Global Powder Sulfur Market is Segmented By Product (Non-Oil Filled Powder Sulfur, Oil Filled Powder Sulfur), By Fineness (200 Mesh, 300 Mesh, 400 Mesh, 500 Mesh, Others), By Grade (Agriculture Grade, Industrial Grade, Pharma Grade, Food Grade, Others), and By Region (North America, Europe, South America, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2023-2030

Powder Sulfur Market Size

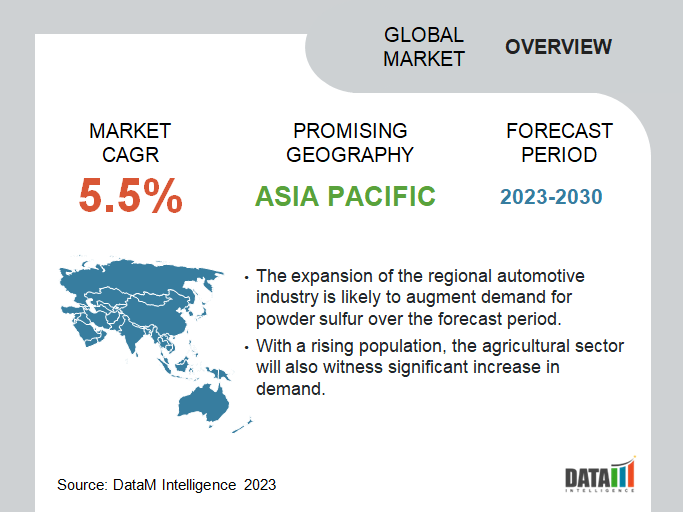

Global Powder Sulfur Market reached USD 1.1 billion in 2022 and is expected to reach USD 1.5 billion by 2030, growing with a CAGR of 5.5% during the forecast period 2023-2030.During the forecast period, rising demand for metals and minerals, especially due to ongoing technological advances will propel the growth of the global powder sulfur market.

The various extraction and refining processes for metals such as iron, copper and nickel require the usage of powder sulfur. As mining companies ramp up production, the demand for powder sulfur from the mining industry is likely to increase over the coming years.

Powder sulfur demand is also likely to increase over the coming years on account of increased research into lithium-sulfur battery chemistry. In May 2022, scientists from the Beijing Institute of Technology published a paper detailing the development of a new high-energy sulfur cathode for lithium-sulfur batteries.

Powder Sulfur Market Scope

|

Metrics |

Details |

|

CAGR |

5.5% |

|

Size Available for Years |

2021-2030 |

|

Forecast Period |

2023-2030 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Product, Fineness, Grade and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle East & Africa |

|

Fastest Growing Region |

Asia-Pacific |

|

Largest Region |

Asia-Pacific |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Equipment Type Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

To Know More Insights - Download Sample

Powder Sulfur Market Dynamics

Rising Global Automotive Production

The global automotive industry has witnessed significantly better recovery from COVID-19, mainly on account of strong pent-up consumer demand during the pandemic period. According to data from the International Organization of Motor Vehicle Manufacturers (OICA), nearly 85 million commercial and passenger vehicles were produced in 2022, which represents an 6% increase from 2021.

The rising global production of automobiles thus leads to an increased demand for vehicle tyres, from original equipment manufacturers (OEM) and the aftermarket. It has also increased demand for other rubber accessories such as gaskets, rubber seals, hoses and liners. Powder sulfur is a key ingredient used in the vulcanization of rubber products. With rising automotive production creating growing demand for various rubber accessories, the demand for powder sulfur from the rubber processing industry will increase over the short and medium term.

Improvements in Agricultural Productivity

According to data from the United Nations (UN), the global population reached 8 billion in mid-November 2022. Furthermore, according to projections, the global population is expected to reach 9.7 billion in 2050. Governments and multilateral organizations are striving to improve agricultural productivity to ensure adequate food supplies for a rising global population.

Modern farming techniques have made considerable improvements to agricultural productivity. According to a long-term study undertaken by the food and agricultural organization (FAO) of the UN, the global production of primary food crops has increased by 52% over the two decades from 2000-2022. Powder sulfur is extensively used as an agricultural fertilizer. With growing efforts to improve agricultural productivity, sulfur fertilizer intake by farmers is likely to increase over the coming years.

Rising Awareness About Sulfur Pollution

One of the biggest concerns about sulfur usage is the growing rates of air pollution by sulfur compounds, namely sulfur dioxide (SO2), which is released when sulfur is burned. The mixing of sulfur dioxide in the atmosphere also leads to acid rain, which can have severe impact on living organisms. According to the American Lung Association, exposure to SO2 can cause shortness of breath, asthma and potential loss of lung function due to high amounts of exposure.

With rising awareness about sulfur pollution, governments are undertaking various measures to restrict sulfur emissions across industries. Furthermore, chemical companies are developing new eco-friendly additives to substitute sulfur as a vulcanizing agent in the production of processed rubber articles. The demand for powder sulfur is likely to decrease over the medium and long term.

Powder Sulfur Market Segment Analysis

The global powder sulfur market is segmented based on product, fineness, grade and region.

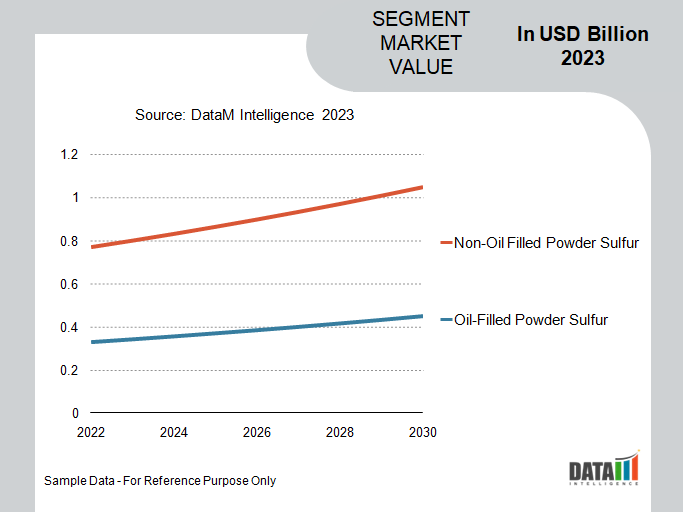

Versatile Agricultural and Industrial Applications Makes Non-Oil Filled Powder Sulfur a Popular Choice

Non-oil-filled sulfur has a larger market share mainly due to its broad range of applications across various industries. One of the biggest applications for non-oil-filled powder sulfur is within the agricultural sector, mainly as a fertilizer. Sulfur fertilizers provide essential nutrients to plants and also help improve soil pH and nutrient absorption and promote the synthesis of enzymes in plants.

Furthermore, non-oil-filled powder sulfur is also used in the formulation of pesticides and fungicides. Sulfur-based pesticide formulations act as an effective and environmentally friendly control agent against various pests, mites, fungi and diseases affecting crops. Sulfur-based pesticides provide an alternative to synthetic chemical pesticides and are commonly used in organic farming.

A major industrial application of non-oil filled powder sulfur is in rubber vulcanization. It is the most commonly used vulcanizing agent, where it forms cross-links between polymer chains, improving the elasticity, durability and heat resistance of rubber products. Vulcanizing agents are used in the production of tires, conveyor belts, seals, gaskets and other processed rubber articles.

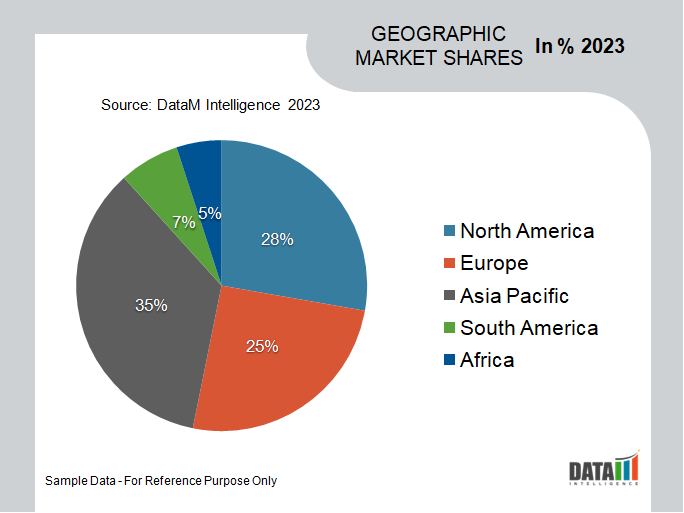

Global Powder Sulfur Market Geographical Share

The Expansion of the Automotive Industry Will Drive Market Growth in Asia-Pacific.

Asia-Pacific is expected to account for nearly a third of the global market and is expected to have a faster growth rate of 5.5% during the forecast period. The rapid expansion of the automotive industry, especially with the current ongoing shift towards electric vehicles is likely to augment demand for industrial grade powder sulfur.

China has the largest automotive industry in the region and became the largest global automotive exporter in 2023, with exports totaling nearly USD 208 billion in 2022. The rapid expansion of electric vehicle (EV) production is China is generating unprecedented demand for various automotive components and materials. With a view to ensuring complete control of the EV supply chain, China has stepped up the domestic extraction and refining of vital battery metals such as nickel and copper. Nickel and copper extraction and refining processes require the use of powder sulfur.

India is another major country in the region which is witnessing rapid expansion of its automotive industry. In 2022, India displaced Japan to become the third largest automotive market globally. The continued growth of the Indian automotive industry will generate sustained demand for powder sulfur, especially from automotive tyre and rubber component manufacturers.

Powder Sulfur Market Companies

The major global players include Grupa Azoty, Kaycee Chem Industries, M. K. CHEMICAL INDUSTRIES, Jordan Sulphur, Golden Chemicals Private Limited, Solar Chemferts Pvt Ltd, American Elements, Jainson Chemicals, Mosaic and Jaishil Sulphur & Chemical Industries.

COVID-19 Impact on Powder Sulfur Market

The COVID-19 pandemic creates several challenges for the global market. A major disruption in the automobile and tyre production led to reduced demand from tyre manufacturers. A drop in demand from major end-users led to significant volatility in sulfur prices. Furthermore, as countries instituted movement restrictions, ensuing labor shortages hindered sulfur and mining extraction, especially in developing countries.

The gradual recovery in various end-user industries in the aftermath of the pandemic has led to a relatively healthy recovery for the global market. However, with many supply chain disruptions still lingering in the pandemic’s aftermath and many industries still yet to rebound from COVID era lows, the medium-term growth prospects for the global market look challenging.

Russia- Ukraine War Impact Analysis

The ongoing conflict between Russia and Ukraine are unlikely to have a major impact on the global market at large, although it will significantly alter the demand dynamics in Ukraine and Russia. With almost all Ukrainian territory under constant attack throughout the war, powder sulfur demand has been drastically reduced within the agricultural and industrial sectors.

Furthermore, Russian demand has also been affected, mainly on account of international sanctions imposed on it for the war. Although Russia sources its powder sulfur from non-western sanctions have made it impossible for Russian companies to pay its suppliers in U.S. dollars, the most commonly used currency for global trade. Therefore, the Russian government is setting up trade in local currencies to overcome these challenges.

By Product

- Non-Oil Filled Powder Sulfur

- Oil Filled Powder Sulfur

By Fineness

- 200 Mesh

- 300 Mesh

- 400 Mesh

- 500 Mesh

- Others

By Grade

- Agriculture Grade

- Industrial Grade

- Pharma Grade

- Food Grade

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In October 2022, scientists from the Hunan University in China, published a research paper exploring the usage of powder sulfur for the preparation of graphene-carbon fibers in production of potassium-ion batteries.

- In December 2022, scientists from the Chang'an University in Xian, China, published a research paper detailing the effects of powder sulfur in improving the properties of cement-based composite materials.

- In April 2023, scientists from the Central South University in Changsha, China published a research paper detailing the usage of powder sulfur for the production of an alternative chemistry lithium-sulfur batteries.

Why Purchase the Report?

- To visualize the global powder sulfur market segmentation based on product, fineness, grade and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of powder sulfur market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global powder sulfur market report would provide approximately 57 tables, 60 figures and 185 Pages.

Target Audience 2023

- Tyre Manufacturers

- Fertilizer Manufacturers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies