Stem Cell Therapy Market Size

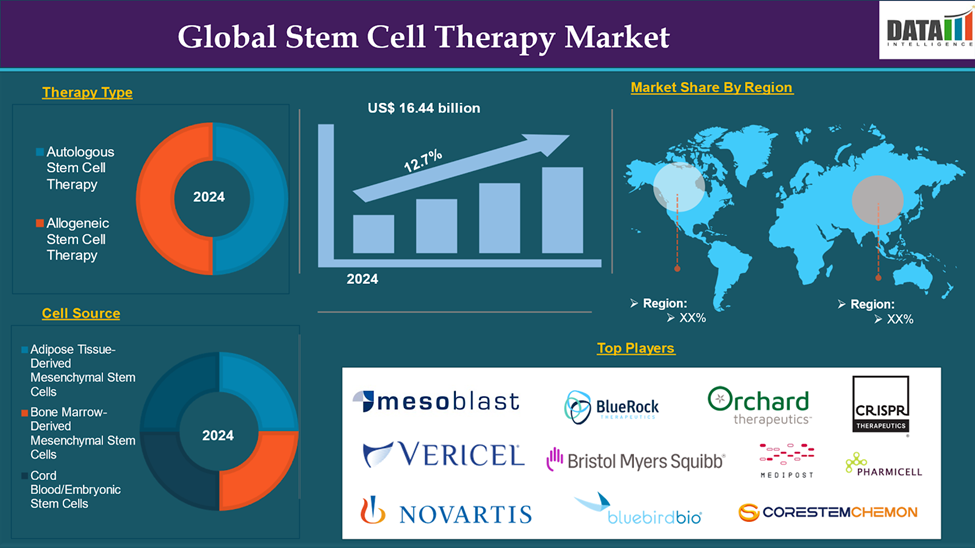

The Global Stem Cell Therapy Market reached US$ 16.44 billion in 2024 and is expected to reach US$ 45.69 billion by 2033, growing at a CAGR of 12.7 % during the forecast period 2025-2033.

In 2022, the Global Stem Cell Therapy Market was at US$ 15.13 Billion, and by 2023, it had reached US$ 15.73 Billion, marking a significant growth in market value.

Stem cell therapy is a medical treatment that employs stem cells to prevent, treat, or manage a variety of diseases and conditions. Stem cells are unique, undifferentiated cells capable of self-renewal and differentiation into specialized cell types, such as muscle, nerve, or blood cells. The primary goal of stem cell therapy is to harness the regenerative properties of these cells to repair or replace damaged tissues, thereby improving health outcomes for patients with conditions that currently have limited treatment options.

Types of stem cells include autologous stem cells which are harvested from the patient's own body and allogeneic stem cells which are sourced from a donor. Stem cell therapy represents a promising frontier in regenerative medicine, aiming to leverage the unique properties of stem cells to address complex health challenges and enhance patient quality of life. As research progresses, this innovative approach holds the potential for significant advancements in treating a variety of conditions that currently lack effective therapies. These factors have driven the global stem cell therapy market expansion.

Executive Summary

For more details on this report – Request for Sample

Stem Cell Therapy Market Dynamics: Drivers & Restraints

Advancements in Regenerative Medicine

Advancements in regenerative medicine are a crucial driver of growth in the global stem cell therapy market, the ongoing evolution and integration of innovative techniques and technologies aimed at enhancing patient outcomes. This field focuses on repairing, replacing, or regenerating damaged tissues and organs, frequently utilizing stem cells due to their unique regenerative properties.

Recent research has significantly improved our understanding of stem cell biology, including their differentiation capabilities and intrinsic repair mechanisms. This knowledge is essential for developing effective therapies that can leverage the regenerative potential of stem cells to treat chronic diseases and injuries that traditional pharmaceuticals cannot adequately address.

Advances in gene editing technologies, such as CRISPR, alongside innovations in tissue engineering, have enhanced the ability to manipulate stem cells for therapeutic purposes. The development of three-dimensional organoids and scaffolds allows for more effective tissue regeneration by mimicking natural tissue environments. These advancements enable personalized medicine approaches, where treatments can be tailored to individual patient needs.

Furthermore, key players in the industry's technological advancements and innovations would drive this global stem cell therapy market growth. For instance, in July 2024, STEMCELL Technologies introduced the CellPore Transfection System, an innovative technology aimed at advancing cell engineering research and the creation of innovative cell therapies for various diseases. This system signifies a major advancement in cellular delivery methods.

Also, in January 2024, Therapeutic Solutions International, Inc. (TSOI) announced the formation of Epilepsy Bio, Inc., a new subsidiary focused on advancing adult stem cell therapies aimed at curing epilepsy. This initiative aligns with TSOI's broader mission to utilize its intellectual property and clinical insights related to cellular and immunological strategies for treating this neurological condition. All these factors demand the global stem cell therapy market.

Moreover, the rising demand for the growth of advancements in technology contributes to the global stem cell therapy market expansion.

High Treatment Costs

High treatment costs are a significant constraint in the global stem cell therapy market, affecting patient access and overall market growth. The financial burden associated with stem cell therapies can discourage both patients and healthcare providers from pursuing these innovative treatments, despite their potential benefits.

According to the DVC, stem data stated that the costs associated with stem cell therapies can vary widely, ranging from $5,000 to USD 50,000, depending on various factors. This variability can deter patients and healthcare providers from pursuing these innovative treatments, despite their potential benefits. Stem cell therapies often involve intricate procedures that require specialized equipment and highly trained personnel.

The costs associated with harvesting, processing, and administering stem cells can be substantial. For instance, basic joint injections may cost up to $1,000, while more complex treatments can exceed $100,000, depending on the specifics of the therapy. Thus, the above factors could be limiting the global stem cell therapy market's potential growth.

Stem Cell Therapy Market Segment Analysis

The global stem cell therapy market is segmented based on therapy type, cell source, therapeutic application, and region.

Therapy Type:

The allogeneic stem cell therapy segment is expected to dominate the global stem cell therapy market share

In 2022, the allogeneic stem cell therapy segment represented one of the fastest-growing segments, reaching US$ 8.49 billion, and further increased to US$ 8.85 billion in 2023.

The allogeneic stem cell therapy segment holds a major portion of the global stem cell therapy market share and is expected to continue to hold a significant portion of the global stem cell therapy market share during the forecast period.

Allogeneic stem cell therapy is a critical segment of the global stem cell therapy market, involving the use of stem cells obtained from a donor to treat various medical conditions, particularly blood disorders and cancers. This approach differs from autologous stem cell therapy, where the patient’s cells are utilized. Allogeneic stem cell therapy relies on stem cells sourced from a donor, which can be either a related individual (such as a sibling) or an unrelated person. The ideal donor typically has a compatible tissue type, defined by human leukocyte antigens (HLAs). If no suitable family member is available, donors can be identified through bone marrow registries.

The allogeneic segment of stem cell therapy is gaining popularity due to its scalability and "off-the-shelf" availability. Unlike autologous therapies that require time-consuming cell collection and processing from individual patients, allogeneic therapies can be prepared in advance from healthy donors and stored for immediate use. This aspect significantly enhances accessibility for patients in urgent need of treatment.

Furthermore, key players in the industry product launches & approvals that would drive this segment growth in the global stem cell therapy market. For instance, in April 2023, the U.S. Food and Drug Administration (FDA) approved Omisirge (generic name: omidubicel-onlv), a modified allogeneic cord blood-based cell therapy designed to expedite the recovery of neutrophils, a critical type of white blood cell essential for fighting infections. This therapy is intended for adults and pediatric patients aged 12 years and older who have blood cancers and are scheduled to undergo umbilical cord blood transplantation following a myeloablative conditioning regimen, which typically includes treatments such as chemotherapy or radiation.

Also, in September 2024, Poseida Therapeutics, Inc. announced that the U.S. Food and Drug Administration (FDA) has granted Regenerative Medicine Advanced Therapy (RMAT) designation to P-BCMA-ALLO1, an investigational allogeneic CAR-T cell therapy based on stem cell memory T cells (TSCM). This therapy is currently in Phase 1/1b clinical development for treating patients with relapsed or refractory multiple myeloma, a challenging type of blood cancer. These factors have solidified the segment's position in the global stem cell therapy market.

Stem Cell Therapy Market Geographical Share

North America is expected to hold a significant position in the global stem cell therapy market share

North America led the Stem Cell Therapy Market in 2022 with a market size of US$ 6.23 billion and expanded further to US$ 6.48 billion in 2023.

North America holds a substantial position in the global stem cell therapy market and is expected to hold most of the market share. The rise in chronic conditions, including cancer, cardiovascular diseases, and musculoskeletal disorders, significantly boosts the demand for stem cell therapies.

The demographic shift towards an older population is contributing to the demand for regenerative medicine. Projections suggest that the number of adults aged 65 and older will increase from approximately 56 million in 2020 to 73 million by 2030, creating a heightened need for treatments targeting age-related health issues. There has been significant investment in stem cell research, exceeding $12 billion in 2023, which is fostering innovation and development in this field. The number of clinical trials has risen by 28% annually, indicating a robust pipeline of new therapies.

Furthermore, advancements in manufacturing and preservation technologies are enhancing the viability and application of stem cell therapies. The Regenerative Medicine Advanced Therapy (RMAT) designation is an important regulatory framework established by the FDA as part of the 21st Century Cures Act. This designation is designed to accelerate the development and review processes for regenerative medicine therapies, including stem cell therapies, that are intended to treat serious or life-threatening conditions.

Moreover, a major number of key players are present, research activities, and product launches & approvals that would drive this global stem cell therapy market. For instance, in November 2024, the University of Texas MD Anderson Cancer Center launched the Institute for Cell Therapy Discovery & Innovation, an initiative focused on advancing impactful cell therapies for a range of conditions, including cancer and autoimmune diseases. This initiative underscores MD Anderson's commitment to leading the field of cell therapy.

Also, in November 2024, GIOSTAR (Global Institute of Stem Cell Therapy and Research) announced that it had received FDA clearance for its Investigational New Drug (IND) application, allowing the company to begin a Phase 2 clinical trial for its innovative stem cell therapy targeting Type II diabetes. This therapy, known as DT2-SCT, utilizes autologous mesenchymal stem cells sourced from the patient's visceral tissues to mitigate the systemic effects of diabetes. Thus, the above factors are consolidating the region's position as a dominant force in the global stem cell therapy market.

Asia Pacific is growing at the fastest pace in the global stem cell therapy market share

Asia-Pacific recorded strong growth, increasing from US$ 3.19 billion in 2022 to US$ 3.35 billion in 2023, supported by rising investments and growing demand in emerging economies like China and India.

Asia Pacific holds the fastest pace in the global stem cell therapy market and is expected to hold most of the market share.

The region's large and aging population contributes to an increased prevalence of age-related diseases such as diabetes, cardiovascular diseases, and neurodegenerative disorders. This demographic shift drives the demand for regenerative therapies that can improve health outcomes in older adults. The growing incidence of chronic diseases, including diabetes, cardiovascular diseases, and Alzheimer’s disease, significantly boosts the demand for stem cell therapies as potential treatments that can alleviate symptoms or reverse disease progression.

There is a rising need for advanced medical therapies, particularly those utilizing stem cells to address complex health issues. This demand is primarily fueled by the necessity for effective treatments for chronic diseases and conditions that currently lack sufficient therapeutic options.

As public understanding of the benefits and potential of stem cell therapies expands, more patients and healthcare providers are recognizing these treatments as viable options for managing various health conditions. The Asia-Pacific region has sophisticated medical facilities and technology that support the development and application of stem cell therapies. Countries like China and India are making substantial investments in healthcare infrastructure, enhancing research and clinical applications.

Furthermore, major players in the industry have key initiatives and awareness programs that would drive this global stem cell therapy market growth. For instance, in July 2024, Bioserve India introduced a new line of advanced stem cell products designed to enhance scientific research and drug development in the Indian market. This launch is part of a comprehensive strategy aimed at fostering progress in regenerative medicine and therapeutic discovery, underscoring the increasing significance of stem cell technology across various medical disciplines.

Also, in June 2024, a new free stem cell treatment program was launched specifically for elderly women, aimed at addressing health issues commonly associated with aging. This initiative reflects a growing recognition of the potential benefits of stem cell therapies in improving health outcomes and quality of life for older populations. Thus, the above factors are consolidating the region's position as the fastest-growing force in the global stem cell therapy market.

Stem Cell Therapy Market Major Players

The major global players in the stem cell therapy market include Mesoblast Ltd, Lineage Cell Therapeutics, Inc., BlueRock Therapeutics LP, Orchard Therapeutics plc., Vericel Corporation., CRISPR Therapeutics AG, Fate Therapeutics, Inc., Novartis AG, Bristol Myers Squibb (Juno Therapeutics, Inc.), Bluebird bio, Inc., MEDIPOST Co., Ltd., ANTEROGEN.CO., LTD., CORESTEMCHEMON Inc., PHARMICELL Co., Ltd, and JCR Pharmaceuticals Co., Ltd. among others.

Key Developments

- In November 2024, Vertex Pharmaceuticals launched a pivotal Phase 1/2 clinical trial for its experimental stem cell-derived islet therapy, named VX-264, targeting patients with Type 1 diabetes (T1D). This trial represents a crucial advancement in the development of innovative therapies that have the potential to revolutionize diabetes treatment.

- In February 2024, Kenai Therapeutics, a biotechnology company based in San Diego, successfully raised $82 million in Series A financing to advance its development of cell therapies targeting Parkinson's disease and other nervous system disorders. This funding round was co-led by Cure Ventures, the Alaska Permanent Fund Corporation, and The Column Group, with additional participation from Euclidean Capital and Saisei Ventures.

| Metrics | Details | |

| CAGR | 12.7% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Therapy Type | Autologous Stem Cell Therapy, Allogeneic Stem Cell Therapy |

| Cell Source | Adipose Tissue-Derived Mesenchymal Stem Cells, Bone Marrow-Derived Mesenchymal Stem Cells, Cord Blood/Embryonic Stem Cells, and Others | |

| Therapeutic Application | Musculoskeletal Disorders, Neurological Disorders, Autoimmune Diseases, Cardiovascular Diseases, Wounds & Surgeries, Inflammatory, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, and product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global stem cell therapy market report delivers a detailed analysis with 60+ key tables, more than 50 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2025

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, and Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, and Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, and Insurance Companies.

- Academic & Research: Academic Institutions.