United States Electronic Health Records Market Size

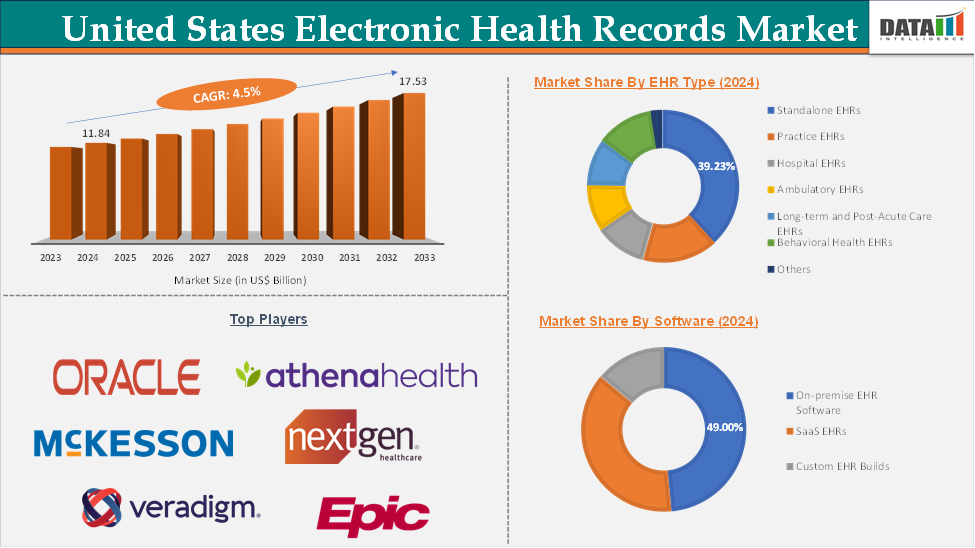

The United States electronic health records market reached US$ 11.84 billion in 2024 and is expected to reach US$ 17.53 billion by 2033, growing at a CAGR of 4.5 % during the forecast period 2025-2033.

An electronic health record (EHR) is an electronic representation of a patient's medical history that healthcare providers maintain over time. It encompasses essential administrative and clinical data pertinent to the patient's care within a specific healthcare provider's system.

The electronic health records (EHR) market in the United States is experiencing steady growth as the healthcare industry continues its shift toward digital solutions. This growth is fueled by the need for more efficient patient care, government support for health IT adoption, and the demand for better data sharing across healthcare systems. Cloud-based platforms, artificial intelligence, and improved interoperability are transforming how providers manage patient information.

While major players like Epic Systems, Oracle Health (formerly Cerner), and Allscripts lead the market, innovation and competition remain strong. Despite ongoing challenges such as high implementation costs and data privacy concerns, the EHR market is expected to expand, supporting more connected, coordinated, and value-driven healthcare across the country.

Executive Summary

For more details on this report, Request for Sample

United States Electronic Health Records Market Dynamics: Drivers & Restraints

Growing adoption of EHRs is expected to significantly drive the United States' electronic health records market growth

The adoption of electronic health record (EHR) solutions is steadily increasing across the U.S. healthcare sector, driven by a growing preference among healthcare providers to improve patient safety and deliver higher-quality care. EHR systems enable seamless sharing of accurate, real-time patient data across different care settings, which enhances care coordination and reduces the likelihood of medical errors. This trend continues to gain momentum, supported by updated data from the Office of the National Coordinator for Health Information Technology.

A decade ago, electronic health record (EHR) adoption among U.S. hospitals stood at approximately 72%. According to the latest data from the Office of the National Coordinator for Health Information Technology (ONC), in 2025, the number has now risen to 96%..

Technological advancements are also playing a crucial role in this growth. EHR systems are becoming more intuitive and powerful, with leading vendors integrating artificial intelligence (AI), machine learning, and advanced data analytics to support better clinical decision-making. These innovations are not only improving patient outcomes but also addressing long-standing challenges like administrative burdens. For example, in March 2025, Suki announced the expansion of its AI-powered voice assistant, Suki Assistant, to support real-time clinical documentation across multiple specialties, significantly reducing charting time and easing physician workload. Such developments are accelerating EHR adoption, positioning the market for continued expansion through 2025 and beyond.

High implementation and maintenance costs are expected to hinder the United States' electronic health records market

The high costs of implementing and maintaining electronic health records (EHR) systems pose a significant challenge to the growth of the market in the United States. These costs are particularly burdensome for small and mid-sized healthcare providers, who often struggle with the initial investment, ongoing maintenance fees, and financial risks associated with the technology.

Although EHR adoption is crucial for enhancing healthcare quality and operational efficiency, the financial strain may cause some providers to delay or even avoid adopting these systems. To drive wider adoption, it will be important to address these financial hurdles by offering better financing options, increasing government incentives, and providing more affordable EHR solutions.

United States Electronic Health Records Market Segment Analysis

The United States electronic health records market is segmented based on EHR type, software, application, and end-user.

Software :

The software segment is expected to dominate the United States electronic health records market with a 39.8% share in 2024

The software segment is expected to hold a significant portion of the market share. This dominance is attributed to the increasing technological advancements, increasing dependence on EHR software to improve healthcare delivery, increasing demand for advanced software integration in the healthcare HER systems and the rising launches of advanced software solutions.

EHR software is increasingly demanded by healthcare professionals to incorporate into their advanced systems and advance the healthcare system by providing efficient care for patients through better decision-making. For instance, in May 2024, Epic announced the introduction of new software that could help hospitals and health systems assess and validate artificial intelligence models. This software is mainly aimed at healthcare organizations that might otherwise lack resources to properly validate their AI and machine learning models and is designed to help providers make decisions based on their own local data and workflows.

In March 2024, Health Information Management Systems (HiMS) released AxiomEHR, an all-new, AI-powered electronic health record (EHR) solution with a unique architecture that supports data-based decision-making, flexible care coordination, and overall resilience to drive quality-based care. Thus, the above factors are expected to drive the segment growth.

United States Electronic Health Records Market Major Players

The major players in the United States electronic health records market include Oracle, Epic Systems Corporation, Veradigm LLC, AdvancedMD, Inc., Athenahealth, McKesson Corporation, NXGN Management, LLC., eClinicalWorks, CureMD Healthcare, and Practice Fusion, Inc., among others.

Key Developments

In October 2024, Oracle introduced a new electronic health record system, marking its most significant healthcare product launch since acquiring medical records leader Cerner for $28 billion in 2022.

In May 2024, Athenahealth introduced new electronic health record products aimed at specialists. By combining critical electronic health record and practice management capabilities with tailored workflows, the company said it is aiming to reduce burnout and improve the EHR experience in specialty care.

Market Scope

Metrics | Details | |

CAGR | 4.5% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | EHR Type | Standalone EHRs, Practice EHRs, Hospital EHRs, Ambulatory EHRs, Long-term and Post-Acute Care EHRs, Behavioral Health EHRs, Others |

Software | On-premise EHR Software, SaaS EHRs, Custom EHR Builds | |

Application | E-prescription, Practice Management, Healthcare Financing, Patient Management, Population Health Management, Clinical Research Application, Others | |

End-User | Hospitals, Clinics, Ambulatory Surgical Centers, Homecare, Others | |

The United States electronic health records market report delivers a detailed analysis with 45 key tables, more than 33 visually impactful figures, and 126 pages of expert insights, providing a complete view of the market landscape.