Memory Integrated Circuits Market is segmented By Type (DRAM, Flash), By Application (Laptop, Camera and Others), By End-User (Consumer Electronics, Automotive, IT and Telecom, Aerospace and Defense and Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2023-2030

Market Overview

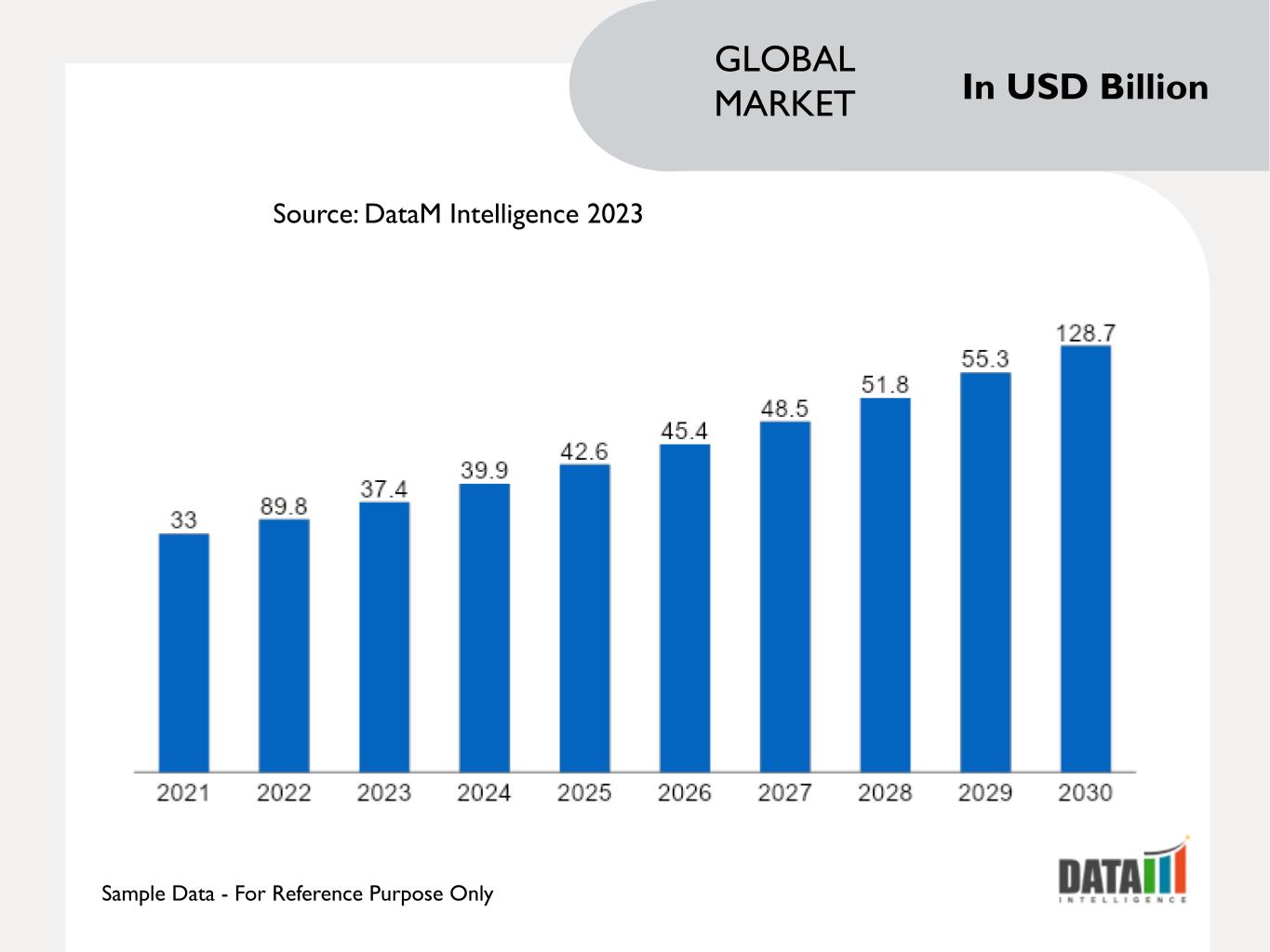

The Global Memory Integrated Circuits Market reached US$ 89.8 billion in 2022 and is expected to reach US$ 128.7 billion by 2030, growing with a CAGR of 8.9% during the forecast period 2023-2030.

The demand for more rapid memory and higher capacity of memory integrated circuits drives the market as there is exponential growth in the generation of data, storage of data and processing across various sectors such as cloud computing , data centers and IoT devices. The deployment of 5G networks will accelerate the adoption of linked devices and IoT applications. Memory ICs play a vital role in supporting the data requirements of 5G networks and devices.

For technologies like autonomous driving, information systems and advanced driver-assistance systems (ADAS), the vehicle industry is adopting more sophisticated electronics, including memory integrated circuits (ICs). In order to keep keeping up with the rising demand for cloud services, data centers are constantly developing. High-capacity and energy-efficient memory ICs are essential for data center infrastructure.

In 2022, North America is expected to be the second dominant region in the global market covering more than 1/4th of the market. The demand for high-performance memory solutions is driven by the necessity of memory ICs in data storage and processing systems and the ongoing growth of data centers. The region has major consumer for electronics, including smartphones, gaming consoles and wearable devices and these products depend on memory ICs for storage and performance, leading to consistent demand.

Market Scope

|

Metrics |

Details |

|

CAGR |

8.9% |

|

Size Available for Years |

2021-2030 |

|

Forecast Period |

2023-2030 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Type, Application, End-User and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle East & Africa |

|

Fastest Growing Region |

Asia-Pacific |

|

Largest Region |

Asia-Pacific |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

Market Dynamics

Rising Proliferation of Smartphones

Smartphone manufacturers release new models with enhanced features regularly. As consumers upgrade to newer smartphones, the demand for memory components remains strong and this cycle of upgrades and replacements sustains the demand for memory-integrated circuits. The global reach of smartphones means that the demand for memory integrated circuits is not limited to specific regions. Smartphone manufacturers serve diverse markets worldwide, further boosting demand.

For instance, on 8 September 2023, the recent launch of Huawei's Mate 60 Pro 5G phone has drawn attention to China's advancements in semiconductor manufacturing technology. Despite challenges related to export restrictions, Huawei managed to produce a 5G system-on-chip (SoC) using SMIC's 7-nm process node, even without access to extreme ultraviolet (EUV) lithography equipment. Huawei's memory chip sourcing remain a topic of speculation, it's possible that the company acquired memory chips from secondary markets.

Rising Adoption of 5G Network

More data is transported and processed in less time because of 5G networks' much faster data speeds and capacity than those of their forerunners. Memory-integrated circuits are essential for effectively storing and managing this data. A key element of 5G networks is edge computing, which moves data processing closer to the data source. For data storage and processing at the edge, memory-integrated circuits are necessary because they enable quicker response times and less reliance on centralized data centers.

For instance, on 23 June 2022, EdgeQ, a startup founded by former Qualcomm executives, is making strides in the 5G private network sector. The company plans to introduce its first chip for 5G private networks in the middle of this year. EdgeQ's focus on compact and efficient chip solutions aligns with the broader trends in the semiconductor industry. Memory-integrated circuits play a critical role in the functionality and performance of telecommunications equipment, including 5G infrastructure.

Increasing Demand for Data Storage Applications

The proliferation of data generated by businesses organizations and individuals requires efficient storage solutions. In order to store and retrieve this enormous amount of data for analytics and decision-making, memory ICs are essential. High-performance memory integrated circuits (ICs) are utilized in data center servers, storage products and networking equipment and are required by businesses and data center operators to maintain their operations.

For instance, on 3 November 2022, Micron's LPDDR5X memory, based on the 1β technology, benefits mobile devices, especially smartphones. It enables quicker download speeds, enhances camera functionalities (e.g., night mode, high-resolution video recording) and supports data-heavy 5G and AI applications and this technology is essential for storing and processing large volumes of data in mobile devices.

Data Integrity and Cyber Threat

Memory ICs can generate heat during operation, especially in high-performance systems. Efficient heat dissipation is crucial to prevent overheating. Designing and integrating memory ICs into electronic systems can be complex, requiring careful consideration of factors like compatibility, power management and data integrity. Memory ICs, like all electronic components eventually reach the end of their operational life.

Even if memory ICs have become more quickly over time, systems with high-speed processors and storage might still experience data transfer bottlenecks. When upgrading or maintaining older devices, outdated memory ICs might not be compatible with newer systems. Protecting data stored in memory from physical and cyber threats is an ongoing concern. Memory ICs can be vulnerable to attacks.

To know more insights - Request for Sample

Segment Analysis

The global memory integrated circuits market is segmented based on type, application, end-user and region.

Advancement in Manufacturing of DRAM

In 2022, DRAM is expected to be the dominant segment in the global market covering around 1/3rd of the market. Advancements in DRAM manufacturing processes, including the development of smaller nanometer nodes, allow for higher memory density and improved energy efficiency and this drives innovation and cost reduction in DRAM production. Modern vehicles are equipped with advanced electronics and infotainment systems, requiring DRAM for fast data access.

For instance, on 25 September 2023, US$ 2.75 billion semiconductor facility is being built by Micron Technology in Gujarat, India. The building will be situated in the Gujarat Industrial Development Corporation's industrial area in Sanand, close to Ahmedabad and is anticipated to be finished by December 2024. Tata Projects has been selected to establish the assembly and test facility, focusing on transforming wafers into ball-grid array (BGA) integrated circuit packages, memory modules and solid-state drives.

Geographical Penetration

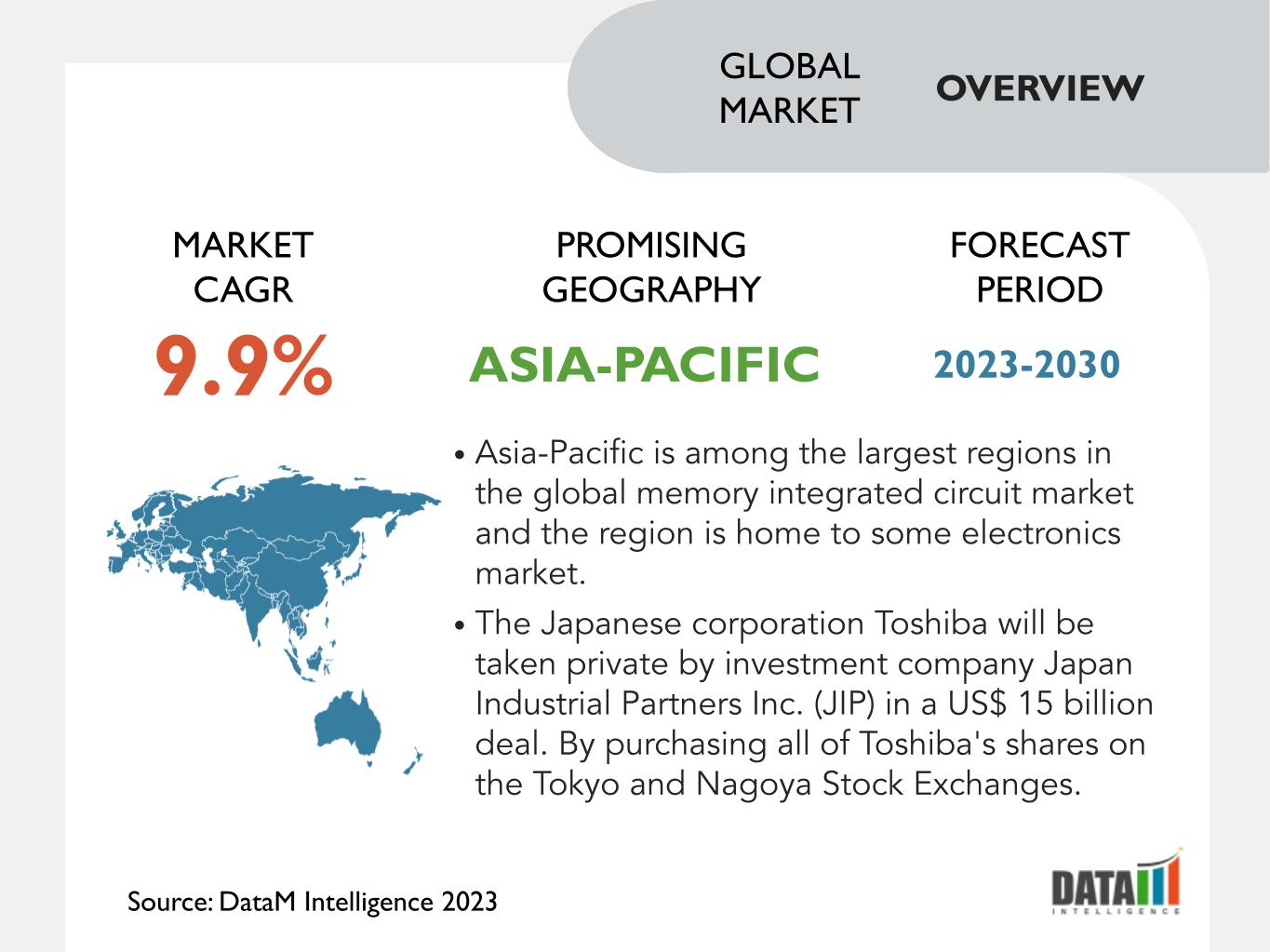

Rising Investments and Competitive Strategies Adoption in Asia-Pacific

Asia-Pacific is the second dominant region in the global memory integrated circuits market covering about 1/4th of the market. Asia-Pacific is the largest region in the global memory integrated circuit market and the region is home to some electronics market. As growing population and increasing disposal income that led to increased demand for smartphones, laptops and tablets. Many countries in the region experienced rapid industrialization which led to increased demand for control systems and industrial automation.

For instance, on 24 March 2023, the Japanese corporation Toshiba will be taken private by investment company Japan Industrial Partners Inc. (JIP) in a US$ 15 billion deal. By purchasing all of Toshiba's shares on the Tokyo and Nagoya Stock Exchanges, TBJH Inc., an indirect subsidiary of JIP, will privatize the business. Despite the price being slightly below the lower limit of the share value range. But Toshiba stills has a stake in the memory chip.

Competitive Landscape

The major global players in the market include Microchip Technology, Samsung, Fujitsu Ltd, Micron, Sk Hynix, Mouser, Hybrid Electronics, NetSource Technology, Alliance Memory and STMicroelectronics.

COVID-19 Impact Analysis

The pandemic disrupted global supply chains, affecting the production and distribution of memory ICs. Many semiconductor manufacturers faced challenges in securing essential raw materials and components, leading to delays in production and increased costs. The pandemic accelerated the adoption of remote work, online learning and digital entertainment and this led to a surge in demand for memory ICs used in computers, laptops, servers and other devices that support remote activities.

The increased demand for memory ICs, coupled with supply chain disruptions, resulted in shortages of certain memory types and this, in turn, led to price increases for memory ICs, affecting the overall cost of electronic devices. As more people work and learn from home, there was a greater reliance on cloud services. Data centers and cloud infrastructure providers required more memory ICs to support the increased demand for online services.

The semiconductor industry, including memory IC manufacturers, started reevaluating their supply chain strategies and adopting measures to enhance resilience against future disruptions. Some memory IC manufacturers accelerated their investments in advanced manufacturing technologies to increase production capacity and meet the rising demand for memory ICs. Companies involved in memory IC design and development faced challenges in transitioning to remote work and collaboration, impacting research and development efforts.

AI Impact

Applications using artificial intelligence, in particular deep learning and neural network models, require a lot of memory to store and interpret data. The high-capacity, high-bandwidth memory needed for AI tasks is largely provided by memory ICs. AI algorithms often involve complex data structures and operations. Memory ICs need to be optimized for AI applications to ensure efficient data access and processing and this includes designing memory hierarchies that cater to AI's unique requirements.

AI accelerators, such as GPUs and TPUs, rely on HBM, a type of memory IC, to provide the high memory bandwidth needed for rapid data movement and processing. HBM's architecture is well-suited to AI's parallel processing nature. AI applications are sensitive to memory latency. Memory ICs that offer low-latency access to data are critical for AI models that require real-time or near-real-time processing, such as autonomous vehicles and natural language processing.

For instance, on 21 October 2022, Samsung Electronics is actively working on memory technology to support Hyperscale AI, which aims to replicate human thinking and decision-making by learning independently. Hyperscale AI requires massive computing infrastructures capable of handling large volumes of data. Processing-in-Memory technology, which offloads some data calculation work from the processor to the memory.

Russia- Ukraine War Impact

Geopolitical tensions and conflicts can disrupt global supply chains. If any part of the semiconductor supply chain, such as the production of raw materials, components or manufacturing facilities, is located in regions affected by conflict, it could lead to disruptions in the supply of memory ICs. Governments involved in conflicts may impose export restrictions on critical technologies, including semiconductors.

Supply chain disruptions and geopolitical tensions can increase the costs of production and logistics and these increased costs may be passed on to consumers in the form of higher prices for electronic devices that rely on memory ICs. Geopolitical instability can create uncertainty in global markets, including the semiconductor market. Uncertainty can impact investment decisions, research and development and future planning for memory IC manufacturers.

Key Developments

- In December 2022, KLA Corporation unveiled the Axion T2000 X-ray metrology system, designed for advanced memory chip manufacturers involved in 3D NAND and DRAM chip fabrication. The system employs patented transmissive X-ray technology to rapidly generate a complete 3D visualization of high aspect ratio structures, helping ensure tight control of critical parameters like width, shape and tilt.

- In November 2022, SABIC introduced a new specialty material called LNP KONDUIT 8TF36E compound designed to meet the demanding requirements of burn-in test sockets (BiTS) used for stress-testing double-data-rate (DDR) memory integrated circuits (ICs). As DDR ICs become smaller and more complex with increased pin counts and testing temperatures, the materials used in BiTS components need to deliver enhanced properties.

- In August 2021, Researchers at the Indian Institute of Technology-Bombay (IIT-B) have developed an indigenous semiconductor memory technology that can be adopted for manufacturing at the commercial unit of a 180nm node in India and this 8-bit memory technology is a critical aspect of the Internet of Things (IoT) and can be used to customize chips for specific storage of digital data, facilitating IoT applications where objects embedded with sensors or chips exchange data wirelessly.

Why Purchase the Report?

- To visualize the global memory integrated circuits market segmentation based on type, application, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of memory integrated circuits market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global memory integrated circuits market report would provide approximately 61 tables, 58 figures and 203 pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies