Interventional Oncology Devices Market Size

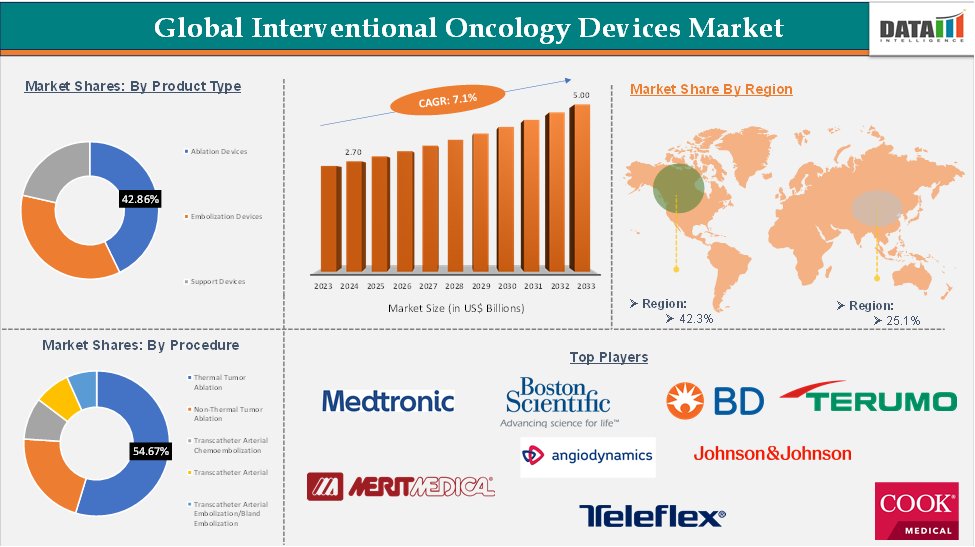

Global Interventional Oncology Devices Market Size reached US$ 2.70 Billion in 2024 and is expected to reach US$ 5.00 Billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025-2033.

The Global Interventional Oncology Devices Market is growing due to the growing global cancer burden and preference for minimally invasive procedures. Techniques like ablation, embolization, and image-guided tumor treatment are crucial for modern cancer therapy. Technological advancements like artificial intelligence and robotics drive innovation in device design and treatment efficacy.

However, challenges include high procedure costs, limited awareness in underdeveloped regions, and stringent regulatory frameworks.

North America region is dominating the global interventional oncology devices market, accounting for the largest market share, owing to the growing incidence of liver cancer in the country, the presence of key market players, and the launch of new commodities influence market growth in the region.

For more details on this report, Request for Sample

Interventional Oncology Devices Market Dynamics: Drivers & Restraints

Rising Demand For Minimally Invasive Procedures is Driving the Market Growth

The demand for minimally invasive procedures has increased due to their advantages over traditional treatments, such as fewer complications, shorter hospital stays, less pain, smaller incisions, lower infection risk, reduced post-operative care, and quicker recovery.

These procedures use advanced technologies to diagnose and treat diseases, including cancer, and assist surgeons in collecting tissues for biopsy and avoiding inaccurate staging studies. Adopting these techniques results in significant cost savings and improved treatment plans.

For instance, in February 2025, IceCure Medical Ltd., a developer of minimally invasive cryoablation technology, was announced as a sponsor of the Breast Cryoablation Mini Masterclass at the 2025 Society of Interventional Oncology Annual Meeting in Las Vegas. The company offers a freezing method for tumor removal, an alternative to surgical methods.

Market players are focusing on developing efficient, technologically superior, and user-friendly interventional oncology systems, which are aimed at increasing their functionality and application areas, driving the need for these systems among end-users.

Shortage of Well-trained and Skilled Radiologists and Oncologists Restraints the Market Growth

The interventional oncology market is witnessing continuous technological innovations and advancements to make the devices and techniques more accurate and specific. However, interventional oncology is a technique wherein high standards can only be achieved and maintained by full-time specialists.

The effect of this factor will be more pronounced in developing and underdeveloped regions. One of the significant obstacles in delivering care for patients with curable cancers in the sub-Saharan African region is the shortage of medical oncologists, radiation oncologists, and other healthcare workers required for cancer care.

Furthermore, India is also facing an acute deficit of oncologists, surgical oncologists, and radiotherapists. With 1.8 million cancer patients in the nation, only one oncologist diagnoses every 2,000 patients. The lack of oncologists and radiologists in numerous countries across the globe is expected to affect the adoption of interventional oncology methods in their respective healthcare systems, notwithstanding a large target patient population.

Interventional Oncology Devices Market Segment Analysis

The global interventional oncology devices market is segmented based on product type, procedure, cancer type, end user, and region.

Product Type:

The ablation devices segment of the product type is expected to hold 42.8% in the interventional oncology devices market

Ablation devices are medical tools used in interventional oncology to destroy cancerous tissues without traditional surgery. They use energy sources like radiofrequency, microwave, cryoablation, and laser to ablate or necrotize tumor cells. These devices are primarily used for minimally invasive procedures in organs like the liver, lungs, kidneys, and bones, offering targeted, localized treatment with minimal patient recovery time.

The global interventional oncology devices market's ablation devices segment is fueled by the increasing adoption of minimally invasive procedures, rising cancer incidence, and demand for outpatient treatments. Technological advancements in ablation techniques, improved imaging guidance, and hybrid systems enhance precision and outcomes. Supportive reimbursement policies and research investments also accelerate the adoption of ablation therapies in clinical settings.

For instance, in July 2024, Techsomed Ltd., a leading medical software company, launched its BioTrace software suite in the U.S., including BioTraceIO Vision and BioTraceIO Precision solutions. These technologies, which received FDA clearance for liver tumor ablation, are now being deployed in leading medical institutions nationwide.

Interventional Oncology Devices Market Geographical Analysis

North America dominated the global interventional oncology devices market with the highest share of 42.3% in 2024

The North American interventional oncology devices market is dominated by the US's established healthcare infrastructure, advanced medical technologies, and preference for minimally invasive treatments. The US has a strong presence of medical device manufacturers, robust cancer research funding, and favorable reimbursement frameworks. The increasing incidence of cancer, particularly liver, lung, and colorectal cancer, and geriatric populations, has boosted demand for interventional oncology devices.

Also, the region's large pool of trained radiologists and oncologists ensures widespread clinical adoption. Innovations in image-guided therapy and FDA approvals of new ablation and embolization technologies contribute to market growth. Strategic collaborations between hospitals, research institutions, and medical device companies further advance precision oncology tools.

For instance, in November 2024, Boston Scientific Corporation agreed to acquire Intera Oncology, a medical device company that provides the Intera 3000 Hepatic Artery Infusion Pump and floxuridine, a chemotherapy drug, both approved by the U.S. Food and Drug Administration. The acquisition aims to expand interventional oncology offerings and complement therapy for treating liver-dominant metastases, primarily caused by metastatic colorectal cancer.

Asia-Pacific region in the global Interventional Oncology Devices market is expected to grow with the highest CAGR of 19.5% in the forecast period of 2025 to 2033

The Asia-Pacific region is experiencing significant growth in the interventional oncology devices market due to rising cancer prevalence, healthcare expenditure, and improved access to advanced diagnostic services. Countries like China, India, Japan, and South Korea are experiencing a surge in demand for minimally invasive oncology procedures. The middle-class population and government initiatives to improve cancer care infrastructure are creating favorable conditions for market expansion.

For instance, Japan's cancer prevalence is projected to rise by 13.1% by 2050, primarily due to a 13.6% increase in female survivors. From 2040 onwards, females will overtake males in prevalence counts. The most prevalent cancer sites in 2050 are colorectal, female breast, prostate, lung, and stomach cancers, accounting for 66.4% of survivors. Males are expected to experience the highest absolute increases in prostate, lung, and malignant lymphoma cancers, while females are expected to experience the highest absolute increases in breast, colorectal, and corpus uteri cancers.

Moreover, technological advancements and local manufacturing capabilities are making interventional oncology devices more accessible and cost-effective. Medical tourism in India and Thailand, along with an increasing number of private hospitals and specialty centers, is also accelerating market penetration.

Interventional Oncology Devices Market Key Players

The major global players in the Interventional Oncology Devices market include Medtronic, Boston Scientific, BD, Terumo, Merit Medical, AngioDynamics, Johnson & Johnson, Teleflex, Cook Medical, and HealthTronics, among others.

Industry Trends

- In December 2024, AngioDynamics received FDA 510(k) clearance for its NanoKnife System, a non-thermal, radiation-free treatment option for minimally invasive prostate cancer treatment.

- In February 2024, Profound Medical and Siemens Healthineers partnered to integrate Profound's TULSA-PRO system with Siemens' MAGNETOM Free. Max MRI scanner, aiming to improve precision in prostate therapy.

Scope

| Metrics | Details | |

| CAGR | 7.1% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Ablation Devices, Embolization Devices, Support Devices |

| Procedure | Thermal Tumor Ablation, Non-Thermal Tumor Ablation Transcatheter Arterial Chemoembolization, Transcatheter Arterial, Transcatheter Arterial Embolization/Bland Embolization | |

| Cancer Type | Liver Cancer, Lung Cancer, Bone Metastasis, Kidney Cancer Breast Cancer, Prostate Cancer, Others | |

| End User | Hospitals, Clinics, Ambulatory Surgical Centers | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |