Oxygen Therapy Market Size

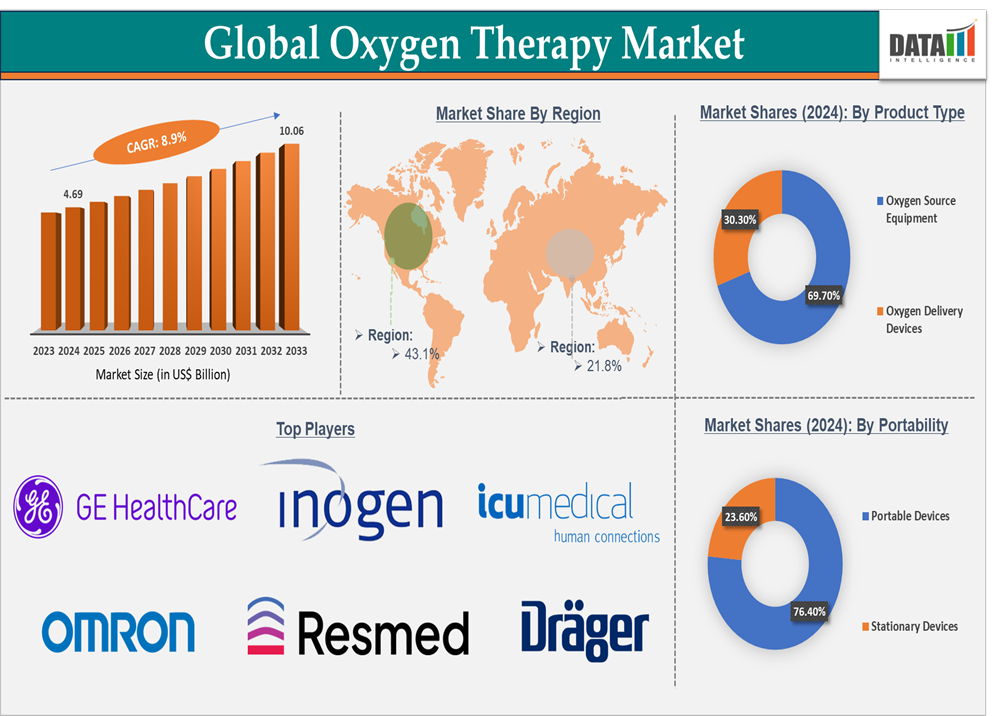

Oxygen Therapy Market size reached US$ 4.69 Billion in 2024 and is expected to reach US$ 10.06 Billion by 2033, growing at a CAGR of 8.9% during the forecast period 2025-2033.

Oxygen Therapy Market Overview

The oxygen therapy market is a rapidly growing segment of the healthcare industry that provides essential treatment to patients suffering from a variety of respiratory conditions. Oxygen therapy is primarily used to increase oxygen levels in the blood for individuals who have difficulty breathing or require supplemental oxygen due to chronic or acute medical conditions. The market is poised for significant growth, driven by factors such as the increasing prevalence of chronic respiratory diseases, an aging global population, advancements in oxygen therapy technologies, and rising awareness of respiratory health.

Additionally, advancements in technology have led to more efficient, portable, and user-friendly oxygen therapy devices. Portable oxygen concentrators, oxygen masks, high-flow nasal cannulas, and non-invasive ventilation technologies are providing patients with greater mobility, comfort, and ease of use, further driving market demand.

Executive Summary

For more details on this report – Request for Sample

Oxygen Therapy Market Dynamics: Drivers & Restraints

Rising technological advancements are significantly driving the market growth

Technological advancements are significantly shaping the oxygen therapy market, enhancing the efficiency, accessibility, and comfort of oxygen delivery systems. These innovations are driving market growth by improving patient outcomes, expanding the range of applications, and increasing the convenience of therapy in both hospital and homecare settings.

Portable oxygen concentrators such as Inogen One G4 and Philips Respironics SimplyGo have revolutionized home oxygen therapy. These devices allow patients with chronic respiratory diseases (e.g., COPD, asthma) to receive oxygen therapy while maintaining their mobility and independence.

For instance, in April 2025, Philips Respironics launched the Simply Go Mini portable oxygen concentrator to empower active lifestyles for oxygen therapy users. The Simply Go Mini is a next-generation, FDA-approved oxygen concentrator designed specifically for active users who refuse to be held back by traditional oxygen tanks. Weighing only 2.3 kilograms (approximately 5 pounds) with the standard battery, this ultra-portable unit fits effortlessly into daily routines, whether users are commuting, shopping, or traveling.

Technical limitations and device performance are hampering the market growth

While the oxygen therapy market has seen significant growth due to technological advancements, several technical limitations and challenges related to device performance continue to hinder its full potential. These limitations not only affect the effectiveness of treatments but also the overall market adoption, especially in regions with limited resources.

Portable oxygen concentrators, while offering greater mobility, often face limitations in oxygen output, especially for patients requiring high flow rates of oxygen. These devices are not always sufficient for patients with severe respiratory conditions such as COPD, severe pneumonia, or acute respiratory distress syndrome.

For instance, portable oxygen concentrators like Inogen One G3 or Philips SimplyGo are suitable for patients with mild to moderate respiratory conditions. However, they may struggle to provide the necessary oxygen flow for acute cases, especially in critical care settings.

A significant technical challenge for portable oxygen therapy devices is the battery life and durability of the devices, particularly when used outside of hospital settings. While advancements have been made, many devices still have limited battery life, especially when the device is used on high flow settings.

Oxygen Therapy Market, Segment Analysis

The global oxygen therapy market is segmented based on product type, portability, application, end-user, and region.

