Micro Irrigation Systems Market Overview

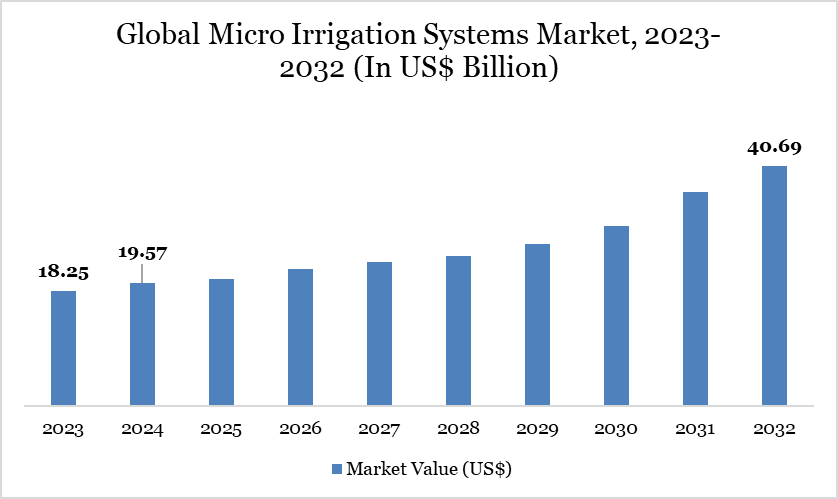

The global market for micro irrigation systems reached US$19.57 billion in 2024 and is expected to reach US$40.69 billion by 2032, growing at a CAGR of 9.8% during the forecast period 2025-2032.

The micro irrigation market is experiencing significant growth, driven by increasing demand for efficient water usage in agriculture amid growing water scarcity and climate change concerns. A study in the AGU journal Earth’s Future warns that over 80% of the world’s croplands will face increased water scarcity by 2050. This growing threat is accelerating global demand for micro irrigation systems, which offer efficient water use and improved crop resilience. Micro irrigation systems—such as drip and sprinkler systems help optimize water usage, improve crop yield and reduce labor and fertilizer costs.

Major drivers include climate variability, growing global food demand, rising awareness about sustainable farming and increasing government support. In April 2025, the government of Mexico announced a substantial investment of US$ 2.6 billion to modernize irrigation systems. This initiative aims to reduce agricultural water consumption, which currently accounts for about 76% of the country's total water use, by up to 50% through advanced irrigation technologies. This type of large public investment not only boosts domestic market growth but also sets a precedent for other water-stressed nations, reinforcing global momentum toward micro irrigation adoption.

For more details on this report, Request for Sample

Micro Irrigation Systems Market Trend

Key trends involve integrating IoT and AI for real-time irrigation management and expanding applications in fruit, vegetable and cash crop cultivation. Technological advancements such as smart irrigation systems and precision agriculture are transforming the market, improving water use efficiency and crop yields. For instance, in August 2024, Rivulis, a pioneer in micro-irrigation solutions, launched Rivulis AI, an advanced AI-powered platform designed to deliver tailored, expert guidance to farmers and irrigation professionals.

Additionally, the rise of precision farming techniques is complementing micro irrigation, enabling efficient resource management. With climate change intensifying drought conditions worldwide, micro irrigation presents a vital solution for sustainable agriculture and food security.

Market Scope

Metrics | Details |

By Product Type | Drip Irrigation Systems, Sprinkler Irrigation Systems and Mechanized Irrigation Systems |

By Crop Type | Field Crops, Vegetables, Arboreal Crops, Vineyards, Tropical and Subtropical Crops, Plantation Crops, Grass and Turf ornamental & Nursery Plants and Specialty and Medicinal Crops |

By Application | Open Field Cultivation, Greenhouse Hydroponics and Greenhouse Soil |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Micro Irrigation Systems Market Dynamics

Rising Water Scarcity and Efficient Water Use

Rising water scarcity is a critical global concern, with demand for freshwater far outpacing supply due to rapid population growth, urbanization and increased agricultural and industrial needs. Agriculture alone accounts for over 70% of global freshwater use, much of which is lost through inefficient irrigation methods. As water stress intensifies projected to affect two-thirds of the world’s population by 2025—governments and agricultural stakeholders are prioritizing efficient water use, positioning micro irrigation systems as a strategic solution.

Micro irrigation technologies, including drip and sprinkler systems, offer significant water-use efficiency by delivering precise amounts of water directly to plant roots. These systems reduce evaporation, runoff and overwatering, making them highly effective in drought-prone and water-scarce regions. In addition to conserving water, they enhance crop productivity and support sustainable farming practices, aligning with broader climate resilience goals and sustainable development objectives.

Government support through subsidies, infrastructure investments and public-private partnerships is further accelerating adoption, particularly in emerging economies. As a result, the micro irrigation systems market is experiencing strong growth, driven by both environmental necessity and policy incentives. Companies offering smart, affordable and scalable irrigation solutions are well-positioned to capitalize on this growing demand for sustainable water management in agriculture.

High Initial Investment and Maintenance Costs

The high initial investment required for micro irrigation systems continues to be a significant barrier, particularly for smallholder farmers and budget-conscious growers. Installation costs can range from US$300 to US$4,000 depending on the system type, with subsurface drip irrigation being the most expensive. Even converting existing sprinkler systems to drip irrigation can cost between US$300 and US$1,200 per irrigation zone, making affordability a key concern for large-scale and resource-limited users.

In addition to installation expenses, micro irrigation systems involve ongoing maintenance costs. Frequent issues such as clogging, component wear, filter replacement and system breakdowns increase operational complexity and cost over time. Although premade drip kits and DIY solutions offer cost-effective options for small-scale users, large farms still face high planning, installation and technical support costs, which can delay wider adoption.

While micro irrigation delivers long-term savings in water, fertilizer and labor, the upfront capital requirement often outweighs immediate financial benefits for many farmers, especially in developing regions. This challenge highlights the need for government subsidies, microfinancing solutions and affordable product innovations to make these systems accessible at scale. Without financial support and cost reduction strategies, the market may face growth limitations in price-sensitive segments.

Micro Irrigation Systems Market Segment Analysis

The global micro irrigation systems market is segmented based on product type, crop type, application and region.

Drip Irrigation Emerges as a Growth Catalyst in the Micro Irrigation Systems Market

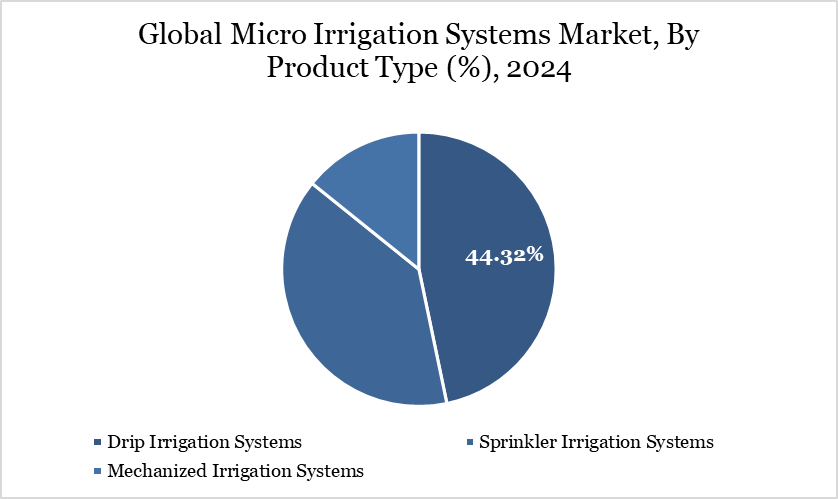

Drip irrigation accounts for a significant portion of the global micro irrigation systems market, covering approximately 44.32% of the total acreage under micro-irrigation. This segment is witnessing faster growth compared to sprinkler and mechanized systems, primarily due to its higher water-use efficiency, precise nutrient delivery and suitability across diverse crop types and climatic conditions. The rising emphasis on sustainable agriculture, water conservation and productivity enhancement is driving accelerated adoption of drip systems worldwide.

Within the drip irrigation segment, several product types are available to suit specific farming needs. These include Multiseasonal Driplines, Light Dripline (Seasonal), On-Line Drippers, Online Dripper + Manifold and the Capillar System. Among these, multiseasonal driplines lead the market, owing to their durability and ability to support long-term cultivation. According to DataM Intelligence, this segment held a value of US$ 5,956.04 million in 2024 and is projected to reach US$ 7,621.56 million by 2027, highlighting its growing preference among commercial and semi-commercial farmers.

Globally, multiseasonal driplines are predominantly used in open-field cultivation for a wide range of crop types, including arboreal crops, tropical plants and vineyards. Their robust design and consistent flow rate make them ideal for long-term perennial crops. Additionally, in greenhouse and hydroponic settings, multiseasonal driplines are widely adopted for flower cultivation, where controlled watering is critical to plant health and yield quality. As growers seek reliable and cost-effective solutions for both open-field and protected farming, demand for drip irrigation—particularly multiseasonal variants continues to rise, strengthening its role as a key driver in the overall micro irrigation systems market.

Micro Irrigation Systems Market Geographical Share

North America Strengthens Commitment to Efficient Agriculture Through Micro Irrigation Investments

North American micro irrigation systems market is experiencing steady growth, driven by the increasing need for water conservation, precision agriculture and higher crop productivity. According to DataM Intelligence, the total land area equipped with micro irrigation systems in North America reached 3.98 million hectares in 2023, reflecting the region’s significant investment in efficient water management practices.

Within North America, the US holds the dominant position in micro irrigation adoption. In 2024, the US micro irrigation systems market was valued at US$ 5,863.18 million and this figure is expected to grow to US$ 7,123.30 million by 2027. The adoption of Multi-seasonal driplines is particularly strong in the US, owing to their durability, long-term cost efficiency and compatibility with a variety of crops, including fruit orchards, vineyards and high-value specialty crops. American farmers are increasingly turning to these systems to enhance water-use efficiency and comply with sustainability initiatives.

Mexico also represents a growing market within the region. Valued at US$ 1,619.51 million in 2024, Mexico’s micro irrigation systems market is projected to reach US$ 2,219.95 million by 2027. The country is witnessing a rising shift toward drip and sprinkler systems, driven by the need to address water scarcity and improve agricultural yields, particularly in arid and semi-arid zones. As water resource challenges intensify across North America, both the US and Mexico are expected to continue investing in advanced micro irrigation solutions, positioning the region as a key contributor to the global market’s expansion.

Micro Irrigation Systems Market Competitive Landscape

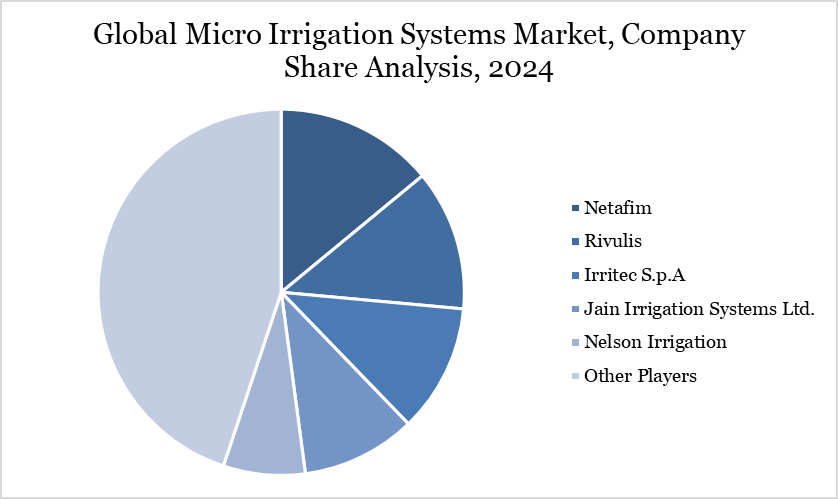

The major global players in the market include Netafim, Rivulis, Irritec S.p.A, Jain Irrigation Systems Ltd., Nelson Irrigation, Kothari Group, Ecoflo Irrigation, Antelco and Chinadrip Irrigation Equipment (Xiamen) Co., Ltd.

Key Developments

In April 2025, the government of Mexico announced a substantial investment of US$ 2.6 billion to modernize irrigation systems. This initiative aims to reduce agricultural water consumption, which currently accounts for about 76% of the country's total water use, by up to 50% through advanced irrigation technologies. This type of large public investment not only boosts domestic market growth but also sets a precedent for other water-stressed nations, reinforcing global momentum toward microirrigation adoption.

In August 2024, Rivulis, a pioneer in micro-irrigation solutions, launched Rivulis AI, an advanced AI-powered platform designed to deliver tailored, expert guidance to farmers and irrigation professionals.

In September 2023, Rivulis and Dragon-Line announced an exclusive distribution agreement for North America, covering the US, Mexico and Canada. Dragon-Line launched a new Mobile Drip Irrigation System based on a Rivulis-developed drip line, enabling farmers to convert center pivots from sprinklers to efficient drip irrigation. The partnership aims to revolutionize irrigation practices in the region with advanced micro-irrigation technology.

DMI Insights

The limited adoption of micro irrigation systems, with only 4% of farmers globally utilizing these technologies, is primarily due to high initial investment costs, limited awareness, lack of technical expertise and inadequate access to financing and infrastructure in many agricultural regions. Additionally, smallholder farmers, who make up a significant portion of the global farming community, often face financial and educational barriers that prevent them from transitioning to modern irrigation practices.

To increase adoption, Firstly, expanding government subsidies, low-interest loans and micro-financing programs can make micro irrigation systems more financially accessible, particularly for small and marginal farmers. Secondly, awareness and capacity-building initiatives such as farmer training, demonstration projects and field trials are critical to educating growers on the long-term benefits of micro irrigation.

Further, developing affordable, easy-to-install and low-maintenance drip and sprinkler kits will make these systems more attractive to cost-sensitive users. Collaborations between public and private sectors to strengthen distribution networks and provide technical support will also help bridge the accessibility gap and accelerate market penetration globally.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies