Vegan Butter Market Size

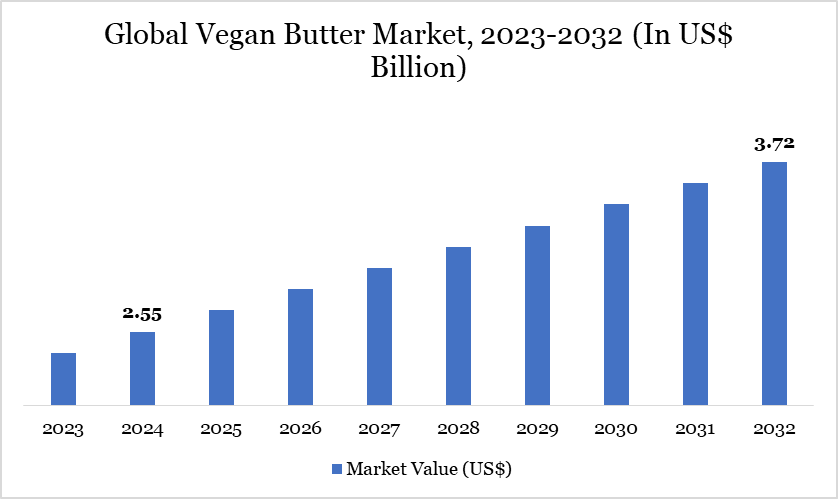

Vegan Butter Market Size reached US$ 2.55 billion in 2024 and is expected to reach US$ 3.72 billion by 2032, growing with a CAGR of 4.82% during the forecast period 2025-2032.

The global vegan butter market is experiencing steady growth, driven by rising consumer demand for plant-based, dairy-free alternatives due to health, environmental, and ethical concerns. Increasing lactose intolerance and awareness of animal welfare are encouraging more people to choose vegan options. Product innovation, such as new flavors and improved textures, is broadening appeal among mainstream consumers.

Major food companies and startups alike are expanding their vegan butter offerings, enhancing availability across retail and foodservice channels. For instance, in May 2025, French luxury pastry brand Maison Linotte unveiled Purely, a new-generation plant-based butter crafted for chefs and pastry enthusiasts. Made from organic, palm oil-free, and allergen-free ingredients, Purely serves as a 1:1 substitute for dairy butter without altering recipe taste or texture. The brand developed this clean-label butter to meet the growing demand for high-quality vegan alternatives in professional baking.

Vegan Butter Market Trend

The focus on health and wellness is a key trend driving growth in the vegan butter market. Consumers are increasingly seeking plant-based alternatives that align with healthier lifestyles and dietary preferences. Vegan butter, often free from cholesterol and trans fats, appeals to those aiming to reduce saturated fat intake. Many brands are also fortifying their products with vitamins and using clean-label ingredients. This trend is fueled by rising awareness of the health risks associated with traditional dairy products. As a result, health-conscious consumers are adopting vegan butter as a nutritious, guilt-free option.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details |

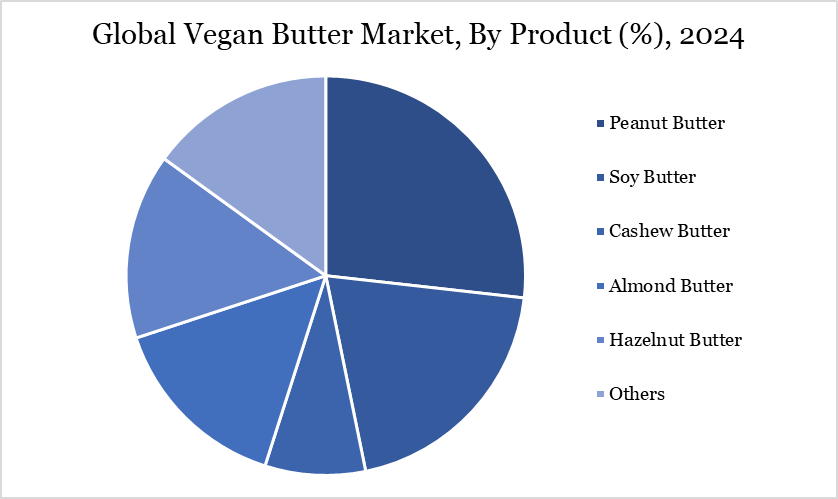

| By Product | Peanut Butter, Soy Butter, Cashew Butter, Almond Butter, Hazelnut Butter, Others, |

| By Type | Flavored, Unflavored |

| By Distribution Channel | Supermarkets & Hypermarkets, Specialty Stores, E-Commerce, Others |

| By End-User | Household, Food Processing, Foodservice Industry |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Vegan Butter Market Dynamics

Rising Demand for Plant-Based Alternatives

The rising demand for plant-based alternatives is a major factor propelling the growth of the vegan butter market. With an estimated 88 million vegans globally, according to the World Animal Foundation, the shift toward dairy-free products is accelerating. Increasing health consciousness among consumers plays a key role, as many perceive plant-based butter as a healthier option due to its lower saturated fat content, typically around 15% compared to 35% in traditional butter. In addition, vegan butter made from coconut oil, almond, soy, or avocado provides lactose-free and cholesterol-free benefits, attracting a broad range of health-focused consumers.

The popularity of veganism and flexitarian diets has significantly expanded the target market for vegan butter. Environmental concerns also drive growth, as consumers seek to reduce the carbon footprint associated with dairy farming. Ethical issues, such as animal welfare, further motivate people to opt for plant-based options. This growing awareness is prompting food companies to invest in innovative, sustainable butter alternatives. As a result, the plant-based butter segment is evolving rapidly, aligning with global trends in health, sustainability, and ethical consumption.

High Production Costs and Premium Pricing

High production costs and premium pricing are significant restraints in the vegan butter market, primarily because of the ingredients and manufacturing processes involved. Vegan butter is often made from high-quality plant-based oils like coconut, avocado, or almond oil, which are more expensive than traditional dairy fat. Additionally, manufacturers invest in research, formulation, and certifications (e.g., non-GMO, organic, vegan) to meet growing consumer expectations, further increasing costs. These elevated production expenses lead to higher retail prices, which can discourage mainstream consumers from purchasing vegan butter regularly.

This premium pricing limits accessibility, especially in price-sensitive markets and developing regions where affordability plays a crucial role in purchasing decisions. According to a survey by food awareness organization ProVeg International, most survey respondents (70%) believe that plant-based food is more expensive and less affordable than animal-based foods. While health-conscious and eco-aware consumers may be willing to pay extra, the majority still compare vegan butter prices with traditional dairy butter or other plant-based spreads. This price disparity reduces consumer adoption, slows market penetration, and affects overall sales volume.

Vegan Butter Market Segment Analysis

The global vegan butter market is segmented based on product, type, distribution channel, end-user, and region.

Peanut Butter Captures a Significant Share of the Vegan Butter Market Due to Its Nutritional Value and Versatile Flavor

Peanut butter holds a significant share in the vegan butter market due to its plant-based origin, wide availability, and high protein content. It is naturally free from dairy, making it a popular choice for vegans seeking nutritious spreads. Its rich, creamy texture closely mimics traditional butter, appealing to health-conscious consumers. The familiarity and long-standing popularity of peanut butter also give it an edge over newer vegan butter alternatives. It is versatile in cooking, baking, and as a spread, enhancing its utility in vegan diets.

Additionally, growing consumer demand for clean-label and minimally processed foods supports its position. Companies are increasingly launching products that are non-GMO, gluten-free, organic, and free from artificial additives to meet the rising demand from health-conscious consumers.

For example, in March 2025, US-based brand Justin’s recently introduced its Classic Crunchy Peanut Butter, which features a no-stir formula and unique grind. This product is non-GMO, gluten-free, and kosher certified, reflecting the brand’s commitment to clean-label offerings. Justin highlights that the launch aligns with growing consumer interest in texture-rich and better-for-you food options.

Vegan Butter Market Geographical Share

North America Holds a Significant Share in the Vegan Butter Market Due to Rising Health Awareness and Demand for Plant-Based Alternatives

North America holds a significant share in the vegan butter market, driven by rising health consciousness and the growing adoption of plant-based diets. Increasing numbers of consumers are seeking dairy alternatives due to lactose intolerance, allergies, and environmental concerns, fueling demand for vegan butter. Moreover, government support and investment in plant-based food startups help advance product development and distribution, making vegan butter more accessible across supermarkets, specialty stores, and online platforms. For instance, in 2023, the USDA awarded over US$ 10 million in grants for innovation in plant-based food processing, indirectly supporting vegan butter manufacturers.

According to the Plant Based Foods Association (PBFA), consumer research shows that despite challenges such as scaling difficulties, lack of subsidies, and shrinking retail space, demand for plant-based foods in the US remains robust and continues to grow. Currently, 70% of the total US population consumes plant-based foods, up from 66% a year ago. In 2022, plant-based foods achieved 60% household penetration and an impressive 80% repeat purchase rate across all categories. This strong consumer adoption and loyalty significantly contribute to North America’s dominant share in the vegan butter market, reinforcing its position as a key growth region.

Sustainability Analysis

The vegan butter market demonstrates strong sustainability potential due to its plant-based ingredients, which reduce reliance on animal agriculture, a major contributor to greenhouse gas emissions. Production typically requires less water and land compared to traditional dairy butter, lowering environmental impact. Additionally, many vegan butter brands emphasize clean-label, non-GMO, and organic sourcing, promoting biodiversity and soil health.

Packaging innovations increasingly focus on recyclable and compostable materials, reducing plastic waste. However, some plant oils used, like palm oil, pose sustainability concerns linked to deforestation, so sourcing responsibly is critical. The market’s growth also encourages shifts in consumer behavior toward more ethical and eco-friendly food choices. Supply chain transparency and fair-trade practices are becoming priorities to support social sustainability. Overall, vegan butter aligns well with global sustainability goals but requires continuous efforts to ensure ingredient sourcing and production methods remain environmentally and socially responsible.

Vegan Butter Market Major Players

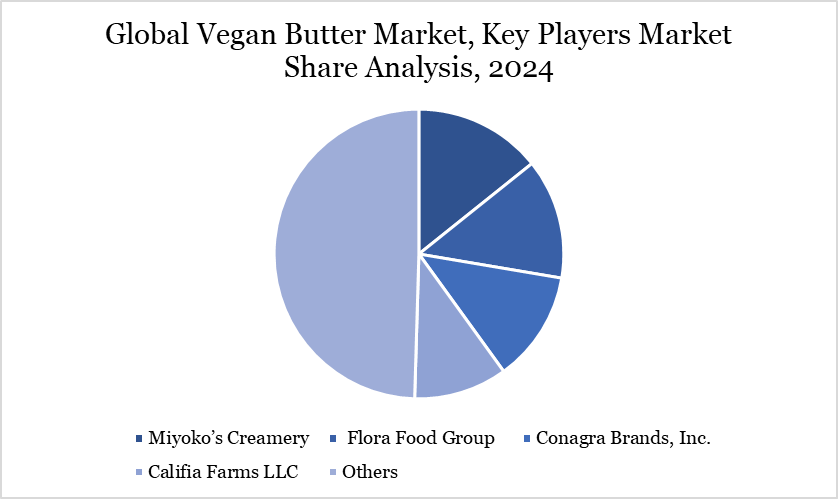

The major global players in the market include Miyoko’s Creamery, Flora Food Group, Conagra Brands, Inc., Califia Farms LLC, WayFare, Better Butter Company, Naturli’ Foods A/S, Danone SA, Jojoba Desert (A.C.S) LTD., NOW Foods and others.

Key Developments

In May 2025, French luxury pastry brand Maison Linotte launched Purely, a new generation plant-based butter aimed at chefs and pastry enthusiasts. Made from organic ingredients and free from palm oil, additives, and major allergens, Purely serves as a direct 1:1 replacement for conventional butter without the need to alter recipes. The butter features a neutral taste and appearance, ensuring it does not affect the flavor or color of baked goods.

In September 2024, Flora announced the launch of the first-ever plant-based smoked garlic butter block, set to hit supermarkets later this month. The limited-edition product, developed over 12 months, is designed to enhance dishes like pasta and garlic mushrooms. With 78% less climate impact than dairy butter, it aligns with ethical and environmental values. Flora’s innovation marks a significant step in the evolution of plant-based butters and spreads.

In August 2024, Danish premium butter brand Lurpak, owned by Arla Foods, launched a plant-based version of its spreadable butter, offering the same quality and versatility for spreading, cooking, and baking as its dairy counterpart. The new product features a simple ingredients list and aims to capture the growing demand for dairy alternatives, supporting Arla’s innovation-driven growth strategy.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies