Global Logic Integrated Circuits Market is segmented By Type (TTL (Transistor Transistor Logic), CMOS (Complementry Metal Oxide Semiconductor), Mixed-Signal IC), By Product (ASIC, ASSP, PLD), By Application (Consumer Electronics, IT & Telecommunications, Manufacturing and Automation, Others), By End-User (Healthcare, Aerospace, Defense, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Size, Share Outlook, and Opportunity Analysis, 2023-2030

Logic Integrated Circuits Market Overview

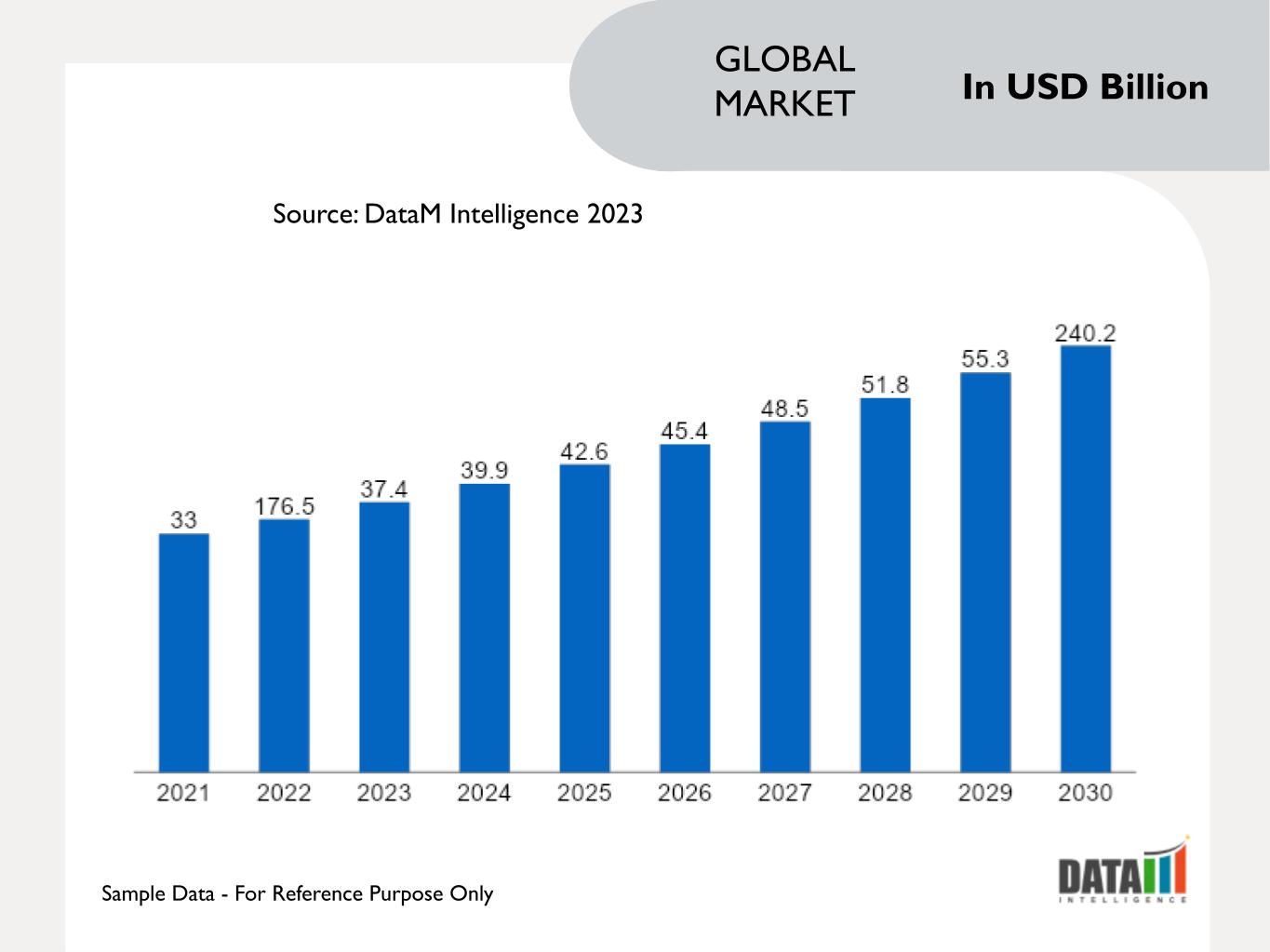

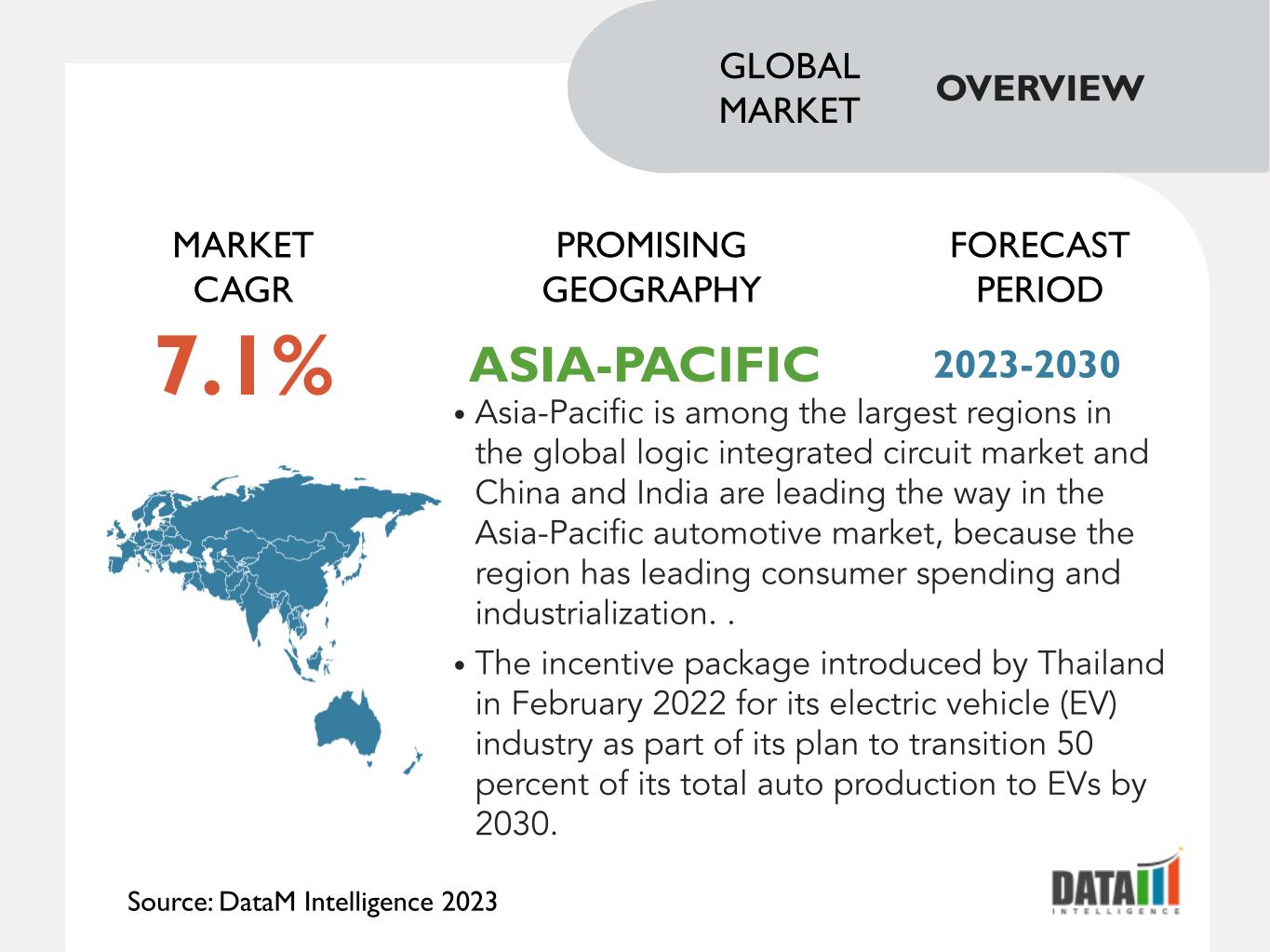

Global Logic Integrated Circuits Market reached USD 176.5 billion in 2022 and is expected to reach USD 240.2 billion by 2030, growing with a CAGR of 6.2% during the forecast period 2023-2030.

Continuous advancements in semiconductor technology which includes miniaturization and increased performance, drive the growth of logic ICs. As technology evolves, logic ICs become more efficient, faster and capable of performing complex functions. The demand for consumer electronics like smartphones, tablets and wearable devices, fuels the growth of logic ICs and these devices require various logic ICs for processing, memory and connectivity functions.

The automotive industry relies on logic ICs for various applications, including engine control, safety systems, infotainment and autonomous driving features. The increasing integration of electronics in vehicles drives the demand for logic ICs. Logic ICs play a crucial role in industrial automation and control systems. As industries adopt automation and robotics, there is a growing need for logic ICs to control and manage processes efficiently.

In 2022, North America is expected to be the second dominant region in the global market covering about 1/4th of the market. It has a significant demand for consumer electronics, automotive electronics, industrial automation and communication devices. Logic ICs are essential components in these applications, driving the market's growth. The automotive industry is increasingly incorporating advanced electronics for safety, infotainment and automation. Logic ICs play a crucial role in these applications, fostering their growth.

Logic Integrated Circuits Market Scope and Summary

|

Metrics |

Details |

|

CAGR |

6.2% |

|

Size Available for Years |

2021-2030 |

|

Forecast Period |

2023-2030 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Type, Product, Application, End-User and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle East & Africa |

|

Fastest Growing Region |

Asia-Pacific |

|

Largest Region |

Asia-Pacific |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For more details on this report Request for Sample

Logic Integrated Circuits Market Dynamics and Trends

Rising Demand for Electric Vehicles

Due to their advanced power electronics, battery management systems and motor control units, electric vehicles are more complex than conventional internal combustion engine vehicles and this complexity necessitates a greater number of logic integrated circuits to manage and control these systems effectively. Logic integrated circuits are crucial parts of EV battery management systems that monitor battery health, control charging and discharging procedures and ensure the durability and safety of the battery pack.

For instance, on 28 September 2022, Tata Motors introduced the 'Tiago EV,' an electric version of its well-known hatchback. This makes the Tiago EV more affordable than Tata's own Tigor compact sedan, which had previously been India's most economical EV. The demand for semiconductor parts, such as logic ICs, to assist the development and manufacturing of electric cars is rising as the EV market expands.

Adoption of 5G Network

5G networks need quicker data speeds and increased capacity. In these networks, logic integrated circuits (ICs) are essential for processing and controlling the high-speed data flow. 5G networks demand ultra-low latency to enable real-time communication for applications like autonomous vehicles and remote surgery. Logic ICs help reduce processing delays, contributing to low-latency network performance.

For instance, on 23 June 2022, EdgeQ, a startup founded by former Qualcomm executives, is poised to make an impact in the 5G private network sector. The company plans to launch its first chip for 5G private networks later this year and they are collaborating with Vodafone for a technology demonstration at the Mobile World Congress (MWC) in Barcelona. Logic ICs, EdgeQ's chip likely includes various logic components that enable it to process and manage data efficiently within 5G private networks.

Technology Advancement Boosts the Market

System-on-Chip and System-in-Package technologies enable the integration of various functions and components onto a single IC and this integration enhances performance reduces form factor and lowers costs. Configurable logic devices, like FPGAs and Complex Programmable Logic Devices (CPLDs), offer flexibility for designers to create customized logic circuits, speeding up prototyping and development.

According to paper published in ACM library in April 2023, the advancement of digital circuit design is critical for various applications, especially in resource-constrained devices used in IoT and Wireless Sensor Networks. Among the essential components for these devices, multiplier modules play a crucial role in achieving high-speed and low-power consumption designs. The Vedic multiplier has emerged as one of the most efficient multiplier designs due to its parallel processing capability.

High Cost and Excessive Heat Generation

As logic ICs become more complex because they require more transistors and interconnections leading to larger chip sizes and this can be a limitation in applications with strict size constraints. Despite efforts to lower it, some high-performance logic ICs can still waste a lot of power, which prevents their use in battery-powered products. As power-dense logic IC generated excessive heat and it often required cooling mechanism.

Advanced logic ICs are challenging to manufacture due to their intricate designs and small feature sizes and this complexity can lead to production yield issues and increased costs. Developing and manufacturing cutting-edge logic ICs involves substantial research and development costs. Additionally, smaller process nodes can be expensive to implement. As technology evolves, older logic ICs become obsolete, making it challenging for manufacturers and users to find replacement parts and support for legacy systems.

Logic Integrated Circuits Market Segmentation Analysis

The global logic integrated circuits market is segmented based on type, product, application, end-user and region.

