Military Robotics Market Size

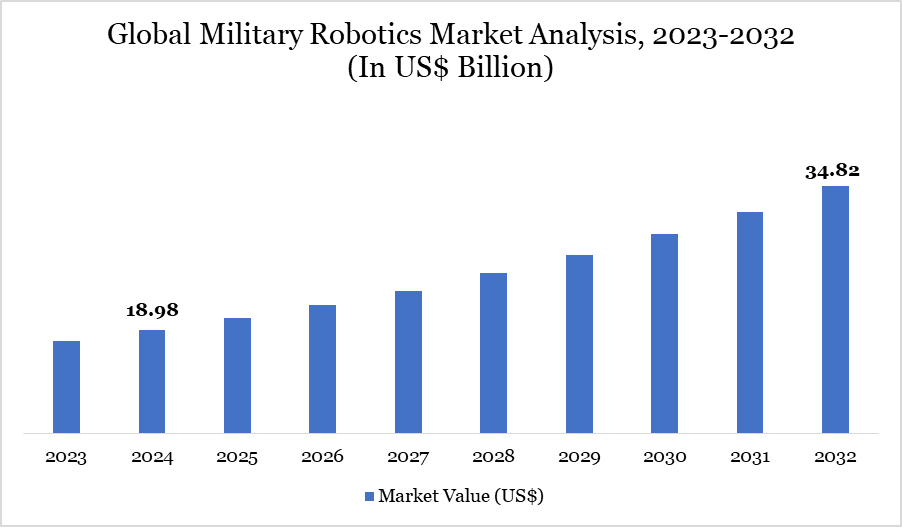

Global Military Robotics Market size reached US$ 18.98 billion in 2024 and is expected to reach US$ 34.82 billion by 2032, growing with a CAGR of 7.88% during the forecast period 2025-2032.

The growing use of cutting-edge technology to improve defense capabilities is fueling the notable expansion of the global military robotics market. Unmanned and autonomous systems are being adopted by militaries worldwide in an effort to lower deaths and increase operational effectiveness. Robotic systems for direct combat situations, monitoring, and reconnaissance are becoming more and more popular among governments and defense agencies.

Modern warfare is being revolutionized by the incorporation of artificial intelligence (AI) and machine learning (ML) into robotic systems, which allow for autonomous navigation, cooperative mission execution, and real-time decision-making. These intelligent platforms maximize mission outcomes with little human participation.

The defense industry views robots as a strategic asset in light of growing worries about border security, geopolitical tensions, and national security. Specifically, nations such as the US and India are investing large amounts of their defense expenditures in AI and robotics. For companies working in the field of military robotics, this is fostering a strong growth environment.

Military Robotics Market Trend

In the military robotics business, one of the most noticeable trends is the increasing use of AI-powered systems for intricate battlefield operations. In intelligence, surveillance, and reconnaissance (ISR) missions, where accuracy, speed, and flexibility are crucial, intelligent unmanned systems are being used more and more.

The Autonomous Tactical Light Armor System (ATLAS) and other autonomous unmanned ground vehicles (UGVs) are establishing new standards in modular mission flexibility, real-time route planning, and tactical decision support. These systems' autonomous threat detection and vital action capabilities are transforming military strategy.

Autonomous target identification and cooperative operations amongst several unmanned systems are gaining traction. These patterns suggest that defense objectives are changing, with autonomous and semi-autonomous systems becoming frontline assets rather than merely support tools. Scalable, mission-configurable robotic systems that can collaborate with soldiers and other unmanned systems in extremely dynamic threat settings are what defense forces are looking for.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details |

| By Platform | Airborne, Land, Naval |

| By Mode of Operation | Semi-Autonomous, Autonomous |

| By Mode of Propulsion | Electric, Mechanical, Hybrid |

| By Application | Intelligence, Surveillance, and Reconnaissance (ISR), Search and Rescue, Combat Support, Transportation, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Global Military Robotics Market Dynamics

Growing Need for Defense Operations' Autonomous Systems

The market for military robots is expanding due in large part to the rising demand for autonomous systems. For carrying out high-risk operations in harsh terrain and inclement weather, autonomous UGVs are proving to be invaluable. The exposure of human people to hazardous missions, like ISR, bomb disposal, and logistics in conflict areas, is greatly decreased by these self-operating robots.

Advanced autonomy is making it possible for systems like ATLAS to make tactical decisions and avoid obstacles without continual human supervision. They can adjust to quickly shifting threat landscapes because of their modularity, which guarantees adaptability across mission profiles. These devices may now participate in intricate battlefield engagements, such as cooperative missions and intelligent target detection, thanks to developments in AI and ML.

Autonomous robotic systems are becoming more and more popular as a cost-effective and risk-reducing option for countries looking to update their defense equipment. Their incorporation into defense plans positions them as a crucial tenet of next-generation warfare by enhancing combat capabilities and optimizing resource use.

Lack of Experienced UAV System Operators

The lack of qualified workers who can operate and maintain unmanned aerial vehicles (UAVs) is a major barrier to the military robotics business, despite its promising future. The demand for technically skilled operators who can carry out missions and decipher data produced by the system has increased as UAV technology advances.

The effectiveness and deployment rate of UAVs in defense operations are impacted by the present lack of such talent. Furthermore, scalability is further constrained by the high expense and duration of staff training. Lack of experience can cause operational mistakes, a higher chance of mishaps, and a lower level of mission dependability in military contexts, which can result in monetary losses and harm to one's reputation.

For nations with weak technical infrastructure and sluggish adoption of new technology, this problem becomes especially important. The establishment of specialist UAV training facilities, collaborations with academic institutions, and government programs centered on certification programs are essential to resolving this issue and ensuring the market's long-term viability.

Segment Analysis

The global military robotics market is segmented based on platform, mode of operation, mode of propulsion, application and region.

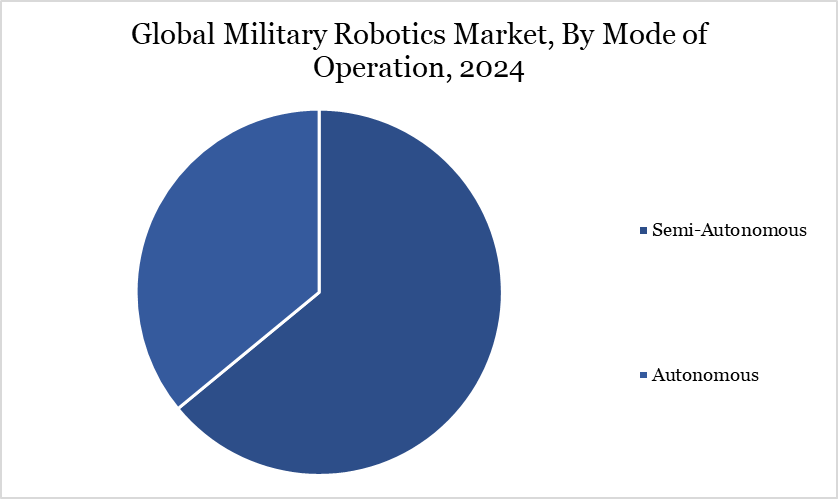

Semi-Autonomous Systems Driven by Ethical and Strategic Control Factors

The semi-autonomous mode of operation commands the biggest market share in the military robotics market because high-stakes defense activities require human control. Because of their capacity to strike a balance between ethical issues and technological growth, these systems are widely used throughout the world.

Semi-autonomous robots, as opposed to completely autonomous ones, permit human involvement in crucial decision-making, especially when it comes to target identification and weapon deployment. This strategy reduces the dangers of giving computers complete command over deadly activities, which is consistent with global norms and moral principles in robotic warfare, cybersecurity, and artificial intelligence (AI) warfare.

These systems are preferred by defense organizations because they provide improved safety, operational effectiveness, and adherence to military norms of conduct. Furthermore, without sacrificing accountability or control, their incorporation into contemporary military strategy offers enhanced capabilities in combat support, surveillance, and reconnaissance. The market position of semi-autonomous systems is further reinforced by the growing need for responsible AI in defense operations.

Market Geographical Share

Technology Developments and Strategic Investments

Growing defense spending and rising geopolitical tensions are driving the Asia-Pacific military robotics market's steady expansion. A significant emphasis on improving military capabilities, particularly investments in autonomous systems and cutting-edge robotics, is reflected in this budget rise. Intelligent robotic systems are being deployed as a result of countries in the region placing a higher priority on marine surveillance, border security, and counterterrorism efforts.

In order to create domestic robotic solutions, governments are also working with regional military companies and tech entrepreneurs. Innovation in AI, ML, and sensing technologies that are suited to particular defense requirements is being made possible by the regional emphasis on technical independence.

In Asia-Pacific, the growing use of unmanned ground and aerial systems is in line with worldwide patterns while simultaneously tackling particular regional issues such rugged terrain, crowded urban areas, and extensive marine borders. This establishes the area as a military robotics strategic growth frontier.

Technological Analysis

The development of the military robotics market is largely dependent on technological breakthroughs. High degrees of autonomy, adaptability, and intelligence in defense systems are made possible by the incorporation of AI and machine learning into robotic platforms. Complex tasks including autonomous navigation, obstacle detection, swarm coordination, and real-time decision-making are all within the reach of modern military robots.

The development of ATLAS and other similar systems is an example of how robotics technology is being adapted to carry out vital tasks in dangerous situations with little assistance from humans. Additionally, by switching out sensors, weaponry, or support gear, these systems may quickly adapt to new missions.

In order to improve strategic efficacy, collaboration capabilities are being improved to enable the coordination of various unmanned systems. The use of technologies like real-time data analytics, sophisticated perception systems, and human-machine interfaces (HMI) is growing quickly.

Military Robotics Companies

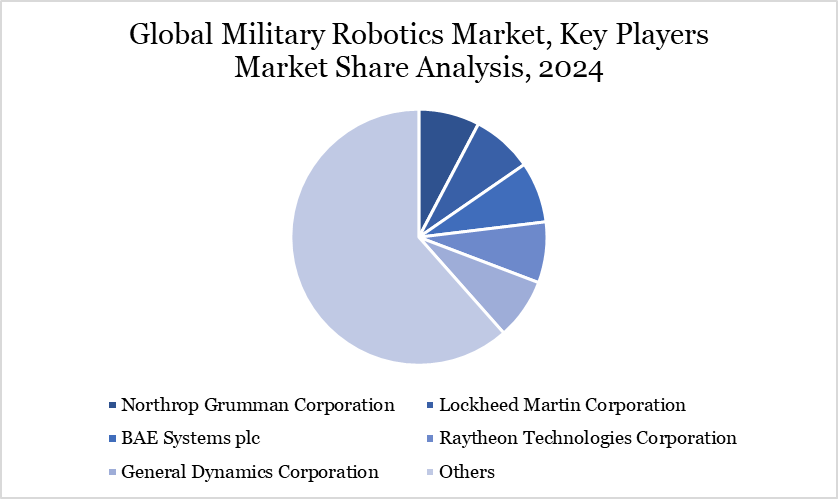

The major global players in the market include Northrop Grumman Corporation, Lockheed Martin Corporation, BAE Systems plc, Raytheon Technologies Corporation, General Dynamics Corporation, Thales Group, Elbit Systems Ltd., QinetiQ Group plc, iRobot Defense & Security, Turkish Aerospace Industries (TAI).

Key Developments

- In September 2024, Boeing and Sagar Defence Engineering inked a deal to work together on unmanned vehicle production. This agreement supports the development of advanced unmanned systems and demonstrates Boeing's commitment to growing its market share in India. It supports larger initiatives to promote technological collaboration and innovation between the US and India in the aerospace and military industries.

- In April 2024, to advance unmanned aerial system technologies, IAI (Israel) and Aerotor Unmanned Systems (Israel) inked a Memorandum of Understanding. Aerotor will incorporate its Apus multicopter, which has a variable-pitch mechanism and a core heavy-fuel propulsion system, while IAI will draw on its experience in aviation and unmanned platforms.

- In February 2024, the Canadian Department of National Defence awarded Teledyne FLIR LLC (US) a contract to purchase 800+ SkyRanger R70 UAS, with a total contract value surpassing CAD 95. For long-range target detection and identification, these UASs are outfitted with thermal and daylight optical sensors as well as autonomous navigation. Canada will donate the SkyRanger R70 drones to Ukraine, which are capable of carrying a variety of payloads weighing up to 3.5 kg, including bombs.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies