Global Peripheral Interventions Market: Industry Outlook

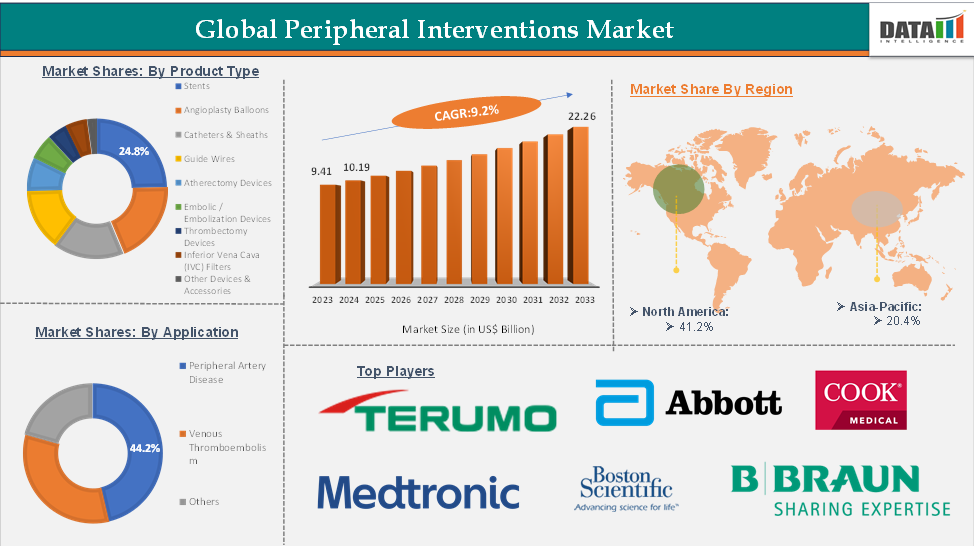

The global peripheral interventions market reached US$ 9.41 billion in 2023, with a rise of US$ 10.19 billion in 2024, and is expected to reach US$ 22.26 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025-2033.

The peripheral interventions space is undergoing a rapid transformation, driven by device innovations and the integration of smart technologies into modern cath labs and hybrid ORs. Next-generation systems now combine advanced imaging compatibility, robotics-assisted navigation, and ultra-low-profile access solutions to deliver higher precision in treating complex vascular conditions. Intelligent peripheral intervention devices, equipped with advanced sensors and connectivity capabilities, enable real-time procedural adjustments tailored to patient-specific hemodynamic data, enhancing both accuracy and safety. At the same time, ergonomically designed delivery systems and catheters provide superior clinician control, minimizing fatigue during complex or lengthy procedures. These advancements are streamlining workflows, shortening procedure times, and improving patient outcomes.

Executive Summary

Dynamics: Drivers & Restraints

Driver: Rising Prevalence of Peripheral Artery Disease (PAD) & VTE

The growing prevalence of peripheral artery disease (PAD) and venous thromboembolism (VTE) is a key driver of demand for peripheral interventions, as these conditions are affecting an increasing number of patients worldwide due to aging populations, rising diabetes and obesity rates, sedentary lifestyles, and persistent smoking habits. PAD, characterized by arterial narrowing that restricts blood flow to the limbs, often leads to pain, mobility loss, and in severe cases, amputation. According to Elsevier B.V. in 2025, peripheral artery disease (PAD) prevalence rises with age, roughly doubling every decade, and currently affects about 6.5 million adults (5.8%) aged 40 and above, with an annual incidence rate of 2.69%. The global increase in PAD cases elevates the risk of complications, resulting in more hospitalizations and interventions.

Similarly, VTE, encompassing deep vein thrombosis (DVT) and pulmonary embolism (PE), remains a leading cause of cardiovascular-related morbidity and mortality, necessitating rapid and effective interventional management. These epidemiological trends are pushing healthcare systems to adopt advanced minimally invasive solutions that not only restore circulation but also reduce recovery times, prevent recurrence, and improve long-term outcomes, thereby fueling consistent growth in the peripheral interventions sector.

Restraint: High Device Costs and Procedure Expenses

High device costs and overall procedure expenses are expected to restrain the growth of the peripheral interventions market, particularly in low- and middle-income regions where healthcare budgets are limited. Advanced devices such as drug-eluting stents, atherectomy systems, and intravascular imaging tools often come with premium pricing, while associated costs for specialized staff, hybrid operating rooms, and post-procedure care further increase the financial burden. These factors can limit accessibility for patients, delay adoption in smaller healthcare facilities, and place pressure on reimbursement systems, ultimately slowing market penetration despite the clinical benefits of these technologies.

For more details on this report, Request for Sample

Segmentation Analysis

The global peripheral interventions market is segmented based on product type, intervention type, application, end-user, and region.

Product Type:

The stents segment is estimated to have 24.8% of the Peripheral Interventions market share.

The stents segment is expected to dominate the peripheral interventions market, driven by continuous advancements in stent technology and their critical role in restoring and maintaining vessel patency in patients with peripheral artery disease (PAD). Modern stents, including drug-eluting stents (DES), covered stents, and bioresorbable scaffolds, offer improved deliverability, radial strength, and biocompatibility, reducing restenosis rates and the need for repeat procedures.

Innovations such as flexible designs for tortuous anatomies, enhanced coatings for drug delivery, and compatibility with smaller-diameter delivery systems are expanding treatment options for complex lesions in femoro-popliteal, iliac, and below-the-knee arteries. For instance, in April 2024, Abbott announced FDA approval of the Esprit BTK Everolimus Eluting Resorbable Scaffold System, a cutting-edge solution for patients with chronic limb-threatening ischemia (CLTI) below the knee. The Esprit BTK System is engineered to maintain arterial patency and deliver Everolimus to aid vessel healing before fully resorbing, offering a minimally invasive approach to improve patient outcomes. Additionally, the growing adoption of minimally invasive endovascular procedures, favorable clinical outcomes, and increasing global PAD prevalence are reinforcing the stent segment’s leadership position within the peripheral interventions market.

Geographical Share Analysis

The North America peripheral interventions market was valued at 41.2% market share in 2024

North America holds a dominant position in the peripheral interventions market, supported by a combination of advanced healthcare infrastructure, high adoption of cutting-edge endovascular technologies, and the strong presence of leading medical device manufacturers. The region faces a significant burden of peripheral artery disease (PAD) and venous thromboembolism (VTE), driven by aging populations, high obesity and diabetes rates, and lifestyle-related risk factors such as smoking and sedentary habits. Favorable reimbursement policies, robust physician training programs, and widespread availability of specialized vascular centers further accelerate the uptake of innovative devices, including drug-coated balloons, atherectomy systems, stents, and intravascular imaging tools.

Continuous R&D investment, frequent FDA approvals, and early adoption of minimally invasive techniques also position North America at the forefront of market growth, making it a hub for both technological innovation and high procedural volumes in peripheral interventions. For instance, in March 2023, Shockwave Medical, Inc. announced the full U.S. commercial launch of the Shockwave L6 Peripheral IVL Catheter following FDA clearance. The L6 catheter is specifically designed to treat challenging calcified lesions in large peripheral vessels, including the iliac and common femoral arteries, enhancing procedural effectiveness and patient outcomes.

Major Players

The major players in the peripheral interventions market include Boston Scientific Corporation, Medtronic, Abbott, Terumo Corporation, Cook, B. Braun SE, BD, Cordis, Biotronik, and W. L. Gore & Associates, Inc., among others.

Key Developments

In December 2024, Terumo Interventional Systems (TIS), a division of Terumo Corporation, announced the U.S. launch of its R2P NaviCross peripheral support catheter, further strengthening its radial-to-peripheral (R2P) portfolio. The R2P NaviCross is specifically designed to optimize performance in R2P procedures. Featuring a double-braided stainless-steel construction, it offers exceptional trackability and precise torque control, enabling clinicians to navigate and cross lesions effectively in even the most complex peripheral interventions.

In September 2024, Shockwave Medical, Inc. announced the full U.S. launch of its Shockwave E8 Peripheral IVL Catheter following FDA clearance. The Shockwave E8 is engineered to enhance treatment outcomes for patients with calcified femoro-popliteal and below-the-knee peripheral artery disease (PAD), including those facing complex chronic limb-threatening ischemia (CLTI).

Report Scope

Metrics | Details | |

CAGR | 9.2% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Stents, Angioplasty Balloons, Catheters & Sheaths, Guide Wires, Atherectomy Devices, Embolic / Embolization Devices, Thrombectomy Devices, Inferior Vena Cava (IVC) Filters, Other Devices & Accessories |

Intervention Type | Atherectomy, Stent Implantation, Angioplasty, Thrombectomy, Embolization | |

| Application | Peripheral Artery Disease, Venous Thromboembolism, Deep Vein Thrombosis (DVT) and Others |

| End-User | Hospitals, ASCs, Cath Labs/Specialty Clinics, Other |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global peripheral interventions market report delivers a detailed analysis with 73 key tables, more than 76 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click her