Orphan Drugs Market Size

The Global Orphan Drugs Market reached US$ 223.76billion in 2023 and is expected to reach US$ 486.51 billion by 2032, growing at a CAGR of 9.1% during the forecast period 2024-2032.

Orphan drugs are the medication indicated to treat, prevent, or diagnose an orphan disease. As per the U.S. Food and Drug Administration (FDA), orphan disease is a rare condition with less than 200,000 patients in the country. According to the European Medicine Agency, a disease is defined as rare if it affects fewer than 5 in 10,000 people across the European Union.

The World Health Organization defines a rare disease or an orphan disease as one that affects fewer than 65 per 100,000 people. As per Orphanet, orphan designation is a legal procedure that allows for the designation of a medicinal substance with therapeutic potential for a rare disease, before its first administration in humans or during its clinical development.

However, Developing orphan drugs is less financially attractive for pharmaceutical companies due to the limited patient size, and less market potential. To encourage the development of these novel therapies, governments and regulatory bodies across the globe offer incentives like tax credits, market exclusivity, and expedited regulatory approval.

Executive Summary

For more details on this report – Request for Sample

Market Dynamics: Drivers & Restraints

Rising Novel Drug Development Activities and Orphan Drug Designations

As the demand for advanced therapeutics continues to rise among patients with rare diseases, manufacturers are actively involved in developing these novel drugs to cater to the high unmet needs. The regulatory bodies across the world have been continually supporting the manufacturers considering the high unmet needs, and providing orphan drug designations and accelrated approvals to these new drugs.

For instance, in February 2024, the U.S. Food and Drug Administration (FDA) granted orphan drug designation for olezarsen developed by Ionis Pharmaceuticals, Inc. Olezarsen is an investigational drug aimed at the treatment of familial chylomicronemia syndrome (FCS) which is a rare, genetic disease characterized by extremely elevated triglyceride levels and recurrent acute pancreatitis (AP). Ionis states that If approved, olezarsen has the potential to be the standard of care in the U.S. for the treatment of FCS. In January 2023, the drug has already received Fast Track Designation from the U.S. FDA.

Moreover, in October 2024, Kind Pharmaceuticals LLC announced that the U.S. Food and Drug Administration (FDA) has granted orphan drug designation to AND017 in the treatment of Sickle Cell Disease (SCD). AND017 is a first-in-class hemoglobin-elevating agent that targets multiple stages of the red blood cell (RBC) life cycle. Kind Pharmaceuticals states that the orphan drug designation to AND017 underscores the urgent medical need for new therapies, particularly oral drugs to safely and effectively treat patients with SCD.

These increasing Product development activities and orphan drug designations are expected to create significant traction in various therapeutic areas with high unmet needs and propel the overall market growth.

The high cost of orphan drugs may restrain the market growth.

Orphan drugs, although revolutionizing the treatment scenario for several rare diseases, their high cost may restrain the adoption rate, especially among low to middle-income patients. For instance, as per Drugs.com the list price of Spinraza is $750,000 for the first year and then $350,000 in later years. Spinraza is an alternative drug to Zolgensma for the treatment of patients with spinal muscular atrophy (SMA). The same drug costs approximately INR 7 million in India, where the majority of the patients lack proper medical insurance.

Market Segment Analysis

The global orphan drugs market is segmented based on product type, therapy area, and region.

Oncology is dominating the therapy area segment of the orphan drugs market with the highest market share.

Oncology is the most widely explored indication for orphan drugs, due to high unmet needs for various types of rare cancers. Majority of the current approved orphan drugs are aimed for rare cancer treatments. For instance below is the list of top-selling orphan drugs with different types of cancers as their major indications. The top 5 selling orphan drugs for oncology accounted for nearly US$24.2 billion in 2023.

| Sr. No | Drug | Indication | Sales Value (2023) in Milion |

| 1 | Darzalex | Multiple Myeloma | 9,744.00 |

| 2 | Imbruvica | Chronic Lymphocytic Leukemia (CLL)/Small Lymphocytic Lymphoma (SLL) | 6,860.00 |

| 3 | Lynparza | Multiple Cancers | 2,811.00 |

| 4 | Calquence | Mantle Cell Lymphoma (MCL), Chronic Lymphocytic Leukemia (CLL)/Small Lymphocytic Lymphoma (SLL) | 2,514.00 |

| 5 | Venclexta | Chronic Lymphocytic Leukemia (CLL) Or Small Lymphocytic Lymphoma (SLL), Acute Myeloid Leukemia (AML) | 2,288.00 |

Market Geographical Share

North America is expected to hold a significant share of the orphan drugs market.

North America dominates the market for orphan drugs and is expected to show a similar trend over the forecast period. The factors contributing to the region’s dominance include the advanced healthcare system, government initiatives, and the strong presence of many market players. The FDA Office of Orphan Products Development approves orphan drug designation for novel drugs and biologics that are used for the safe and effective treatment, diagnosis, and prevention of rare diseases or disorders that affect fewer than 200,000 people in the United States. The designation allows key players to qualify for various incentives, including tax credits for qualified clinical trials and, upon regulatory approval, 7 years of market exclusivity.

Moreover, all the manufacturers of orphan drugs majorly operate in the region, generating higher sales, especially from the U.S. Below is the list of top 5 selling orphan drugs and their revenue share from the U.S.

| Sr. No | Drug | Sales Value (2023) in Milion | U.S. Share |

| 1 | Darzalex | 9,744.00 | 54.16% |

| 2 | Trikafta/Kaftrio | 8,944.70 | 61.20% |

| 3 | Imbruvica Total | 6,860.00 | 54.17% |

| 4 | Lynparza | 2,811.00 | 44.61% |

| 5 | Calquence | 2,514.00 | 72.20% |

This represents the dominance of North America, especially the U.S. in the global market for orphan drugs.

Competitive Landscape

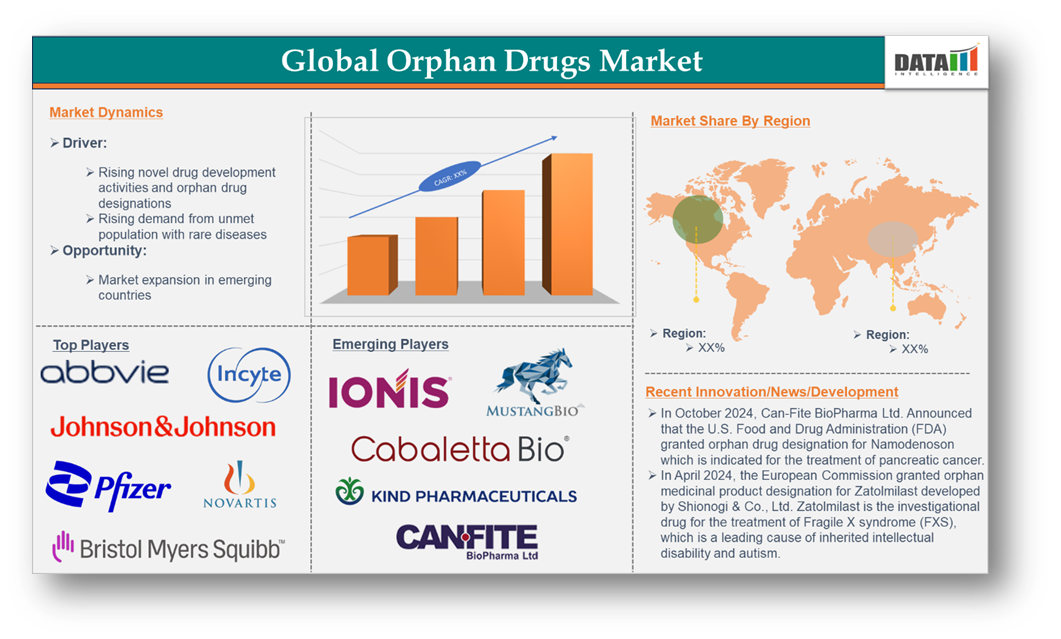

The major global players in the orphan drugs market are Johnson & Johnson Services, Inc., AbbVie Inc., Vertex Pharmaceuticals Incorporated, AstraZeneca., Incyte., Biogen., Novartis AG, F. Hoffmann-La Roche Ltd, Pfizer Inc., and Bristol-Myers Squibb Company among others.

Key Developments

- In October 2024, Can-Fite BioPharma Ltd. Announced that the U.S. Food and Drug Administration (FDA) granted orphan drug designation for Namodenoson which is indicated for the treatment of pancreatic cancer.

- In April 2024, the European Commission granted orphan medicinal product designation for Zatolmilast developed by Shionogi & Co., Ltd. Zatolmilast is the investigational drug for the treatment of Fragile X syndrome (FXS), which is a leading cause of inherited intellectual disability and autism.

Emerging Players

The emerging players in the orphan drugs market include Can-Fite, Mustang Bio, Kind Pharmaceuticals LLC, Cabaletta Bio, Inc. and Ionis Pharmaceuticals, Inc. among others.

| Metrics | Details | |

| CAGR | 9.1% | |

| Market Size Available for Years | 2022-2032 | |

| Estimation Forecast Period | 2024-2032 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Product Type | Small Molecules, Biologic Drugs, Others |

| Therapy Area | Oncology, Hematology Diseases, Central Nervous System, Cardiovascular, Endocrine, Respiratory, Immunologic Conditions, Gastro-Intestinal, Musculoskeletal, Dermatology and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, and Product Type pipelines, and forecasts upcoming pharmaceutical advancements.

- Product Type Performance & Market Positioning: Analyzes Product Type performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into Product Type development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient Product Type delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance Product Type safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global Orphan drugs market report would provide approximately 54 tables, 50 figures, and 179 pages.

Target Audience 2024

- Manufacturers: Pharmaceutical, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.