Sulphur Pastilles Market Overview

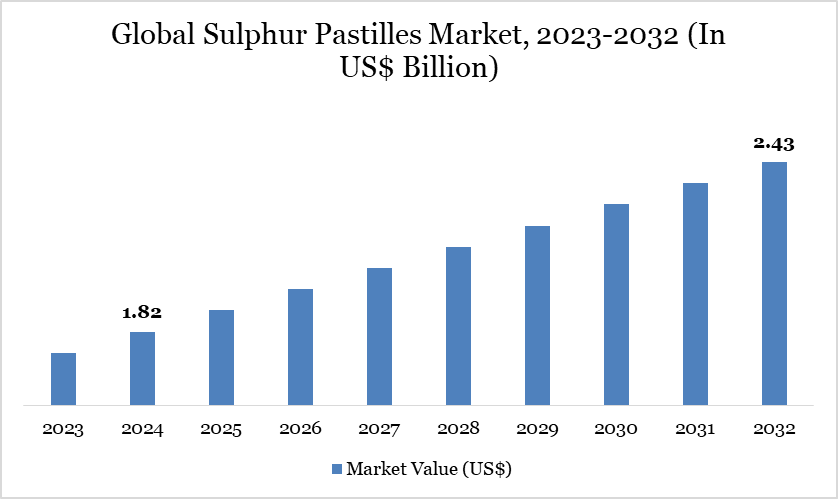

Global Sulphur Pastilles Market reached US$ 1.82 billion in 2024 and is expected to reach US$ 2.43 billion by 2032, growing with a CAGR of 3.67% during the forecast period 2025-2032.

The global sulfur pastilles market is set for significant growth, propelled by increased demand in the automotive and agricultural industries. The growing prevalence of electric vehicles (EVs) and the anticipated rise in worldwide tyre production projected to attain 22.7 million tons in 2024 (a 3.4% increase from 2023) is markedly enhancing the utilization of sulphur-based rubber processing agents.

The Asia-Pacific region is anticipated to account for almost one-third of the global market share, supported by China's rise as the leading global automotive exporter in 2023, with exports valued at nearly US$ 208 billion. Simultaneously, sulfur pastilles are becoming increasingly significant in agriculture as fertilizers, driven by escalating food security issues. As the global population is anticipated to attain 9.7 billion by 2050, efforts to enhance crop yield such as the implementation of contemporary fertilizers—are driving sulphur consumption. The interplay of these two sectors is anticipated to support and propel market expansion throughout the forecast period.

Sulphur Pastilles Market Trend

A significant factor impacting the sulphur pastilles market is the rapid transition to the production of tyres specifically for electric vehicles. High-torque electric vehicles result in accelerated tire degradation, prompting manufacturers to develop EV-specific tires with enhanced materials and innovative tread designs. This innovation is driving increased demand for sulphur pastilles in rubber compounding.

The Asia-Pacific region is experiencing significant industrial growth, particularly in China and India, where electric vehicle manufacture and local automobile production are rapidly increasing. A significant development is the incorporation of contemporary prilling and pelletizing technology, facilitating enhanced control over pellet uniformity, shape, and size. These advancements enable firms to make high-quality sulphur pastilles at scale, enhancing product quality for applications in agriculture, chemicals, and mining. The intersection of technical advancement and consumer sector growth is fostering an advantageous environment for continuous market progress.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details |

| By Type | Sulphur 90%, Sulphur 85% |

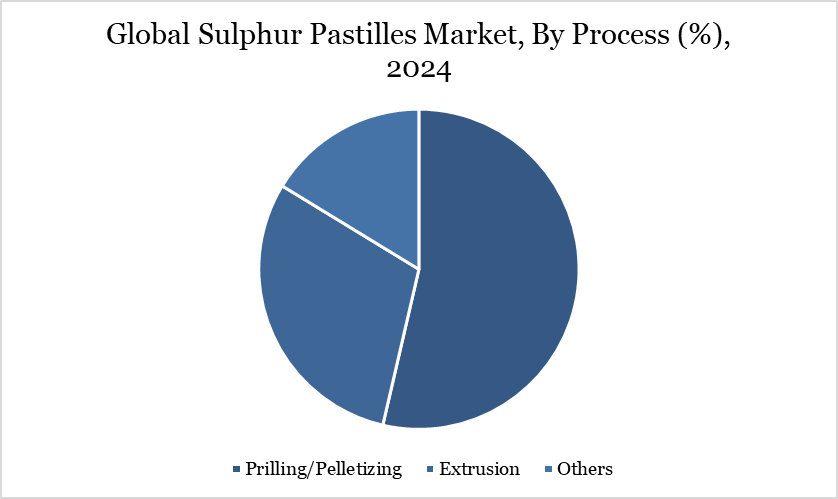

| By Process | Prilling/Pelletizing, Extrusion, Others |

| By Agriculture | Agriculture, Chemical Processing, Rubber Processing, Pharmaceuticals, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Sulphur Pastilles Market Dynamics

Electrification of Mobility Stimulates Sulphur Demand

The continuous electrification of the global automotive industry is a crucial catalyst for the sulfur pastilles market. As automobile manufacturers shift to entirely electric vehicle fleets by 2035, the demand for tyres with improved durability is increasing. Electric vehicles, distinguished by superior acceleration and torque, expedite tire wear, necessitating more frequent replacement cycles.

Tire manufacturers have reacted by creating specialist tires utilizing thicker, more durable compositions, which require a greater application of sulfur-based vulcanizing chemicals. Projections for tyre manufacturing in 2024 suggest an annual output of 22.7 million tons, reflecting a 3.4% increase from the prior year. This volume is bolstered by expansion initiatives in rapidly growing regions like as India and China. The enduring synergy between electric vehicle adoption and the tire industry's demand for sulfur-based products underpins the upward trajectory of the worldwide sulfur pastilles market.

Environmental Oversight and Regulatory Restrictions

Environmental issues associated with sulphur compound emissions present a significant constraint. The combustion of sulfur-based fertilizers, especially in agricultural practices, results in the emission of sulfur dioxide (SO₂), a contaminant associated with acid rain and detrimental health effects. The American Lung Association cautions that extended exposure to SO₂ can diminish lung function and aggravate respiratory ailments such as asthma.

Regulatory authorities are enhancing scrutiny of industrial sulphur emissions, necessitating manufacturers to transition to more environmentally friendly options. Furthermore, the advancement of environmentally sustainable rubber processing additives as alternatives to sulphur may progressively reduce sulphur pastille usage in specific applications. The environmental and regulatory factors pose enduring obstacles to unchecked commercial expansion.

Sulphur Pastilles Market Segment Analysis

The global sulphur pastilles market is segmented based on type, process, application, and region.

Prilling and Pelletizing Advance in Industrial Efficiency

The prilling/pelletizing category is projected to experience substantial expansion during the projection period. Contemporary advancements in these methods have facilitated the manufacture of sulfur pastilles with enhanced physical characteristics, including constant dimensions, homogeneity, and shape.

These properties are essential for enhancing performance in end-use sectors such as fertilizers, rubber processing, and industrial chemicals. The increased demand for high-performance sulfur-based products in agriculture, mining, and chemicals has resulted in the wider implementation of modern prilling and pelletizing systems. This segment is swiftly becoming as the favored process path owing to its economic and quality benefits.

Sulphur Pastilles Market Geographical Share

The Regulatory Duality and Technological Advantage of North America

The sulfur pastilles market in North America is influenced by a combination of rigorous environmental regulations and the use of modern technology. Despite heightened air quality requirements and restrictions on sulfur dioxide emissions due to worries over sulfur emissions, the region's established chemical and agricultural sectors persist in demonstrating steady demand.

Contemporary prilling and pelletizing facilities in North America facilitate the manufacture of high-purity sulphur pastilles appropriate for fertilizer and industrial applications. Furthermore, the region's emphasis on food security corresponds with the global trend of enhancing agricultural output to satisfy the demands of an expanding population. These factors enable North America to maintain a solid position in the global sulphur pastilles market, notwithstanding regulatory restrictions.

Sustainability Analysis

Sustainability is becoming increasingly essential to the future of the sulfur pastilles sector. The material is essential for enhancing food security, demonstrated by a 52% rise in crop yields from 2000 to 2022, attributable to contemporary agricultural inputs such as sulphur fertilizers. Environmental concerns over sulfur dioxide emissions have prompted advancements in cleaner manufacturing and consumption practices.

The advancement of sustainable additives in rubber processing and the implementation of optimal procedures to reduce post-application emissions in agriculture are increasingly being embraced. As governments and companies prioritize sustainable development, market participants must align with circular economy objectives and invest in cleaner, more efficient technologies. Long-term sustainability in this sector will depend on reconciling increasing demand with environmental responsibility.

Sulphur Pastilles Market Major Players

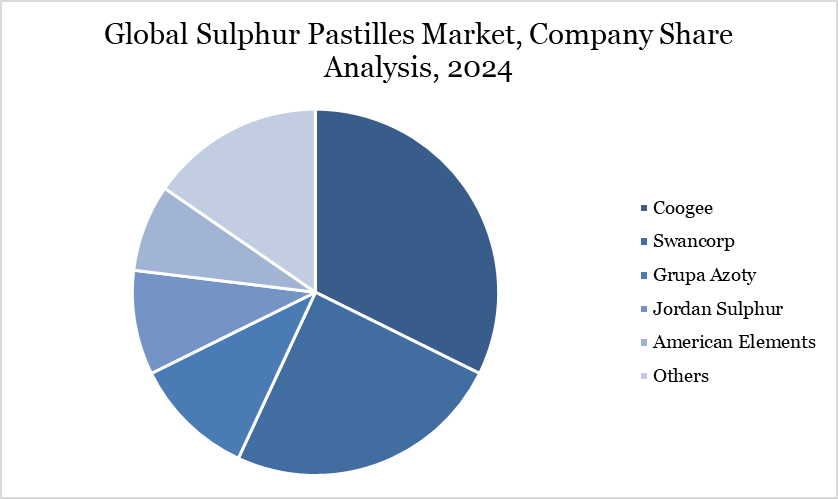

The major global players in the market include Coogee, Swancorp, Grupa Azoty, Jordan Sulphur, American Elements, Devco Australia, Saeed Ghodran Group, Tiger-Sul Products LLC, Vasmate Sulphur Industries, Georgia Gulf Sulfur Corporation.

Key Developments

In February 2023, Grupa Azoty, a Polish chemical manufacturer, established a new R&D center for conducting research into new types of biofertilizers. The research could enhance the efficiency of sulphur pastilles.

In March 2024, researchers at University of California in San Diego, US announced the development of a new sulphur iodide crystal which could help in creating the next generation of lithium sulphur batteries.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies