Global Zero-Calorie Chips Market is segmented By Source(Potato, Tapioca, Tortilla), By Packaging Type(Pouches, Can, Box), By Distribution Channel(Supermarkets/Hypermarkets, Convenience Stores, Online Stores, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2023 - 2030

Market Overview

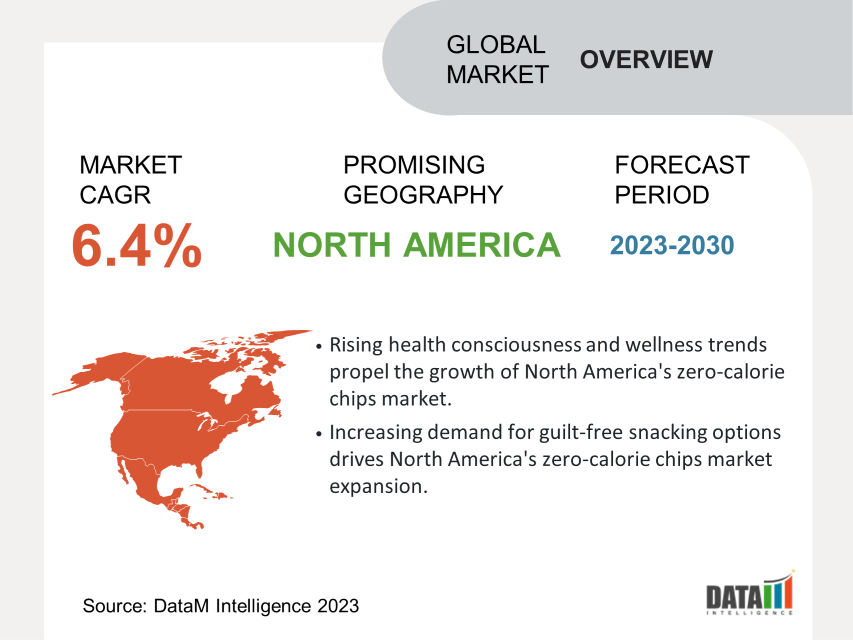

Global Zero-Calorie Chips Market reached USD 2.4 billion in 2022 and is expected to reach USD 3.9 billion by 2030 growing with a CAGR of 6.4% during the forecast period 2023-2030. The trend of innovative flavors in the zero-calorie chips market has gained traction, with companies introducing unique and exciting options to cater to diverse consumer preferences.

The zero-calorie chips market has experienced significant growth due to increasing consumer demand for healthier snacking options. With a focus on weight management and wellness, zero-calorie chips offer guilt-free indulgence. This market is characterized by innovative flavors and alternative ingredients, catering to various dietary preferences. The convenience and availability of zero-calorie chips make them a popular choice for health-conscious individuals seeking satisfying and nutritious snacks.

The rising demand for zero-calorie chips is driven by the growing interest in weight management and healthier snacking options. For instance, kale chips are a great pick for weight loss. 15% of your daily dose of vitamin A is there, 30% of your daily value of vitamin C is present, and 130% of your daily value of vitamin K is present in these chips. In addition, each bag contains 1/2 pound of actual vegetables. These are ideal for weight loss as they have just 70 calories per serving, which is a very low-calorie count.

Market Scope

|

Metrics |

Details |

|

CAGR |

6.4% |

|

Size Available for Years |

2021-2030 |

|

Forecast Period |

2023-2030 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

By Source, Packaging Type, Distribution Channel, and By Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, and Middle East & Africa |

|

Fastest Growing Region |

Europe |

|

Largest Region |

North America |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis, and Other key Insights. |

For More Insights about the Market Download Sample

Market Dynamics

Rising Health Consciousness Fuels the Growth of Zero-Calorie Chips Market

The zero-calorie chips market trend is driven by the increasing demand for low-calorie chips as consumers seek healthier snacking options. With rising health consciousness and a desire for guilt-free indulgence, the market is witnessing a surge in the popularity of calorie-free chips. These chips provide satisfying crunch and flavors while being virtually devoid of calories, appealing to weight-conscious individuals.

Another significant driver is the growing preference for light chips, which offer a reduced calorie content compared to traditional potato chips. Additionally, the trend towards healthy chips, made with natural and nutritious ingredients, is propelling the market growth. As consumers become more aware of their dietary choices, the demand for zero-calorie chips continues to rise, driving innovation and expansion within the market.

Growing Awareness of Portion Control and Calorie Management Drives the Zero-Calorie Chips Market

The zero-calorie chips market trend is driven by the increasing awareness of the importance of portion control and calorie management. With a growing focus on weight management and healthy eating habits, consumers are seeking snack options that allow them to indulge without compromising their calorie intake. Zero-calorie chips provide a solution by offering a guilt-free snacking experience that helps individuals meet their dietary goals.

Zero-calorie chips offer a ready-to-eat alternative that can be enjoyed on the go or as a quick and enjoyable snack, which also serves as a motivating factor. Additionally, the attractiveness of zero-calorie chips as a healthy option to conventional potato chips is what propels the market, which is consistent with the shift towards thoughtful and aware eating practices.

Taste and Texture Replication Challenges Restraining Zero-Calorie Chips Market Growth and Share

One restraint in the zero-calorie chips market is the challenge of taste and texture replication. Despite manufacturers' best efforts, it can be challenging to replicate the same taste and texture of traditional potato chips without using oil or other high-calorie components. This may hinder consumers who are used to the flavor and texture of ordinary chips in terms of attractiveness and adoption of zero-calorie chips.

Consequently, the zero-calorie chips market share is impacted, as some consumers may opt for other snack alternatives. Additionally, the restraint poses a hurdle to the market's growth potential as it may hinder the expansion of the consumer base and limit the overall zero-calorie chips market size.

Segment Analysis

The global zero-calorie chips market is segmented based on source, packaging type, distribution channel, and region.

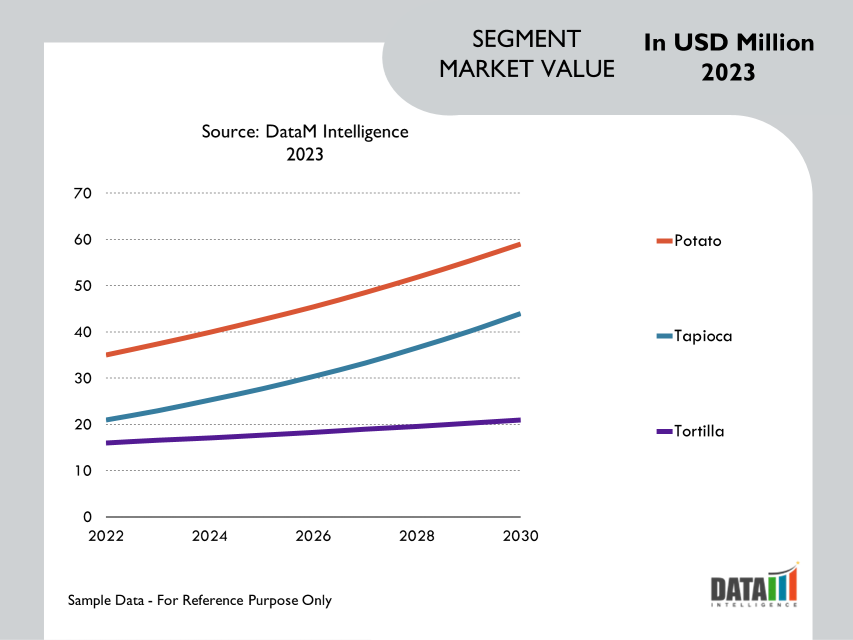

Potato Zero-Calorie Chips Dominate the Market, Holding a Significant Share in the Thriving Zero-Calorie Chips Industry

The global zero-calorie chips market has been segmented by source into potato, tapioca, and tortilla.

The potato zero-calorie chips segment holds a 65% market share of the zero-calorie chips market. These chips are made from thinly sliced potatoes that are baked or air-popped to achieve a crispy texture without the need for excessive oil or added calories. The popularity of potato zero-calorie chips can be attributed to their familiar taste, versatility in flavor options, and widespread availability.

With a sizable market size, the segment caters to the demand of health-conscious consumers seeking guilt-free snack options. The potato zero-calorie chips market share is influenced by factors such as consumer preferences, regional variations, and competition from alternative ingredients. However, the enduring popularity and consumer trust associated with potato-based snacks contribute to the expansion of the zero-calorie chips market size.

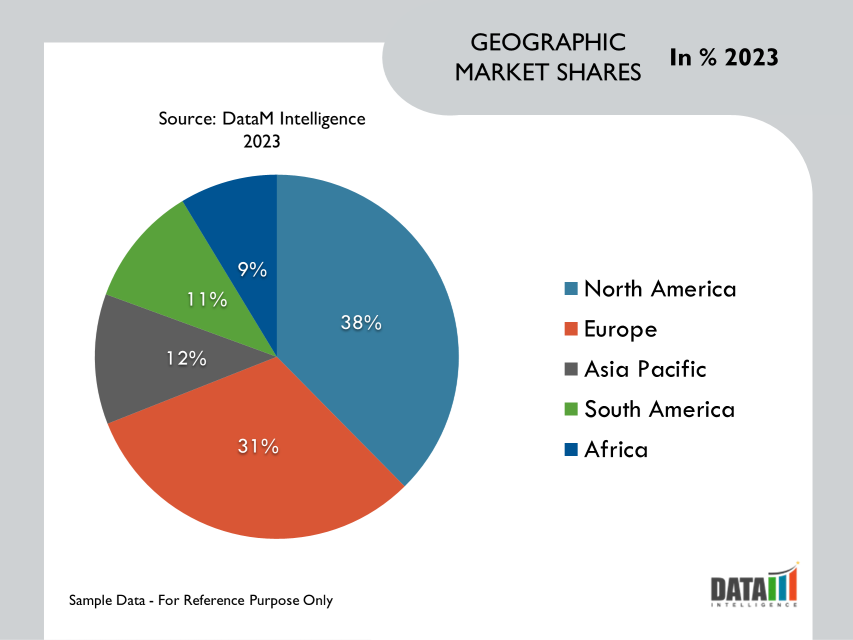

Geographical Share

North America Takes the Lead in Dominating the Zero-Calorie Chips Market with Healthy Snacking Trends

The North America region has witnessed significant growth in the zero-calorie chips market segment, with consumers actively seeking guilt-free chips as snack alternatives. The demand for low-fat chips has surged as health-conscious individuals look for healthier options that align with their dietary preferences. Baked chips and air-popped chips have gained popularity due to their lower fat content and perceived healthier profiles.

These snack alternatives offer a satisfying crunch and flavor while being lower in calories compared to traditional potato chips. The North American market has seen a rise in brands offering a wide range of healthy chips, including innovative flavors and alternative ingredients. The trend towards guilt-free snacking has driven the expansion of this segment, with consumers seeking tasty yet nutritious options in the form of zero-calorie chips.

Major Key Players

The major global players in the market include Quest Nutrition LLC., Popchips Inc., Simply 7 Snacks LLC, Rhythm Superfoods LLC, Beanfields Snacks, Eat Real Snacks, The Hain Celestial Group, Inc., The Kellogg Company, The Good Crisp Company, and Deep River Snacks.

COVID-19 Impact

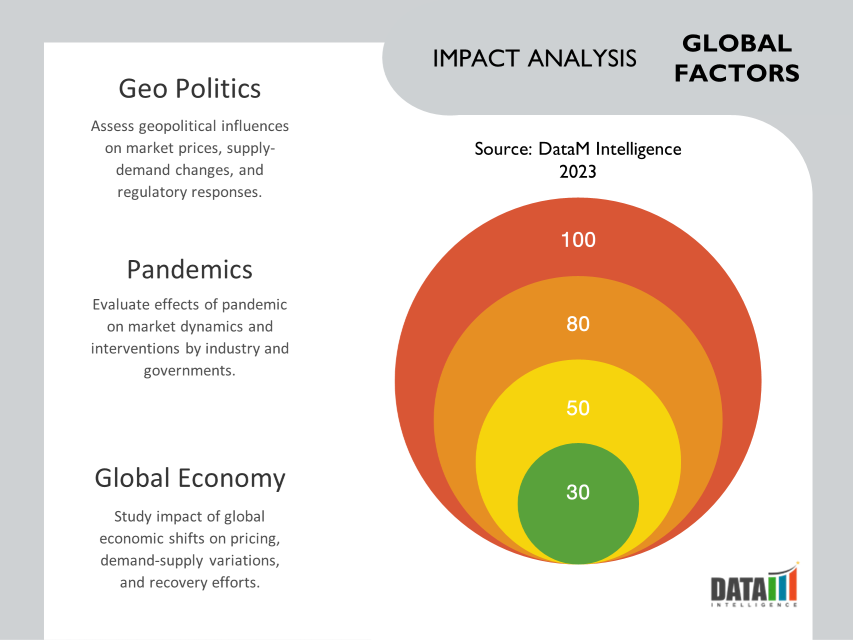

Global Recession/Ukraine-Russia War/COVID-19, and Artificial Intelligence Impact Analysis:

Covid-19 Impact:

The COVID-19 pandemic had a mixed impact on the zero-calorie chips market. On the one hand, Due to the increased focus on health and wellness during the pandemic, consumer interest in healthier snack options has increased. including zero-calorie chips. This led to a rise in demand and sales for these products. However, supply chain disruptions, restrictions on manufacturing, and shifts in consumer purchasing patterns impacted the market.

The closure of gyms, workplaces, and social events also affected impulse buying and snack consumption habits. Overall, while the pandemic created opportunities for the zero-calorie chips market, it also presented challenges that required adaptation and flexibility from manufacturers. Additionally, the pandemic accelerated the shift towards online shopping, prompting many zero-calorie chips manufacturers to strengthen their e-commerce presence and explore direct-to-consumer channels.

By Source

- Potato

- Tapioca

- Tortilla

By Packaging Type

- Pouches

- Can

- Box

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Stores

- Other

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Germany

- The U.K.

- France

- Italy

- Spain

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On December 02, 2020, PepsiCo acquired the BFY brand, the maker of air-popped snacks, flex protein chips, Flourish veggie chips, and low-calorie chips to expand the product portfolio and distribution channel as well production capacity of PepsiCo.

- On February 02, 2022, Better-for-you snacking brand, BRB Chips, launched BRB Popcorn Chips. The BRB Popcorn Chips have been launched in four delicious flavors Golden Butter, Salted Caramel, Salsa, and Cheese & Oliv. These chips contain low calories. This new product range is available to order from the company's D2C website and on Amazon.

Why Purchase the Report?

- To visualize the global zero-calorie chips market segmentation based on source, packaging type, distribution channel, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities in the market by analyzing trends and co-development.

- Excel data sheet with numerous data points of zero-calorie chips market-level with all segments.

- The PDF report consists of a cogently put-together market analysis after exhaustive qualitative interviews and an in-depth market study.

- Product mapping is available as Excel consists of key products of all the major market players.

The global zero-calorie chips market report would provide approximately 61 tables, 58 figures, and 190 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies