Idiopathic Pulmonary Fibrosis Market Size

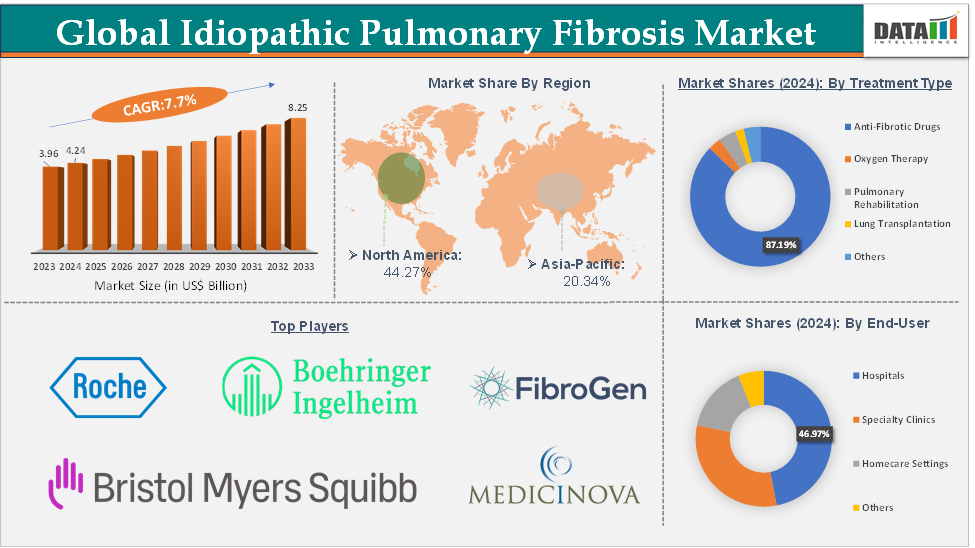

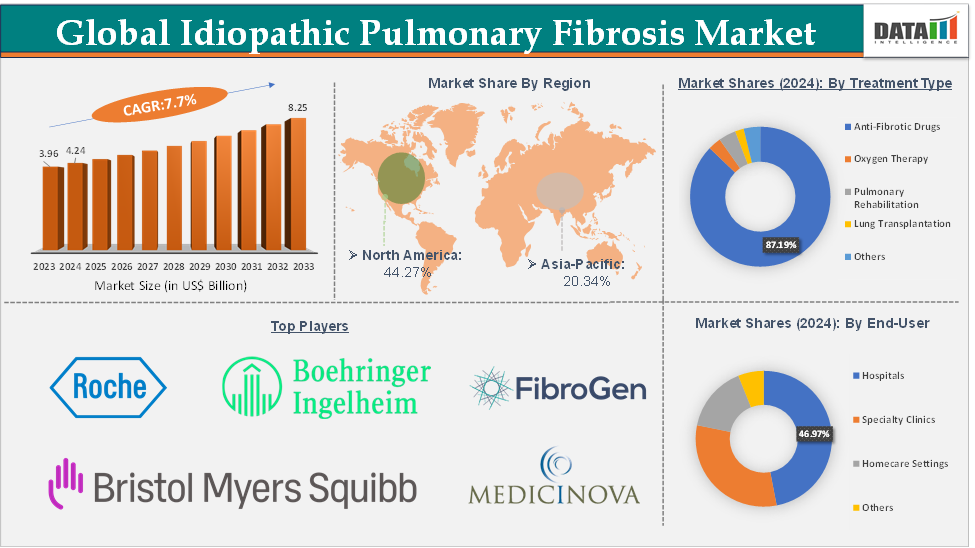

The global idiopathic pulmonary fibrosis market size reached US$ 4.24 Billion in 2024 from US$ 3.96 Billion in 2023 and is expected to reach US$ 8.25 Billion by 2033, growing at a CAGR of 7.7% during the forecast period 2025-2033.

Idiopathic Pulmonary Fibrosis Market Overview

The idiopathic pulmonary fibrosis (IPF) market has witnessed substantial growth over the past decade, driven by advancements in treatment, increased disease awareness, and the approval of novel antifibrotic therapies that slow disease progression. The market is primarily dominated by two FDA-approved drugs, Pirfenidone and Nintedanib, which have revolutionized the management of IPF by demonstrating the ability to reduce lung function decline and improve patient outcomes. However, the market’s full potential will depend on overcoming affordability issues, enhancing early diagnosis, and improving long-term patient management.

Idiopathic Pulmonary Fibrosis Market Executive Summary

Idiopathic Pulmonary Fibrosis Market Dynamics

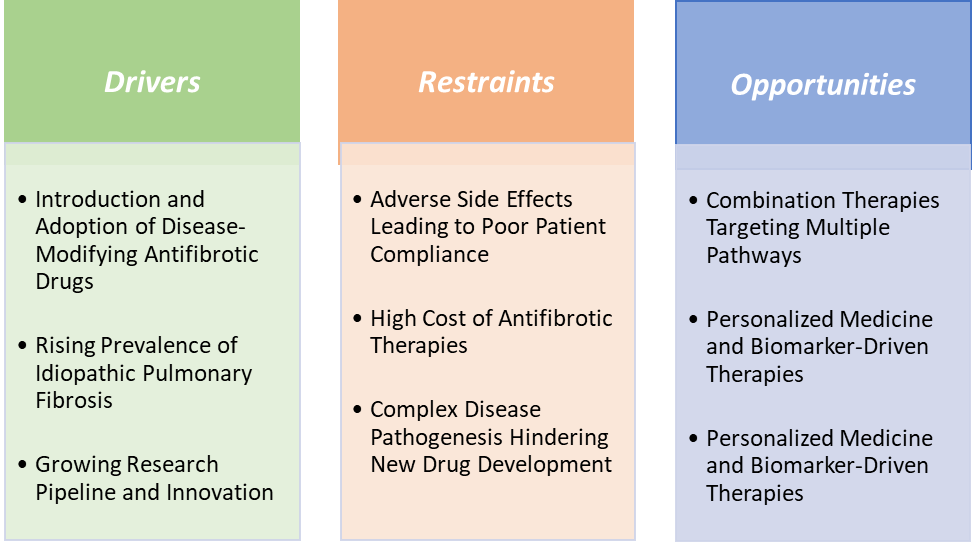

Drivers:

The approval and widespread adoption of Pirfenidone (Esbriet) and Nintedanib (Ofev) have revolutionized the treatment landscape of IPF, which historically had minimal therapeutic options and primarily relied on supportive care. Before 2014, IPF treatment was limited to symptom management and oxygen therapy. The introduction of Pirfenidone and Nintedanib offered the first drugs that could slow the progression of fibrosis, addressing the root cause of the disease. This breakthrough created a new treatment paradigm, shifting IPF from an untreatable condition to a manageable chronic disease, thereby expanding the treatment market.

Their proven clinical efficacy, broadening guidelines endorsement, increasing patient diagnosis, and expanding geographic reach have collectively transformed IPF treatment from limited supportive care to an active therapeutic market projected to grow robustly in the coming years. Rising clinical trials on anti-fibrotic drugs for IPF treatment are further accelerating the market by offering various drugs. For instance, in May 2025, Shanghai Ark Biopharmaceutical Co., Ltd. (ArkBio) announced positive top-line Phase II study results for its novel anti-fibrotic drug AK3280 in the treatment of idiopathic pulmonary fibrosis (IPF).

Restraints:

Adverse side effects leading to poor patient compliance are hampering the growth of the idiopathic pulmonary fibrosis market

While Pirfenidone and Nintedanib have significantly advanced IPF treatment by slowing disease progression, their side effect profiles pose major challenges that negatively impact patient adherence and, consequently, market growth. Pirfenidone is frequently associated with gastrointestinal issues (nausea, diarrhea, dyspepsia) and photosensitivity rash, while Nintedanib commonly causes diarrhea, liver enzyme elevations, and abdominal pain. These side effects often lead to dose reductions, treatment interruptions, or complete discontinuation in real-world settings.

Poor adherence reduces the clinical effectiveness of antifibrotic therapies in practice, potentially leading physicians and patients to hesitate to initiate or continue treatment. This reluctance constrains overall market growth despite drug availability and guideline recommendations. Treatment interruptions can increase healthcare costs due to disease progression and hospitalizations, creating challenges for payers and healthcare systems.

Opportunities:

Combination therapies targeting multiple pathways create a market opportunity for the idiopathic pulmonary fibrosis market

Idiopathic pulmonary fibrosis is a complex disease involving multiple biological pathways, such as fibrosis, inflammation, and epithelial injury. Current approved treatments, Pirfenidone and Nintedanib, mainly target fibrosis but do not fully address other pathogenic mechanisms. This gap creates an opportunity for combination therapies that target multiple pathways simultaneously, potentially improving efficacy and patient outcomes.

Combining antifibrotics with anti-inflammatory or immunomodulatory agents could slow disease progression more effectively. Many patients show an incomplete response or intolerance to monotherapy. Combination therapies provide options for these patients, potentially improving treatment adherence and quality of life. By targeting multiple disease pathways simultaneously, combination therapies offer the potential for superior treatment outcomes and expanded patient populations. This innovation not only addresses limitations of current drugs but also opens new commercial avenues, making it a pivotal growth opportunity in the IPF treatment market.

Idiopathic Pulmonary Fibrosis Market Trends

For more details on this report – Request for Sample

Idiopathic Pulmonary Fibrosis Market Segment Analysis

The global idiopathic pulmonary fibrosis market is segmented based on treatment type, end-user, and region.

The anti-fibrotic drugs segment from the treatment type is expected to hold 87.19% of the market share in 2024 in the idiopathic pulmonary fibrosis market

Currently, Pirfenidone and Nintedanib are the only two FDA-approved antifibrotic therapies specifically for idiopathic pulmonary fibrosis. Both drugs have demonstrated significant efficacy in clinical trials, reducing the decline in lung function by approximately 30–50%, making them the preferred treatment options worldwide. Since their approvals (Pirfenidone in 2014 and Nintedanib in 2014), these drugs have rapidly penetrated major markets such as North America and Europe. For instance, Nintedanib (Ofev) global sales reached nearly USD 3,795.36 million in 2023, reflecting strong market demand.

Before these antifibrotics, IPF management was largely limited to supportive care like oxygen therapy or lung transplantation. The lack of effective alternatives means the anti-fibrotic segment captures a large share of treatment expenditure. The anti-fibrotic drugs segment dominates the IPF market due to the proven clinical benefits of Pirfenidone and Nintedanib, strong guideline backing, limited alternative treatments, and growing patient populations. These factors combine to make antifibrotics the cornerstone of IPF therapy and the largest revenue-generating segment in the market.

Idiopathic Pulmonary Fibrosis Market, Geographical Analysis

North America is expected to dominate the global idiopathic pulmonary fibrosis market with a 44.27% share in 2024

The prevalence of idiopathic pulmonary fibrosis in North America is among the highest globally. Up to approximately 140,000 people are living with IPF in the US, and about 50,000 people are diagnosed with IPF annually; this rising prevalence is accelerating the demand for the market in the region. Major players like Roche (Nintedanib) and Genentech (Pirfenidone) have strong distribution and marketing capabilities in North America.

North America is a hotspot for IPF clinical research, accelerating the introduction of new therapies and combination treatments. For instance, in February 2025, Pliant Therapeutics, Inc. initiated the assembly of an outside expert panel to review unblinded data from the ongoing BEACON-IPF Phase 2b trial of bexotegrast in patients with idiopathic pulmonary fibrosis (IPF). The panel, consisting of world-renowned experts in pulmonary diseases and biostatistics, will provide an independent recommendation to Pliant regarding the BEACON-IPF trial. Subsequently, the panel will serve as part of an expanded DSMB to reach a consensus recommendation regarding BEACON-IPF. The Company expects this process to conclude in two to four weeks.

Asia-Pacific is growing at the fastest pace in the idiopathic pulmonary fibrosis market holding 20.34% of the market share

APAC has one of the fastest-growing aging populations globally. Since IPF primarily affects people over 50, the growing elderly demographic expands the patient pool significantly. In China alone, the population aged 60+ is expected to exceed 400 million by 2030, fueling demand for IPF treatments. Global and local pharmaceutical companies are actively expanding their presence in APAC through partnerships, clinical trials, and local manufacturing. This enhances drug availability and affordability, increasing patient access.

The Asia-Pacific region is the fastest-growing IPF treatment market due to rising disease prevalence, an expanding elderly population, improved healthcare infrastructure, greater adoption of antifibrotic drugs, and active pharmaceutical industry expansion. These factors combine to create a robust environment for rapid market growth.

Idiopathic Pulmonary Fibrosis Market Competitive Landscape

Top companies in the idiopathic pulmonary fibrosis market include F. Hoffmann-La Roche Ltd, Boehringer Ingelheim Pharmaceuticals, Inc., FibroGen, Inc., Bristol-Myers Squibb Company, AstraZeneca, Ark Biopharmaceutical, and MediciNova, Inc., among others.

Idiopathic Pulmonary Fibrosis Market, Key Developments

In May 2025, Tvardi Therapeutics, Inc. announced that it had completed enrollment for its lead program in a Phase 2 clinical trial of TTI-101 for patients with idiopathic pulmonary fibrosis (IPF). The REVERT IPF Phase 2 clinical trial is a randomized, double-blind, placebo-controlled clinical trial of TTI-101 in patients suffering from IPF. Key endpoints include safety and lung function (FVC).

In May 2025, Cumberland Pharmaceuticals Inc. announced a partnership with Qureight, a Core Imaging Laboratory developing deep-learning image analytics, to enhance the outcome and output of data from Cumberland's FIGHTING FIBROSIS clinical trial. The Phase II study is evaluating Cumberland's ifetroban product candidate in patients with idiopathic pulmonary fibrosis (IPF). This collaboration aims to address a critical unmet need for the estimated 2 million IPF patients worldwide, who currently have limited treatment options that can effectively halt disease progression.

Idiopathic Pulmonary Fibrosis Market Scope

Metrics | Details | |

CAGR | 7.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Treatment Type | Anti-Fibrotic Drugs, Oxygen Therapy, Pulmonary Rehabilitation, Lung Transplantation, and Others |

End-User | Hospitals, Specialty Clinics, Homecare Settings, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

DMI Insights on Idiopathic Pulmonary Fibrosis Market

The idiopathic pulmonary fibrosis market is experiencing steady growth primarily due to the advent and adoption of disease-modifying antifibrotic drugs like Pirfenidone and Nintedanib. These therapies have transformed IPF management by slowing lung function decline, which was previously untreatable. The increasing global prevalence of IPF, driven by aging populations and improved diagnostics, further propels market expansion.

The current market is dominated by antifibrotics; however, it highlights the significant potential of emerging therapies, including combination regimens, novel antifibrotic agents, immunomodulators, and biologics. The pipeline is robust, with many candidates in various stages of clinical trials aiming to improve efficacy and reduce adverse effects, key limitations of existing treatments.

The market is moderately consolidated, with major pharmaceutical companies like Roche and Boehringer Ingelheim, and other leading and emerging players. Increased competition from new entrants and biosimilars/generics entering the market, which could drive innovation and potentially lower treatment costs.

The global idiopathic pulmonary fibrosis market report delivers a detailed analysis with 42 key tables, more than 41 visually impactful figures, and 141 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here