Product Type:

The oxygen source equipment segment is expected to hold 69.7% of the oxygen therapy market

The oxygen source equipment forms the backbone of any oxygen therapy regimen, as it directly provides the oxygen needed for patients. Without these devices, other elements like oxygen therapy masks, nasal cannulas, or ventilators would be ineffective, as they rely on the oxygen supply from these source devices. The development of advanced oxygen concentrators, particularly portable oxygen concentrators, has greatly improved the convenience, comfort, and mobility of oxygen therapy. These devices are smaller, lighter, and more efficient than traditional oxygen tanks, making them highly desirable for patients who need to stay active and mobile.

For instance, in April 2025, Philips Respironics launched the Simply Go Mini portable oxygen concentrator to empower active lifestyles for oxygen therapy users. The Simply Go Mini is a next-generation, FDA-approved oxygen concentrator designed specifically for active users who refuse to be held back by traditional oxygen tanks. Weighing only 2.3 kilograms (approximately 5 pounds) with the standard battery, this ultra-portable unit fits effortlessly into daily routines, whether users are commuting, shopping, or traveling.

Additionally, in July 2022, OMRON Healthcare announced its latest advancement in the Oxygen therapy category with the launch of a portable Oxygen Concentrator. It is a medical molecular sieve-based Oxygen concentrator providing a continuous supply of Oxygen (5L per minute) with more than 90% high concentration output. The product is designed to aid home care providers who are managing the therapy and lifestyle needs of patients with COPD and respiratory problems.

Oxygen Therapy Market Geographical Analysis

North America is expected to hold 43.1% of the global oxygen therapy market

North America, particularly the United States, has a high prevalence of chronic respiratory diseases, including Chronic Obstructive Pulmonary Disease (COPD), asthma, sleep apnea, and pneumonia. These conditions are key drivers for the demand for oxygen therapy. The aging population in North America is also more prone to such conditions, further fueling the need for long-term oxygen therapy.

For instance, according to the American Lung Association, in the U.S., over 16 million people are diagnosed with COPD. The need for oxygen therapy to manage these conditions is growing, leading to higher demand for oxygen concentrators, portable oxygen devices, and liquid oxygen systems.

North America boasts some of the most advanced healthcare systems in the world, with highly developed medical technology and infrastructure. This region is at the forefront of adopting innovative oxygen therapy solutions, such as portable oxygen concentrators, high-flow oxygen systems, and advanced homecare devices. The availability of state-of-the-art devices is contributing to the growth of the oxygen therapy market.

Companies like Inogen, Philips, and ResMed are headquartered in North America, offering cutting-edge portable oxygen concentrators like the Inogen One G5 and Philips SimplyGo. These devices allow patients to maintain mobility and continue daily activities while receiving the oxygen therapy they need. This innovation is one of the key reasons for North America’s market dominance.

For instance, in April 2025, Philips Respironics launched the Simply Go Mini portable oxygen concentrator to empower active lifestyles for oxygen therapy users. The Simply Go Mini is a next-generation, FDA-approved oxygen concentrator designed specifically for active users who refuse to be held back by traditional oxygen tanks. Weighing only 2.3 kilograms (approximately 5 pounds) with the standard battery, this ultra-portable unit fits effortlessly into daily routines, whether users are commuting, shopping, or traveling.

Asia Pacific is expected to hold 21.8% of the global oxygen therapy market

Japan is a key player in the Asia-Pacific (APAC) region's oxygen therapy market, and it is one of the fastest-growing markets owing to the country’s aging population, increasing prevalence of respiratory diseases, and ongoing advancements in healthcare infrastructure. Japan’s sophisticated healthcare system, government policies, and insurance programs aimed at improving access to home healthcare devices also contribute significantly to the growth of the oxygen therapy market in the country. For instance, twenty-six years have passed since home oxygen therapy (HOT) was approved for coverage under the public health insurance program in Japan, and now over 150,000 patients receive this therapy.

Japan is known for its technological innovations in healthcare, and this extends to the oxygen therapy market. The country’s cutting-edge technologies in medical devices, including smaller, more efficient portable oxygen concentrators, smart oxygen systems, and improved ventilators, are driving growth in the market by making oxygen therapy more efficient, comfortable, and accessible. Portable oxygen concentrators in Japan have become smaller, lighter, and more efficient due to technological advancements. Companies such as Omron Healthcare and Philips are constantly innovating to create user-friendly and battery-efficient devices that patients can use seamlessly at home or on the go.

Oxygen Therapy Market Top Companies

Top companies in the oxygen therapy market include GE Healthcare, Inogen, Inc., ICU Medical, Inc., ResMed, OMRON Healthcare, HERSILL S.L., Koninklijke Philips N.V., Drägerwerk AG & Co. KGaA, CAIRE Inc., Rhythm Healthcare, LLC, and others.

Oxygen Therapy Market Scope

| Metrics | Details | |

| CAGR | 8.9% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Oxygen Source Equipment and Oxygen Delivery Devices |

| Portability | Stationary Devices and Portable Devices | |

| Application | Chronic Obstructive Pulmonary Disease (COPD), Asthma, Sleep Apnea, Pneumonia, Cystic Fibrosis, Respiratory Distress Syndrome, and Others | |

| End-User | Hospitals, Home Healthcare, Ambulatory Surgical Centers, Specialty Clinics, Rehabilitation Centers, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global oxygen therapy market report delivers a detailed analysis with 70 key tables, more than 67 visually impactful figures, and 173 pages of expert insights, providing a complete view of the market landscape.