Overview

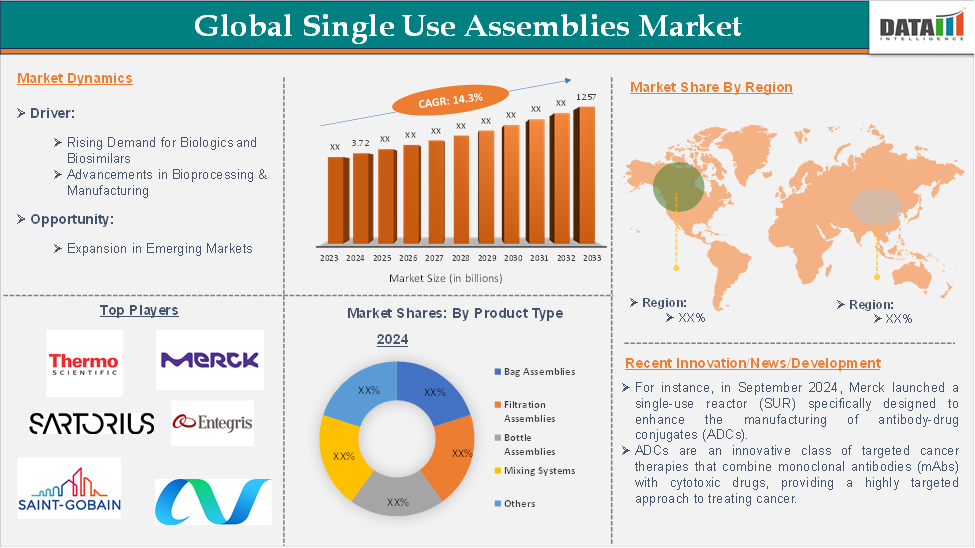

The global single-use assemblies market reached US$ 3.72 billion in 2024 and is expected to reach US$ 12.57 billion by 2033, growing at a CAGR of 14.3% during the forecast period of 2025-2033.

A single-use assembly is a set of components, such as tubing, bags, and fittings, assembled according to a customer's needs, commonly used in biopharmaceutical manufacturing for fluid transfer, mixing, filtration, containment, and final fill. Single-use assemblies offer advantages like reduced cross-contamination risk, increased flexibility, faster changeover, lower capital and operating costs, and reduced environmental impact compared to traditional stainless-steel systems.

Executive Summary

Market Dynamics: Drivers & Restraints

Rising Demand for Biologics and Biosimilars

The growing demand for biologics and biosimilars is a major factor driving the adoption of single-use assemblies (SUA) in biopharmaceutical manufacturing. Biologics are complex, large-molecule drugs derived from living cells and are used to treat conditions like cancer, autoimmune diseases, and rare genetic disorders. Biosimilars are highly similar, lower-cost versions of biologics that help expand patient access to life-saving treatments.

The growing prevalence of chronic diseases (e.g., cancer, diabetes, autoimmune disorders) is fueling demand for biologics-based therapies. Single-use assemblies enable faster, more efficient bioproduction, helping companies scale up production to meet demand. All these factors demand the global single-use assemblies market.

Given the complexity, sterility requirements, and high costs associated with manufacturing biologics and biosimilars, single-use technologies are increasingly preferred over traditional stainless-steel systems to enhance efficiency, flexibility, and cost-effectiveness.

For instance, in April 2024, SaniSure introduced Fill4Sure, a custom single-use filling assembly designed to address major bottlenecks in the fill-finish stage of drug manufacturing. This launch highlights the growing demand for advanced single-use solutions in the global biopharmaceutical industry.

Complex and Stringent Regulatory Approvals

The complex and stringent regulatory approvals are expected to be a significant barrier to the growth of the single-use assemblies market. Regulatory authorities such as the FDA (U.S.), EMA (Europe), and NMPA (China) enforce strict compliance standards for single-use systems used in biopharmaceutical manufacturing.

The FDA requires that single-use systems meet Good Manufacturing Practice (GMP) guidelines, which specify strict protocols for the materials used in production, the processes involved, and the end-product quality. The European Medicines Agency (EMA) also imposes similar GMP standards, ensuring that the biopharmaceutical products manufactured are safe for human consumption.

As China’s regulatory body, NMPA focuses on ensuring the quality and compliance of pharmaceutical products, which includes stringent standards for biocompatibility and sterility of materials used in manufacturing.

Manufacturers are required to carry out thorough validation tests, including biocompatibility, sterility assurance, and extractables & leachables (E&L) testing, to meet these regulatory requirements. These rigorous processes can lead to lengthy approval timelines, increased operational costs, and delays in product launches. Thus, the above factors could be limiting the global single-use assemblies market's potential growth.

Segment Analysis

The global single-use assemblies market is segmented based on product type, solution, application, end-user, and region.

Product Type:

The filtration assemblies segment in product type is expected to dominate the global single-use assemblies market with the highest market share

The filtration assemblies segment is driven by its widespread application in biopharmaceuticals, biotechnology, and research labs. These assemblies play a crucial role in sterile filtration, purification, and contamination control, making them indispensable in drug manufacturing and bioprocessing.

The increasing production of monoclonal antibodies, vaccines, and cell & gene therapies has fueled the demand for single-use filtration systems. Filtration assemblies ensure high sterility and reduced contamination risks, which is critical for biologics manufacturing.

Compared to traditional stainless-steel filtration systems, single-use assemblies reduce setup time, cleaning validation, and cross-contamination risks. They also lead to lower capital expenditure since they do not require extensive maintenance or sterilization. These factors have solidified the segment's position in the global single-use assemblies market.

Geographical Analysis

North America is expected to hold a significant position in the global single-use assemblies market with the highest market share

North America is expected to dominate the single-use assemblies market due to various significant factors. The growing prevalence of chronic diseases, cancer, and genetic disorders in North America fuels the demand for single-use assemblies. As more individuals are diagnosed with conditions such as diabetes, cancer, and hereditary diseases, there is a growing demand for single-use assemblies to help in early diagnosis, risk assessment, and personalized treatment planning. For instance, according to the report by the American Cancer Society in 2025, it is stated that approximately 1 in 8 women in the United States are diagnosed with breast cancer.

Being one of the common cancers among women, the need for single-use assemblies is expected to increase, which is expected to drive the single-use assemblies market. Genetic testing detects inherited genetic mutations for various cancers. Companies in the region are mainly focusing on developing advanced solutions for the diagnosis of genetic diseases to help in identifying the mutations in the genes and help in developing personalized medicine.

For instance, in March 2024, Nucleus Genomics, a next-generation single-use assemblies and analysis company, launched its DNA analysis product aimed at making the benefits of personalized medicine accessible to everyone. This product is designed to empower individuals with the knowledge of their genetic makeup, helping them make informed decisions about their health. Thus, various factors are contributing to the region’s dominant position in the global single-use assemblies market.

Competitive Landscape

The major global players in the single-use assemblies market include Thermo Fisher Scientific, Inc., Merck KgaA, Sartorius AG, Saint-Gobain, Avantor, Entegris, Parker Hannifin Corp, Intellitech, Inc., AdvantaPure, and BioPulse Solutions, among others.

Key Developments

- In September 2024, Merck launched a single-use reactor (SUR) specifically designed to enhance the manufacturing of antibody-drug conjugates (ADCs). ADCs are an innovative class of targeted cancer therapies that combine monoclonal antibodies (mAbs) with cytotoxic drugs, providing a highly targeted approach to treating cancer. This allows ADCs to precisely target cancer cells while minimizing damage to healthy cells, making them a promising treatment option for many types of cancer.

| Metrics | Details | |

| CAGR | 14.3% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Bag Assemblies, Filtration Assemblies, Bottle Assemblies, Mixing Systems, Others |

| Solution | Standard Solution, Customized Solution, Others | |

| Application | Purification and Filtration, Cell culture, and Mixing Storage, Sampling, Formulation, and Fill Finish | |

| End-User | Pharmaceutical and Biopharmaceutical Companies, Academic and Research Institutes, CROs and CMOs, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials and product pipelines and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzed product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: This covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyze competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global single-use assemblies market report delivers a detailed analysis with 60+ key tables, more than 50 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions

Suggestions for Related Report

- Global Integrated Microwave Assembly Market

- Global Assembly Adhesives Market

- Global Laboratory Filtration Market

For more medical-device-related reports, please click here