Multiple Sclerosis Therapeutics Market Size & Industry Outlook

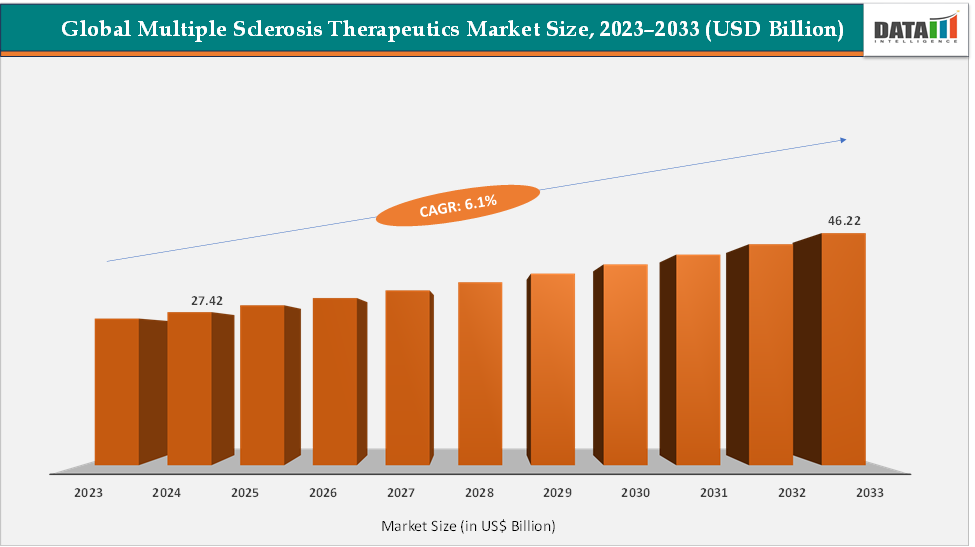

The global multiple sclerosis therapeutics market size reached US$ 27.42 Billion in 2024 from US$ 25.98 Billion in 2023 and is expected to reach US$ 46.22 Billion by 2033, growing at a CAGR of 6.1% during the forecast period 2025-2033. Market growth is driven by the rising prevalence of multiple sclerosis, increasing adoption of disease-modifying therapies (DMTs), and ongoing advancements in oral and monoclonal antibody-based treatments. Key products include Ocrevus (ocrelizumab), Tysabri (natalizumab), Gilenya (fingolimod), and Kesimpta (ofatumumab), all of which have demonstrated strong efficacy in reducing relapse rates. North America dominates the market due to rising prevalence and strong presence of major market players and product launches, while the Asia-Pacific region is expected to show the fastest growth owing to expanding treatment access.

Key Market Highlights

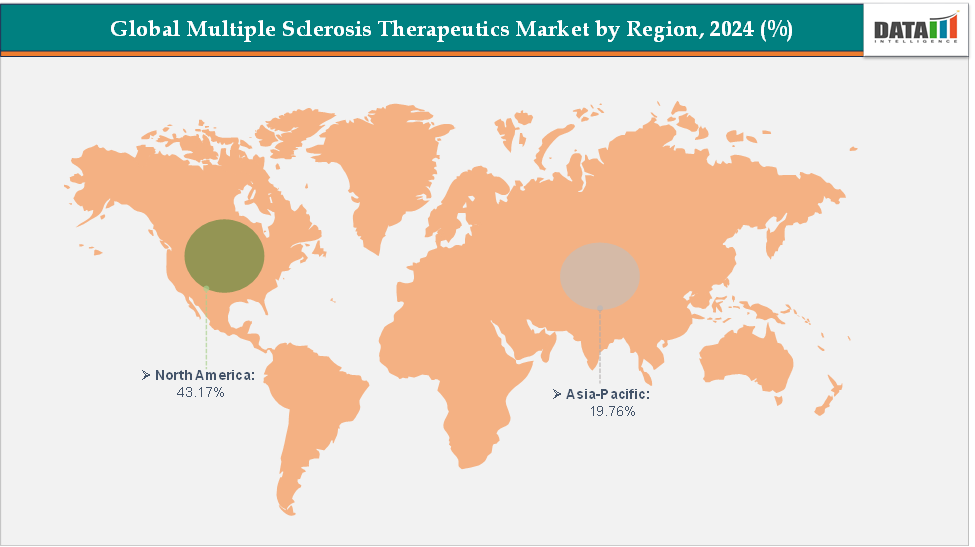

- North America dominates the multiple sclerosis therapeutics market with the largest revenue share of 43.17% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 6.5% over the forecast period.

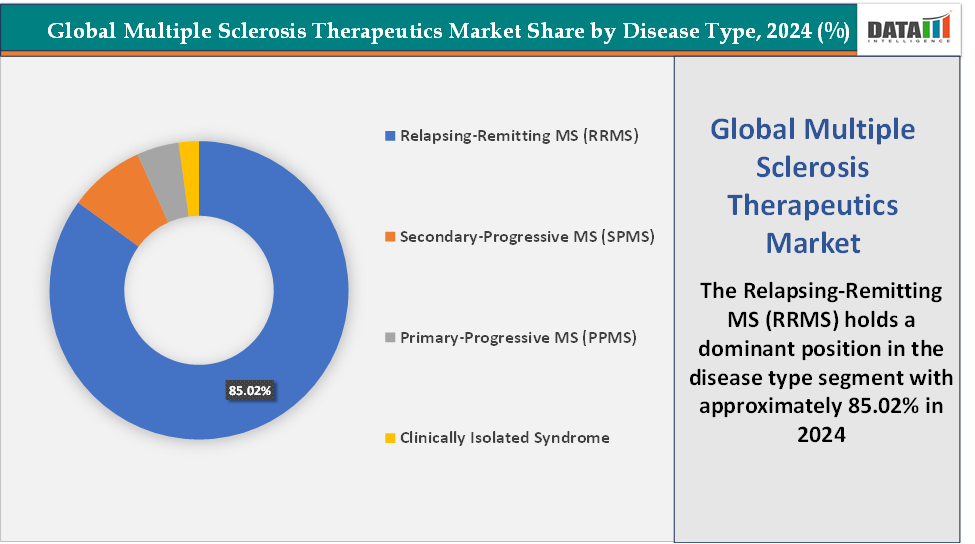

- Based on disease type, the Relapsing-Remitting MS (RRMS) segment led the market with the largest revenue share of 85.02% in 2024.

- The major market players in the multiple sclerosis therapeutics market are Biogen, Merck KGaA, Genentech USA, Inc., Novartis AG, Bristol-Myers Squibb Company, Genzyme Corporation (Sanofi), Teva Pharmaceuticals USA, Inc., TG Therapeutics, Inc., Vanda Pharmaceuticals, Inc., and Cycle Pharmaceuticals Limited, among others

Market Dynamics

Drivers: Rising prevalence of multiple sclerosis is significantly driving the multiple sclerosis therapeutics market growth

The rising global prevalence of multiple sclerosis (MS) is a key factor driving the robust growth of the MS therapeutics market. According to the National Multiple Sclerosis Society, more than 2.9 million people worldwide are living with MS, a 30% increase since 2013, highlighting both improved diagnosis and a genuine rise in disease incidence. In the United States alone, approximately 1 million individuals are affected, compared to 400,000 a decade ago, making it one of the most significant neurological disorders in the region.

The rising prevalence among women, who are nearly three times more likely to develop MS than men has further expanded the patient base. As the number of patients requiring long-term disease-modifying therapies (DMTs) increases, the demand for effective and accessible treatments continues to surge. This growing patient population is fueling innovation in oral DMTs, monoclonal antibodies, and progressive MS therapies, supporting sustained revenue growth for pharmaceutical companies.

Furthermore, the aging population, improved survival rates, and expanding healthcare access in emerging regions such as Asia-Pacific and Latin America are expected to further accelerate market demand in the coming decade. Collectively, the rising global MS burden is not only heightening clinical urgency but also creating substantial commercial opportunities for new, more effective therapeutic interventions.

Restraints: High cost of treatment is hampering the growth of the market

The high cost of multiple sclerosis treatment is a significant factor hampering the growth of the therapeutics market, particularly in low- and middle-income countries. Disease-modifying therapies (DMTs), which are the cornerstone of MS management, can cost between $60,000 and $100,000 per patient annually in the United States. Drugs such as KESIMPTA (ofatumumab), Ocrevus (ocrelizumab) and Tysabri (natalizumab) at the higher end of this range. For instance, for those patients who may not have prescription drug coverage, the list price for KESIMPTA is $9,347.07 per treatment. The list price may not reflect the price paid by patients; most patients with prescription coverage will pay less. This high cost of approved drugs may hamper the market growth.

Even oral therapies like Gilenya (fingolimod) or Zeposia (ozanimod) involve substantial expenses, making long-term adherence financially challenging for patients without robust insurance coverage. In regions with limited reimbursement policies, such as parts of Asia-Pacific and Latin America, affordability barriers lead to delayed treatment initiation or non-adherence, directly impacting patient outcomes. High treatment costs also increase healthcare system burdens, with payers often restricting coverage or requiring prior authorizations, which slows market uptake. The combination of high drug prices, ongoing monitoring costs, and limited insurance coverage continues to act as a restraint, making affordability one of the most pressing challenges for market growth.

For more details on this report – Request for Sample

Segmentation Analysis

The global multiple sclerosis therapeutics market is segmented based on disease type, drug class, route of administration, distribution channel, and region.

Disease Type: The Relapsing-Remitting MS (RRMS) segment is dominating the multiple sclerosis therapeutics market with a 85.02% share in 2024

The Relapsing-Remitting MS (RRMS) segment is dominating the accounting for approximately 85% of initial MS diagnoses globally, according to the National Institutes of Health, making it the largest patient pool for treatment. RRMS is characterized by clearly defined relapses followed by periods of remission, which creates high demand for disease-modifying therapies (DMTs) aimed at reducing relapse frequency and delaying disease progression.

Leading approved therapies targeting RRMS include Ocrevus (ocrelizumab), Gilenya (fingolimod), Kesimpta (ofatumumab), Tysabri (natalizumab), and Vumerity (diroximel fumarate), all of which have demonstrated significant efficacy in managing relapses. The segment’s dominance is further reinforced by oral therapies like Gilenya and Zeposia (ozanimod), which offer improved convenience and patient adherence compared to traditional injectable therapies such as Copaxone (glatiramer acetate) and interferons (Avonex, Rebif, Betaseron). The chronic nature of RRMS and the need for long-term management create sustained demand, making this segment the primary revenue driver in the global MS therapeutics landscape.

Geographical Analysis

North America is expected to dominate the global multiple sclerosis therapeutics market with a 43.17% in 2024

North America, particularly the United States, is expected to continue dominating the global driven by high disease prevalence, strong presence of major market players, FDA approvals, strong healthcare infrastructure, rapid adoption of innovative drugs, and robust research funding.

US Multiple Sclerosis Therapeutics Market Trends

According to the National Multiple Sclerosis Society (NMSS), approximately 1 million people in the US are living with MS, the highest prevalence worldwide and this number has more than doubled over the past decade due to improved diagnostics and increased disease awareness. The US also benefits from the early and widespread adoption of FDA-approved therapies, including leading disease-modifying treatments such as Ocrevus (ocrelizumab), Kesimpta (ofatumumab), Gilenya (fingolimod), Tysabri (natalizumab), and Zeposia (ozanimod). These drugs dominate the US market due to their high efficacy, proven safety profiles, and insurance coverage through major healthcare programs.

Moreover, the presence of major market players like Biogen, Novartis, and Bristol Myers Squibb along with emerging players such as Halozyme Therapeutics driving the market growth in US for next-generation MS drugs along with FDA approvals. For instance, in September 2024, Halozyme Therapeutics, Inc. announced that Roche received U.S. Food and Drug Administration (FDA) approval for OCREVUS ZUNOVO (ocrelizumab and hyaluronidase-ocsq) with Halozyme's ENHANZE drug delivery technology for the treatment of relapsing multiple sclerosis (RMS) and primary progressive multiple sclerosis (PPMS) as a twice-a-year, approximately 10-minute subcutaneous (SC) injection to be administered by a healthcare practitioner.

The Asia Pacific region is the fastest-growing region in the global with a CAGR of 6.5% in 2024

The Asia Pacific (APAC) region is currently emerging as the fastest-growing market for multiple sclerosis therapeutics, driven by a combination of rising disease prevalence, rising product launches in APAC, and expanding healthcare infrastructure. While MS has historically been considered more prevalent in Western countries, recent epidemiological studies indicate a growing number of cases across China, India, Japan, and Southeast Asia, fueled by increased awareness, better reporting systems, and urbanization-related lifestyle factors.

Key drivers include the adoption of innovative FDA- and EMA-approved therapies, such as Ocrevus (ocrelizumab), Gilenya (fingolimod), Kesimpta (ofatumumab), and newer entrants like Tolebrutinib, which was recently approved in the UAE as the first oral treatment for progressive MS, indicating expanding access to advanced therapies in the region. For instance, in February 2024, Roche Pharma India, a subsidiary of the Swiss pharmaceutical giant Roche, launched monoclonal antibody drug, Ocrevus (ocrelizumab) in India for the treatment of multiple sclerosis. The company said Ocrevus is the first disease-modifying therapy (DMT) for both relapsing multiple sclerosis (RRMS) and primary progressive multiple sclerosis (PPMS) and targets 150,000-200,000 patients diagnosed with multiple sclerosis in India.

Europe Multiple Sclerosis Therapeutics Market Trends

The European multiple sclerosis therapeutics market is witnessing steady growth, driven by increasing disease prevalence, advancements in treatment options with novel product launches, and supportive healthcare infrastructure across the region. The high prevalence of MS in countries such as Germany, the United Kingdom, France, and Italy, combined with strong patient awareness and early diagnostic capabilities, has created a significant demand for disease-modifying therapies (DMTs).

Europe has seen several recent launches of innovative therapies that are driving market expansion. For instance, in October 2025, Neuraxpharm Group has launched Riulvy (tegomil fumarate) in Germany, marking the first European introduction of the next-generation oral fumarate therapy for relapsing-remitting multiple sclerosis (RRMS). Tegomil fumarate is designed to provide equivalent efficacy to existing fumarate treatments while improving gastrointestinal tolerability, a common concern with older oral therapies. The therapy is approved for use in adults and adolescents aged 13 and above. By addressing tolerability, Riulvy aims to support long-term adherence and offer neurologists more flexible treatment options for managing RRMS.

Similarly, in February 2024, Sandoz, the global leader in generic and biosimilar medicines, announced the launch of Tyruko (natalizumab) in Germany. Developed by Polpharma Biologics, Tyruko is the first and only biosimilar to treat RRMS. Tyruko is indicated as a single disease-modifying therapy (DMT) in adults with highly active RRMS. This is the same indication as approved by the European Commission for reference medicine Tysabri.

Competitive Landscape

Top companies in the multiple sclerosis therapeutics market include Biogen, Merck KGaA, Genentech USA, Inc., Novartis AG, Bristol-Myers Squibb Company, Genzyme Corporation (Sanofi), Teva Pharmaceuticals USA, Inc., TG Therapeutics, Inc., Vanda Pharmaceuticals, Inc., and Cycle Pharmaceuticals Limited, among others.

Market Scope

| Metrics | Details | |

| CAGR | 6.1% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Disease Type | Relapsing-Remitting MS (RRMS), Secondary-Progressive MS (SPMS), Primary-Progressive MS (PPMS), and Clinically Isolated Syndrome |

| Drug Class | Disease-Modifying Therapies (DMTs), Corticosteroids, Monoclonal Antibodies, and Others | |

| Route of Administration | Oral and Injectable | |

| Distribution Channel | Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global multiple sclerosis therapeutics market report delivers a detailed analysis with 70 key tables, more than 63 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here