Market Size

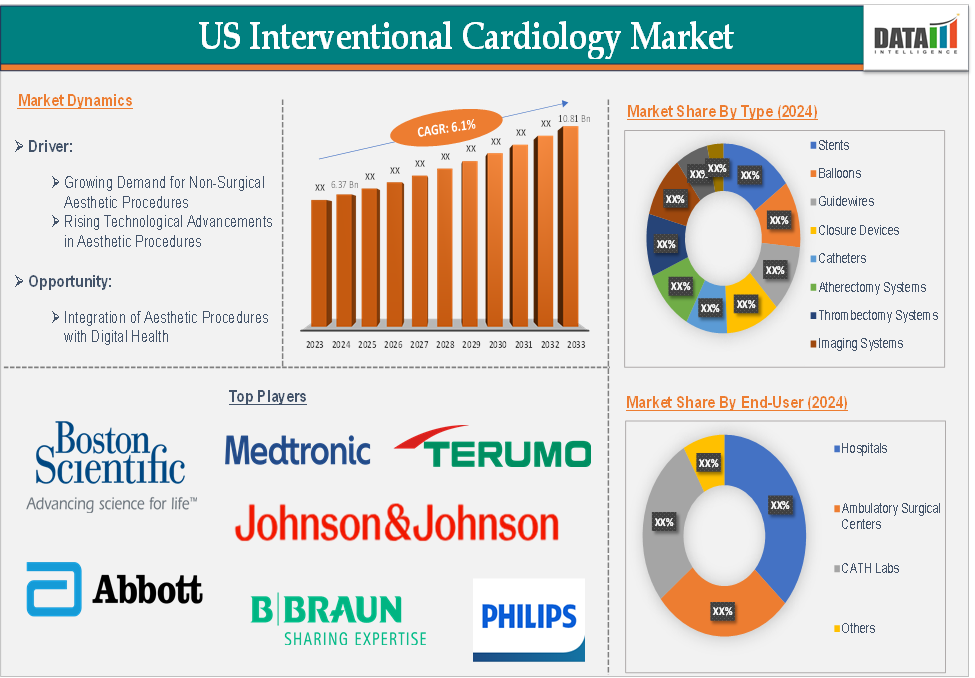

The US Interventional Cardiology Market size reached US$ 6.37 billion in 2024 and is expected to reach US$ 10.81 billion by 2033, growing at a CAGR of 6.1% during the forecast period of 2025-2033.

Interventional cardiology refers to a specialized field within cardiology that deals with the diagnosis and treatment of heart diseases using minimally invasive techniques, primarily involving stents and catheters (thin, flexible tubes) that are inserted into blood vessels. Unlike traditional open-heart surgeries, interventional cardiology procedures are performed through small incisions and do not require large surgical openings or extended recovery periods.

The primary goal of interventional cardiology is to diagnose and treat conditions related to the coronary arteries, heart valves, and other cardiovascular structures with the use of devices, catheters, and imaging technologies to perform specific procedures. One of the primary distinguishing features of interventional cardiology is its minimally invasive approach. Procedures are performed through small incisions, allowing patients to recover more quickly, experience less pain, and reduce hospital stays compared to traditional open-heart surgery.

Executive Summary

For more details on this report, Request for Sample

Market Dynamics: Drivers & Restraints

Rising structural heart disease interventions are driving the US interventional cardiology market growth

The shift from surgical to percutaneous procedures in treating severe aortic stenosis and mitral regurgitation is expanding due to better patient selection criteria, improved procedural outcomes, and shorter recovery times. The aging population and the rising prevalence of valvular heart diseases are contributing to this trend. For instance, according to the American College of Cardiology, since the approval of the first transcatheter aortic valve replacement (TAVR) device in 2011, more than 276,000 patients have undergone a TAVR procedure in the United States.

The integration of advanced imaging techniques such as 3D echocardiography, OCT, and IVUS is enhancing procedural success rates in structural heart disease interventions. For instance, in May 2022, Philips launched EchoNavigator 4.0. By integrating real-time transoesophageal echocardiography, EchoNavigator 4.0 helps interventional teams to decide, guide, treat, and confirm complex structural heart disease therapy, such as heart valve repair or replacement.

High cost of devices and procedures hampering the growth of the market

The high cost of devices and procedures is expected to hamper the growth of the US interventional cardiology market due to various factors, including device prices, procedural costs, and associated healthcare expenses. This economic barrier limits accessibility and affordability, particularly in regions with less advanced healthcare systems or lower economic capacities.

The cost of advanced interventional cardiology devices, such as drug-eluting stents (DES), bioresorbable stents, and drug-coated balloons (DCBs), is a significant barrier, making them unaffordable for many patients, especially in developing regions. For instance, a drug-eluting stent can cost between $1,000 and $3,000 in the U.S., and sometimes more depending on the technology used. This can limit access to these advanced technologies for patients in need.

According to the American Medical Association, across hospitals, the median price ranged from $204 to $2,588 for an echocardiogram. The median price ranged from $2821 to $9,382 for a right heart catheterization [RHC], $2,868 to $9,203 for a coronary angiogram, and $657 to $25,521 for a percutaneous coronary intervention [PCI].

Market Segment Analysis

The US interventional cardiology market is segmented based on type and end-user.

Type:

The stents from the type segment are expected to dominate the US interventional cardiology market with the highest market share

Coronary artery disease (CAD) is one of the most prevalent heart conditions in the United States, which directly contributes to the demand for stents. CAD occurs when the coronary arteries that supply blood to the heart become narrowed or blocked, leading to chest pain (angina) and even heart attacks.

For instance, according to the American Heart Association (AHA), over 18 million adults in the U.S. have CAD, and this number continues to grow due to lifestyle factors such as poor diet, lack of physical activity, and smoking. Stents are one of the primary solutions for treating CAD, especially in patients who experience arterial blockages or narrowing. The percutaneous coronary intervention (PCI) procedure, which often involves stent implantation, has become the preferred treatment for such conditions.

In 2023, the American College of Cardiology (ACC) and the American Heart Association (AHA) updated their guidelines, emphasizing the increasing role of drug-eluting stents (DES) for patients with CAD. This update recognizes the shift toward more advanced stent technologies that are improving outcomes for patients with heart disease, further driving demand.

Stents have evolved significantly over the years, and this technological progress has solidified their dominance in interventional cardiology. The development of drug-eluting stents (DES), bioabsorbable stents, and improved bare-metal stents (BMS) has made stents more effective and safer for patients. For instance, in May 2024, Abbott announced the XIENCE Sierra Everolimus Eluting Coronary Stent System in India. XIENCE Sierra is among the latest generation stents in the family of XIENCE, which is currently available for patients and interventional cardiologists. It provides safety for complex cases.

Additionally, in December 2023, Terumo India launched Ultimaster Nagomi, a drug-eluting stent for treating coronary artery disease, a move to invest in newer-generation stents to improve the safety and effectiveness of coronary artery treatments.

Major US Players

The major US players in the interventional cardiology market include Medtronic PLC, TERUMO CORPORATION, Boston Scientific Corporation, Abbott Laboratories, Canon Medical Systems Corporation, Teleflex Incorporated, B. Braun SE, Johnson & Johnson Services, Inc., Koninklijke Philips N.V and Cook Medical among others.

Scope

| Metrics | Details | |

| CAGR | 6.1% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Type | Stents, Balloons, Guidewires, Closure Devices, Catheters, Atherectomy Systems, Thrombectomy Systems, Imaging Systems, Chronic Total Occlusion Systems (CTO), and Others |

| End-User | Hospitals, Ambulatory Surgical Centers, CATH Labs, and Others | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical Procedures and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The US interventional cardiology market report delivers a detailed analysis with 36 key tables, more than 29 visually impactful figures, and 148 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.