Neurology Devices Market Size and Growth

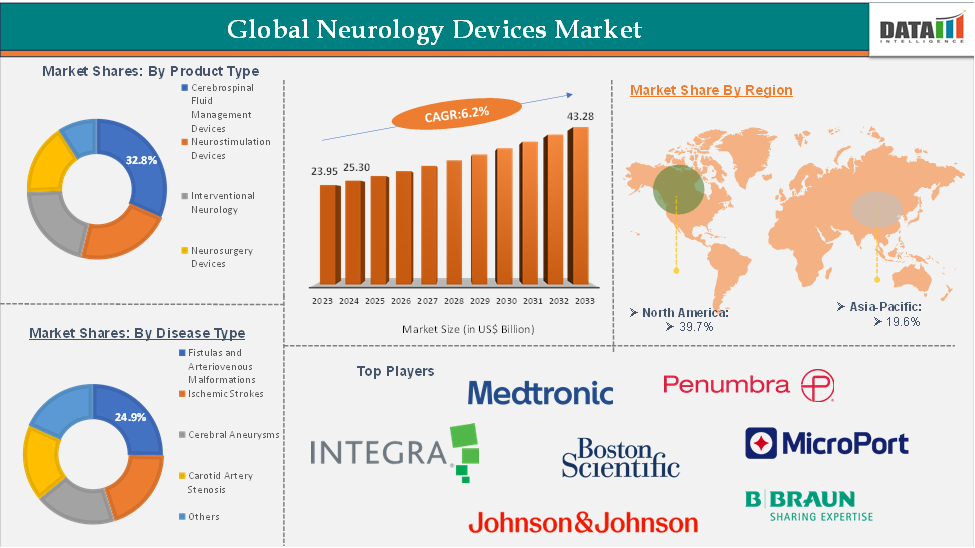

The global neurology devices market reached US$ 23.95 billion in 2023, with a rise to US$ 25.30 billion in 2024, and is expected to reach US$ 43.28 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025-2033. The market growth is driven by increasing prevalence of neurological disorders, technological advancements in diagnostic and therapeutic devices, and rising healthcare infrastructure investments worldwide.

Neurology Devices Market Key Market Trends & Insights

North America accounted for approximately 39.7% of the global neurology devices market in 2023 and is expected to retain a significant market share throughout the forecast period.

Asia Pacific is anticipated to be the fastest-growing region, supported by expanding healthcare facilities, growing awareness of neurological conditions, and increasing demand for advanced medical devices.

By product type, the cerebrospinal fluid management devices segment is expected to hold a major portion of the market, holding 32.8%.

Ongoing innovations in neuroimaging, neuromodulation, and neurodiagnostic devices are expected to further fuel market expansion.

Neurology Devices Market Market Size & Forecast

2024 Market Size: USD 25.30 Billion

2033 Projected Market Size: USD 43.28 Billion

CAGR (2025–2033): 6.2%

North America: Largest market in 2023

Asia Pacific: Fastest-growing market.

Neurology Devices Market Executive Summary

Neurology Devices Market Dynamics: Drivers & Restraints

Driver: Rising Prevalence of Neurological Disorders

The rising prevalence of neurological disorders is expected to drive the demand for neurology devices. For instance, according to Yale Medicine, approximately 795,000 Americans experience a stroke each year, with about 87% classified as ischemic strokes. Stroke incidence is notably higher among adults aged 65 and older, as the risk increases significantly with age, making it a leading neurological concern in the aging U.S. population.

Conditions such as Alzheimer's disease, Parkinson’s disease, epilepsy, multiple sclerosis, and stroke are becoming increasingly common, particularly with aging populations across developed and developing regions. This surge in neurological conditions fuels demand for advanced diagnostic, monitoring, and therapeutic devices that can improve patient outcomes and quality of life. Thus, the above factors are driving the neurology devices market.

Restraint: High Cost of Therapy

The high cost of neurology devices poses a significant challenge to the market’s growth, especially in low- and middle-income regions. Advanced diagnostic and therapeutic equipment, such as neuroimaging systems, implantable neuromodulation devices, and wearable monitors, often require substantial investment in both acquisition and maintenance. These elevated costs limit accessibility for many healthcare providers and patients, restricting widespread adoption. As a result, despite the growing demand for neurology devices, the high price barrier may slow market penetration and hinder equitable healthcare delivery, particularly in resource-limited settings.

For more details on this report, Request for Sample

Neurology Devices Market Segment Analysis

The global neurology devices market is segmented based on product type, disease type, end-user, and region.

Product Type - The cerebrospinal fluid (CSF) management devices segment is estimated to have 32.8% of the neurology devices market share.

Cerebrospinal fluid (CSF) management devices are poised to dominate the neurology devices market, driven by significant technological advancements and strategic collaborations in 2023 and 2024. In August 2024, Aesculap, Inc. and Christoph Miethke GmbH & Co. KG received FDA Breakthrough Device Designation for their M.scio System, a non-invasive, telemetric system providing continuous intracranial pressure (ICP) monitoring through an implantable sensor. This innovation offers real-time CSF assessment, enhancing hydrocephalus management and positioning CSF management devices at the forefront of neurology device advancements.

Furthermore, in January 2023, Biogen and Alcyone Therapeutics entered a partnership to develop ThecaFlex DRx, an implantable device for subcutaneous administration of antisense oligonucleotides (ASOs) into the CSF. This system represents a significant leap in intrathecal medication delivery, expanding the therapeutic applications of CSF management devices beyond traditional uses. These developments underscore the growing importance and versatility of CSF management devices in the neurology sector, highlighting their potential to lead the market in the coming years.

Neurology Devices Market Geographical Share

The North America neurology devices market was valued at 39.7% market share in 2024

North America is poised to maintain its leadership in the global neurology devices market, driven by a confluence of demographic, technological, and healthcare infrastructure factors. In 2023, the region accounted for approximately 39.7% of the global market share, with the United States being the largest contributor.

A significant driver is the rising prevalence of neurological disorders. For instance, Alzheimer's disease affects over 6 million Americans aged 65 and older, a number projected to nearly double by 2050. This aging population is increasingly susceptible to conditions such as Parkinson’s disease, epilepsy, and stroke, thereby escalating the demand for advanced diagnostic and therapeutic devices.

Technological innovation further propels market growth. The U.S. Food and Drug Administration (FDA) has approved several cutting-edge devices, including the NeuroPace RNS System for epilepsy management. Companies like Medtronic, Boston Scientific, and Abbott Laboratories are at the forefront, investing heavily in research and development to introduce minimally invasive and wearable neurology devices. For instance, in February 2025, Johnson & Johnson MedTech, a rising leader in neurovascular care, announced the launch of the CEREGLIDE 92 Catheter System, a next-generation .092” catheter designed to support complex neurovascular interventions. The system features the innovative INNERGLIDE 9 delivery aid and is indicated for facilitating the insertion and navigation of interventional devices within the neurovascular system, offering enhanced performance and precision in endovascular procedures.

Neurology Devices Market Major Players

The major players in the neurology devices market include Stryker, Boston Scientific Corporation, Integra LifeSciences Holdings Corporation, Johnson and Johnson, Medtronic, Penumbra Inc., Abbott, NIHON KOHDEN CORPORATION, B. Braun SE, MicroPort Scientific Corporation, among others.

Key Developments:

In February 2025, Penumbra introduced the Access25 delivery microcatheter, a single-lumen medical device engineered to assist physicians in navigating the neurovasculature for precise delivery of Penumbra’s advanced 0.020-inch coil platform.

In February 2024, Royal Philips, a global leader in health technology, unveiled significant upgrades to its Image Guided Therapy System. This advanced interventional platform is designed to enhance clinical productivity, enable faster decision-making, increase patient throughput, and improve treatment outcomes.

Neurology Devices Market Scope

Metrics | Details | |

CAGR | 6.2% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Cerebrospinal Fluid Management Devices, Neurostimulation Devices, Interventional Neurology, Neurosurgery Devices, Others |

Disease Type | Fistulas and Arteriovenous Malformations, Ischemic Strokes, Cerebral Aneurysms, Carotid Artery Stenosis, Others | |

| End-User | Hospitals & Clinics, Specialty Centers, Others |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global neurology devices market report delivers a detailed analysis with 73 key tables, more than 76 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here