Market Size

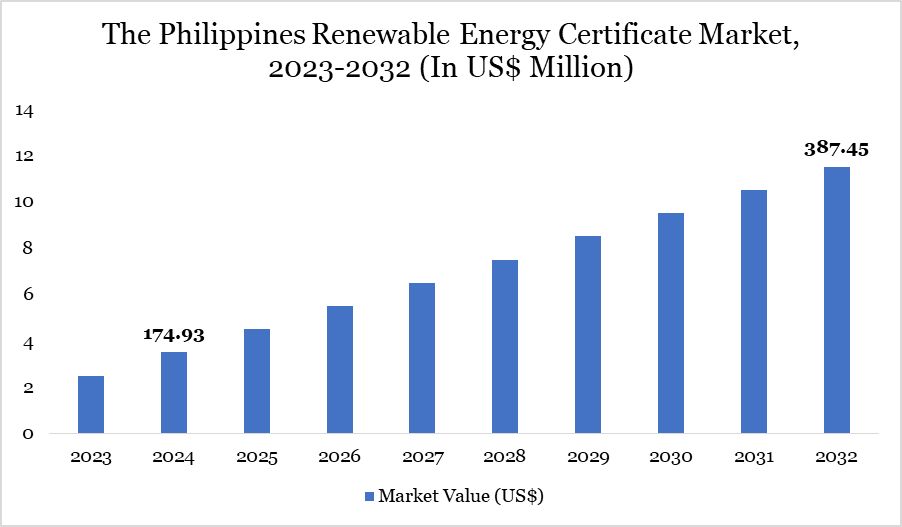

The Philippines renewable energy certificate market reached US$ 174.93 million in 2024 and is expected to reach US$ 387.45 million by 2032, growing with a CAGR of 9.8% during the forecast period 2025-2032.

The Philippines is gaining traction in the renewable energy certificate (REC) market due to its strong commitment to renewable energy development and government-backed policies promoting clean energy. The country has abundant renewable energy resources, including solar, wind, hydro and geothermal power, making it a key player in the region.

As of December 26, 2024, the Philippines has granted green lane access to 176 projects, with 141 renewable energy projects valued at US$ 70 billion (PHP 4.13 trillion). In December alone, six projects were approved, including the US$ 217.21 million (PHP 12.72 billion) Laguna Wind Project in Calabarzon, according to the Board of Investments. This type of investment directly contributes to REC availability, enabling more businesses to purchase RECs to meet Renewable Portfolio Standards (RPS) compliance and sustainability targets.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details | |

| By Type | I-REC, TIGR | |

| By Energy Source | Solar RECs, Wind RECs, Hydro RECs, Biomass, Geothermal | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Increasing Corporate Demand for Clean Energy

A key driver for the Philippines renewable energy certificate (REC) market is the government's Renewable Portfolio Standards (RPS) and corporate sustainability commitments. The Philippine Department of Energy (DOE) has set an ambitious 35% renewable energy target by 2030 and 50% by 2040, which mandates electricity suppliers to source a portion of their energy from renewable sources. This policy drives the demand for RECs as a compliance mechanism, encouraging businesses and utilities to invest in clean energy.

The Independent Electricity Market Operator of the Philippines (IEMOP) expects a surge in Renewable Energy Certificate (REC) trading in 2025, driven by new renewable energy facilities. According to IEMOP’s assistant manager Chris Warren Manalo, the government's ongoing Green Energy Auction (GEA) will boost REC transactions.

Lack of a Clear Regulatory Framework

The growth of the Philippines' renewable energy certificate (REC) market is hindered by the lack of a well-defined regulatory framework and enforcement mechanisms. While the country has introduced RECs as part of its Renewable Energy Act, ambiguities in compliance requirements, trading mechanisms, and certification processes create uncertainty for businesses and investors.

The absence of a centralized and fully operational REC trading platform further limits market participation, making it difficult for companies to seamlessly buy, sell and track RECs. This regulatory uncertainty discourages foreign and domestic investments in the REC market, as stakeholders remain unclear about pricing structures, penalties for non-compliance, and long-term policy stability.

Market Segment Analysis

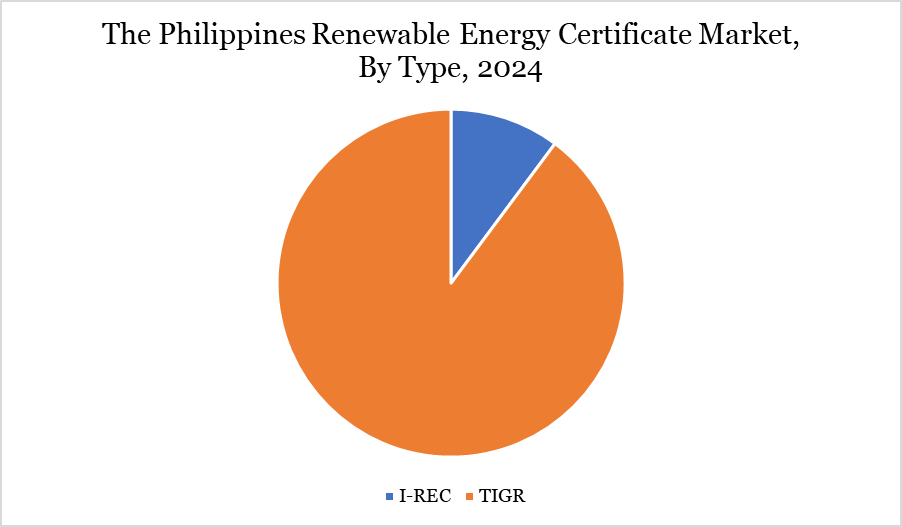

The Philippines renewable energy certificate market is segmented based on type and energy source.

I-RECs are Expected to Drive the Segment Growth.

The I-REC Standard provides a robust framework for issuing, trading and redeeming renewable energy certificates internationally. The system has gained traction as countries seek to meet their renewable energy targets and corporations aim to fulfill sustainability commitments. Multinational corporations (MNCs) operating in the Philippines, particularly in sectors like manufacturing, technology and retail, are actively seeking renewable energy solutions to align with their ESG (Environmental, Social and Governance) targets.

For instance, companies like Coca-Cola Beverages Philippines and Nestlé Philippines have committed to using 100% renewable energy in their operations. Since the direct installation of renewable energy infrastructure may not always be feasible, these companies are turning to I-RECs to meet their sustainability goals. The availability of I-RECs provides a flexible mechanism for businesses to claim renewable energy consumption, thereby driving demand in the market.

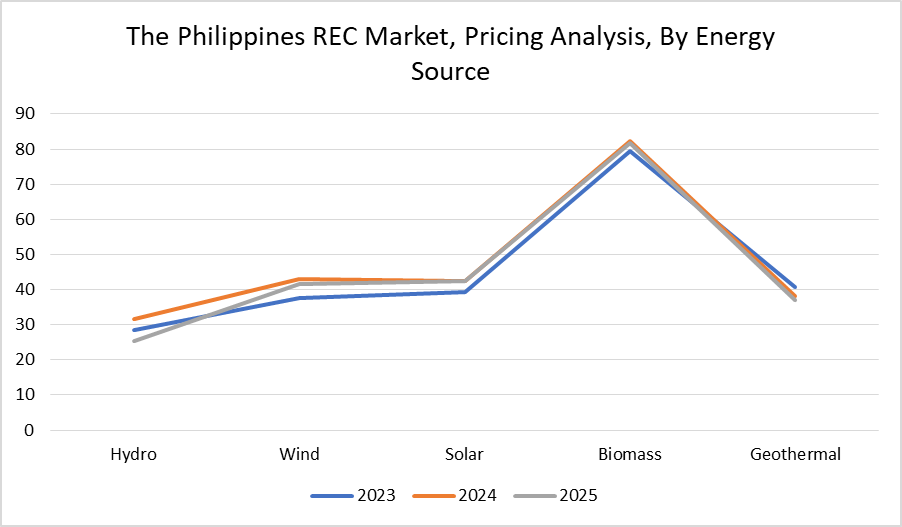

Pricing Analysis

The pricing of renewable energy certificates (RECs) in the Philippines is influenced by multiple factors, including supply-demand dynamics, renewable energy policies, corporate sustainability commitments and global REC price trends. The I-REC system is the primary certification mechanism in the country, with prices varying based on the type of renewable energy source, project location and market demand.

Biomass RECs often trade at a premium due to higher corporate demand for these sources, typically range between US$ 79.41 per MWh in 2023 to US$ 81.72 per MWh in 2025. The Green Energy Option Program (GEOP) and increasing corporate adoption of ESG-driven procurement strategies are key drivers pushing demand, which could lead to further price increases.

However, pricing remains relatively competitive compared to other markets, as the Philippines is expanding its renewable energy capacity through government incentives and private sector investments.

Major Players

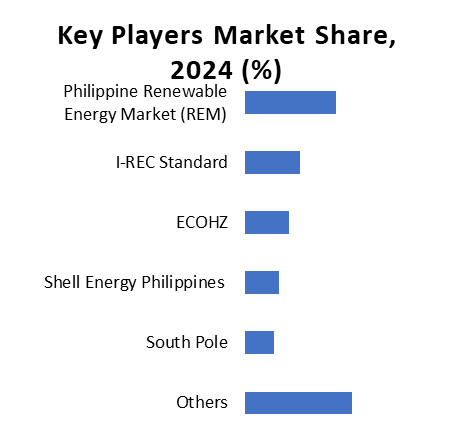

The major players in the market include the Philippine Renewable Energy Market (REM), I-REC Standard, ECOHZ, Shell Energy Philippines and South Pole.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies