Metabolism Drugs Market – Industry Trends & Overview

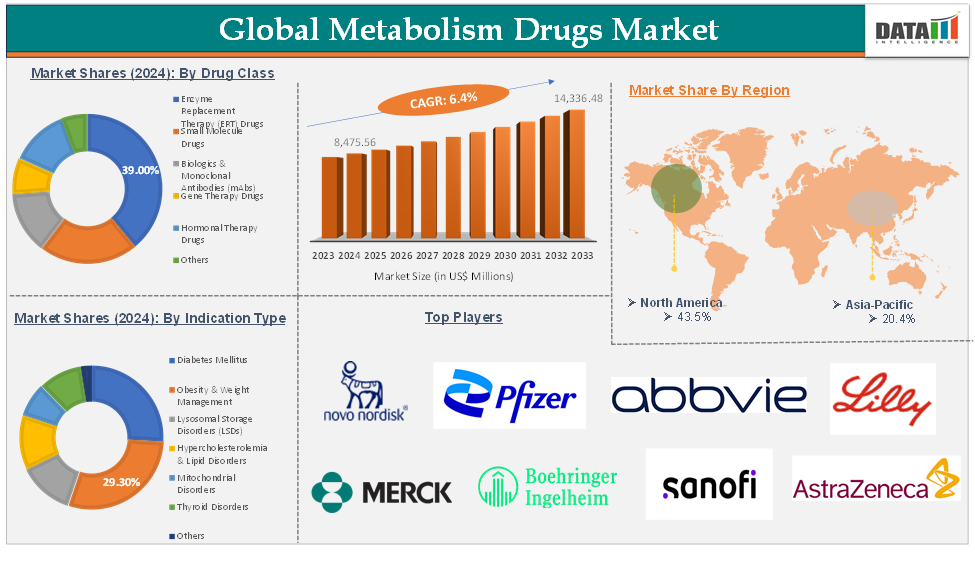

Metabolism Drugs Market reached US$ 8,475.56 Million in 2024 and is expected to reach US$ 14,336.48 Million by 2033, growing at a CAGR of 6.4% during the forecast period 2025-2033.

Metabolism drugs are a class of medications that work to modify or influence the body's metabolic processes. Metabolism refers to the complex network of chemical reactions that occur within cells to convert food into energy, build and repair tissues, and regulate bodily functions. Metabolic processes are essential for maintaining health, and when these processes are disrupted, various health conditions can arise, such as diabetes, obesity, thyroid disorders, and metabolic syndrome.

The global metabolism drugs market comprises a wide array of pharmaceutical products designed to regulate and influence metabolic processes in the body, addressing conditions such as diabetes, obesity, thyroid disorders, and rare metabolic diseases.

Market growth is primarily driven by the rising prevalence of metabolic disorders worldwide, fueled by factors like sedentary lifestyles, aging populations, and increasing awareness of metabolic health. Technological advancements, such as personalized medicine, novel drug delivery systems, and ongoing R&D investments, are enabling the development of more effective and targeted therapies, further accelerating market expansion.

Opportunities in this sector include the emergence of innovative therapies through biotechnology and gene editing, strategic collaborations between pharmaceutical companies and research centers, and the expansion of e-commerce and direct-to-consumer sales channels, which enhance patient access to medications. Key trends shaping the market include the growing focus on preventive healthcare, early diagnosis, and the integration of digital health solutions, alongside regional growth in Asia-Pacific due to increasing healthcare infrastructure and awareness.

Executive Summary

For more details on this report – Request for Sample

Metabolism Drugs Market Dynamics: Drivers

Growing prevalence of metabolic disorders

The growing prevalence of metabolic disorders worldwide has become a significant public health challenge. Metabolic disorders, which include conditions like obesity, diabetes, hyperlipidemia, and metabolic syndrome, are increasingly common due to factors such as poor dietary habits, sedentary lifestyles, and rising levels of stress.

Metabolism drugs have become a cornerstone in the treatment of these disorders. These drugs target various aspects of metabolism, including blood sugar regulation, fat metabolism, and appetite control. For instance, medications like GLP-1 receptor agonists (e.g., Ozempic) and SGLT2 inhibitors (e.g., Jardiance) are used to manage blood sugar levels and promote weight loss in individuals with diabetes and obesity.

Similarly, statins and PCSK9 inhibitors help regulate cholesterol and prevent cardiovascular events. With the increasing prevalence of metabolic disorders, the development and use of metabolism drugs are essential for managing these conditions effectively, improving patient quality of life, and reducing the long-term health burden.

Additionally, major players in the industry are investing in technological advancements that would drive this market growth. For instance, in April 2024, Metsera, Inc. is a biopharmaceutical company focused on creating next-generation medicines for obesity and metabolic diseases. Population Health Partners and ARCH Venture Partners, the company is based in New York City. Metsera has secured over $500 million in funding from healthcare investors.

Also, in February 2024, Optibrium, a company specializing in software and AI for drug discovery, launched Semeta, a platform designed for drug metabolism and pharmacokinetics (DMPK) scientists. Semeta helps predict Phase I and II metabolic routes, sites, products, and liabilities during early drug discovery with greater precision than other similar software. All these factors demand the global metabolism drugs market.

Global Metabolism Drugs Market Dynamics: Restraints

High cost of drug development & treatment

The high cost of drug development and treatment is one of the most significant challenges facing the healthcare industry today. Developing a new drug can take many years, often exceeding a decade, and cost billions of dollars. This includes the lengthy research and clinical trial phases, as well as the costs associated with regulatory approvals and manufacturing.

However, the cost of developing these drugs remains a significant barrier to making them widely available. For instance, therapies like Mounjaro and Ozempic, which address both blood sugar regulation and weight loss, come with high price tags, despite their potential benefits.

With the rising prevalence of metabolic disorders and the need for continuous care, the economic burden on patients, healthcare systems, and governments is expected to increase unless solutions to lower drug costs and improve access are found. This situation underscores the need for more cost-effective drug development strategies and the implementation of policies to make these treatments more accessible to a broader population. Thus, the above factors could limit the growth of the global metabolism drugs market.

Metabolism Drugs Market Segment Analysis

The global metabolism drugs market is segmented based on drug class, indication type, route of administration, distribution channel, and region.

Drug Class:

The enzyme replacement therapy (ERT) drug class segment is expected to hold 39.0% of the global metabolism drugs market in 2024

Enzyme replacement therapy (ERT) drugs are a vital segment within the broader metabolic drug market, especially for rare metabolic disorders that result from enzyme deficiencies. These therapies aim to replace or supplement the missing or malfunctioning enzymes in patients' bodies, helping to manage conditions that are often life-threatening or severely debilitating.

ERT is particularly important in the treatment of lysosomal storage disorders (LSDs), a group of rare diseases caused by the inability to break down specific molecules due to enzyme deficiencies. Conditions such as Fabry disease, Gaucher disease, and Pompe disease fall into this category, and they often lead to severe symptoms involving organ damage, muscle weakness, and neurological decline.

The enzyme replacement therapy market for metabolic disorders is expected to grow as awareness of rare diseases increases and as new therapies enter the market. Pombiliti and Opfolda for Pompe disease and Cerdelga for Gaucher disease are examples of ERT treatments that have gained approval in recent years, contributing to the segment’s expansion.

Additionally, key players in the industry are focusing more on the research activities that would propel this segment’s growth in the global metabolism drugs market. For instance, in December 2024, Chiesi Global Rare Diseases, a division of the Chiesi Group that focuses on developing therapies for rare diseases, announced the publication of the results from the Phase 3 BRIGHT study of ELFABRIO (pegunigalsidase alfa-ix). This study tested a higher dose of ELFABRIO, specifically 2 mg/kg, administered every four weeks for 52 weeks, in adult patients with Fabry disease.

Also, in October 2024, Inozyme Pharma, a clinical-stage biopharmaceutical company focused on developing treatments for rare diseases affecting bone health and blood vessel function, announced positive interim data from its ongoing Phase 1 SEAPORT 1 trial. This trial is evaluating INZ-701, a therapeutic candidate, in patients with end-stage kidney disease (ESKD) who are undergoing hemodialysis. These factors have solidified the segment's position in the global metabolism drugs market.

Metabolism Drugs Market Geographical Analysis

North America is expected to hold 43.5% of the global metabolism drugs market in 2024

The North American metabolism drugs market is experiencing significant growth, driven by the increasing prevalence of metabolic disorders, advancements in medical research, and the rising demand for innovative therapies. Metabolic disorders, such as obesity, diabetes, hyperlipidemia, and metabolic syndrome, are becoming more widespread in North America due to factors like unhealthy diets, sedentary lifestyles, and aging populations.

According to the Centers for Disease Control and Prevention (CDC), more than 34 million people in the United States are living with diabetes, with many more at risk due to obesity and related conditions. This growing burden of metabolic diseases has led to an increased demand for drugs that can regulate blood sugar levels, aid in weight loss, and manage cholesterol and triglyceride levels.

Additionally, key players’ strategies such as partnerships, collaborations, and investments would drive this global metabolism drugs market growth. For instance, in October 2024, Amneal Pharmaceuticals and Metsera entered into a partnership aimed at developing new weight loss medicines for global markets. Amneal, a global pharmaceutical company, is known for producing generic drugs and specialty medicines. Metsera, on the other hand, is a clinical-stage biopharmaceutical company focused on advancing treatments for obesity and metabolic diseases. Thus, the above factors are consolidating the region's position as a dominant force in the global metabolism drugs market.

Asia Pacific is expected to hold 20.4% of the global metabolism drugs market in 2024

The Asia-Pacific metabolism drugs market is also experiencing notable growth, driven by the increasing prevalence of metabolic disorders, evolving healthcare infrastructure, and rising awareness about chronic diseases. The region, which includes diverse countries with varying levels of development, is facing a rapid rise in conditions like obesity, diabetes, cardiovascular diseases, and metabolic syndrome.

According to the International Diabetes Federation (IDF), approximately 90 million people in the Asia-Pacific region are living with diabetes, and this number is expected to increase significantly in the coming years. The combination of urbanization, changing dietary patterns, and sedentary lifestyles is contributing to the rise in these metabolic conditions, creating a growing need for effective medications to manage them.

Additionally, key players in the industry are investing in innovative launches that would drive this global metabolism drugs market growth. For instance, in October 2024, Kailera Therapeutics launched with $400 million in funding to develop next-generation weight-loss drugs, licensing its portfolio from Jiangsu Hengrui Pharmaceuticals. The company’s lead drug candidate, HRS9531 (renamed KAI-9531), is a dual GLP-1/GIP receptor agonist that has shown promising results in a Phase 2 clinical trial conducted in China.

Also, in December 2024, Eli Lilly is set to launch Mounjaro, a weekly injectable drug, in India next year. Mounjaro is designed to treat both type 2 diabetes and obesity, making it a dual-purpose medication. It works by targeting certain hormones to control blood sugar and help patients lose weight, offering significant benefits for individuals with these two common conditions. Thus, the above factors are consolidating the region's position as the fastest-growing force in the global metabolism drugs market.

Metabolism Drugs Market Major Players

The major global players in the metabolism drugs market include Novo Nordisk, Eli Lilly and Company, Merck & Co., Inc., Sanofi, AstraZeneca, Pfizer Inc., Johnson & Johnson Services, Inc., Boehringer Ingelheim International GmbH, Merck KGaA, and AbbVie Inc., among others.

Key Developments

In March 2025, Eli Lilly introduced Mounjaro (tirzepatide) in India, marking a significant advancement in the treatment of metabolic conditions such as type 2 diabetes and obesity. Mounjaro is a once-weekly injectable medication that stands out because it is a dual-action drug, it is designed to activate both the GIP (glucose-dependent insulinotropic polypeptide) and GLP-1 (glucagon-like peptide-1) receptors. These two hormones play key roles in regulating blood sugar levels and metabolism.

In January 2025, Verdiva Bio launched with $411 million in Series A financing to develop a once-weekly oral GLP-1 receptor agonist for obesity and weight loss. The drug, known as VRB-101, was licensed by Sciwind Biosciences and is designed for weekly oral administration, unlike most oral GLP-1 drugs that require daily dosing.

In December 2024, Eli Lilly launched Mounjaro, a weekly injectable drug, in India. Mounjaro is designed to treat both type 2 diabetes and obesity, making it a dual-purpose medication. It works by targeting certain hormones to control blood sugar and help patients lose weight, offering significant benefits for individuals with these two common conditions.

In October 2024, Kailera Therapeutics launched with $400 million in funding to develop next-generation weight-loss drugs, licensing its portfolio from Jiangsu Hengrui Pharmaceuticals. The company’s lead drug candidate, HRS9531 (renamed KAI-9531), is a dual GLP-1/GIP receptor agonist that has shown promising results in a Phase 2 clinical trial conducted in China.

Market Scope

Metrics | Details | |

CAGR | 6.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Drug Class | Enzyme Replacement Therapy (ERT) Drugs, Small Molecule Drugs, Biologics & Monoclonal Antibodies (mAbs), Gene Therapy Drugs, Hormonal Therapy Drugs, Others |

Indication Type | Diabetes Mellitus, Obesity & Weight Management, Lysosomal Storage Disorders (LSDs), Hypercholesterolemia & Lipid Disorders, Mitochondrial Disorders, Thyroid Disorders, Others | |

Route of Administration | Oral, Injectable, Topical | |

Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |