Overview

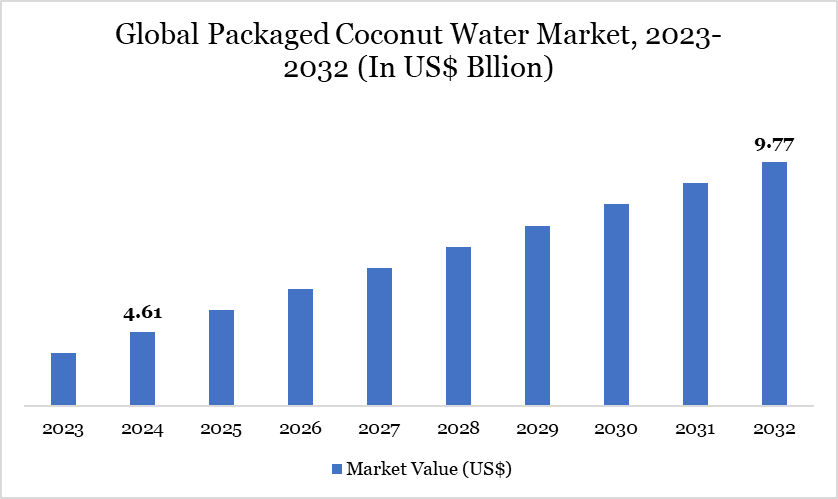

Global packaged coconut water market reached US$ 4.61 billion in 2024 and is expected to reach US$ 9.77 billion by 2032, growing with a CAGR of 9.84 % during the forecast period 2025-2032.

The global packaged coconut water market is rapidly growing due to increased health awareness and the popularity of natural beverages. Consumers favor coconut water for its hydration and nutritional benefits, especially among health-conscious individuals and athletes. Key players are innovating with flavored and organic options while expanding distribution through e-commerce, positioning the market for further growth, particularly in emerging regions.

In major coconut-producing countries, about 12.26 million hectares yield around 66.67 billion nuts, with a productivity rate of 5,440 nuts per hectare. This highlights the significance of coconuts as an agricultural commodity for local economies and the global market. As demand for coconut products rises, enhancing productivity will be crucial to sustaining supply and supporting market growth.

Asia-Pacific leads the global packaged coconut water market, with coconut exports growing 41% to US$ 393 million, according to the India Brand Equity Foundation. Key markets like Vietnam and the UAE, along with China's status as the top importer, underscore strong demand. With abundant resources and increasing exports, the region is well-positioned to meet the rising global appetite for coconut water.

Packaged Coconut Water Market Trend

According to the World Health Organization (WHO), mental health is a vital part of overall well-being, influencing the shift toward preventive health and wellness-focused lifestyles. This has significantly impacted consumer preferences, with a growing demand for natural, functional beverages. Packaged coconut water is increasingly favored due to its hydration benefits, clean-label profile and nutrient-rich composition.

In response, market players are launching fortified coconut water variants with added vitamins, adaptogens and immune-boosting ingredients. These innovations cater to health-conscious consumers seeking multifunctional wellness solutions. With WHO’s emphasis on holistic health, coconut water is strategically positioned within the expanding health and wellness segment.

Market Scope

Metrics | Details |

By Type | Non-Concentrated and Concentrated |

By Flavors | Pineapple, Lemonade, Mango, Cafe Latte and Others |

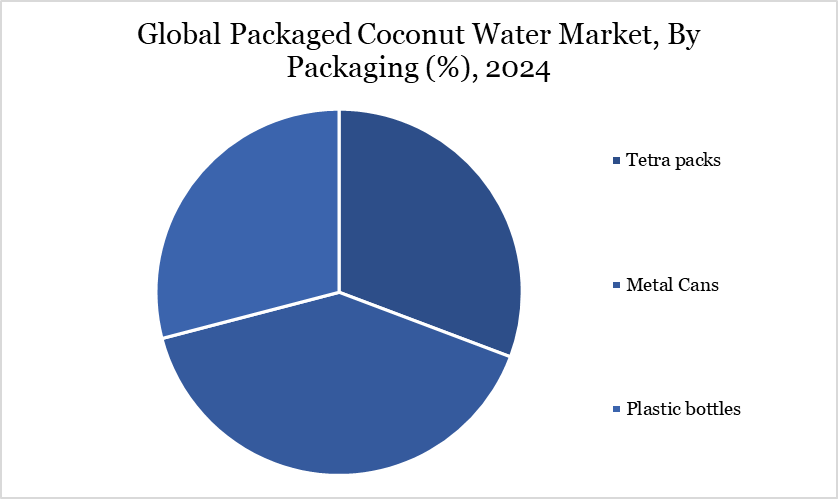

By Packaging | Tetra packs, Metal Cans and Plastic bottles |

By Distribution Channel | Supermarkets/ Hypermarkets, Grocery/Convenience Stores and Online |

By Region | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Dynamics

Rising Demand for Convenient Products

The global packaged coconut water market is experiencing significant growth driven by the increasing demand for convenient and ready-to-drink products. As the employment-to-population ratio rises to 58%, according to The World Bank Group, a larger segment of the population is engaged in work, leading to busier lifestyles. In this context, consumers are seeking healthier beverage options that are easily portable.

Coconut water, known for its natural hydration and electrolyte content, aligns perfectly with this trend, making it a popular choice among health-conscious individuals. Additionally, the rise of health trends has prompted brands to innovate with new flavors and packaging formats, enhancing the appeal of coconut water. With greater availability in stores and cafes, this convenient beverage is becoming more accessible, further fueling its popularity in the global market.

Introduction of Innovative and Convenient Products

The global packaged coconut water market has been seeing significant innovation, with various brands reaching out for innovation. For instance, in July 2022, Vita Coco expanded its offerings by introducing coconut water in 16.9-ounce aluminum cans. Available in mango and original with pulp flavors, this ready-to-drink option is designed for hot weather refreshment. The use of aluminum cans preserves the juice by blocking sunlight and aligns with sustainability efforts.

Meanwhile, Del Monte made strides in June 2021 by launching its King Coconut Water in a 250 ml tetra pack, becoming the first brand in India to offer this product. King Coconut Water is noted for its unique flavor and health benefits, tapping into the growing demand for healthier beverage choices. These innovative flavor introductions and convenient packaging options reflect a broader trend in the market, catering to consumer preferences for both taste and sustainability.

Supply Constraints

Supply constraints in the coconut water industry significantly hinder market growth by limiting production and distribution capabilities. Factors such as climate dependency and geographical limitations affect the availability of coconuts, while labor shortages can restrict harvesting efficiency. These challenges create a mismatch between surging consumer demand for coconut water and the ability of producers to meet it, leading to increased prices and occasional shortages.

Additionally, the emphasis on sustainable farming practices, along with regulatory challenges in exporting countries, further complicates the supply landscape. As companies struggle to maintain consistent quality and availability, the overall growth of the packaged coconut water market is restrained, preventing it from fully capitalizing on its expanding consumer base.

Segment Analysis

Convenience Provided by the Plastic Bottle

The global packaged coconut water market is segmented based on packaging into tetra packs, metal cans and plastic bottles. Plastic bottles have become the dominant packaging choice for coconut water due to their lightweight, convenient and portability. They are easy to handle, making them ideal for on-the-go consumption, which aligns perfectly with the lifestyle of many consumers today.

For instance, B Natural's introduction of packaged tender coconut water in plastic bottles in April 2023 caters to the demand for refreshing and hydrating beverages that can be enjoyed anywhere, reinforcing the brand's commitment to delivering the best refreshment in a format that fits modern life. Additionally, plastic bottles offer excellent barrier properties, preserving the freshness and quality of the coconut water. They can be customized in convenient sizes further enhancing their appeal.

Geographical Penetration

Larger Production Activities in Asia-Pacific

The impressive statistics surrounding coconut production in India underscore the significant role of Asia-Pacific in the global packaged coconut water market. With India as the world's largest coconut producer, covering 2,277.18 thousand hectares and yielding over 20,535 million nuts in 2022-23, according to according to the India Brand Equity Foundation, the potential for value-added products like packaged coconut water is substantial.

The region's dominance is further highlighted by the high productivity rates, averaging 9,018 nuts per hectare, supported by a robust industry that contributes approximately US$ 3.88 billion to India's GDP. The cultivation of coconuts, primarily concentrated in states like Kerala, Karnataka, Tamil Nadu and Andhra Pradesh collectively accounting for over 89% of the area and production ensures a steady supply of quality coconuts for processing.

The Indian government’s commitment to supporting this sector, including the allocation of US$ 10 million for expanding cultivation and establishing processing units, sets a strong foundation for growth in the packaged coconut water market. Additionally, the significant rise in coconut exports, including a 41% increase in 2022, indicates a growing demand for coconut-based products, both domestically and internationally.

Sustainability Analysis

Sustainability is becoming a key competitive factor in the packaged coconut water market, with growing consumer demand for environmentally responsible products. Traditional packaging materials, such as plastics and Tetra Paks, are increasingly viewed as unsustainable due to their environmental impact. As a result, brands are investing in biodegradable packaging innovations like cornstarch-based plastics and plant-based PET to reduce waste and align with eco-conscious consumer values.

Early adopters of biodegradable bottles are gaining market traction by improving brand image, increasing consumer loyalty and expanding into sustainability-focused segments. These initiatives not only help reduce carbon footprints but also meet evolving regulatory standards. As sustainability continues to shape purchasing decisions, eco-friendly packaging is poised to become a long-term growth driver in the coconut water industry.

Competitive Landscape

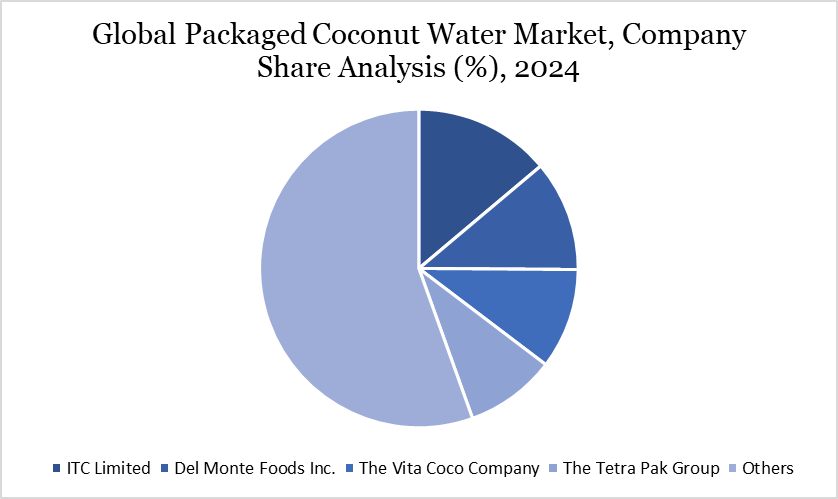

The major global players in the market include ITC Limited, Del Monte Foods Inc., The Vita Coco Company, The Tetra Pak Group, Dabur India Limited, Thai Agri Foods Public Company Limited, Storia Foods & Beverages, Rollins International Pvt. Ltd., C2O Coconut Water and PepsiCo (O.N.E. Coconut Water).

Key Developments

- In April 2023, ITC launched B Natural Select Tender Coconut Water, leveraging its expertise in the fruit beverage segment. The product comes in 200 ml and 750 ml packages.

In July 2022, Vita Coco expanded its offerings by introducing coconut water in 16.9-ounce aluminum cans. Available in mango and original with pulp flavors, this ready-to-drink option is designed for hot weather refreshment.

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies