Global Zirconium Market is segmented By Type (Zircon, Zirconia, Others), By Form (Crystal, Powder), By Process (Hydrothermal Method, Precipitation Method), By End-User (Ceramic, Foundry Sands & Coatings, Refractory, Chemical, Glass, Nuclear Power, Cosmetics, Food Packaging, Healthcare, Industrial, Papers, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2024-2031

Zirconium Market Size

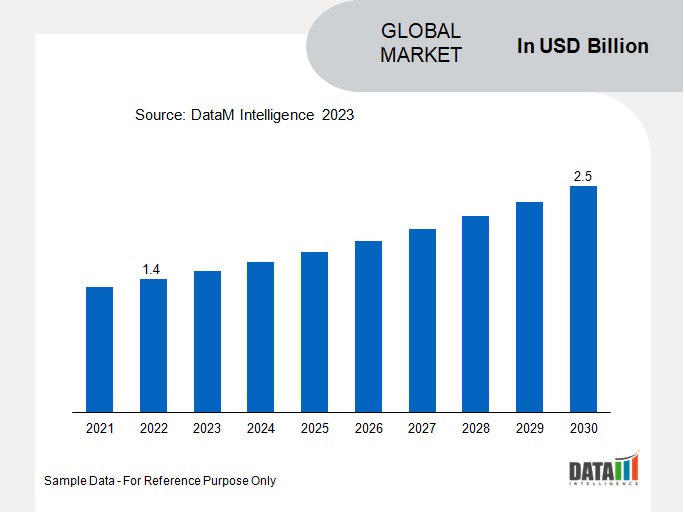

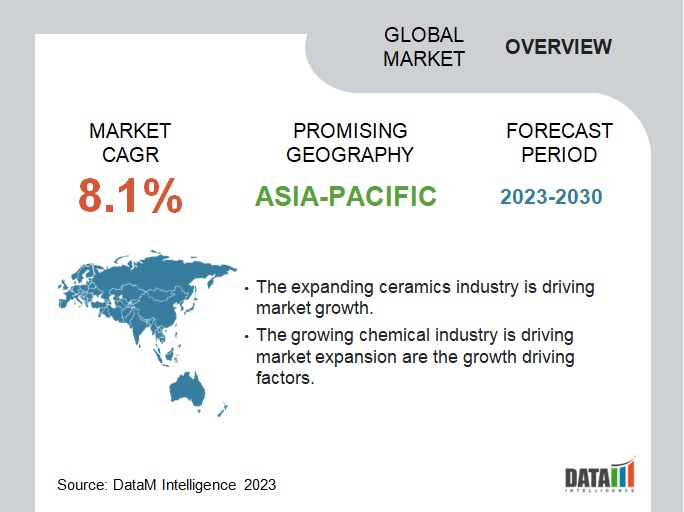

Global Zirconium Market reached USD 1.4 billion in 2022 and is expected to reach USD 2.5 billion by 2030, growing with a CAGR of 6.9% during the forecast period 2024-2031.

Zirconium plays a vital role in nuclear reactor fuel rods and various components. The increasing demand for zirconium is propelled by the global pursuit of cleaner energy alternatives and the establishment of new nuclear power facilities in numerous countries. This pattern was expected to continue as nations endeavored to reduce carbon emissions and broaden their energy sources.

Because of its numerous qualities, including its ability to bind with all organic and inorganic sand binders, low acidity, low thermal expansion coefficient, high spatial stability at increased temperatures, chemical stability at high temperatures and good recyclability, zircon is widely used in ceramics and foundry, typically in the form of sand and flour.

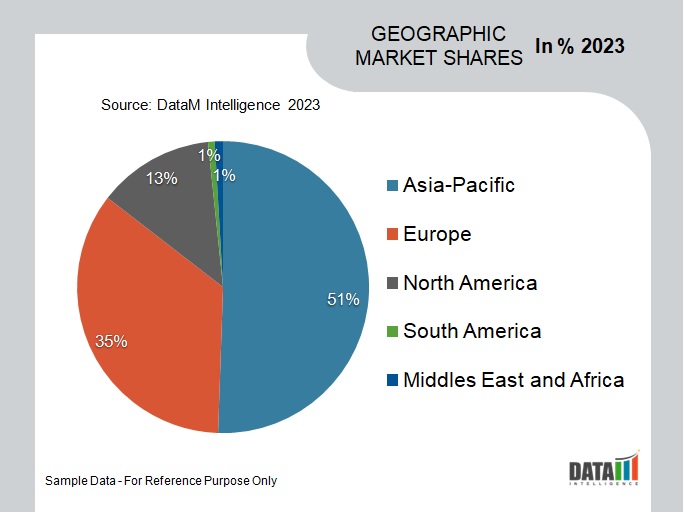

Asia-Pacific dominates the zirconium market with a total share of 54.5% and Asia-Pacific has seen growth in the aerospace and defense industries as nations like China improve their military technologies and aircraft production capacities. Zirconium's demand is mostly fueled by the aerospace and defense sectors due to its value in high-temperature and corrosion-resistant applications.

Market Summary

| Metrics | Details |

| CAGR | 6.9% |

| Size Available for Years | 2021-2030 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (US$) |

| Segments Covered | Type, Form, Process, End-User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

| Fastest Growing Region | Europe |

| Largest Region | Asia-Pacific |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Type Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For more details on this report Request for Sample

Market Dynamics

Expanding Ceramics Industry

Zirconium is a widely utilized material in the global ceramics industry, finding extensive applications in products such as tiles, glazes and enamels. This significant role positions the ceramics sector as one of the largest markets for zirconium worldwide. The market is expected to develop at a rapid rate during the estimated time frame due to the booming ceramic industry worldwide and rising ceramic output and consumption.

For instance, according to data from the Trade Promotion Council of India, India's exports of ceramic items rose in 2019 and totaled USD 1.7 billion. The market for ceramic tiles also performed well in Europe, with Germany seeing an increase in tile consumption of 10.8%.

According to statistics provided by Ceramica.info, the official online source for the Italian ceramic sector. Zirconium demand is anticipated to rise as a result of this expansion in the ceramics sector worldwide, which will propel market growth throughout the period of forecasting.

Growing Chemical Industry

Zirconium plays a crucial role in the chemical industry, finding diverse applications. It is extensively used in various equipment such as boilers, tanks, pressure vessels, pumps and valves, with zirconium alloys providing exceptional corrosion resistance against salt solutions, certain molten salts organic and inorganic acids and strong alkalis.

Moreover, zirconium plays a catalytic role in various chemical processes across the industry. The projected global expansion of the chemical sector is poised to increase the demand for zirconium and its alloys, consequently fostering market growth in the foreseeable future. For instance, according to a forecast by the India Brand Equity Foundation, the small and medium firms in the Indian chemical sector would have 18–23% revenue growth in FY22.

Additionally, In June 2021 Mid-Year U.S. Chemical Industry Outlook research predicts that chemical volumes in the US market will increase by 3.2% and that shipments will increase by 8.2% in 2022. Global chemical industry growth of this magnitude is anticipated to enhance zirconium demand, which will fuel market expansion all through the forecast period.

Price Volatility

A variety of factors add to the considerable moves in zirconium pricing. Supply and demand dynamics' complex interaction is the main cause of this instability. The price of zirconium is extremely sensitive to changes in industrial demand, particularly from industries like aerospace, nuclear power and chemical processing.

Price increases may result from an abrupt increase in demand, which is frequently fueled by technology improvements or changes in the global economy's objectives. On the other side, a decline in demand brought on by economic downturns or changing industry preferences may result in increases in prices. Due to the direct influence these changes in supply and demand have on their production costs and pricing strategies, manufacturers and end users actively watch these changes.

Strict Restrictions on Zirconium

The health risks connected with zirconium usage have long been a prominent worry and this might hinder the market's growth throughout the projected period. Exposure to zirconium can lead to irritation of the eyes, lungs and skin, often resulting in allergic reactions. Various regulatory bodies maintain vigilant oversight over its usage and its potential impact on human health.

For Instance, the Occupational Safety and Health Administration has implemented an exposure limit of 5 mg/m3. Zirconium utilization is subject to such rigorous regulations, which may limit market expansion throughout the forecasted period. It may be difficult to acquire the required permissions and licenses for zirconium mining, refining and processing due to strict requirements. Reducing the overall supply of zirconium on the market may result in higher costs and less availability.

Market Segmentation Analysis

The global zirconium market is segmented based on type, form, process, end-user and region.

Rising Consumer Demand for Fashionable Ceramic Items in the Ceramic Industry

Zirconium is used in a broad variety of industrial applications, including ceramics, piezoelectric crystals and zirconium alloys. The greatest market for zirconium among them is the ceramics sector which covers nearly 1/3rd of the market share, where it is used in ceramic tiles, glazes, frits, enamels and several other applications. Due to rising consumer demand for fashionable and high-end ceramic items, the demand for ceramic is rising internationally and this is expected to fuel the market's expansion over the next years.

As an illustration, the ceramic tile industry experienced positive growth in the initial quarter of 2021, witnessing a 9% increase in turnover compared to the same period in 2020, as reported by the Italian ceramics association Confindustria Ceramica. Moreover, data from the Tile Council of North America reveals a substantial 17.8% surge in the volume of ceramic tile usage during the first quarter of 2021 in comparison to the corresponding period of the previous year.

Market Geographical Share

Increasing Demand for Zirconium in Ceramic Industry in Asia-Pacific

Asia-Pacific has been a dominant force in the global zirconium market and the growing ceramic industry in the region is responsible for the increased demand for zirconium. Numerous ceramic items, including tiles, frits and pigment, are made with zirconium. The Asia-Pacific area produces a significant number of ceramics, which contributes to the region's extensive usage of zirconium.

For instance, China is the world's top producer of ceramic tiles, according to data from the Trade Promotion Council of India (TPCI). The region's ceramic sector has had outstanding expansion in recent years and this is anticipated to continue to drive up demand for zirconium over the projection period.

For instance, the ceramic items & glassware category had positive growth (20.32%) in May 2021 compared to May 2019, according to the June 2021 statistics from the India Brand Equity Foundation. Similar to this, according to Iluka Resources' 2021 Half Year Results report, China's output of ceramic tile has reached pre-pandemic levels. During the projected period, it is anticipated that a significant increase in ceramics manufacturing in the region will drive up demand for zirconium.

China gave rise to the global zirconium market covering more than 2/3rd at the regional level and is regarded as the nation with the fastest pace of nuclear energy consumption development. It is projected that zirconium demand will increase as nuclear power supplies become more valued. The world's top manufacturer of steel is China. China produced 53% of the total amount of steel produced globally or 1950.5 metric tonnes, according to World Steel Association research.

In addition, the Chinese government authorized the building of 43 additional EAFs in 2021, with a combined capacity of 29.33 million mt/year for crude steel. As a result, the development of new steel mills is probably going to increase demand for refractories and boost the nation's zirconium consumption.

Market Companies

The major global players in the market include Australian Strategic Materials Ltd, Base Resources Limited, Iwatani Corporation, Eramet SA, Iluka Resources Limited, Kenmare Resources Plc, Rio Tinto Group, Saint-Gobain ZirPro, Tosoh Corporation, Tronox Holdings Plc.

COVID-19 Impact on Market

The rapid rise of COVID-19 cases forced some countries to impose lockdowns, which significantly impacted the global economy. The cessation of economic and industrial activity impacted the zirconium market in terms of output and demand from several end-user industries, including cement, energy and chemicals, iron and steel and ceramics. The development of the construction sector has considerably impacted the cement sector.

The demand for cement and refractories will probably be affected until these sectors' expenditures recover as it is anticipated that the residential, commercial and industrial segments of the construction industry will experience a slowdown. The COVID-19 pandemic's effects on the world zirconium market have been extensive. Industrial processes and supply chains were hampered by the pandemic, which caused delays in the extraction, processing and shipment of zirconium materials and goods.

Lockdowns and health safety precautions forced the temporary closure or capacity reduction of several zirconium mines and processing plants, which limited the availability of zirconium's raw materials. Zirconium prices fluctuated as a result of this disruption in supply and the resulting market unpredictability.

For instance, lockdowns and economic uncertainty slowed down building activity in the construction sector, which employs zirconium in ceramic tiles and refractory materials. Similar production cuts and a decline in the market for new cars and planes were experienced by the automotive and aerospace industries, which depend on zirconium alloys for their lightweight and corrosion-resistant qualities.

Russia-Ukraine War Impact

The war between Russia and Ukraine may affect the zirconium market in several ways. Zirconium sand, which is the main source of zirconium, is produced in substantial quantities in Ukraine and around the world. Exports of zirconium ore might be reduced as a result of any supply chain interruptions brought on by the war, such as transportation blockades or infrastructure damage; this could result in a scarcity of zirconium and price changes in the world zirconium market.

Additionally, geopolitical unrest may result in more ambiguity, which might undermine investor confidence and market stability, which could influence zirconium prices and trade. The conflict's effects on critical end-use sectors might also influence the zirconium market from a demand standpoint. Companies in the zirconium sector should constantly follow developments in the conflict between Russia and Ukraine and evaluate their supply chains and market strategy accordingly to reduce potential risks.

For instance, sanctions or export limits placed on Russia, a key source of zirconium, might cause supply chain disruptions in the aerospace and defense industries, which depend on zirconium alloys for their high-temperature resilience and lightweight qualities. Further altering the dynamics of the world zirconium market is geopolitical unrest, which can also result in currency and trade relationship volatility.

Key Developments

- On August 03, 2023, ASM and USA Rare Earth announced a long-term metal sales and tolling framework agreement. We are happy to announce the signing of a five-year contractual framework agreement (Framework Agreement) for the supply of neodymium iron boron (NdFeB) alloy with USA Rare Earth, LLC (USARE).

- On May 11, 2023, Eramet declared that it will rapidly implement its commitment to CSR with the beginning of its first audit under the Initiative for Responsible Mining Assurance framework.

- On August, 2023, Iluka announced planned to construct one of the world's few rare earth oxide refineries at Eneabba in Western Australia. This is the result of a strategic alliance with the Australian government, which gave Iluka a non-recourse credit for A$1.25 billion to build the refinery.

Why Purchase the Report?

- To visualize the global zirconium market segmentation based on type, form, process, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of zirconium market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global zirconium market report would provide approximately 69 tables, 74 figures and 208 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies