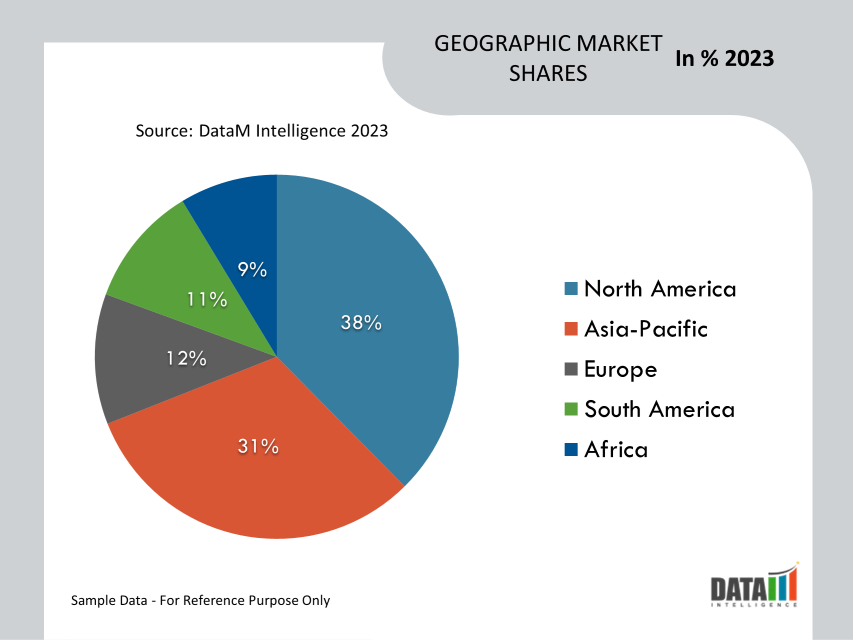

Market Geographical Share

Growing Awareness and Preference for Plant-Based Diets in North America

North America region is dominating the global hemp protein market. The food and beverage industry is playing a crucial role in driving the demand for hemp protein as a popular plant-based protein source in the region. The rising health consciousness among consumers in North America further boosted the adoption of hemp protein in various food products.

The growing popularity of vegan and vegetarian lifestyles is supporting the strong market presence of hemp protein in North America. The favorable regulatory environment of hemp-based products in North America facilitated the integration of hemp protein into a wide range of food and beverage offerings.

Hemp Protein Market Companies

The global hemp protein market players include Herbalife International, GNC Holdings, Amway, Glanbia, Bayer, Abbott Laboratories, NutraClick, Nature’s Sunshine Forms, Bionova Lifesciences, and PowerBar Europe GmbH.

COVID-19 Impact Analysis

The pandemic disrupted global supply chains, affecting the availability of hemp protein products in the market. Shipping delays and distribution challenges hindered product accessibility for consumers. Many physical retail outlets faced closures or reduced operating hours due to lockdowns and restrictions. This impacted the sales of hemp protein products in brick-and-mortar stores, affecting market revenues.

However, with lockdowns and restrictions in place, online sales channels became vital for product distribution. The hemp protein market benefited from the significant increase in e-commerce activities, as consumers turned to online platforms to purchase health-focused products from the comfort of their homes.

By Nature

- Organic

- Conventional

By Application

- Food and Beverages

- Pharmaceuticals

- Dietary Supplements

- Personal Care

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On June 20, 2022, Applied Food Sciences, a Texas-based company, introduced a new hemp seed protein ingredient known as PurHP-75. This organic ingredient is derived from hemp hearts and boasts an impressive protein content of 75%, encompassing all nine essential amino acids. Innovatively, AFS has addressed the challenge of bitter taste and gritty texture often associated with traditional hemp ingredients.

- In March 2020, a significant partnership was established between Victory Hemp Foods in Kentucky's Louisville and Applied Food Sciences (AFS) in Texas, Austin. Their strategic agreement aimed to substantially expand the application of hemp grains as a versatile ingredient across a wide range of products. AFS is renowned for being a supplier of botanical extracts used in the food, beverage, and supplement industries, and it also serves as a reliable supply partner for various top food and beverage brands.

- In August 2020, Sustainable Foods Inc., based in Wooster, OH, United States, introduced a new line of hemp-based meat analogs. These innovative products are crafted using locally sourced hemp, cultivated in New Zealand, and processed at a private hydroelectric power plant. This strategic move not only expands the company's product range but also reinforces its commitment to sustainability and environmentally responsible practices.

Why Purchase the Report?

- To visualize the global hemp protein market segmentation based on nature, application, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of the hemp protein market level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global hemp protein market report would provide approximately 53 tables, 48 figures, and 101 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies