Frozen Fruits Market Size

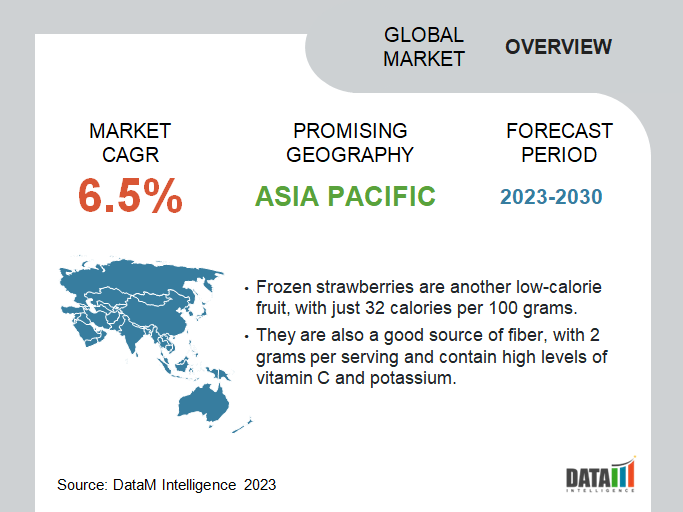

The Global Frozen Fruits Market size reached USD 3,957.4 million in 2022 and is projected to witness lucrative growth by reaching up to USD 6,549.4 million by 2030. The market is growing at a CAGR of 6.5% during the forecast period 2024-2031.Due to long working hours, rising health consciousness and the increasing prevalence of lifestyle diseases, consumers are shifting to frozen fruits as they do not need to be washed, peeled or chopped. Additionally, they help in minimizing the overall cooking time without affecting the nutritional intake.

In line with this, manufacturers are launching unique product variants, incorporating herbs and spices from local produce, to widen their portfolio and attract a large consumer base. Frozen blueberries are a low-calorie option, with just 57 calories per 100 grams. They are also a good source of fiber, providing 2.4 grams per serving, as well as vitamin C and potassium.

Frozen strawberries are another low-calorie fruit, with just 32 calories per 100 grams. They are also a good source of fiber, with 2 grams per serving and contain high levels of vitamin C and potassium which drives the frozen fruits market value.

Market Scope

| Metrics | Details |

| CAGR | 6.5% |

| Size Available for Years | 2022-2031 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (USD ) |

| Segments Covered | Fruit Type, Category, Form, End-User, Distribution Channel and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

| Fastest Growing Region | Asia-Pacific |

| Largest Region | Asia-Pacific |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

To Know more Insights Download Sample

Market Dynamics

The Growing Consumer Demand for Natural Food

Consumer demand for natural, organic and plant-based food products, has witnessed exponential growth in recent years. Due to increased consumer preferences for healthy and nutritious food products, along with this consumer prefer plant-based healthy and tasty food alternatives, research studies show that the global frozen fruits market is anticipated to witness significant growth in those coming years.

For instance, on May 11, 2022, The UK online retailer, The Vegan Kind launched new frozen section stocking the biggest names in plant-based food. The company aims to further establish its position as "the home of all things plant-based grocery" by expanding its selection to now include ice cream, frozen pizzas, meat substitutes, as well as frozen organic fruit and vegetables. Furthermore, changing consumer dietary preferences and inclination toward nutritious food products are increasing the demand for frozen fruits.

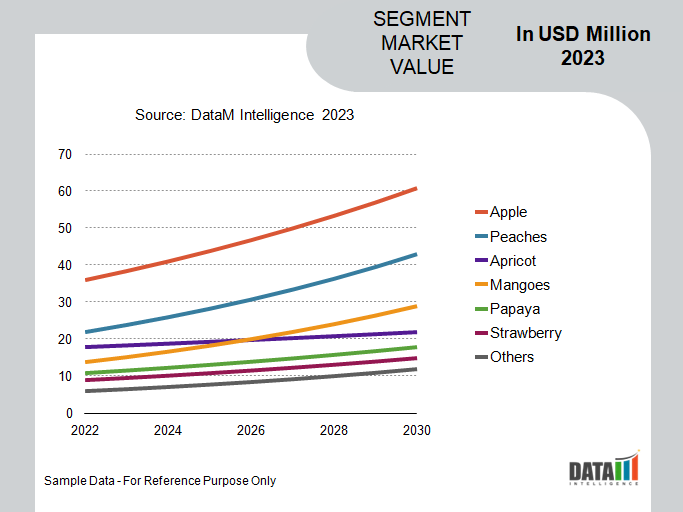

Market Segment Analysis

The global frozen fruits market is segmented based on fruit type, category, form, end-user, distribution channel and region.

Organic Segment Accounts for the Highest Share in the Global Frozen Fruits Market

In 2022, the organic frozen fruits segment had the highest revenue share of 46.2 %. Organic frozen fruits have been the most preferred choice of consumers due to the growing demand for organic and chemical-free food products globally, coupled with a rise in demand for healthy & nutritious products along with good taste.

For instance, on April 16, 2021, Whole Foods launched its 365 Everyday Value Organic Frozen Fruit line, which includes options like organic blueberries, organic mixed berries and organic mango chunks. The fruits are certified organic and non-GMO and are sold in resealable bags for convenience which drives the segment revenue.

On the other hand, In 2020, Nature's Earthly Choice launched a line of organic frozen fruits, including options like organic strawberries, organic blueberries and organic mixed berries. The fruits are sustainably sourced and certified organic and are sold in resealable bags.

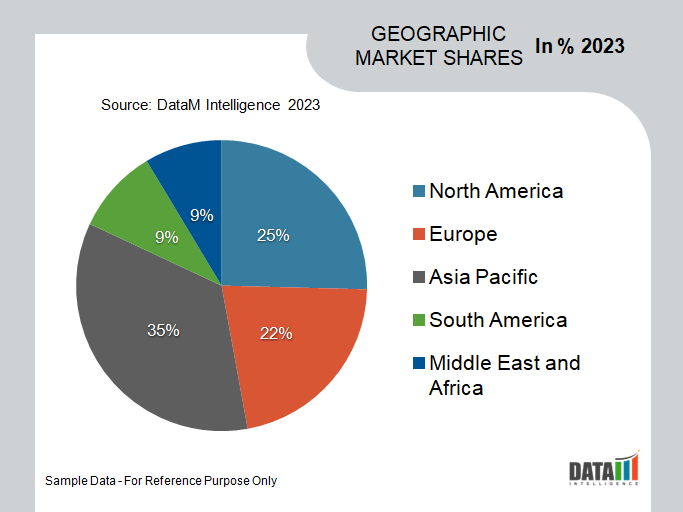

Market Geographical Share

Asia-Pacific is Expected to be the Dominating Region During Forecast Period.

By region, the global frozen fruits market is segmented into North America, South America, Europe, Asia-Pacific, Middle-east and Africa.

In 2022, Asia Pacific accounted for about 42.9% of worldwide sales. China, Japan, South Korea, Australia, New Zealand, Taiwan, Indonesia, Thailand, Philippines, Japan, and China are all major markets for the product. For instance, according to the Japanese National Health and Nutrition Survey, 100 grams of frozen blueberries contain about 55 calories.

Frozen blueberries, raspberries, strawberries, peaches, papayas, pineapples, mangos and grapes are just a few of the fruits that The Meat Guy, a Japanese company, sells to restaurants, lodging establishments, vacation spots, exclusive clubs and private individuals across Japan.

Frozen Fruits Companies

The major global players include SunOpta Inc, Diafrost Frozen Fruit Industry N.V., Fruitex Australia, Arla Foods, Capricorn Food Products India Ltd., Ravifruit (Kerry Group), Uren Food Group Limited., Rosemary & Thyme Limited, Brecon Foods and Milne Fruit Pty Ltd.

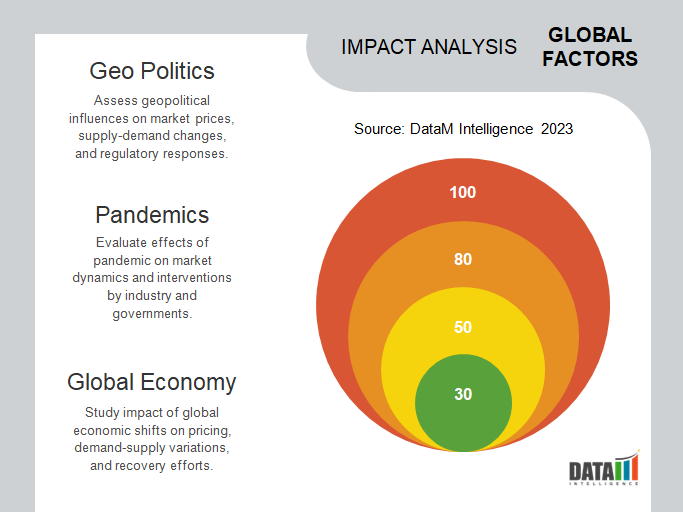

Covid Impact

The COVID-19 pandemic has adversely affected the economies of various countries due to lockdowns, business close, and travel bans. Food and beverages are among the major industries that suffered from intense disruptions such as restrictions on the supply chain and the shutdown of warehouse plants.

In addition, the closures/shutdowns of companies, factory production facilities in various countries have disrupted the whole supply chain. It has negatively impacted manufacturing activities, delivery schedules and various goods sales. Multiple companies have already announced possible delays in product deliveries and a decline in future sales of their products.

Furthermore, the import-export restrictions imposed by governments in North America, Asia and Europe are hindering geographical expansion, business collaboration and partnership opportunities. Thus, these factors are hindering the growth of the frozen fruits market in the food and beverages industry.

Key Developments

- On January 11, 2023, Pukpip launched a range of new frozen fruit with frozen bananas dipped in a choice of milk, dark and white chocolate. Bananas from the Pukpip brand are ethically sourced from Ecuador's coast and immediately frozen to preserve their natural goodness.

- On March 19, 2023, Dole Packaged Foods LLC launched fruit-forward snacks and frozen products. The company also launched a new line of fruit-powered vitamin chews and probiotic fruit sodas under the name The Secret Nature of Fruit, which comes in flavors like Tropical Passionfruit, Refreshing Peach, Spiced Pineapple and Mixed Berry.

- On August 26, 2022, Dole Packaged Foods LLC launched Dole Boosted Blends Berry Spark. Dole Boosted Blends Berry Spark is non-GMO, kosher-certified, and has no added sugar. The mixture's fruity flavor comes from a combination of blueberries, bananas, blackberries, dark cherries, acai and flax; and it's made to deliver a variety of nutrients and health benefits, such as support for memory and concentration, an excellent source of the antioxidant Vitamin C, and a good source of dietary fiber.

Why Purchase the Report?

- To visualize the global frozen fruits market segmentation based on fruit type, category, form, end-user, distribution channel, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of frozen fruits market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The Global Frozen Fruits Market Report Would Provide Approximately 77 Tables, 82 Figures and 195 Pages.

Target Audience 2024

- Manufacturers / Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies