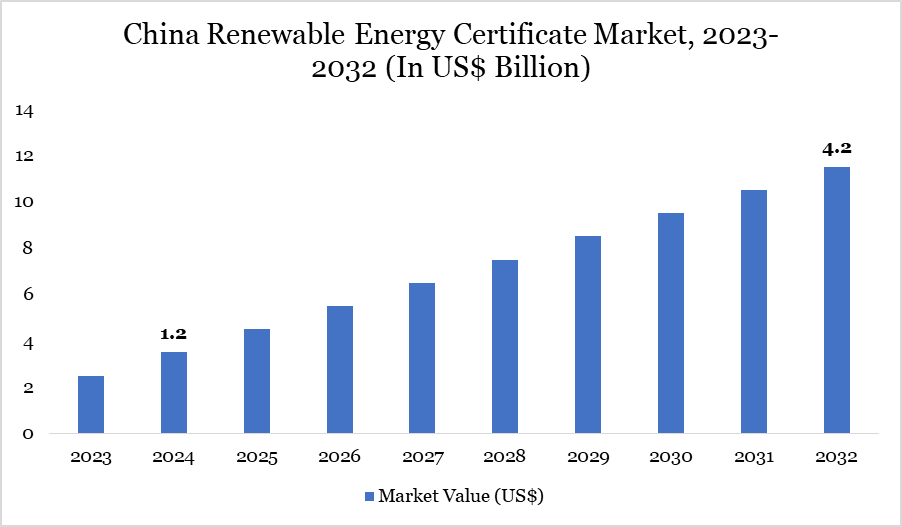

Market Size

China renewable energy certificate market reached US$ 1.2 billion in 2024 and is expected to reach US$ 4.2 billion by 2032, growing with a CAGR of 14.2% during the forecast period 2025-2032.

China has been the world’s largest and fastest-growing producer of renewable energy for over a decade, generating more than three times the renewable electricity of the US. It holds a significant share in the renewable energy certificate (REC) market due to its massive renewable energy capacity, government policies and commitment to carbon neutrality by 2060. As the world's largest producer of solar and wind energy, China generates a substantial volume of RECs.

For instance, according to the International Trade Administration, China maintained its leadership in renewable energy capacity additions, installing nearly 350 GW in 2023—accounting for two-thirds of global deployment. The country’s 14th Five-Year Plan for Renewable Energy, released in 2022, sets ambitious targets for renewable energy use, expected to drive significant investment and further accelerate the transition to clean energy in the coming years.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details | |

| By Type | I-REC, GEC | |

| By Energy Source | Solar RECs, Wind RECs, Hydro RECs, Biomass, Geothermal | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Growing Energy Transition

The country has experienced a significant transformation in its energy landscape over the past decade, marked by a robust shift towards renewable energy sources. This transition is not only altering the region's energy mix but also propelling the development and adoption of Renewable Energy Certificates (RECs) as mechanisms to certify and trade renewable energy generation.

China is set to lead the global surge in renewable energy, contributing nearly 60% of the world's new renewable energy capacity by 2030. This rapid expansion is fueled by significant policy support and declining costs, particularly in solar energy, which is expected to represent 80% of the new renewable capacity. The growing emphasis on renewable energy in the Asia-Pacific region is driving the development of REC markets.

Limited Transparency and Standardization

One of the key restraints in China’s renewable energy certificate (REC) market is the lack of transparency and standardization, which creates challenges for both domestic and international buyers. Unlike mature REC markets in regions such as North America and Europe, China’s REC system has faced inconsistent policy enforcement, limited third-party verification and a lack of clear tracking mechanisms. This makes it difficult for corporations and investors to ensure the credibility and traceability of RECs, thereby hindering market confidence and large-scale adoption.

Additionally, the dominance of state-owned enterprises in renewable energy generation limits private sector participation, creating barriers for smaller players who wish to trade RECs competitively. As a result, despite the growing demand for clean energy commitments, companies may hesitate to rely on China's REC market due to concerns over double-counting, regulatory uncertainty and inconsistent pricing mechanisms.

Market Segment Analysis

The China renewable energy certificate market is segmented based on type and energy source.

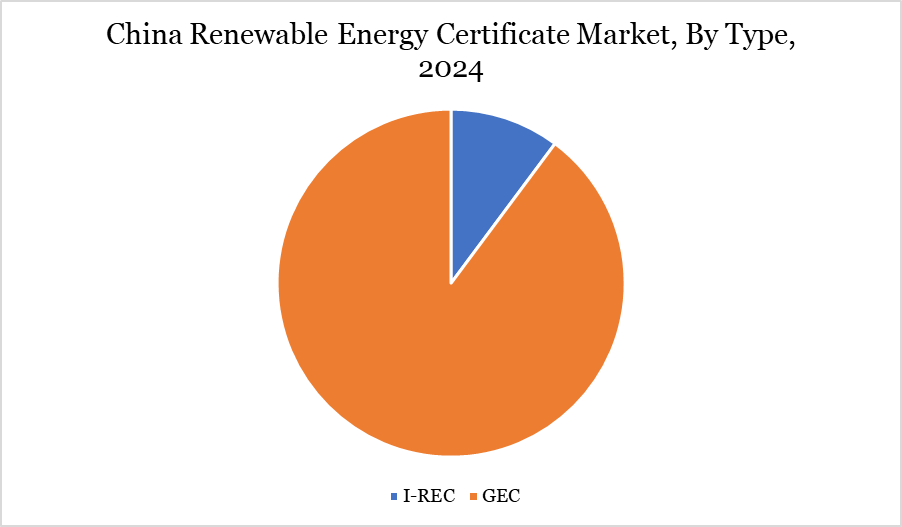

GEC Mandate by the Government is Expected to Drive the Segment Growth.

Green Energy Certificates (GECs) have emerged as a pivotal mechanism to promote renewable energy adoption in China. The certificates serve as tradable instruments representing the environmental benefits of generating electricity from renewable sources, enabling consumers and businesses to support clean energy without directly investing in physical infrastructure.

The government’s Renewable Portfolio Standards (RPS) mandate power companies to procure RECs, driving market growth. The Green Electricity Certificate (GEC) program, launched in 2017, supports voluntary and mandatory REC trading. In August 2024, the National Energy Administration issued the "Rules for the Issuance and Trading of China Green Electricity Certificates," which established a defined framework for the issuance, trading and transfer of GECs. This move reinforces GECs as China's only accepted proof of green electricity's environmental benefits.

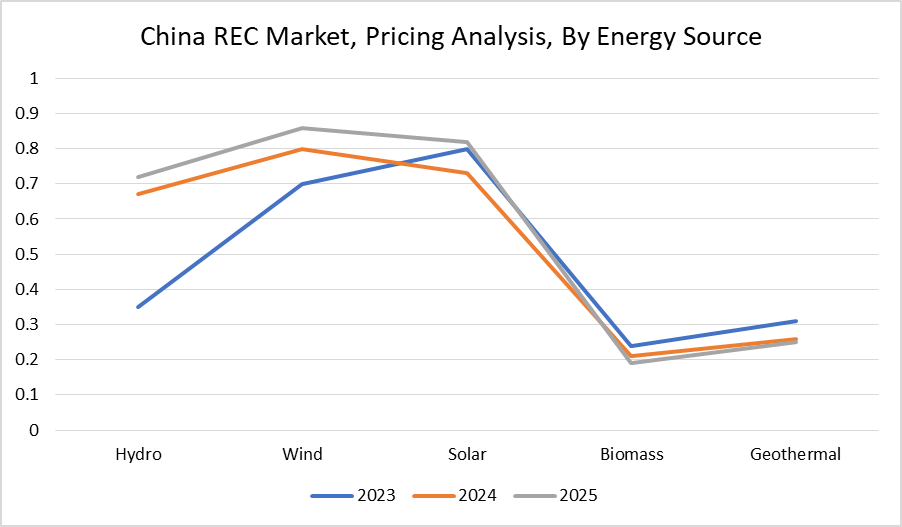

Pricing Analysis

The pricing of renewable energy certificates (RECs) in China is influenced by several factors, including government policies, supply-demand dynamics, corporate sustainability commitments and the dominance of state-owned enterprises in the renewable energy sector. The price of China’s RECs fluctuates based on the type of renewable energy source, with wind and solar RECs generally priced higher than hydropower RECs due to differences in generation costs and technology maturity. China’s hydro RECs were priced at US$ 0.30/MWh, while solar RECs were priced at US$ 0.80/MWh in 2023.

The increasing demand from multinational corporations looking to meet renewable energy targets under initiatives like RE100 has contributed to price adjustments, but concerns over double-counting, lack of transparency and limited third-party verification have kept some buyers hesitant, preventing price surges seen in more mature REC markets.

Major Players

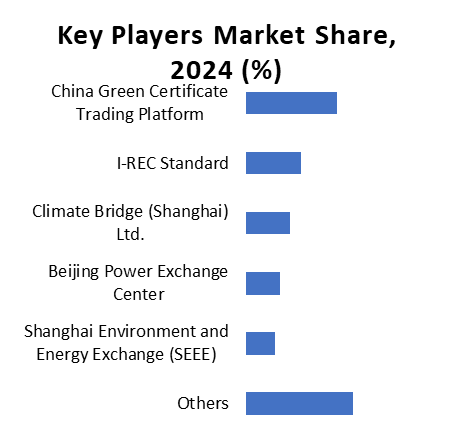

The major players in the market include China Green Certificate Trading Platform, I-REC Standard, APX Inc., Beijing Power Exchange Center, Shanghai Environment and Energy Exchange (SEEE) and Climate Bridge (Shanghai) Ltd.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies