Slip Additives Market Size

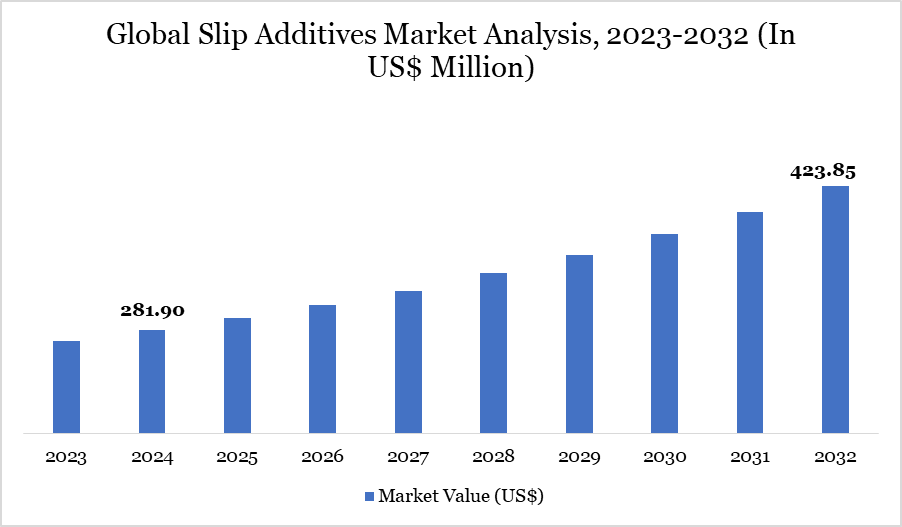

Slip Additives Market size reached US$ 281.90 million in 2024 and is expected to reach US$ 423.85 million by 2032, growing with a CAGR of 5.23% during the forecast period 2025-2032.

Slip Additives Market Overview

The global slip additives market is essential for improving the surface characteristics of polymers and coatings, especially in high-performance industries like packaging, automotive, and consumer products. These additives markedly diminish friction, enhance processability, and avert complications such as sticking or clogging. The incorporation of slip additives in packaging films is a crucial factor for growth, ensuring performance standards are met during handling, shipping, and storage.

The World Packaging Organisation (WPO) reports that the worldwide packaging business attained a valuation of US$ 1.05 trillion in 2024, hence underscoring the significance of effective slip solutions. Between March 2023 and February 2024, export statistics documented 552 shipments by 195 exporters to 231 purchasers, reflecting an 11% year-on-year increase, signifying heightened worldwide demand.

Continuous advancements in non-toxic, high-performance slip additives highlight the market's progression towards ecologically sustainable and performance-oriented solutions, particularly in response to stringent worldwide environmental regulations and rising sustainability demands.

Slip Additives Market Trend

Market developments are increasingly characterized by the intersection of material science advancements and sustainability requirements. The advancement of non-toxic, biodegradable, and high-efficiency slip additives is more prominent, especially in light of legislative measures like the European Union's Plastics Strategy aimed at recyclable packaging by 2030.

Organizations such as the American Chemical Society (ACS) and the Society of Plastics Engineers (SPE) are vigorously advocating for enhancements in additive efficacy and safety. The use of slip additives into lightweight and flexible packaging materials is increasing, driven by the growth of e-commerce and consumer demands for quality and durability.

The demand for consumer items, food and beverages, and electronics is propelling the expansion of slide agents' application breadth. Simultaneously, export statistics confirm a growing impetus in international trade. As markets transition to circular economy concepts, producers are concentrating on manufacturing slip additives that are compatible with recyclable and compostable substrates, fostering a highly adaptable and progressive product development landscape.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details |

| By Type | Fatty Amides, Waxes and Polysiloxanes, Others |

| By Carrier Resin | Low-density polyethylene, Linear low-density polyethylene, High-density polyethylene, Polypropylene, Others |

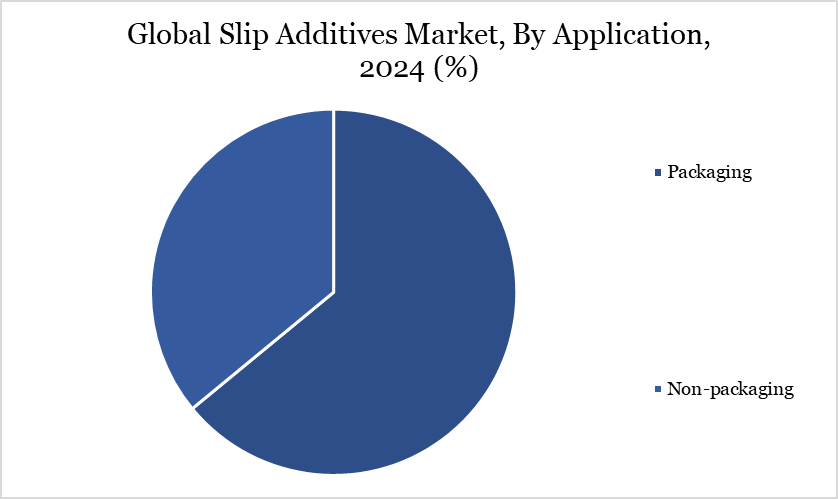

| By Application | Packaging, Non-packaging |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Slip Additives Market Dynamics

Packaging Surge Fuels Market Momentum

The swift rise of the global packaging industry is a principal catalyst for the slip additives market. The Packaging Industry Association of India (PIAI) reports that India's packaging industry is expanding at a remarkable annual rate of 22–25%, indicative of the increasing need for functional packaging materials.

Slip additives are crucial for improving the surface properties of packaging films, reducing friction, and facilitating smooth machinability. This demand is intensified by the global transition to e-commerce, where secure, durable, and efficient packaging is essential for logistics and delivery. Slip additives enhance processing efficiency and product safety, particularly in food and beverage, electronics, and pharmaceutical industries.

As packaging design increasingly prioritizes lightweight and flexible materials, high-performance slip additives are becoming essential. This increasing dependence highlights their strategic importance in facilitating safe, efficient, and sustainable packaging solutions, establishing the packaging industry as a fundamental component of global slip additive demand.

Regulatory Obstacles and Raw Material Instability Impede Growth

The global slip additives market has substantial limitations due to changing regulatory frameworks and fluctuations in raw material costs. Regulatory bodies, like the European Chemicals Agency (ECHA) and the US Environmental Protection Agency (EPA), are enforcing more stringent regulations on plastic additives in response to escalating concerns regarding human health and environmental contamination.

Compliance requires substantial expenditure in research and development to create additives that adhere to safety and sustainability criteria. The International Energy Agency (IEA) concurrently reported increased volatility in crude oil markets attributed to geopolitical turmoil, particularly in the Middle East and Russia.

This has resulted in volatile prices of petrochemical derivatives, essential feedstocks for slip additive manufacturing. These cost variations impact profitability and complicate pricing strategies for producers. Consequently, although demand is strong, market participants face pressure to innovate and establish more stable, sustainable supply chains to alleviate risks and ensure regulatory compliance.

Slip Additives Market Segment Analysis

The global slip additives market is segmented based on type, barrier resin, application and region.

Precision Performance and Sustainability Driving Slip Additives in Packaging Films

The utilization of slip additives in the packaging sector remains the largest and most developing section of the market. With the increasing demand for superior, efficient packaging materials across diverse industries such as electronics, personal care, pharmaceuticals, and food and drinks, slip additives have become essential in film manufacturing processes. These additives improve anti-blocking, anti-scratch, and friction-reducing characteristics, facilitating smoother operations in high-speed packaging processes. Their existence is essential for preserving product aesthetics, safety, and functionality.

As customer tastes evolve towards flexible, lightweight, and environmentally sustainable packaging, the packaging sector necessitates progressively sophisticated slip formulations that conform to material recyclability and performance criteria. The swift urbanization and expansion of e-commerce in emerging nations are transforming packaging demands. Thus, packaging continues to be a primary focus for R&D efforts, as producers strive to comply with changing technical standards and environmental requirements via customized, sustainable slip additive solutions.

Slip Additives Market Geographical Share

Asia-Pacific Capitalizes on Manufacturing Expertise and Cost Effectiveness

The Asia-Pacific region has become the preeminent area in the global slip additives market, supported by strong industrial infrastructure, cheap production expenses, and significant consumption from end-use sectors. In 2020, China produced almost 60 million tons of plastic garbage, of which 16 million tons were recycled, underscoring the nation's considerable plastic processing efforts.

The region's focus on enhancing material efficiency and recyclability has heightened the demand for sophisticated slip additives. India is gaining momentum due to increasing urbanization, an expanding middle class, and advantageous manufacturing initiatives such as "Make in India." The Plastics Export Promotion Council (PLEXCONCIL) observes a sustained increase in India's plastic exports, underscoring the necessity for performance-enhancing additives in packaging applications.

The region's flourishing consumer goods and personal care industries are significant contributions. The increasing domestic demand in China and India, bolstered by robust governmental and industrial initiatives, establishes the Asia-Pacific region as a pivotal growth center for slip additive producers.

Slip Additives Market Major Players

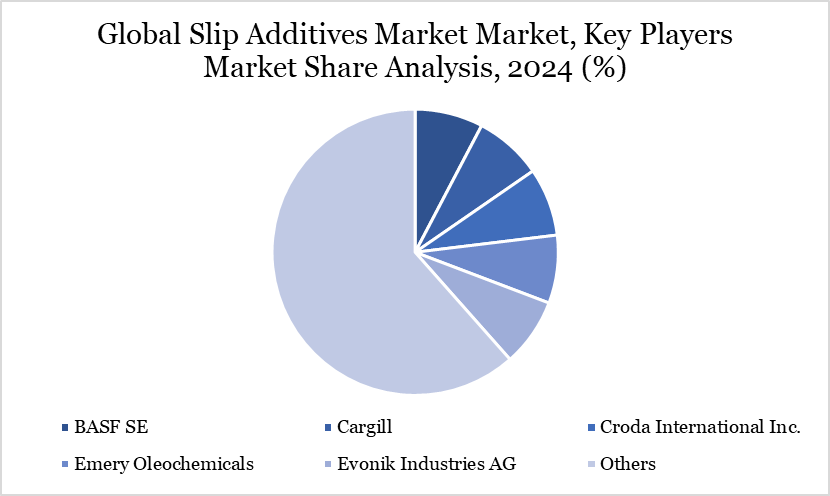

The major global players in the market include BASF SE, Cargill, Croda International Inc., Emery Oleochemicals, Evonik Industries AG, Fine Organics, Honeywell International Inc., Lonza Group, Lubrizol Corporation, PMC Biogenix and among others.

Sustainability Analysis

Sustainability factors are significantly altering the direction of the slip additives industry. Increasing environmental awareness and regulatory and customer pressures are driving manufacturers to adopt eco-friendly formulas. Initiatives like the EU’s Plastics Strategy and EPA sustainability frameworks are promoting the advancement of additives sourced from renewable resources and enhancing recyclability.

This trend is further bolstered by the global transition to circular economy models, wherein materials are required to be designed for reuse, recycling, and little environmental impact. Manufacturers are pioneering in green chemistry by creating biodegradable and non-toxic slip additives that maintain safety and processing efficiency.

Sustainability advantages encompass diminished energy usage in production, decreased material waste owing to enhanced processability, and superior lifespan performance. These initiatives not only satisfy compliance requirements but also establish competitive distinction. Sustainable innovation has transitioned from a regulatory requirement to a strategic necessity influencing the future of the slip additives sector.

Key Developments

In September 2023, Ampacet introduced a new slip additive solution aimed at enhancing flexible packaging applications. This innovative product is designed to provide low and consistent slip performance, ensuring smooth processing and high-quality results in packaging films. One of its key features is its ability to maintain a coefficient of friction (CoF) between 0.20 and 0.25, which is crucial for ensuring optimal surface smoothness and reducing the chances of film sticking during production.

In June 2023, Evonik launched the TEGO Rad 2550, a new slip and defoamer additive designed for radiation-curing inks and coatings. This innovative product is a transparent, low-viscosity liquid that effectively reduces both static and dynamic surface tension in traditional UV- and LED-cured formulations, enhancing performance and application in these advanced curing processes.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies