Sterile Injectable Market Size

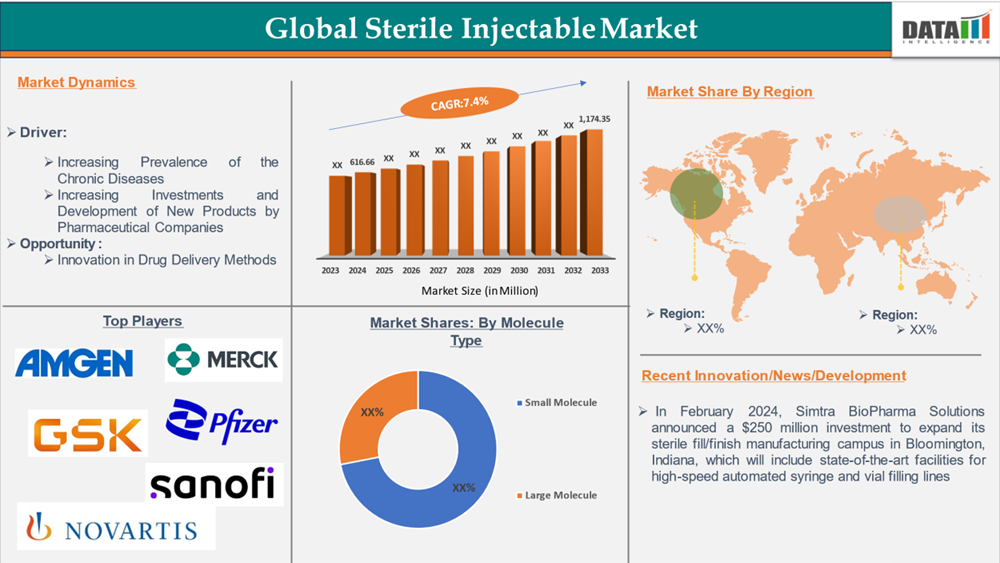

The global sterile injectable market reached US$ 616.66 million in 2024 and is expected to reach US$ 1,174.35 million by 2033, growing at a CAGR of 7.4% during the forecast period 2025-2033.

Sterile injectables are medications or biologics that are administered through injections and are manufactured under stringent conditions to ensure they are free from any microorganisms. These products are commonly used to treat a wide range of medical conditions, especially those requiring rapid action or precise delivery to specific parts of the body. Sterile injectables are often preferred for conditions such as cancer, diabetes, autoimmune diseases, and infections.

Executive Summary

For more details on this report – Request for Sample

Sterile Injectable Market Dynamics: Drivers & Restraints

Increasing Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases is expected to significantly drive the growth of the sterile injectables market over the forecast period. Conditions such as diabetes, cancer, and heart disease are becoming more widespread globally, and many of these diseases require ongoing treatment. For example, the 2023 ICMR INDIAB study reported that 10.1 crore people in India are living with diabetes. Additionally, cancer is responsible for around 10 million deaths annually, making it one of the leading global health concerns.

Many chronic diseases are treated with medications that are most effective when administered through injection. This is often due to the need for rapid absorption into the bloodstream, extended therapeutic action, or targeted delivery to specific areas of the body. Sterile injectables play a critical role in managing these conditions, making them essential for effective therapy. As these conditions continue to rise, the demand for sterile injectables is expected to grow, driving market expansion during the forecast period.

High Manufacturing Costs

The high production costs associated with sterile injectables often result in higher drug prices, which can limit patient access, especially in regions with weaker healthcare infrastructure or limited insurance coverage. This creates a significant barrier for patients in need of these medications, reducing the overall market potential. Additionally, the high costs of production can cut into profit margins, leaving fewer resources available for investment in research and development (R&D) of new drugs and innovative delivery systems. This can slow the development of new treatment options and hinder the market’s ability to reach new patient populations.

Unlike simpler forms of medication like tablets, sterile injectables require complex manufacturing processes to maintain sterility. This added complexity demands specialized skills, more manpower, and additional quality control measures, all of which drive up production costs. As a result, these factors are expected to limit the growth of the sterile injectables market.

Sterile Injectable Market Segment Analysis

The global sterile injectable market is segmented based on molecule type, drug type, application, and region.

Molecule Type:

Large molecule in the molecule type segment is expected to dominate the sterile injectable market.

The large molecules segment is expected to dominate the sterile injectable market due to their targeted approach in treating chronic diseases. These biologics are designed to precisely target specific molecules or pathways, offering more effective treatments with fewer side effects compared to traditional small-molecule drugs. Their complex structures allow for high specificity, reducing off-target effects and improving safety profiles.

Additionally, large-molecule biologics often have immunomodulatory effects, making them especially beneficial for autoimmune diseases. The ability to tailor treatment plans based on individual patient characteristics further enhances their therapeutic outcomes. These advantages are expected to maintain the segment's dominant position in the market throughout the forecast period.

Sterile Injectable Market Geographical Analysis

North America is expected to dominate the sterile injectable market.

North America is expected to maintain its dominant position in the sterile injectable market. North America has a strong regulatory framework that ensures the safety, efficacy, and quality of sterile injectables. Regulatory bodies like the FDA play a crucial role in approving and monitoring the use of sterile injectables, providing a secure environment for both manufacturers and consumers.

Additionally, significant investments from major market players in the region are also expected to contribute to the overall regional market growth. For instance, in February 2024, Simtra BioPharma Solutions announced a $250 million investment to expand its sterile fill/finish manufacturing campus in Bloomington, Indiana, which will include state-of-the-art facilities for high-speed automated syringe and vial filling lines.

Additionally, in June 2021, Jubilant HollisterStier, a subsidiary of Jubilant Pharmova Limited, invested $92 million to increase its sterile injectable manufacturing capacity in Spokane, WA, which will enhance production by 50%.

Alongside these investments, the growing prevalence of chronic diseases and the increasing adoption of sterile injectables are further boosting the market in the region. These factors combined are expected to solidify North America's dominant position in the sterile injectable market throughout the forecast period.

Sterile Injectable Market Major Players

The global market players in the sterile injectable market include Pfizer Inc., Amgen Inc., GSK Plc, Merck & Co., Inc., Novartis AG, Sanofi, Bausch Health Companies Inc., Gilead Sciences, Inc., Hikma Pharmaceuticals PLC, and Cipla Inc., among others.

| Metrics | Details | |

| CAGR | 7.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Molecule Type | Small Molecule, Large Molecule | |

| Drug Type | Monoclonal Antibodies, Insulin, Immunoglobulin, Cytokines, Blood factors, Others | |

| Segments Covered | Application | Oncology, Cardiovascular Diseases, Infectious Diseases, Diabetes, Others |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, and product pipelines, and forecasts upcoming pharmaceutical advancements.

- Type Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient Type delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global sterile injectable market report would provide approximately 45 tables, 46 figures, and 180 pages.

Target Audience 2024

Manufacturers: Pharmaceutical, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

Technology & Innovation: R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

Supply Chain: Distribution and Supply Chain Managers.

Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.