Global Workforce Management Software Market is segmented By Type(Workforce Scheduling and Workforce Analytics, Time and Attendance Management, Performance and Goal Management, Absence and Leave Management, Others), By Deployment(On-premise, Cloud), By End-User(BFSI, Consumer Goods, and Retail, Automotive, Energy and Utilities, Healthcare, Manufacturing, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2024 - 2031

Market Size

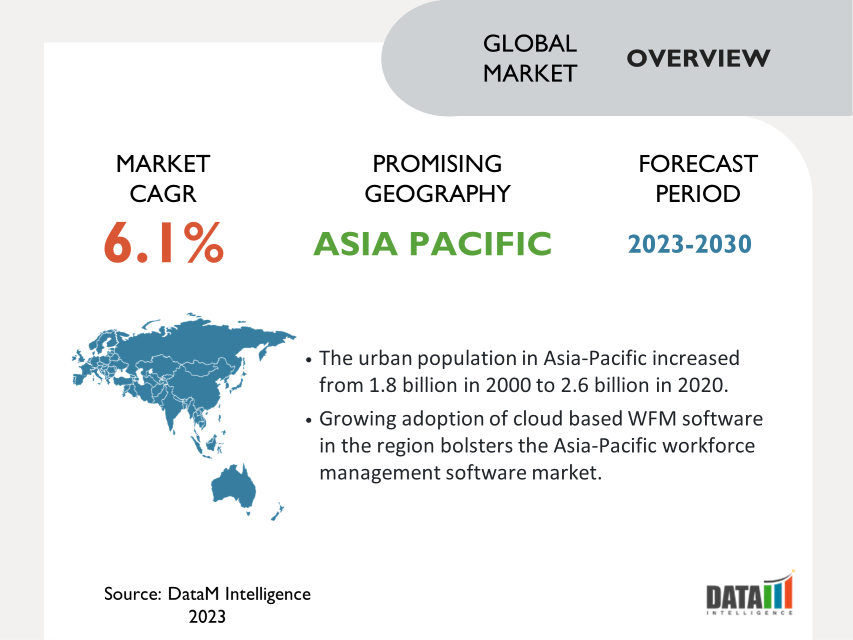

Global workforce management software market reached USD 7.8 billion in 2022 and is expected to reach USD 12.5 billion by 2030, growing with a CAGR of 6.1% during the forecast period 2024-2031. With the aid of workforce management software, employers may plan, manage, and track employee work, including labor needs, timetables, and paid time off (PTO).

Platforms for workforce management include a range of capabilities that let users maximize workforce efforts. Software for workforce management is used by businesses to estimate the need for labor, design and allocate employee schedules, monitor attendance, and provide workforce efficiency reports. As a result, it is fueling the expansion of the global market.

The COVID-19 epidemic will cause Chinese businesses to spend more money on digital labor management systems with artificial intelligence characteristics, generating a flourishing industry worth more than 30 billion yuan (USD 4.16 billion) in 2023 in China. Therefore, above mentioned factors drive the growth of the China market and is acoounting for 3/4th of the market shares.

Market Scope

|

Metrics |

Details |

|

CAGR |

6.1% |

|

Size Available for Years |

2022-2031 |

|

Forecast Period |

2024-2031 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Type, Deployment, End-User and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle East & Africa |

|

Fastest Growing Region |

Asia-Pacific |

|

Largest Region |

North America |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Equipment Type Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For More Insights Request Free Sample

Market Dynamics

Adoption of Cloud Technology

Businesses that are under constant pressure to increase workplace efficiency, cut costs, and boost their bottom line need cloud technology for the adoption and administration of workforce management (WFM) technologies.

Even though a few companies continue to seek to keep WFM capabilities on-premise, many are now constrained by outdated technology and lengthy processes that limit agility and growth while also harming a company's long-term financial viability. Managers and procurement leaders need to be aware of the immediate benefits of a cloud-based strategy in order to overcome their obsession and strategic reliance on on-premise infrastructure and address these concerns. As a result, it fuels the expansion of the world WFM software market.

Integrated Experience Management

WFM offers channels for collaboration and communication, information access, real-time feedback, micro-training, self-service tools, and automation. By analysing both fresh and old data, it uses machine learning to enhance forecast models and forecast levels of demand and labour. Therefore, above mentioned modules bolsters the experience in new suites.

For instance, A version of WorkForce Software's Workforce Suite was released that incorporates a variety of experience capabilities intended for deskless workers. WorkForce Software offers enterprise-level workforce management solutions.

When taken as a whole, the package is intended to promote spontaneous encounters between managers and employees. Two-way interactions and real-time workforce statistics are among the features included in the update that managers can use to engage personnel, gather feedback, and respond to employee sentiment.

Integration and Implementation Problems

Employees may be reluctant to use the new software if the implementation procedure is extremely complicated or time-consuming. The usefulness of the software can be restricted by low user acceptance, which will ultimately lower organizations' returns on investment.

Data inaccuracies and inconsistencies may result from integration problems. Important worker data must move easily between systems to avoid bottlenecks, inaccurate reporting, and poor decision-making. Hence, data inaccuracies and inconsistencies and decrased user adoption hampers the growth of the global workforce management software market.

Market Segment Analysis

The global workforce management software market is segmented based on type, deployment, end-user and region.

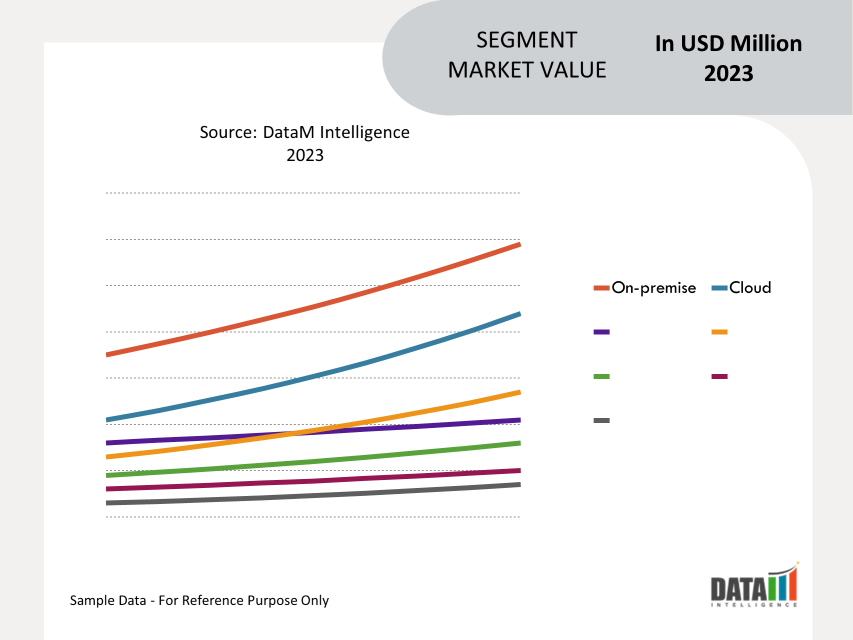

Cloud to Witness the Fastest Segment Growth

Businesses offer these software solutions through the private cloud to provide multi-level physical and logical security features; as a result, private cloud investment is increasing. The necessity for process transparency is supported by the rising popularity of cloud-based software and businesses.

Cloud-based workforce management software helps businesses save time and grow the workforce management industry by automating repetitive, tiresome operations. One of the main factors influencing the preference of many businesses for cloud-based workforce management is the need to find an all-in-one solution that includes services like inbound marketing software, Salesforce, marketing automation software, business analytical tools, and workforce management software. This makes it easier to acquire business, financial, and operational insights that the software can only enable through cloud technology. Therefore, cloud segment expected to grow at a highest CAGR during the freocast period.

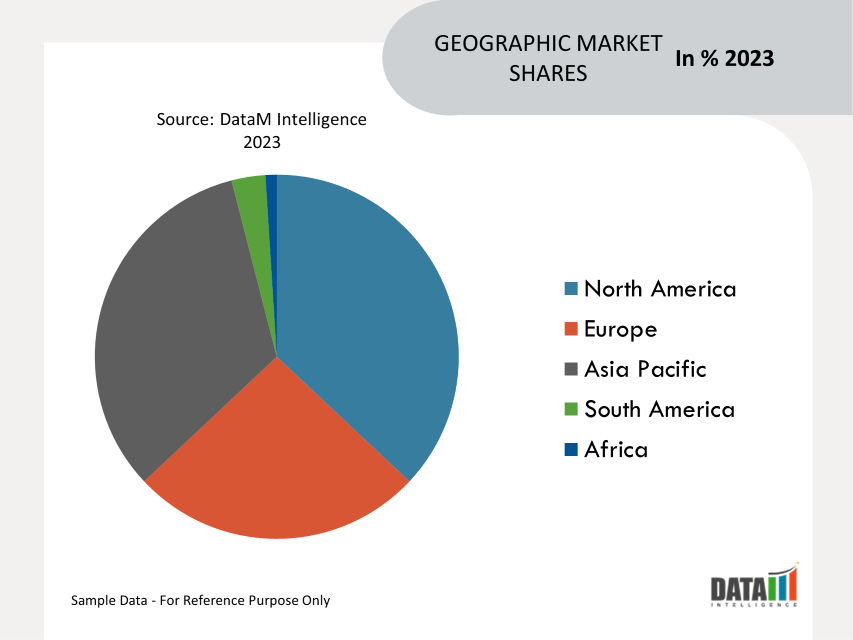

Market Geographical Share

A Boost in Productivity and Efficiency Led to the Dominance of North America

The market for workforce management software in North America has grown significantly. Local businesses are mostly worried about increased worker productivity and efficiency. The program's visibility among corporate executives has greatly grown as a result.

Due to multiple-fold growth in trade volumes, the region had a sizable market share and established itself as one of the top merchants in the retail venture industry. The issue is related to the fact that countries like U.S. and Canada, which employ both local and distant workers, require reliable and efficient labor management software. Therefore, North America dominates the global WFM software market with significant share.

Market Key Players

The major global players include ActiveOps PLC, NICE Ltd., Oracle Corporation, Infor Group, UKG Inc., Reflexis Systems Inc., SISQUAL Workforce Management, Lda, Workday Inc., WorkForce Software LLC and Blue Yonder Group, Inc. (Panasonic Corporation).

COVID-19 Impact Analysis

With the COVID-19 pandemic increasing the need for an agile workplace, many businesses are attempting to balance the usage of high-performance and user-friendly solutions. Mobile workforce applications are being quickly adopted since they reduce the expense of the additional system required for managing the workforce. The workforce management software is anticipated to gain significant momentum and further fuel market expansion throughout the projected period because of features like real-time notifications, task scheduling, attendance monitoring, and many more.

The COVID-19 pandemic has changed the workforce in several ways during the past two three years. As more people work from home or other remote locations, their work schedules and methods have significantly changed. Additionally, the percentage of "gig" and temporary employees has increased, posing both opportunities and challenges for businesses.

AI Impact

In the next five years or so, IDC predicts that the use of AI/ML-based management software, including those algorithms and bots, would increase from US$150 billion to more than USD 500 billion.

According to IDC, by 2023, 60% of the top 2,000 companies globally will implement platforms with AI and machine learning capabilities to support the employee life cycle from onboarding to retirement. And by 2024, 80% of those businesses will employ "digital managers" with AI/ML capabilities to help with employee hiring, training, and termination. However, IDC predicts that just one in five will experience value without human interaction.

Key Developments

- On September 28, 2022, Oracle NetSuite has introduced NetSuite SuitePeople Workforce Management to assist businesses optimize their staffing requirements. SuitePeople Workforce Management aids businesses in controlling labor expenditures and profits. By automating regular operations like staff scheduling, tracking employee hours worked, and calculating compensation, the system improves employee engagement. Additionally, it offers ideas on worker scheduling that are unique and assist organizations in achieving their business objectives.

- On July 20, 2021, Workforce Insight, a workforce optimization company that offers technology and advice services for workforce management and human capital management, has been acquired by Accenture. Accenture's labor management capabilities are improved by the acquisition, which also boosts the company's capacity to provide clients with HR transformation.

- On February 8, 2021, A recent study by Nucleus Research found that deployments of workforce management (WFM) have an average payback duration of just under 5 months and a return on investment of USD 12.24 for every dollar invested.

Why Purchase the Report?

- To visualize the global workforce management software market segmentation based on type, deployment, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of workforce management software market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global workforce management software market report would provide approximately 61 tables, 61 figures and 202 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies