Regenerative Medicine Market Size

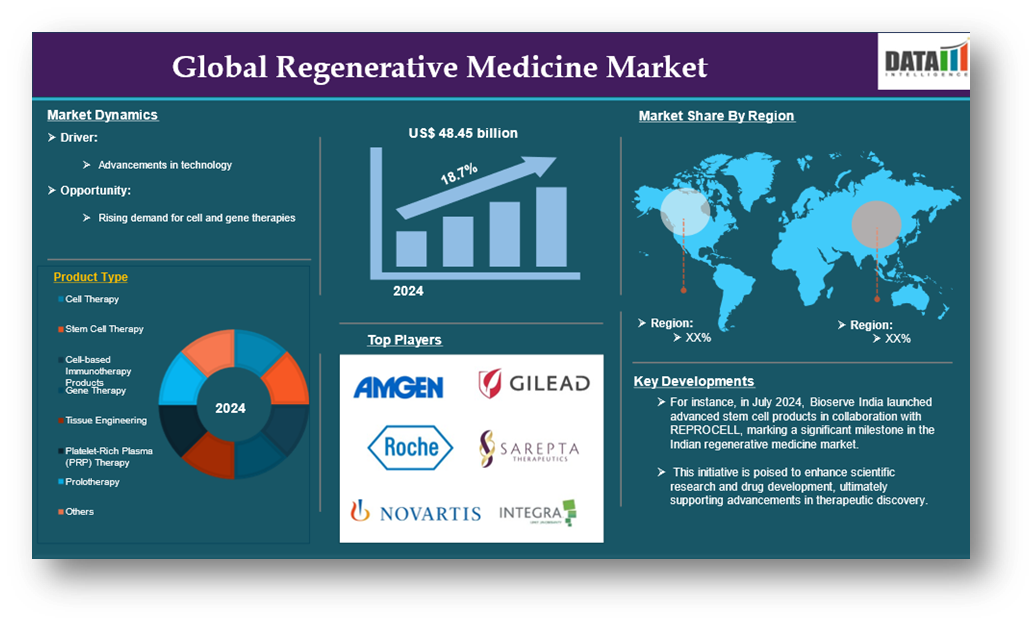

The global regenerative medicine market reached US$ 48.45 billion in 2024 and is expected to reach US$ 403.86 billion by 2032, growing at a CAGR of 27.3 % during the forecast period 2025-2033.

Regenerative medicine is defined as the process of replacing or regenerating human cells, tissues, or organs to restore or establish normal function. Its goal is to heal or replace damaged tissues and organs rather than merely managing symptoms with medications or procedures. This field encompasses a range of approaches that leverage the body's natural healing mechanisms.

This innovative field utilizes various tools and techniques, including tissue engineering, cellular therapies, and the development of medical devices and artificial organs. Techniques and tools used in regenerative medicine are tissue engineering, cellular therapies, medical devices, and artificial organs. By combining these approaches, regenerative medicine can amplify the body’s natural healing processes where they are most needed or assume the function of permanently damaged organs. Researchers are exploring ways to stimulate the regeneration of tissues that typically do not heal well on their own.

The field brings together experts from diverse disciplines such as biology, chemistry, computer science, engineering, genetics, medicine, and robotics. This collaboration is essential for developing comprehensive solutions to some of the most challenging medical problems faced by humanity. These factors have driven the global regenerative medicine market expansion.

Regenerative Medicine Market Executive Summary

Market Growth: Drivers & Restraints

Advancements in Technology

Advancements in technology are a crucial driver of growth in the global regenerative medicine market, significantly influencing its evolution and expanding its capabilities. This sector is rapidly progressing, propelled by innovations that enhance the effectiveness and application of regenerative therapies.

Innovations in stem cell research, particularly the development of induced pluripotent stem cells (iPSCs), have broadened the potential applications of regenerative medicine. iPSCs can be generated from adult cells and possess the ability to differentiate into various cell types, making them invaluable for therapeutic purposes.

Technologies such as CRISPR/Cas9 have transformed gene therapy by enabling precise modifications to DNA. This capability allows for targeted treatments for genetic disorders and enhances the effectiveness of regenerative therapies. The incorporation of AI in drug development and clinical trials streamlines processes, enhances data analysis, and improves patient outcomes. Collaborations between tech companies and biotech firms aim to shorten the time-to-market for new therapies while maximizing their effectiveness.

Furthermore, key player strategies such as partnerships & collaborations, and innovative launches would propel this global regenerative medicine market growth. For instance, in October 2024, the University of Southern California (USC) announced a strategic collaboration with StemCardia, a biotechnology company founded by Dr. Charles Murry, to advance therapies focused on heart regeneration. This partnership aims to tackle the critical need for innovative treatments for heart failure, which is the leading cause of death worldwide and poses a significant burden on healthcare systems.

Also, in August 2024, Meso Numismatics, Inc. ("Meso Numismatics" or the "Company") is in the process of rebranding itself as Regenerative Medical Technology Group. The Company is excited to announce the launch of an innovative peptide line by Global Stem Cells Group (GSCG). This new line, called Cellgenic, is part of GSCG's ongoing efforts to promote and distribute advanced products and equipment specifically designed for physicians in the field of regenerative medicine. Through this initiative, Cellgenic aims to provide healthcare professionals with cutting-edge solutions that enhance patient care and treatment outcomes.

Similarly, in April 2023, Mount Sinai launched the Institute for Regenerative Medicine, an innovative initiative designed to enhance research and treatment options for a variety of diseases, including leukemia, Alzheimer’s disease, breast cancer, and respiratory disorders. This institute aims to integrate and coordinate research efforts across various departments within the Icahn School of Medicine at Mount Sinai, establishing the institution as a leader in regenerative medicine. All these factors demand the global regenerative medicine market.

Moreover, the rising demand for cell and gene therapies contributes to the global regenerative medicine market expansion.

High Treatment Costs

High treatment costs are a significant restraint in the global regenerative medicine market, impacting patient access and overall market growth.

The development of regenerative medicine therapies requires extensive research, clinical trials, and regulatory compliance, all of which involve substantial financial investment. These high R&D costs are often passed on to patients, resulting in expensive treatments. As per DVC stem data stated that the cost of stem cell therapy can vary significantly based on several factors, including the type of stem cells used, the number of cells administered, the quality of those cells, the location of the treatment facility, and the source of the stem cells. On average, patients can expect to pay between $5,000 and $50,000 for stem cell therapy.

A single injection typically costs around $4,000. If additional joints or injuries are treated during the same session using Platelet Rich Plasma (PRP), these can be addressed for as little as $800 each. In 2023, the most common price for stem cell therapy utilizing an expanded cell product ranged between $15,000 and $30,000. This reflects the growing acceptance and demand for these therapies in clinical practice.

Producing regenerative therapies, particularly those involving stem cells or complex biological materials, is intricate and costly. Advanced manufacturing techniques, stringent quality control measures, and the need for specialized facilities contribute to the overall expenses. Thus, the above factors could be limiting the global regenerative medicine market's potential growth.

Regenerative Medicine Market Segment Analysis

The global regenerative medicine market is segmented based on product type, application, and region.

Product Type:

The cell therapy segment is expected to dominate the global regenerative medicine market share

The cell therapy segment grew from US$ 15.16 billion in 2022 to US$ 17.14 billion in 2023

The cell therapy segment holds a major portion of the global regenerative medicine market share and is expected to continue to hold a significant portion of the global regenerative medicine market share during the forecast period.

The rising incidence of long-term conditions such as cancer, autoimmune diseases, and cardiovascular ailments has led to greater adoption of cell therapies. According to the CDC, about 60% of adults in the U.S. have at least one chronic condition, highlighting the demand for effective treatment options.

Innovations in cell therapy, including stem cell therapy and cell-based immunotherapies, are enhancing treatment efficacy. These therapies involve replacing damaged tissues with healthy cells or stimulating tissue repair and regeneration. Cell therapies often utilize autologous cells (derived from the patient), which minimizes the risk of rejection and side effects while providing tailored treatment options based on individual patient needs.

Significant investments in R&D for cell therapies are leading to discoveries and improved treatment methodologies. Funding initiatives aimed at developing cell-based immunotherapies are gaining traction, further propelling market growth.

Furthermore, key players in the industry key initiatives, and expansion would propel this segment's growth in the the global regenerative medicine market. For instance, in December 2024, Sumitomo Chemical and Sumitomo Pharma announced the formation of a joint venture called RACTHERA Co., Ltd., aimed at advancing research and development in regenerative medicine and cell therapy. This initiative represents a strategic effort to enhance the capabilities of both companies within the rapidly expanding market for regenerative therapies.

Also, in October 2023, Bayer AG inaugurated its first Cell Therapy launch Facility in Berkeley, California, marking a significant advancement in the company's ability to produce cell therapies on a global scale. This state-of-the-art facility represents a substantial investment of $250 million and covers an area of 100,000 square feet. It is designed to supply essential materials for late-stage clinical trials and the potential commercial launch of bemdaneprocel (BRT-DA01), an investigational cell therapy currently under evaluation for treating Parkinson’s disease. These factors have solidified the segment's position in the global regenerative medicine market.

Top of Form

Regenerative Medicine Market Geographical Analysis

North America is expected to hold a significant position in the global regenerative medicine market share

North America led the Global regenerative medicine Market in 2022 with a market size of US$ 14.49 billion and reached further to US$ 16.50 billion in 2023.

The increasing incidence of long-term conditions such as cancer, cardiovascular diseases, and autoimmune disorders has led to a greater demand for effective regenerative therapies. According to the CDC, around 60% of adults in the U.S. have at least one chronic condition, emphasizing the need for innovative treatment options.

North America is home to numerous research institutions and biotechnology companies that are at the forefront of regenerative medicine. Significant R&D investments are fueling advancements in cell therapies, gene therapies, and tissue engineering. The presence of supportive regulatory frameworks allows for faster approval processes for new therapies. The number of clinical trials has surged, with 394 trials reported during the third quarter of 2023, demonstrating active engagement from key players in developing and testing new regenerative treatments.

Major pharmaceutical and biotech companies are heavily investing in regenerative medicine initiatives within North America. For instance, Pfizer's recent investment in cell therapy development reflects growing interest from industry leaders to expand their capabilities in this area. North America benefits from a well-established healthcare system with advanced technological frameworks that facilitate rapid diagnosis and treatment of chronic diseases. High healthcare spending further supports the adoption of innovative therapies.

The trend towards personalized medicine, where treatments are tailored to individual patient needs, is particularly strong in North America. Cell therapies often utilize autologous cells (derived from the patient), which reduces the risk of rejection and improves treatment outcomes. Furthermore, key players in the industry product launches and approvals that would drive this regenerative medicine market growth.

For instance, in September 2024, Poseida Therapeutics, Inc. announced that the U.S. Food and Drug Administration (FDA) has granted Regenerative Medicine Advanced Therapy (RMAT) designation to its investigational therapy, P-BCMA-ALLO1. This allogeneic CAR-T cell treatment, which utilizes stem cell memory T cells (TSCM), is currently undergoing Phase 1/1b clinical development aimed at treating patients with relapsed/refractory multiple myeloma, a challenging form of blood cancer.

Thus, the above factors are consolidating the region's position as a dominant force in the global regenerative medicine market.

Asia Pacific is growing at the fastest pace in the global regenerative medicine market share

The prevalence of chronic conditions such as diabetes, cardiovascular diseases, and neurodegenerative disorders is on the rise in the Asia Pacific region. This trend increases the demand for innovative treatments that regenerative medicine can provide. The Asia Pacific region has seen a surge in healthcare expenditure, driven by both government initiatives and private investments. Countries like China, India, and Japan are significantly increasing their healthcare budgets to improve access to advanced medical technologies, including regenerative medicine.

The region is home to a vast and growing patient population that is increasingly seeking affordable and effective treatment options for chronic diseases, injuries, and degenerative conditions. This demand fuels the adoption of regenerative therapies. Many governments in the Asia Pacific are actively promoting regenerative medicine through favorable policies and funding for research and development. For instance, Japan's Regenerative Medicine Act encourages the clinical development of cell-based therapies, while South Korea's legislation supports advanced regenerative medical products.

Rapid advancements in stem cell technology, gene therapy, and tissue engineering are driving innovation in the field. Companies are increasingly investing in R&D to develop new therapies that can effectively address various health issues.

Furthermore, key players in the industry product launches that would drive this global regenerative medicine market growth. For instance, in July 2024, Bioserve India launched its advanced stem cell products, representing a significant advancement in the Indian regenerative medicine sector. This initiative, developed in collaboration with REPROCELL, aims to drive innovation in scientific research and drug development, thereby enhancing progress in regenerative medicine and therapeutic discovery within the Indian market.

Also, in September 2024, Aurion Biotech announced the commercial launch of Vyznova (generic name: neltependocel) in Japan, marking a significant advancement in the treatment of bullous keratopathy of the cornea. This therapy is recognized as the first approved cell therapy specifically designed for corneal endothelial diseases and has successfully received both regulatory and reimbursement approvals in Japan.

Thus, the above factors are consolidating the region's position as the fastest-growing force in the global regenerative medicine market.

Regenerative Medicine Market Competitive Landscape

The major global players in the regenerative medicine market include Amgen Inc., Novartis AG, Gilead Sciences, Inc. (Kite Pharma, Inc.), F. Hoffmann-La Roche Ltd, Integra LifeSciences Corporation., Astellas Pharma Inc., Bayer AG, Pfizer Inc., Vericel Corporation, MIMEDX Group, Inc., Biogen Inc., Sarepta Therapeutics, Inc., Smith+Nephew, and MEDIPOST among others.

Key Developments

- In January 2025, CellSave Arabia announced the launch of adult stem cell banking services, expanding its offerings beyond its established newborn stem cell preservation. As a leader in stem cell storage, CellSave Arabia is dedicated to providing a forward-thinking approach to personal health by safeguarding individuals' well-being through advanced stem cell preservation techniques.

| Metrics | Details | |

| CAGR | 27.3% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Cell Therapy, Stem Cell Therapy, Cell-based Immunotherapy Products, Gene Therapy, Tissue Engineering, Platelet-Rich Plasma (PRP) Therapy, Prolotherapy, Others |

| Application | Oncology, Cardiovascular Diseases, Neurology, Ophthalmology, Immunology & Inflammation, Dermatology & Wound Care, Musculoskeletal Disorders | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, and product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global regenerative medicine market report delivers a detailed analysis with 60+ key tables, more than 50 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2023

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.