Polymer Emulsions Market Size

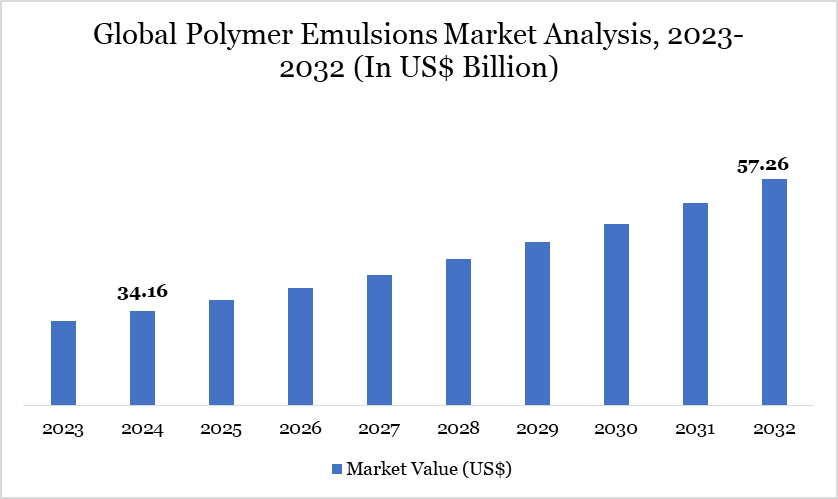

Polymer Emulsions Market size reached US$ 34.16 billion in 2024 and is expected to reach US$ 57.26 billion by 2032, growing with a CAGR of 6.67% during the forecast period 2025-2032.

The global polymer emulsions market is experiencing significant growth, driven by substantial demand from the construction, automotive and textile sectors. The emulsions, created by dispersing polymer particles in a water-based media, are increasingly preferred for their non-toxic, biodegradable and environmentally acceptable characteristics. The construction sector, contributing 5% to GDP in wealthy nations and 8% in developing ones, serves as a vital economic engine.

Construction Perspectives and Oxford Economics project that worldwide construction output would increase by 85% to US$ 15.5 trillion by 2030, primarily driven by China, India and the US. The increase, along with swift urbanization in developing countries, is amplifying the demand for adhesives, sealants and coatings derived from polymer emulsions. The extensive application of the material in textiles, coatings and hygiene products highlights its adaptability, positioning it as a crucial facilitator for industrial performance and sustainability objectives.

Polymer Emulsions Market Trend

The polymer emulsions market is experiencing a transitional period, driven by sustainability, technological advancements and regulatory adherence. A significant trend is the transition from solvent-based to water-based polymer emulsions in applications including paints, adhesives and coatings, propelled by increasing consumer demand for environmentally acceptable solutions and strict VOC (Volatile Organic Compound) laws in North America and Europe.

Moreover, producers are developing high-performance emulsions that provide superior durability, adaptability and cost-efficiency. Nanotechnology is increasingly utilized to enhance emulsion compositions, hence enhancing performance across several end-user sectors. Concurrently, regional expansion is influencing market dynamics, as investments are directed towards rising economies and local manufacturing capacities are developed.

The focus on minimizing carbon footprints has resulted in considerable initiatives to create bio-based emulsifiers, crosslinkers and chain transfer agents. Despite the constraints of radical polymerization, the exploration of biobased monomers, particularly itaconates and myrcene, has significant future possibilities. These developments are collectively directing the market towards more sustainable and intelligent solutions.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details |

| By Product | Acrylic, Styrene Butadiene Latex, Vinyl Acetate Polymers, Polyurethane Dispersions, Others |

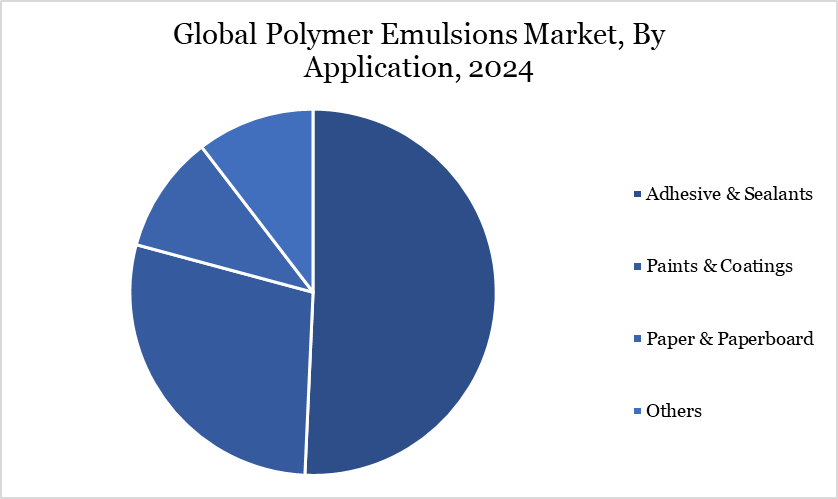

| By Application | Adhesive & Sealants, Paints & Coatings, Paper & Paperboard, Others |

| By End-user | Building & Construction, Chemicals, Automotive, Textile & Coatings, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Polymer Emulsions Market Dynamics

Construction and Textile Boom Powering Emulsion Polymer Demand

A primary driver of the polymer emulsions market is the global construction surge, especially in developing nations. According to Euromonitor International, the Asia-Pacific region is projected to account for 40% of worldwide building activity by 2030. Countries such as China, India and Indonesia are undergoing swift urbanization, requiring the establishment of permanent housing and infrastructure development.

Emulsion polymers, widely utilized in adhesives and sealants for carpeting, wallpapers and insulation systems, are essential for facilitating this growth. Furthermore, demand from the textile and nonwoven industries is growing. These polymers are preferred in textile coatings, printing and finishing due to their durability and color retention.

In the nonwoven industry, they function as binders in hygiene, medicinal and filtering applications. In the automotive industry, escalating investment in China is enhancing the utilization of polymer emulsions in paints and coatings that guarantee maximum adhesion and filler compatibility. Consequently, industrial expansion and population growth are jointly propelling this market's robust upward trend.

Dependence on Petroleum-Derived Inputs Restricts Complete Sustainability

Emulsion polymerization employs water as a continuous phase, with roughly 50%–55% of its composition generated from petroleum-based basic materials. This significant dependence on fossil-based inputs undermines the environmental advantages advocated by emulsion technology.

The shift to really sustainable solutions is obstructed by the scarcity of radically polymerizable biobased monomers, which are crucial for chain-growth polymerization processes. Despite the potential of certain biobased chemicals, such acrylic acid derivatives and itaconates, their manufacturing is still constrained and expensive.

Moreover, the economic feasibility of entirely biobased emulsifiers and crosslinkers continues to fall short of consumer and regulatory anticipations. The chemical intricacy of biomass-derived polymers poses further challenges, necessitating more sophisticated synthesis and copolymerization methods. Consequently, although the market is progressing towards sustainability, the existing reliance on non-renewable feedstock is a substantial barrier to realizing entirely green manufacturing in the polymer emulsion industry.

Polymer Emulsions Market Segment Analysis

The global polymer emulsions market is segmented based on product, application, end-user and region.

Eco-Driven Innovation Elevates Paints and Coatings in Polymer Emulsions Market

The paints and coatings sector constitutes a significant part of the polymer emulsion market, principally propelled by the extensive utilization of water-based polymer emulsions. The industry's transition to environmentally friendly solutions has markedly expedited the utilization of polymer emulsions, especially those derived from acrylic, vinyl acetate and styrene-butadiene.

These emulsions provide enhanced environmental compatibility by facilitating the formulation of low-VOC paints, by rigorous green building standards and regulatory requirements. Their minimal toxicity, along with superior performance characteristics, renders them an optimal selection for both decorative and industrial uses.

Ongoing progress in polymer dispersion technology and latex formulas has improved the longevity, weather resistance and visual attractiveness of these coatings. These advancements let manufacturers to meet changing consumer needs, such as high-gloss coatings and durable surface protection. Consequently, the paints and coatings industry continue to be the predominant consumer of polymer emulsions, underscoring its pivotal position in influencing the market's future direction.

Polymer Emulsions Market Geographical Share

Textile and Construction Industries Foster Asia-Pacific Regional Supremacy

Asia-Pacific is becoming the preeminent center in the global polymer emulsions market, supported by its flourishing textile, construction and automotive industries. The region's nonwoven and textile sectors largely employ polymer emulsions for applications such as textile finishing, printing and coatings, due to the emulsions' impermeability, durability and color retention.

Polymer emulsion binders play a crucial role in the manufacture of hygiene products and medical fabrics. The construction sector, characterized by growing urbanization and infrastructure initiatives, is a significant catalyst for regional demand. By 2030, the Asia-Pacific region is projected to represent 40% of the worldwide construction output, indicative of substantial investments in housing, transportation and industrial infrastructure.

The expansion of the automobile sector in China is markedly increasing the need for emulsion-based paints and coatings. Moreover, the burgeoning middle class and increasing consumer demand for sustainable and high-performance products are bolstering market penetration. Consequently, the Asia-Pacific region is crucial in influencing the worldwide direction of polymer emulsions.

Sustainability Analysis

The polymer emulsions market is progressively conforming to global sustainability objectives, emphasizing the reduction of environmental impact and the improvement of biodegradability. Emulsion polymerization, owing to its aqueous composition, presents a more sustainable option compared to solvent-based methods. Efforts are intensifying to diminish dependence on petroleum-derived ingredients, which presently constitute more than fifty percent of typical formulations.

Recent progress is occurring in substituting traditional inputs with renewable biobased alternatives, in accordance with the "12 principles of green chemistry and engineering." Innovations encompass the utilization of biobased surfactants, emulsifiers and novel monomers sourced from biomass, including acrylic acid, methacrylic acid and itaconate molecules. These advancements facilitate step-growth polymerization techniques, although investigations persist to address obstacles in radical polymerization compatibility.

The drive for eco-friendly materials is bolstered by customer demand and regulatory requirements, promoting investment in sustainable production methods. The move to totally sustainable polymer emulsions, although in its nascent phase, is gaining traction and possesses considerable long-term potential.

Polymer Emulsions Market Major Players

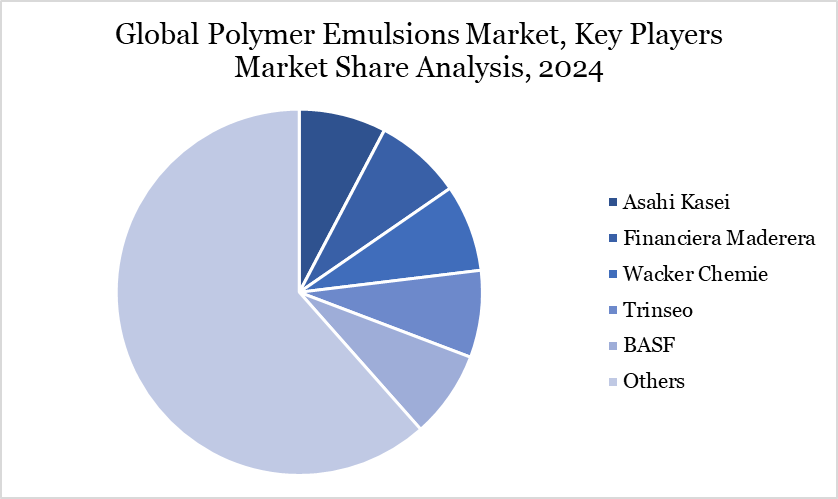

The major global players in the market include Asahi Kasei, Financiera Maderera, Wacker Chemie, Trinseo, BASF, Celanese, OMillionova Solutions, Arkema, DIC and BATF Industrial.

Key Developments

In October 2023, Asahi Kasei declared intentions to invest in new coating machinery for its HiporeTM lithium-ion battery separators. The coating lines will be established in the company's existing facilities in the US, Japan and South Korea, with operations commencing in the initial segment of fiscal 2026.

In June 2023, Avient Corporation and BASF partnered to launch Color grades of Ultrason high-performance polymers. Color grades of Ultrason high-performance polymers were launched globally through a partnership between Avient Corporation and BASF.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies