Market Size

North America renewable energy certificate market reached US$ 5.52 billion in 2024 and is expected to reach US$ 12.04 billion by 2032, growing with a CAGR of 10.24% during the forecast period 2025-2032.

The North America renewable energy certificate (REC) market is a well-established and dynamic sector driven by both compliance and voluntary demand. The US and Canada have structured REC markets, with the US operating under Renewable Portfolio Standards (RPS) at the state level and Canada integrating RECs into its carbon offset and clean energy programs.

The market is influenced by factors such as regulatory mandates, corporate sustainability initiatives, and country-level variations in renewable energy generation. The US market, in particular, is dominated by state-based RECs and Green-e certified voluntary RECs, while Canada’s market is shaped by provincial clean energy goals. Increasing demand from corporations for Scope 2 emissions reduction and the rise of long-term Power Purchase Agreements (PPAs) continue to drive growth in North America’s REC market.

Market Scope

| Metrics | Details |

| CAGR | 10.24% |

| Size Available for Years | 2023-2032 |

| Forecast Period | 2025-2032 |

| Data Availability | Value (US$) |

| Segments Covered | Type, Certificate, Energy Source, End-User and Country |

| Countries Covered | US, Canada and Mexico |

| Fastest Growing Country | US |

| Largest Country | US |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For more details on this report, Request for Sample

Market Dynamics

Rising Corporate Commitment to Sustainability

One of the primary drivers of the North American REC market is the increasing commitment of corporations to sustainability and carbon neutrality. Major companies, including tech giants like Google, Amazon, and Microsoft, have pledged to source 100% of their energy from renewable sources, leading to a surge in demand for RECs.

Many corporations purchase RECs to offset their Scope 2 emissions and meet ESG (Environmental, Social, and Governance) goals, even in regions where direct renewable energy procurement is not feasible. For example, Google’s long-term commitment to clean energy has significantly influenced REC pricing trends, as the company actively purchases RECs to match its electricity consumption. Google has announced a cooperation with renewable energy company Intersect Power and investment firm TPG Rise Climate to create enough renewable energy to power several gigawatt-scale data centres.

The total investment in renewable energy is projected at US$ 20 billion, with Intersect having already funded the first project. This ambitious project seeks to provide renewable energy for gigawatts of data centre capacity across US and will be carried out in phases. The initial phase is planned to become operational by 2026, with full completion by 2027. This growing corporate demand continues to fuel REC market expansion in North America, especially in voluntary markets.

Price and Market Volatility

One key restraint in the North American REC market is the significant price volatility caused by fluctuating supply and demand dynamics. Factors such as changes in state-level renewable portfolio standards (RPS), regulatory shifts, and variations in renewable energy generation influence REC pricing, making it difficult for buyers to forecast costs.

For example, in states like Texas and California, REC prices have seen sharp fluctuations due to oversupply from wind and solar farms or sudden policy changes affecting incentives. This uncertainty can deter long-term REC purchasing commitments from corporations and utilities, impacting market stability and investment confidence.

Market Segment Analysis

The North America renewable energy certificate market is segmented based on type, certificate, energy source, end-user and country.

Corporate Sustainability Commitments Drive Voluntary REC Segment

The voluntary REC segment is expected to dominate the North America REC market in 2024. The voluntary REC industry is expanding rapidly, driven by corporate sustainability commitments and net-zero ambitions. Companies like Google, Microsoft and Amazon have established high renewable energy objectives, driving REC purchases in this sector.

In 2022, around 240 million RECs retired in voluntary markets, vs approximately 390 million RECs in compliance markets. The voluntary market encompasses a wide range of items, buyers and market situations. Different products package RECs and power differently, catering to different types of clients, ranging from residential families making relatively small buys to non-residential buyers making huge purchases.

Market Geographical Share

Rising Government Regulations in the US

The US particularly plays a dominant role in the North American renewable energy certificate market, driven by both production and consumption factors. The country is primarily driven by a robust regulatory framework and government requirements for renewable energy. The US and Canada are the market leaders in terms of both issuance and acquisition of RECs.

Voluntary RECs are increasing in popularity in the US due to business sustainability goals and tax incentives, such as the Inflation Reduction Act of 2022. This trend is especially noticeable in the data center industry, where corporations are aggressively pursuing green Power Purchase Agreements (PPAs). Mexico's REC market is stable, with regulators aiming to entice smaller generators with standard changes and rate reductions. This program is projected to promote the development of International Renewable Energy Certificates (I-RECs), especially in sectors like retail and industry that want to certify their renewable energy use.

Major Players

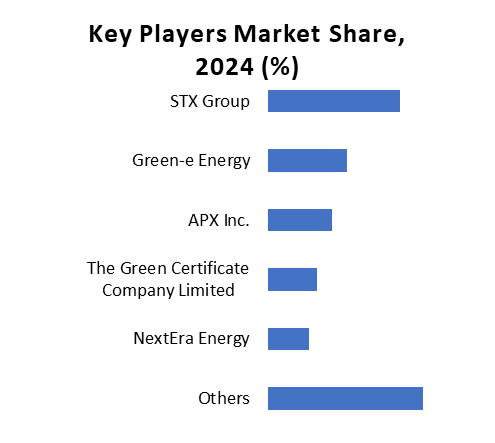

The major players in the market include STX Group, Green-e Energy, ENGIE, ECOHZ, APX Inc., Karbone, NextEra Energy, I-REC standard, Statkraft and The Green Certificate Company Limited.

Pricing Analysis

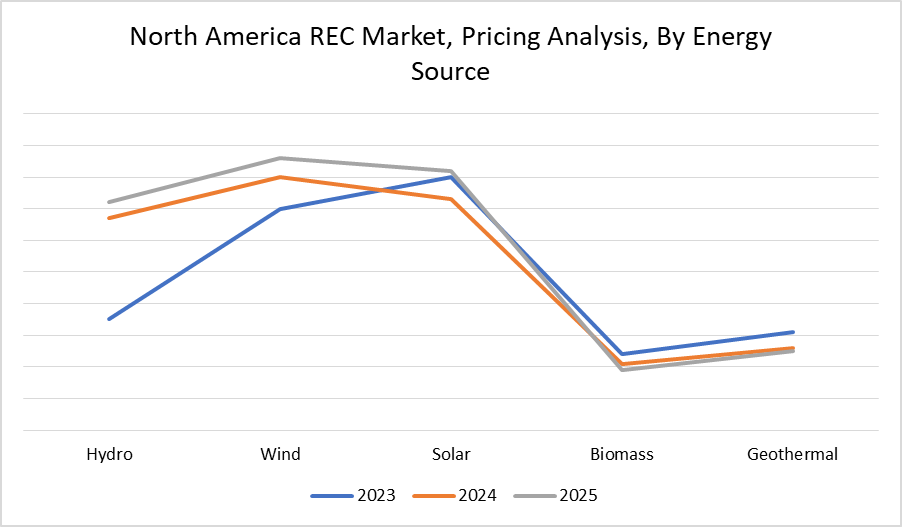

The pricing of RECs in North America varies significantly based on state policies, supply-demand dynamics, and the type of renewable energy source. States with strong Renewable Portfolio Standards (RPS), such as California, Massachusetts, and New Jersey, often see higher REC prices due to stricter compliance requirements. For instance, Solar RECs in New Jersey have historically traded at premium prices, whereas wind and hydro RECs in regions with abundant supply, such as Texas, can trade at low.

Voluntary REC markets, driven by corporate sustainability commitments, also influence pricing, with premium rates for RECs sourced from high-demand renewable projects like solar and wind farms. Additionally, policy changes and federal tax incentives play a crucial role in price fluctuations, making the North American REC market dynamic and regionally diverse.

Sustainability Analysis

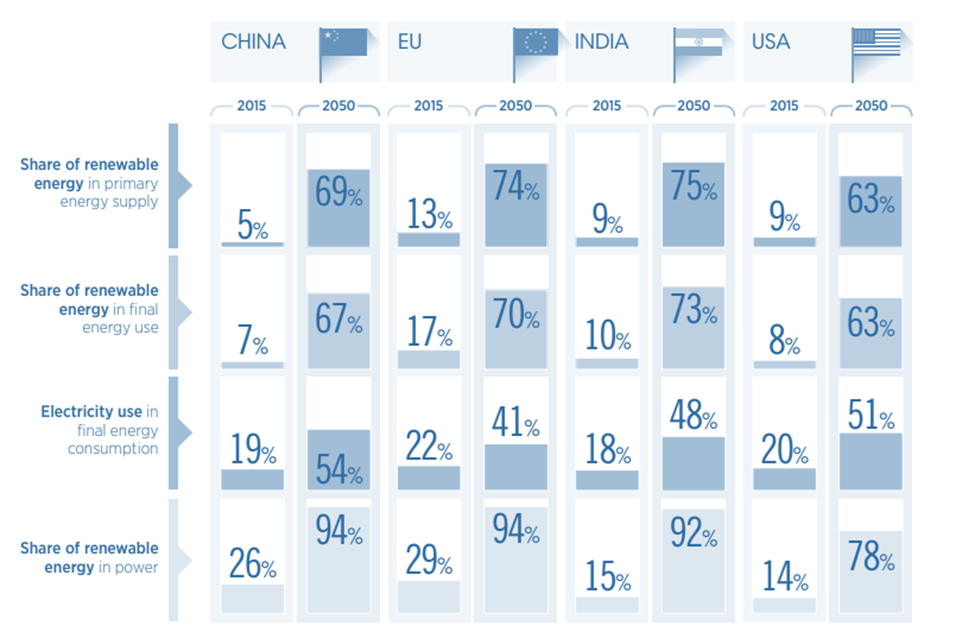

The renewable energy certificate (REC) market plays a vital role in driving sustainability efforts globally by incentivizing renewable energy production, reducing carbon emissions and facilitating the energy transition. By purchasing RECs, organizations directly fund renewable energy projects like wind, solar, hydro and biomass, increasing global renewable energy capacity.

Regulatory mandates like Renewable Portfolio Standards (RPS) drive demand in compliance REC markets, ensuring a stable framework. Voluntary markets grow as more corporations commit to sustainability goals and adopt Science-Based Targets or net-zero pledges. Emerging platforms simplify REC purchasing for small businesses and individuals, expanding market participation.

The government and private entities' significant investment in renewable energy, notably large-scale solar power facilities, is propelling industry expansion. For example, in April 2023, the US Department of Energy (DOE) announced a US$ 52 million financial commitment for a carefully selected collection of 19 projects. This includes US$ 10 million supplied from the Bipartisan Infrastructure Law, aimed at strengthening the domestic solar supply chain in the US.

By Type

- Compliance RECs

- Voluntary RECs

By Certificate

- I-REC

- TIGR

- GEC

By Energy Source

- Solar RECs

- Wind RECs

- Hydro RECs

- Others

By End-User

- Industrial

- Commercial

- Residential

- Governmental

By Country

- US

- Canada

- Mexico

Why Choose DataM Intelligence?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.