Arthroscopy Devices Market Size & Industry Outlook

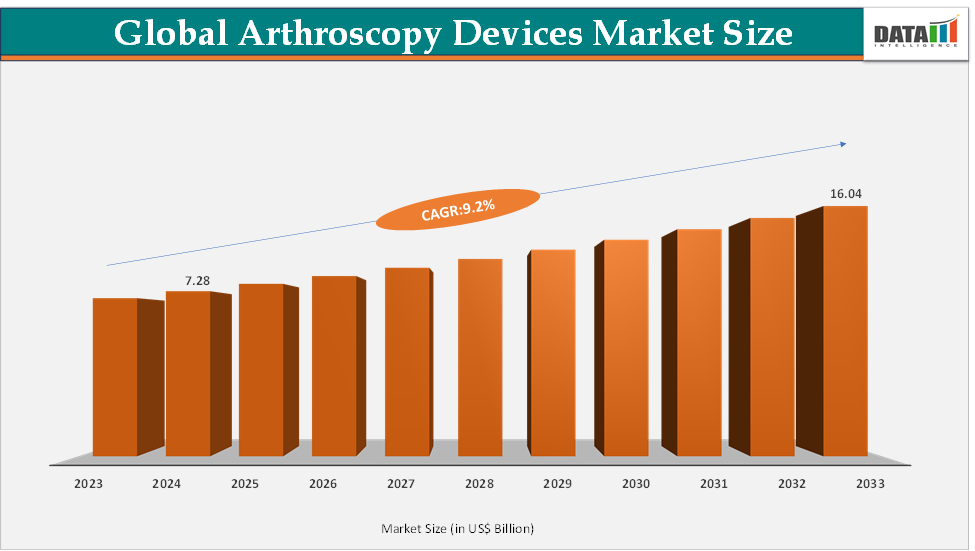

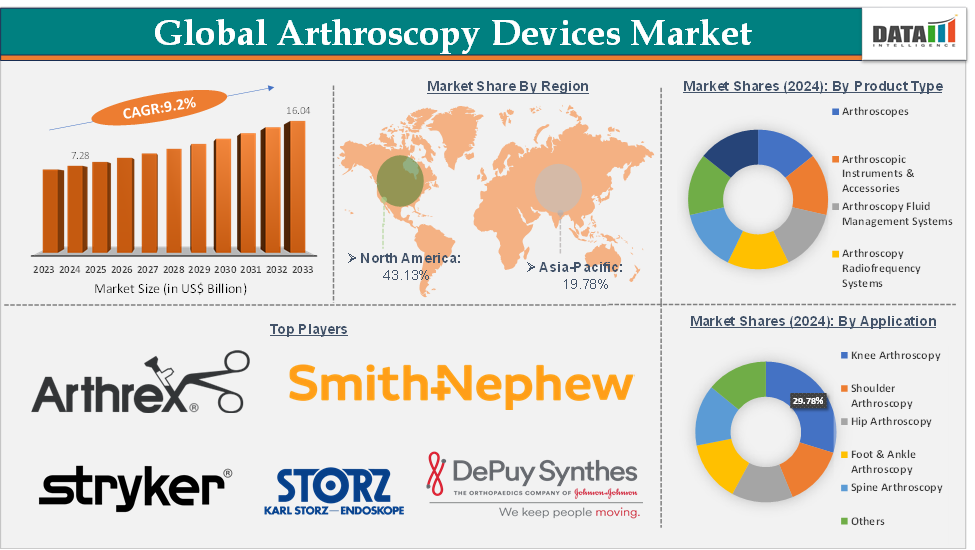

The global arthroscopy devices market size reached US$ 7.28 Billion in 2024 from US$ 6.71 Billion in 2023 and is expected to reach US$ 16.04 Billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025-2033. The market is evolving with strong demand for minimally invasive procedures that reduce recovery times and surgical risks. Knee arthroscopy remains the most common application, followed by growing adoption in shoulder and hip repairs, reflecting broader use across sports medicine and orthopedic care. Hospitals continue to lead in device utilization, but ambulatory surgical centers are expanding rapidly as they prioritize efficiency and cost savings. Industry leaders like Stryker, Arthrex, and Smith+Nephew are driving innovation with advanced systems to meet shifting clinical and economic needs.

Key Market Trends & Insights

The global arthroscopy devices market is shaped by the interplay of rising sports injuries, aging-related joint disorders, and the growing demand for minimally invasive surgery. Market dynamics are defined by steady adoption in hospitals, rapid growth in ambulatory surgical centers seeking cost-efficient solutions, and increasing reliance on consumables such as implants and disposable instruments for recurring revenue. At the same time, technological innovations from advanced visualization systems to robotic-assisted platforms are intensifying competition, while reimbursement pressures and evolving care models push manufacturers toward flexible pricing and bundled offerings.

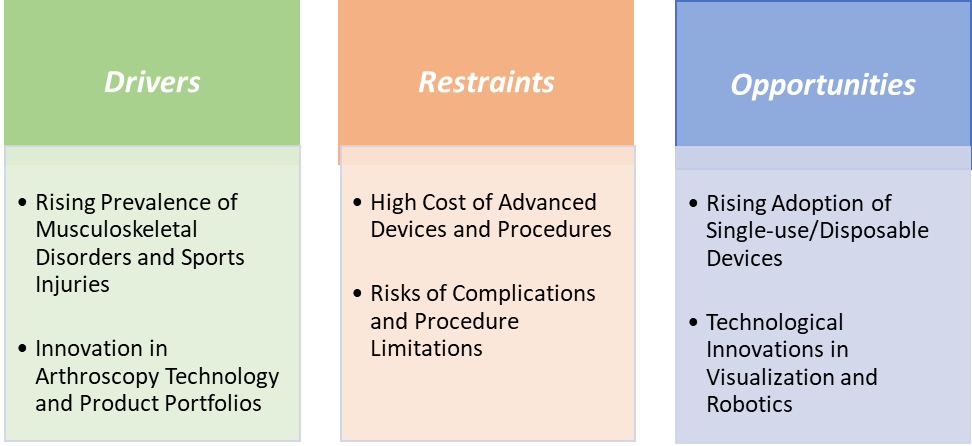

Infection control concerns, reprocessing costs, and ambulatory surgical centers (ASCs) preferences are driving rapid adoption of single-use arthroscopes, shavers, tubing sets, and one-time procedure kits, expanding recurring consumables revenue and simplifying logistics. Market reports and manufacturers are increasingly highlighting single-use arthroscopes and disposable visualization options as a core innovation area.

North America dominates the arthroscopy devices market with the largest revenue share of 43.13% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 9.1% over the forecast period.

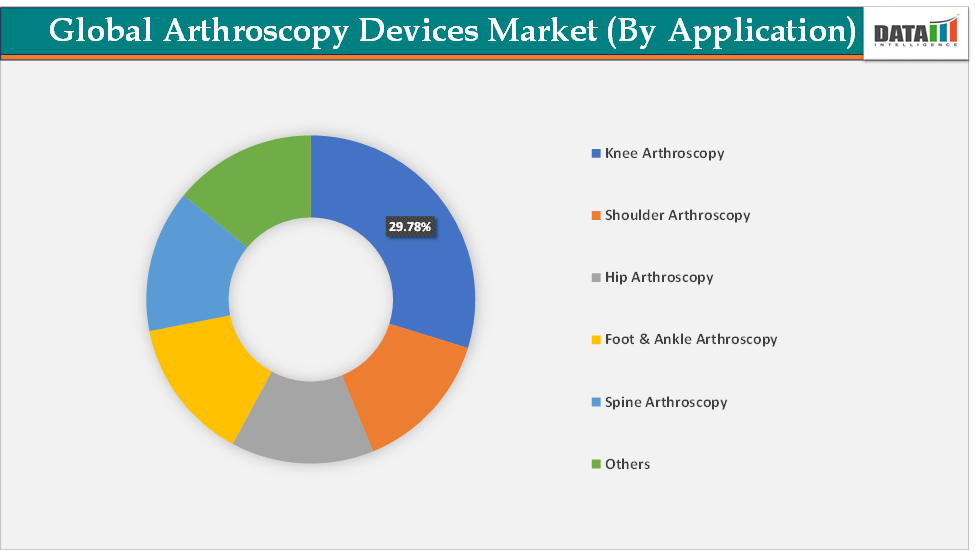

Based on application, the knee arthroscopy segment led the market with the largest revenue share of 29.78% in 2024.

The major market players in the arthroscopy devices market are Arthrex, Inc., Smith+Nephew, Stryker, Medtronic, KARL STORZ, Zimmer Biomet, CONMED Corporation, DePuy Synthes, Olympus, and Vimex Sp. z o.o., among others

Market Size & Forecast

2024 Market Size: US$ 7.28 Billion

2033 Projected Market Size: US$ 16.04 Billion

CAGR (2025–2033): 9.2%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

Arthroscopy Devices Market Executive Summary

Market Dynamics

Drivers-The rising prevalence of musculoskeletal disorders and sports injuries is significantly driving the arthroscopy devices market growth

The rising prevalence of musculoskeletal disorders and sports injuries is one of the most significant growth drivers for the arthroscopy devices market, as it directly increases the volume of minimally invasive orthopedic procedures. Conditions such as osteoarthritis, meniscal tears, anterior cruciate ligament (ACL) ruptures, rotator cuff injuries, and cartilage defects are becoming more common due to both an aging population and higher participation in sports and fitness activities. According to the World Health Organization (WHO), over 1.7 billion people suffer from musculoskeletal conditions worldwide, making them the leading contributor to disability.

Within this burden, sports-related injuries account for millions of cases annually, especially in high-impact activities like soccer, basketball, and skiing, where ACL and meniscus injuries dominate. Arthroscopy offers a less invasive approach compared to open surgery, enabling faster recovery and reduced complications, which makes it the preferred choice for athletes and elderly patients alike. For instance, knee arthroscopy remains the most frequently performed arthroscopic procedure, with ACL reconstruction and meniscus repair being the key drivers of arthroscopic implant demand, particularly for anchors, screws, and meniscal repair devices. Shoulder arthroscopy is also gaining traction for rotator cuff repairs and labral stabilization, increasing demand for suturing devices, shavers, and visualization systems.

According to the Centers for Disease Control and Prevention (CDC), osteoarthritis (OA) is the most common form of arthritis, affecting 33 million US adults. Additionally, according to the International Osteoporosis Foundation, osteoporosis is a major non-communicable disease and the most common bone disease, affecting one in three women and one in five men over the age of 50 worldwide. It is estimated that 75 million people in Europe, the USA, and Japan are affected by osteoporosis. Thus, the growing incidence of musculoskeletal and sports injuries not only increases the overall demand for arthroscopic procedures but also sustains recurring revenue streams from implants and disposable devices, cementing this as a critical driver of market growth.

Restraints-Risks of complications and procedure limitations are hampering the growth of the arthroscopy devices market

Although arthroscopy is widely regarded as a safe and minimally invasive alternative to open surgery, the risks of complications and procedural limitations remain a major restraint to market growth. Complications such as infection, blood clots, nerve or vessel injury, fluid extravasation, and joint stiffness occur in a minority of cases but can have significant clinical and cost implications. These limitations affect the adoption of arthroscopy devices, particularly for implants and visualization systems used in older populations with advanced osteoarthritis, where the procedure may not provide meaningful outcomes.

From a product standpoint, powered shavers and fluid management systems have been associated with risks of cartilage damage and excessive fluid extravasation if not carefully controlled, underscoring the importance of skilled use. Similarly, shoulder arthroscopy for rotator cuff repair carries a notable risk of re-tear, with studies reporting re-tear rates between 20%–40%, which may discourage patients or push providers toward alternative treatments. Regulatory bodies and payers are increasingly cautious about approving or reimbursing procedures with limited evidence of benefit, further slowing device uptake in certain indications.

Moreover, the inherent learning curve in complex cases such as hip or ankle arthroscopy adds to the risk profile, as inexperienced surgeons may encounter higher complication rates. These challenges not only affect patient confidence but also place pressure on manufacturers to continually improve device safety features, such as better arthroscopes, fluid control systems, and implant designs. In this way, the procedural risks and clinical outcome uncertainties act as significant brakes on the otherwise strong demand trajectory of the arthroscopy devices market.

For more details on this report – Request for Sample

Arthroscopy Devices Market, Segment Analysis

The global arthroscopy devices market is segmented based on product type, application, end-user, and region.

Application-The knee arthroscopy segment is dominating the arthroscopy devices market with a 29.78% share in 2024

The knee arthroscopy segment dominates the arthroscopy devices market owing to the high global prevalence of knee injuries and degenerative conditions such as meniscal tears, ACL ruptures, and cartilage damage. Knee procedures account for the largest share of arthroscopic surgeries, supported by both sports-related trauma in younger populations and age-related osteoarthritis in older patients. For instance, according to the American Academy of Orthopaedic Surgeons, more than 700,000 total knee replacements are performed annually in the U.S.

Visualization systems, powered shavers, and fluid management devices are heavily utilized in knee procedures, ensuring steady revenue for companies like Arthrex, Stryker, and Smith & Nephew. Moreover, the availability of well-established surgical techniques and strong reimbursement support for knee arthroscopy further cement its market dominance. With sports injuries rising globally and the aging population contributing to degenerative joint cases, the knee arthroscopy segment is expected to maintain its leadership position and continue driving overall market growth.

Geographical Analysis

North America is expected to dominate the global arthroscopy devices market with a 43.13% in 2024

North America has established itself as the dominant region in the global arthroscopy devices market, largely due to its advanced healthcare ecosystem, higher surgical volumes, and strong reimbursement frameworks. The US, in particular, accounts for the majority of procedures, fueled by both a high incidence of sports injuries and a rapidly aging population prone to degenerative joint conditions such as osteoarthritis. For instance, according to the National Institutes of Health (NIH), the annual number of arthroscopic procedures in the US was predicted to be 1.77 million.

Knee arthroscopy, including ACL reconstructions and meniscus repairs, is the most common application, followed closely by shoulder arthroscopy for rotator cuff and labral repairs. These procedures drive substantial demand for arthroscopic implants like anchors, interference screws, and meniscal repair devices, as well as powered shavers, high-definition arthroscopes, and fluid management systems. The region also leads in the adoption of ambulatory surgical centers (ASCs), which are reshaping procedure economics by performing same-day arthroscopies with bundled disposable kits and single-use scopes.

North America consistently holds the largest share of global revenues, with major device makers such as Arthrex, Stryker, and Johnson & Johnson (DePuy Synthes) developing advanced products, which further accelerate the market growth. For instance, in June 2025, Arthrex launched Synergy Power, a versatile and reliable battery-powered system designed for a wide variety of orthopedic applications. The Synergy Power system offers a comprehensive selection of attachments and blades to facilitate the system’s use across orthopedics, including sports, arthroplasty, trauma and distal extremities procedures.

The Asia Pacific region is the fastest-growing region in the global arthroscopy devices market, with a CAGR of 9.1% in 2024

Asia-Pacific is emerging as the fastest-growing region in the global arthroscopy devices market, driven by rapid improvements in healthcare infrastructure, rising disposable incomes, and growing awareness of minimally invasive surgical options. Countries such as China, India, and Japan are witnessing a sharp rise in the prevalence of musculoskeletal disorders and sports injuries, creating a robust demand for knee and shoulder arthroscopy procedures.

Increasing government investments in healthcare modernization, along with the expansion of private hospitals and orthopedic specialty centers, are enabling wider adoption of arthroscopes, powered shavers, and arthroscopic implants. In particular, the rise of medical tourism hubs like India and Thailand has boosted procedure volumes, as international patients seek cost-effective arthroscopic surgeries compared to North America and Europe.

Global leaders such as Stryker, Arthrex, and Smith & Nephew are strengthening their presence in Asia-Pacific through distribution partnerships, training programs, and the introduction of cost-efficient disposable instruments tailored for emerging markets. Moreover, the region benefits from a large young population engaged in sports and fitness activities, alongside a rapidly aging demographic vulnerable to osteoarthritis and joint degeneration, creating a dual demand base. Together, these factors make Asia-Pacific not only the fastest-growing region but also a strategic priority for device makers seeking long-term expansion opportunities in the global arthroscopy devices market.

Competitive Landscape

Top companies in the arthroscopy devices market include Arthrex, Inc., Smith+Nephew, Stryker, Medtronic, KARL STORZ, Zimmer Biomet, CONMED Corporation, DePuy Synthes, Olympus, and Vimex Sp. z o.o., among others.

Arthrex, Inc.: Arthrex, Inc. is a leading player in the arthroscopy devices market, recognized for its extensive portfolio of implants, instruments, and visualization systems dedicated to minimally invasive orthopedic surgery. The company is particularly strong in sports medicine and arthroscopic implants, such as suture anchors, fixation devices, and disposable instruments, which generate consistent recurring revenues. Arthrex has built a reputation for innovation, introducing advanced products like single-use arthroscopes and biologic-augmented repair solutions, while also investing heavily in surgeon education and training programs worldwide. Its global presence and focus on procedure-specific solutions have positioned it as a key driver of innovation and adoption in the arthroscopy segment.

Market Scope

Metrics | Details | |

CAGR | 9.2% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Arthroscopes, Arthroscopic Instruments & Accessories, Arthroscopy Fluid Management Systems, Arthroscopy Radiofrequency Systems, Arthroscopic Implants, Arthroscopy Visualization Devices and Others |

Application | Knee Arthroscopy, Shoulder Arthroscopy, Hip Arthroscopy, Foot & Ankle Arthroscopy, Spine Arthroscopy and Others | |

End-User | Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Orthopedic Centers and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global arthroscopy devices market report delivers a detailed analysis with 62 key tables, more than 61 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here