Milking Robots Market Size

Global Milking Robots Market reached USD 2,289.28 million in 2024 and is projected to witness lucrative growth by reaching up to USD 5,923.29 million by 2030. The market is growing at a CAGR of 16.7% during the forecast period (2024-2031). In 2024, the global milking robots market witnessed growth, owing to the increase in the consumer demand for milk.

One of the major factors driving the trend is that more than half of all workers on dairy farms are immigrants and the country's hard-line policy stances are signaling that labor could be even harder to come by. Therefore, it is anticipated that robots can cut the number of workers on a dairy farm by 50%.

Market Summary

| Metrics | Details |

| CAGR | 16.7% |

| Size Available for Years | 2022-2031 |

| Forecast Period | 2025-2031 |

| Data Availability | Value (US$) |

| Segments Covered | Type, Herd Size, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

| Fastest Growing Region | Asia-Pacific |

| Largest Region | North America |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For more insights - Download Sample

Milking Robots Market Dynamics

Increasing consumer awareness about bthe enefits of milking robots

According to the data published by American Dairy Science Association in 2024, an increase in the milking robot trend and adoption he milking robots helps to reduce labor costs (84.6%), improve herd performance (73.1%), improve cow's welfare (76.9%), and reduce the number of employees (69.2%). It also helps to improve the life quality of cows (50%) and improve reproductive performance and milk production (36%). According to the article published by De Koning, it helps to increase 5-10% of milk production.

An increase in the production of milk globally creatan es opportunity

According to the data published by OECD-FAO Agricultural Outlook 2025-2031, world milk production (roughly 81% cow milk, 15% buffalo milk) increased by 1.1% to about 887 Mt in 2021, which is primarily driven byan increase in the dairy herd number in India and Pakistan. The amount of milk produced by the three biggest exporters of dairy products, New Zealand, the United States, and the European Union, varied from a minor increase to the upcoming season.

Milking Robots Market Segment Analysis

The global milking robots market is segmented based on type, herd size and region.

Increase in the large farm sizes worlwide

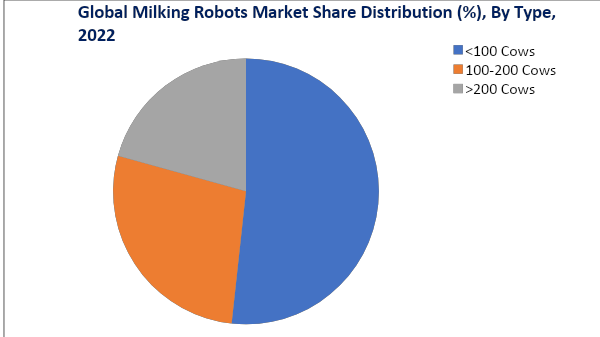

Milking robots have been segmented by herd size as <100 Cows, 100-200 Cows, and >200 Cows.

In 2022, >200 cows segment accounted for approximately 16.4% market share in the global milking robots market. >200 cows segment accounted for the largest market share of the milking robots, owing to the increase in the use of milking automation to reduce labor costs. A 24-bail internal herringbone rotary is used in the robotic rotary. Cows stand with their heads looking out and their rumps facing in at a 30-degree angle. The five centrally situated robots can approach the cows from the side thanks to the 30-degree angle.

Milking Robots Market Geographical Share

Owing to increase in the milk production in North America, there is rising demand for milking robots

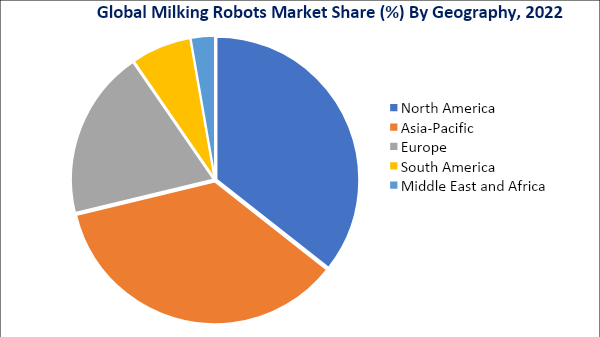

By region, the global milking robots market is segmented into North America, South America, Europe, Asia-Pacific, Middle-east and America.

In 2022, the North America region accounted for approximately 16.1% of the market share in the global milking robots market. Milk output increased slightly in Canada, despite a slowdown in milk deliveries due to labor constraints and plummeted milk sales in early 2022. In June 2021, The University of British Columbia (UBC) Dairy Education and Research Center partnered with GEA for research purposes. With the partnership, UBC would become the largest robotic milking research facility in North America with six GEA DairyRobot R9500 box robots.

Milking Robots Market Key Players

The major global players include GEA Group Aktiengesellschaft, Fullwood Packo, Lely, DeLaval, BouMatic, Dairymaster, Afimilk Ltd., Daritech Inc., E-Zee Milking Equipment, LLC, and Westmoor, Ltd.

Ukraine-Russia War

As in 2022, Russia continued to bomb power plants in Ukraine dairy farmers were using diesel generators for milking. Over a million homes and businesses in central and western Ukraine are currently without electricity. According to Ukraine's President Zelenskyy, the country's electrical infrastructure has suffered catastrophic damage to almost 40% of it.

In an effort to save energy, many cities around the country are experiencing blackouts that last up to four hours at a time. Cows still need to be milked, so a dairy farm near Kropyvnytskyi had been running on diesel generators for days to keep things going. The Ukraine-Russia War has negatively impacted the milking robots market.

Artificial Intelligence Impact Analysis

The employment of AI may bring about a revolution in the dairy sector, starting with dairy farms and ending with the plate of the customer. The majority of the work involved in dairy farm operations as well as in the processing sector for the preparation of dairy products can be automated with the use of AI technology, which may ultimately save time and money.

The dairy business may utilize a variety of AI applications, including those using robotics, drones, sensors, 3D printing, virtual reality, blockchains, and artificial neural networks.

Key Developments

- On July 07, 2022, Ams Galaxy Usa, which specializes in robotic milking, automatic calf feeding, robotic bedding, cow feed pushers, & complete robotic feeding solutions, launched next-generation automated milking solutions. The Galaxy Merlin2single G's box design gives the barn layout additional flexibility. The robot fits into any barn with ease and style thanks to its modern design.

- On August 22, 2022, DeLaval,a provider of integrated dairy solutions, launched the next-generation E-series rotary milking system for North America region. The integrated system reduces stress on dairy cattle while increasing milking productivity, streamlining worker tasks, automating cow selection and sorting, and automating worker routines.

- On September 06, 2022, Agrícola Ancali, a leading dairy importer in Chile, planned to grow up to 10,000 cows with 150 milking robots in the coming years. It currently produces 98.5 million liters of milk with milking robotics annually and hopes to increase production to 60 liters per cow in five years while also becoming net positive for emissions.

Why Purchase the Report?

- To visualize the global milking robots market segmentation based on type, herd size, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of milking robots market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key product of all the major players.

The global milking robots market report would provide approximately 53 tables, 41 figures and 195 Pages.

Target Audience 2025

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies