Market Size

Global Round Billets Market reached USD 0.51 billion in 2022 and is expected to reach USD 0.72 billion by 2031, growing with a CAGR of 10.1% during the forecast period 2024-2031. Renewable energy from various sources is frequently required to be carried across areas, necessitating the development of transmission towers and infrastructure.

A round billet is a semi-finished metal bar or block characterized by a round cross-section and a cross-sectional area of less than 36 in² (230 cm²). Billets are utilized in the manufacturing of many items, including rods, bars, tubes, wires, and other structural elements.

The use of round billets in the production of transmission towers is driving the market growth.

North America is anticipated to have a significant growth holding around 1/4th of the global round billets market during the forecast period 2024-2031. The market is likely to be driven by an increase in residential and non-residential building spending. According to U.S. Census Bureau, spending on single-family residential spaces reached from USD 400.5 billion in April 2021 to USD 477.6 billion in April 2022.

Market Scope

| Metrics | Details |

| CAGR | 10.1% |

| Size Available for Years | 2021-2030 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (USD) |

| Segments Covered | Product, Material, Process, End-User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

| Largest Region | Asia-Pacific |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

To Know More Insights - Download Sample

Market Dynamics

Expansion of Aerospace Industry

The increase in the number of fliers around the world is accelerating aircraft production and benefiting market expansion, which is driving demand for round billets for parts in the aerospace industry. Boeing delivered 302 aircraft in 2021, nearly double the amount shipped the previous year. Furthermore, Boeing stated in March 2022 that doubled the 737 Max production.

The increase was credited to increased consumer spending and capital expenditure spending, which boosted U.S. economy to its fastest growth since 1984. In 2021, the country's unemployment rate reached a 37-year high of 5.7%. The rebound signals a return to industrial activity, which is expected to increase demand for round billets during the forecast period.

The Rising Investments in Fuel-efficient Components

The increased focus on fuel efficiency, emissions reduction and lightweighting in industries like automotive and aerospace drives demand for round billets components. Continuous round billet casting is less expensive than other billet manufacturing technologies and has a greater grade and productivity than other billets. Transportation investments are expected to remain a major development driver for the market.

For example, under the 14th five-year action plan (2021-25), the Chinese government committed USD 154 billion in investments to extend the railway network in the Yangtze River Delta region in September 2021. It is expected to increase the region's railway network from 4,200 km to 17,000 km. In addition, the high-speed rail network is anticipated to expand from 3,500 km to 9,500 km.

High Costs and Volatility in Prices

Significant capital investment is required to establish and operate a round billets production operation. The expenses of equipment, machinery and infrastructure might be too expensive for new entrants or smaller businesses, limiting market entrance and expansion. The manufacturing process is energy-intensive, which adds to high energy prices.

Energy price fluctuations, including electricity and fuel, can have an impact on the entire cost of production for round billets, affecting profitability and competitiveness. The market for Round Billets is susceptible to changes in raw material prices, especially the cost of steel. Changes in raw material prices, such as iron ore and scrap metal, can have a substantial impact on the profitability and pricing of round billets.

Market Segment Analysis

The global round billets market is segmented based on product, material, process, end-user and region.

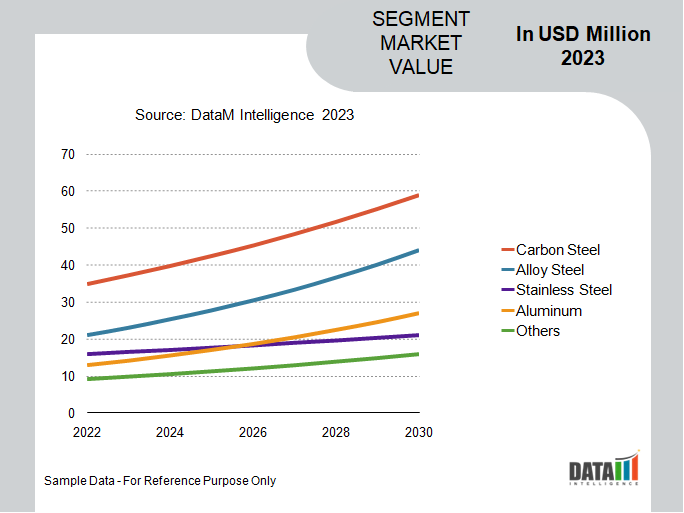

The Demand for Lightweight Materials Drives Aluminum Segment

During the forecast period, aluminum is expected to hold around 1/4th of the global round billets market. Aluminum components are appropriate for environments where safety is paramount and a lighter metal is required for energy economy or speed. Aluminum parts can be found in tractors, airplanes, automobiles, energy missiles, drilling tools and ships.

The usage of aluminum in the vehicle sector reduces CO2 emissions significantly. Rising automotive manufacturer demand is expected to drive demand for aluminum round billets. For example, Sansera Engineering, a maker of high precision components, received a USD 0.3 million contract from BMW AG for the supply of aluminum components in March 2021.

Market Geographical Share

The Large Automotive Sector in Asia-Pacific

Asia-Pacific round billets market has witnessed significant growth covering more than 1/3rd of the global market share in 2022. China, India and Japan are major automotive manufacturing countries. The region has a large automotive industry and steel is an important commodity utilized in vehicle manufacturing. The processing of round billets into various automotive components and parts is expected to make an impact on the region's round billets market.

For example, the International Organization of Motor Vehicle Manufacturers reports that China is the world's largest producer of automobiles, accounting for around 32.5% of global volume. In 2021, the country solely produced 2,60,82,220 vehicles, a 3% rise over the previous year's total of 25,225,242 units. The huge automotive market is likely to drive round billet demand in Asia-Pacific.

Market Companies

The major global players include Alleima, Ellwood City Forge, UBE STEEL, Deutsche Nickel, Baosteel Group, AMETEK, Emirates Global Aluminium, Hindalco, Matalco and Vista Metals.

BAOSTEEL GROUP

Overview:

Baosteel Group Corporation, a subsidiary of China Baowu Steel Group, is one of the largest and most prominent steel manufacturers. The company focus on high-quality steel products, serving industries such as automotive, construction, energy, machinery, and shipbuilding. The company is known for its advanced production facilities, including state-of-the-art technologies for steelmaking, hot rolling, and cold rolling processes. Baosteel also places a strong emphasis on sustainability, integrating green practices into its operations, including recycling, energy conservation, and reducing carbon emissions. Baosteel's round billets are a key product in its diverse steel portfolio, primarily used as raw materials for various downstream industries. Round billets are cylindrical, semi-finished steel products that are later processed into different forms through forging, extrusion, and rolling

COVID-19 Impact Analysis

Due to lockdown measures, travel restrictions and plant shutdowns, the pandemic caused disruptions in global supply networks. The delays impacted raw material availability and shipping, especially steel, which is a main material for round billets. The pandemic's global economic recession reduced demand for round billets items in industries like as automotive, aircraft, construction and oil and gas.

Furthermore, the organizations' financial recovery is entirely dependent on their cash reserves. Major billets manufacturing companies were expected to be able to afford a full lockdown for only a few months until the need to change their investment plans. For example, numerous market participants suspended their service activity for several weeks in order to cut costs. While a few players used workforce layoffs to survive the COVID-19 health crisis.

Russia- Ukraine War Impact

Trade restrictions, sanctions or export/import prohibitions on particular goods, especially steel and associated products, may come from geopolitical tensions between Russia and Ukraine. Trade barriers can have an impact on the international flow of round billets and the dynamics of the global market. Majority of Ukraine's steel facilities have ceased operations and many have been damaged or destroyed. Azovstal and Illich Steel in Mariupol are highly damaged and account for major market of Ukrainian steel production.

Even if the issue is resolved, these plants may not return to normality. Due to port destruction or Russian Navy blockades, Ukrainian entry into seaborne markets has been limited or impeded. Shipments by sea have largely ceased. Western sanctions have had an impact on Russian shipments. Rail services for Ukrainian and Russian producers are disrupted and sanctions have halted or significantly restricted Russian shipments to Western Europe.

Key Developments

- In June 2022, Vista Metals Georgia, an independent manufacturer of Specialty Aluminum Products, started construction on a new USD 30 million casthouse expansion project at its Adairsville production location in Georgia. The initiative will help the company's ability to serve the aerospace extrusion and rolling markets.

- In February 2022, Emirates Global Aluminium, UAE's largest industrial firm outside of oil and gas, stated plans to develop a 150,000-tonne-per-year aluminum recycling facility, the company's first and the largest in UAE. The factory will convert post-consumer aluminum scrap into low-carbon, high-quality billets of aluminum.

- In May 2021, Rae Bareli the plant of RINL, a state-owned steel business, began the commercial manufacture of forged wheels in Uttar Pradesh. Rashtriya Ispat Nigam Ltd (RINL), based in Visakhapatnam, has established a plant in Rae Bareli at a cost of approximately Rs 1,680 crore, with an annual manufacturing capacity of one lakh pieces of forged wheels.

Why Purchase the Report?

- To visualize the global round billets market segmentation based on product, material, process, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of round billets market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global round billets market report would provide approximately 69 tables, 77 figures, and 203 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies