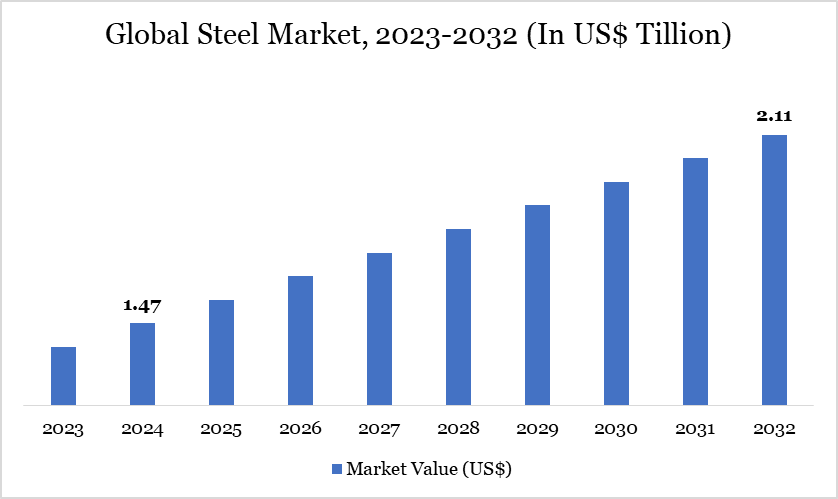

Steel Market Size

Global Steel Market reached US$1.47 trillion in 2024 and is expected to reach US$2.11 trillion by 2032, growing with a CAGR of 4.60% during the forecast period 2025-2032, according to DataM Intelligence report.

The global steel market remains a critical pillar of industrial growth, driven by demand from the construction, automotive, infrastructure, and energy sectors. Steel production is growing primarily due to rising demand from rapid urbanization and industrialization. For instance, in December 2024, world crude steel production reached 144.5 million tons, reflecting a 5.6% increase compared to December 2023. This data covers 71 countries reporting to the World Steel Association. Demand is growing in emerging economies, while developed regions focus on green steel and decarbonization.

Steel Market Trends

Green steel and decarbonization is a key trend in the global steel market as the industry is one of the largest carbon emitters, contributing around 7–9% of global CO₂ emissions. To align with global climate goals, steelmakers are transitioning from traditional blast furnaces to cleaner technologies like hydrogen-based direct reduced iron (H-DRI) and electric arc furnaces (EAFs). This shift is driven by stricter environmental regulations, investor pressure, and carbon pricing mechanisms like the EU’s Carbon Border Adjustment Mechanism (CBAM).

Leading companies are investing heavily in low-carbon solutions to stay competitive and meet ESG targets. For instance, in August 2021, SSAB produced and delivered the world’s first fossil-free steel, made using hydrogen-reduced sponge iron, to Volvo Group. SAB aims to offer fossil-free steel at an industrial scale by 2026 and plans to nearly eliminate its CO₂ emissions by 2030.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details |

| By Steel Type | Carbon steel, Alloy steel, Stainless steel, Tool steel, Others |

| By Product | Flat, Long, Tubular |

| By Manufacturing Process | Basic Oxygen Furnace, Electric Arc Furnace |

| By Application | Industrial Structures, Building and Construction, Automotive, Electrical Appliances, Tools and Machinery, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Infrastructure and Construction Industry Growth

The growth of the infrastructure and construction industry is a major driver of the global steel market, as steel is a core material in buildings, bridges, roads, and railways. Rapid urbanization and population growth in emerging economies are fueling demand for residential and commercial structures. According to the US Geological Survey, in 2024, the construction sector accounted for approximately 30% of net steel shipments, highlighting its substantial role in steel consumption.

The rise of smart cities and sustainable construction practices also relies heavily on advanced steel products. In addition, reconstruction and modernization in developed nations continue to demand high-performance steel. The surge in industrial construction, including factories and warehouses, adds to this upward trend.

Environmental Regulations and Decarbonization Pressures

Environmental regulations and decarbonization pressures are significantly restraining the global steel market by increasing compliance costs and forcing producers to invest in cleaner technologies. Steel production is one of the most carbon-intensive industries, attracting stricter emission limits and carbon taxes. These regulations drive up operational expenses and reduce competitiveness, particularly for older coal-based plants. Companies must now invest heavily in green technologies such as hydrogen-based steelmaking, which are still costly and not widely adopted. This transition phase is slowing growth and creating uncertainty across the global steel industry.

Market Segment Analysis

The global steel market is segmented based on the steel type, product, manufacturing process, application and region.

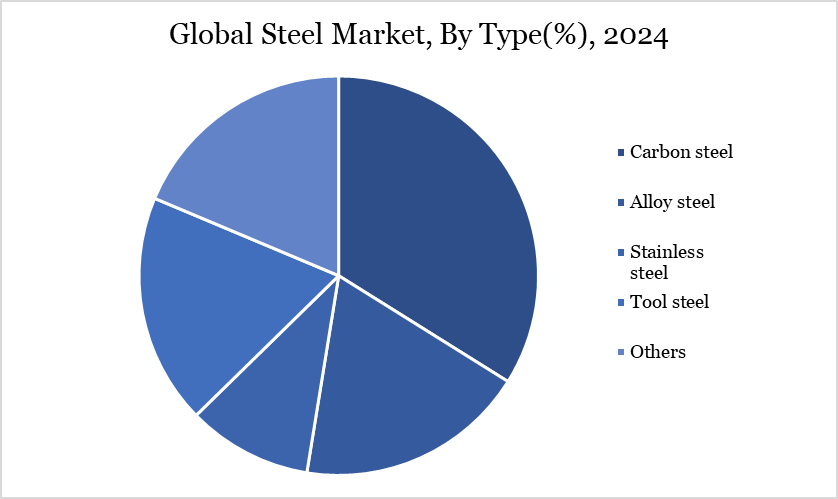

Carbon Steel Dominates the Global Steel Market Due to Its Versatility and Cost-Effectiveness

Carbon steel holds a significant share in the global steel market due to its wide-ranging applications, cost-effectiveness, and versatile properties. It is extensively used in construction, automotive, infrastructure, and manufacturing industries. The material's high strength and durability make it ideal for structural components and machinery. Its relatively low production cost compared to alloy steels contributes to its widespread adoption. Carbon steel is also easy to weld and form, enhancing its appeal in fabrication processes.

Companies expand into emerging markets to tap into untapped resources and reduce production costs. For instance, in 2024, Tsingshan Holding, a China-based company, announced to launch of its carbon steel plant in Manhize, Zimbabwe. This marks a major milestone for Zimbabwe, positioning it to become one of Africa’s leading steel producers.

Market Geographical Share

Asia-Pacific Dominates the Global Steel Market Due to High Production and Rapid Infrastructure Growth

The Asia-Pacific region holds a significant share of the global steel market due to its rapid industrialization, urbanization, and infrastructure development, particularly in countries like China and India. According to World Steel Association AISBL 2024 data, China remained the top steel-producing country with 1,005.1 million tons produced from January to December, marking an 11.8% increase in December alone compared to 2023. India followed as the second-largest producer, recording 149.6 million tons in the same period, with a 9.5% rise in December output year-on-year. These figures highlight the Asia-Pacific region's dominant role in global steel production.

The region's large population and economic growth fuel consistent steel consumption across the automotive, construction, and machinery sectors. The region is also a major exporter, supplying steel to markets worldwide. As a result, Asia-Pacific remains the dominant force shaping global steel industry trends.

Impact Of US Tariffs

In March 2025, the US President imposed a 25% tariff on all steel and aluminum imports to support US manufacturing, sparking immediate backlash. The move, part of a broader effort to fix trade imbalances, triggered swift retaliatory tariffs from the European Union and Canada. Trump warned of further US actions in response, heightening fears of a global trade war.

US tariffs on steel significantly impact the global steel market by disrupting trade flows and increasing prices. Exporting countries face reduced access to the American market, leading to oversupply and price drops in other regions. This causes steel producers worldwide to seek alternative markets, intensifying competition.

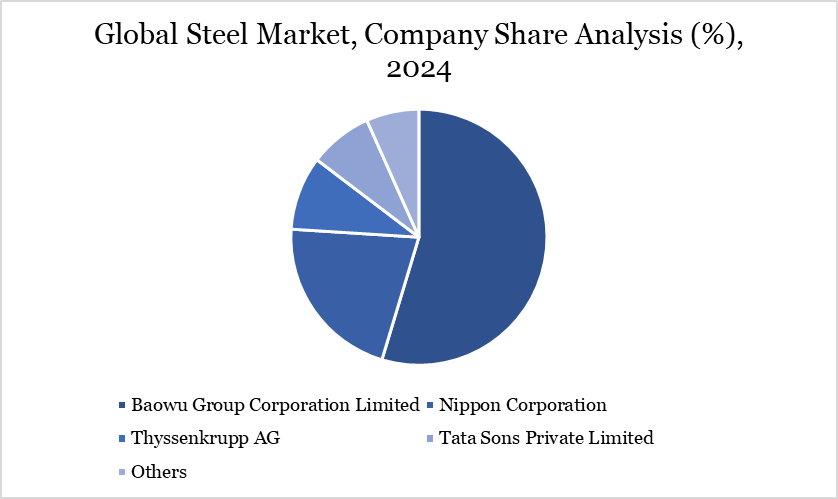

Major Global Players

The major global players in the market include Baowu Group Corporation Limited, Nippon Corporation, Thyssenkrupp AG, Tata Sons Private Limited, JFE Steel Corporation, Hyundai Steel Co., Ltd., Nucor Corporation, JSW Limited, Pohang Iron and Steel Company, Jiangsu Shagang Group Company Limited and others.

Key Developments

- In March 2025, ArcelorMittal Nippon Steel India's Expansion acquired land in Andhra Pradesh, India to establish an integrated steel plant with an initial capacity of 7.3 million tonnes per annum. This move aligns with India's goal to achieve a crude steel capacity of 300 million tonnes by 2030.

- In January 2025, India announced a US$1.8 billion (Rs. 15,000 crore) Green Steel Mission to cut carbon emissions from the steel sector, which accounts for 10–12% of the nation’s total emissions. The initiative includes a Production-Linked Incentive (PLI) for green and specialty steel, promotion of green hydrogen, and mandatory procurement of green steel by government bodies.

- In June 2024, Tata Steel Nederland introduced Zeremis Recycled, a steel product with an allocated 30% recycled content, aimed at supporting customers’ circularity and sustainability goals. Targeting industries like automotive, packaging, and construction, Zeremis Recycled allows customers to claim recycled content at the product level without sacrificing steel quality.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies