Global Interventional Cardiology and Peripheral Vascular Devices Market Size

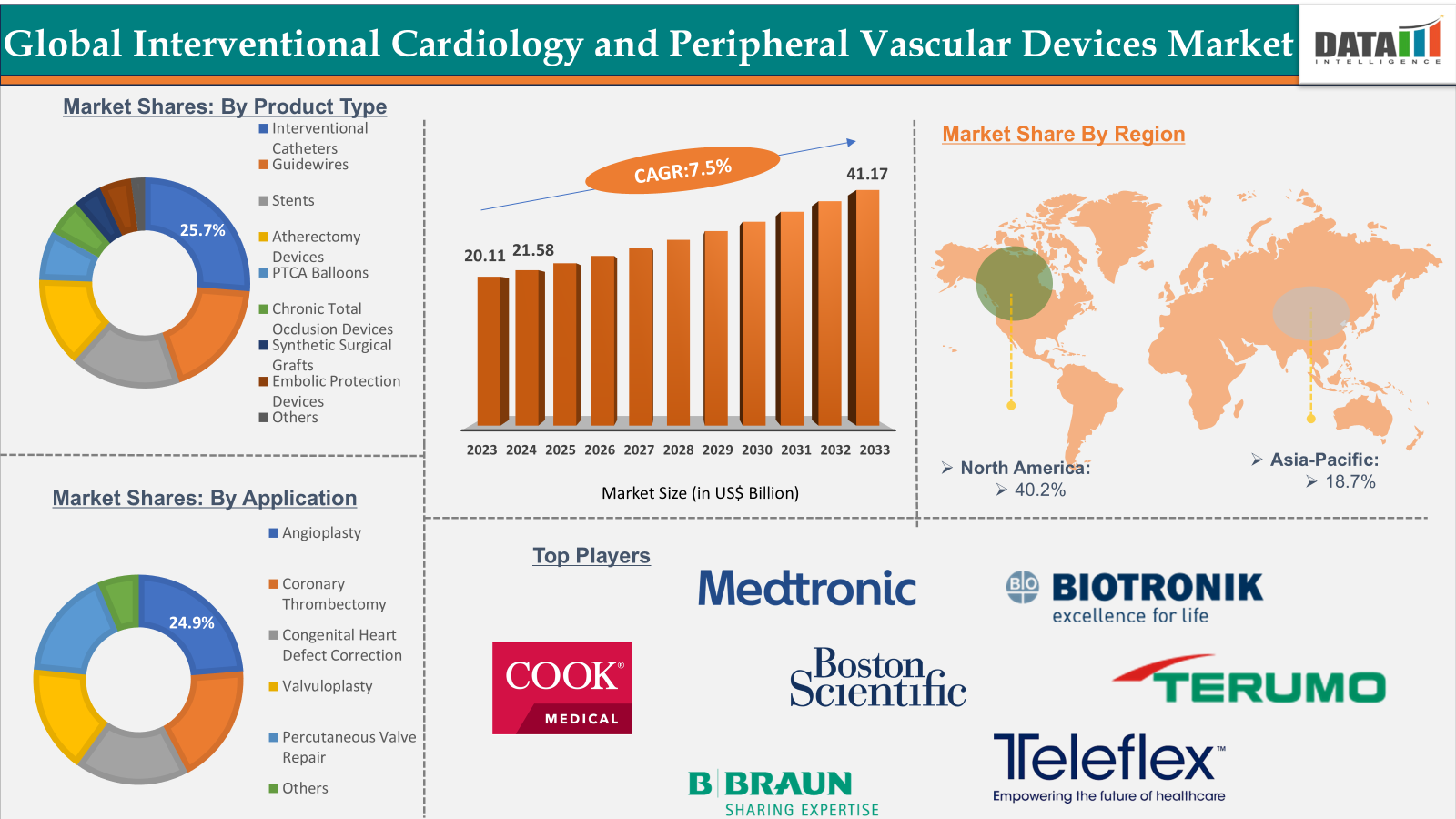

The global interventional cardiology and peripheral vascular devices market reached US$ 20.11 billion in 2023, with a rise to US$ 21.58 billion in 2024, and is expected to reach US$ 41.17 billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025-2033.

Key Market Trends & Insights

North America accounted for approximately 40.2% of the global interventional cardiology and peripheral vascular devices market in 2023 and is expected to retain a significant market share throughout the forecast period.

Asia Pacific is anticipated to be the fastest-growing region, supported by expanding healthcare infrastructure, increasing prevalence of cardiovascular diseases, and growing demand for minimally invasive procedures.

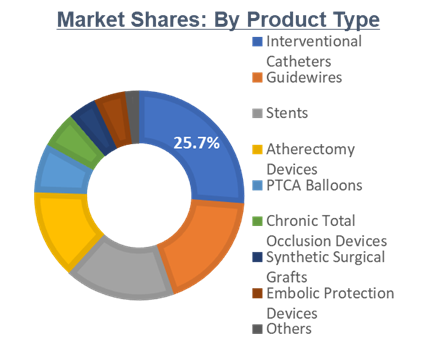

By product type, the interventional catheters segment holds a dominant position due to its essential role in diagnostic and therapeutic cardiovascular interventions.

Continuous technological advancements in catheter design, imaging, and delivery systems are expected to further drive market growth and procedural success rates.

Market Size & Forecast

2024 Market Size: USD 21.58 Billion

2033 Projected Market Size: USD 41.17 Billion

CAGR (2025–2033): 7.5%

North America: Largest market in 2023

Asia Pacific: Fastest-growing market.

Executive Summary

Market Dynamics: Drivers & Restraints

Driver: Rising Incidence of Cardiovascular Diseases (CVDs)

The escalating global prevalence of cardiovascular diseases (CVDs) is a primary catalyst propelling the growth of the interventional cardiology and peripheral vascular devices market. CVDs, encompassing conditions such as coronary artery disease, heart failure, and peripheral artery disease, are now the leading cause of death worldwide. In 2022, CVDs were responsible for approximately 19.8 million deaths globally, reflecting a substantial increase from 12.4 million in 1990. This surge is attributed to factors like aging populations, urbanization, and lifestyle changes, including poor diet, physical inactivity, and tobacco use.

The increasing burden of CVDs necessitates timely and effective medical interventions. Minimally invasive procedures, facilitated by advanced interventional devices, offer significant advantages in treating these conditions. For instance, coronary stenting, angioplasty, and atherectomy procedures are essential for managing coronary artery disease, while peripheral vascular interventions address blockages in peripheral arteries. The demand for these procedures is expected to rise in tandem with the growing incidence of CVDs, thereby driving the market for related devices.

Furthermore, the projected increase in global CVD cases underscores the need for continued innovation and investment in interventional cardiology and peripheral vascular devices. As the prevalence of CVDs continues to rise, the market for these devices is anticipated to expand, offering opportunities for healthcare providers and manufacturers to meet the evolving needs of patients worldwide.

Restraint: High Device and Procedure Costs

The high costs associated with interventional cardiology and peripheral vascular devices, along with the procedures themselves, pose a significant challenge to market growth. Advanced technologies such as drug-eluting stents, specialized catheters, and imaging systems often come with substantial price tags, making them less accessible in cost-sensitive healthcare settings and emerging markets. As a result, high device and procedure costs continue to act as a barrier, particularly in lower-income regions, slowing the overall expansion of the interventional cardiology and peripheral vascular devices market.

For more details on this report, Request for Sample

Segmentation Analysis

The global interventional cardiology and peripheral vascular devices market is segmented based on product type, application, end-user, and region.

Treatment Type - The interventional catheters segment is estimated to have 32.8% of the interventional cardiology and peripheral vascular devices market share.

The interventional catheters segment is poised to dominate the interventional cardiology and peripheral vascular devices market due to its essential role in nearly all minimally invasive cardiovascular procedures. These catheters are critical for accessing, navigating, and treating vascular conditions. The growing adoption of advanced diagnostic and therapeutic techniques, such as intravascular ultrasound (IVUS) and fractional flow reserve (FFR) measurements, is driving demand for specialized catheters that enhance procedural precision and patient outcomes.

Additionally, continuous technological advancements improving catheter flexibility, durability, and imaging capabilities are expanding their use across a wider range of cardiovascular interventions. As cardiovascular disease prevalence rises globally and the shift toward minimally invasive treatments accelerates, interventional catheters remain indispensable tools, securing their leading position in the market.

Geographical Analysis

The North America Interventional cardiology and peripheral vascular devices market was valued at 39.7% market share in 2024

North America holds a leading position in the interventional cardiology and peripheral vascular devices market, driven by a combination of clinical demand, technological leadership, and strong healthcare infrastructure. The region, particularly the United States, faces a high and rising prevalence of cardiovascular and peripheral artery diseases, which fuels consistent demand for minimally invasive interventions. This is supported by advanced healthcare systems equipped with modern catheter labs and surgical centers capable of adopting and integrating the latest devices.

Major global players such as Medtronic, Abbott, and Boston Scientific are headquartered in the U.S., allowing North America to remain at the forefront of innovation with rapid development and commercialization of next-generation devices like drug-eluting stents, atherectomy systems, and bioresorbable scaffolds. For instance, in August 2025, Boston Scientific announced the initiation of a new clinical trial aimed at evaluating its Agent Drug-Coated Balloon (DCB) against the current standard of care.

Additionally, strategic mergers and acquisitions in the region have expanded product portfolios and consolidated market strength. Altogether, these factors ensure North America remains the most dominant and mature market for interventional cardiology and peripheral vascular devices.

Major Players

The major players in the interventional cardiology and peripheral vascular devices market include B. Braun Interventional Systems Inc., Boston Scientific Corporation, BD, Medtronic, Teleflex Incorporated, Lepu Medical Technology (Beijing) Co., Ltd, TERUMO CORPORATION, Cook, Shenzhen MicroApproach Medical Technology Co., Ltd, and Biotronik, among others.

Key Developments:

In May 2024, Abbott announced the launch of the XIENCE Sierra Everolimus-Eluting Coronary Stent System in India. As one of the newest additions to the trusted XIENCE stent family, XIENCE Sierra is now accessible to patients with blocked coronary arteries, offering advanced treatment options. Designed for complex coronary interventions, the system delivers exceptional safety and performance, empowering interventional cardiologists to navigate and treat even the most challenging cases with greater confidence.

Report Scope

Metrics | Details | |

CAGR | 7.5% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Interventional Catheters, Guidewires, Stents, Atherectomy Devices, PTCA Balloons, Chronic Total Occlusion Devices, Synthetic Surgical Grafts, Embolic Protection Devices, Others |

Application | Angioplasty, Coronary Thrombectomy, Congenital Heart Defect Correction, Valvuloplasty, Percutaneous Valve Repair, Others | |

| End-User | Hospitals, Ambulatory Surgical Centers, Others |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global interventional cardiology and peripheral vascular devices market report delivers a detailed analysis with 73 key tables, more than 76 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here