Rising Adoption of TTL Technology

In 2022, TTL technology is expected to be the dominant segment in the global market covering more than 1/3rd of the market. TTL ICs are often used in educational settings and for training purposes, ensuring a steady demand for these components. The systems may require replacement or upgrades, driving demand for TTL ICs. TTL ICs offer specific performance characteristics that make them suitable for certain applications, such as high-speed switching and low-power consumption, which can drive their use in relevant industries.

For instance, on 14 August 2023, TEWS Technologies has unveiled its latest FPGA solution, the TXMC637, designed to offer adaptability for digital and analog applications in complex industrial processes. This single-width Switched Mezzanine Card compatible module features a user-configurable FPGA that can be adapted for various applications. It includes up to 32 ADC input channels with 16-bit resolution, up to 16 DAC output channels, 32 programmable ESD-protected TTL lines for digital interfacing and integrated DDR3L SDRAM for high-speed memory access.

Logic Integrated Circuits Market Geographical Share

Rising Government Investments in Asia-Pacific

Asia-Pacific is the fastest growing and dominant region in the global logic integrated circuits market covering more than 1/3rd of the market. It is among the largest regions in the global logic integrated circuit market and China and India are leading the way in the Asia-Pacific automotive market, because the region has leading consumer spending and industrialization. Some governments in the region are heavily investing and also promoting semiconductor manufacturing.

For instance, on 10 March 2022, the incentive package introduced by Thailand in February 2022 for its electric vehicle (EV) industry as part of its plan to transition 50 percent of its total auto production to EVs by 2030. The package offers a 40 percent reduction in import duty for completely built-up (CBU) battery EVs with a price of up to 2 million baht (USD 61,805). For CBU EVs priced between 2 million and 7 million baht (USD 61,805 - USD 211,278), there is a 20 percent reduction.

Logic Integrated Circuits Market Companies

The major global players in the market include Intel Corporation, Broadcom Inc., Analog Devices, Inc., NXP Semiconductors N.V., Toshiba Corporation, Maxim Integrated Products, Inc., MediaTek Inc., ON Semiconductor Corporation, Texas Instruments Inc. and Infineon Technologies AG.

COVID-19 Impact on Vacuum Interrupter Market

The pandemic disrupted global supply chains, affecting the production and availability of electronic components, including analog ICs. Many semiconductor manufacturing facilities faced temporary closures or reduced capacity, leading to supply shortages. Lockdowns and remote work/learning measures in place, there was a surge in demand for consumer electronics, including laptops, tablets and gaming consoles and this increased demand for analog ICs used in these devices.

Some semiconductor manufacturing facilities had to reduce or temporarily halt production to comply with social distancing and safety measures and this affected the overall production capacity of Logic ICs. Design and development of Logic ICs often require specialized hardware and software tools that may not be easily accessible in a remote work environment. Engineers and designers faced challenges in collaborating and accessing lab facilities during lockdowns.

Research and development efforts for next-generation Logic ICs may have been delayed due to disruptions in laboratory work and testing processes and this could potentially postpone the introduction of new IC technologies. The growth of online services during the pandemic increased demand for data centers. Logic ICs used in data center infrastructure, such as processors and accelerators, saw increased demand as a result.

AI Impact

AI is used to optimize the design of logic ICs. Machine learning algorithms can explore a vast design space, identify optimal configurations and even generate novel circuit designs that are more energy-efficient, faster or smaller in size. AI-driven tools can automate the design process of logic ICs, reducing the need for manual intervention and this leads to faster design cycles and more efficient use of resources.

AI techniques are employed for fault detection in logic ICs. AI algorithms can analyze circuit behavior in real-time, detect faults or errors and implement corrective actions to ensure the IC operates as intended. AI plays a role in improving the testing and quality assurance processes of logic ICs. AI-driven testing systems can identify defects more accurately and efficiently than traditional methods.

According to IOP Science in 2021, the integration of artificial intelligence technology with integrated circuits is a crucial synergy that has evolved over time. AI heavily relies on the computational and learning capabilities of machines and integrated circuits provide the essential hardware support for running AI algorithms. AI technology has driven the development of specialized AI chips designed for tasks such as machine learning and deep learning.

Russia- Ukraine War Impact

A prominent producer of electronic parts, especially semiconductors, is Ukraine. Logic IC production and distribution could be hampered by the conflict, which could result in shortages and price fluctuations on the global marketplace. In times of geopolitical tension, countries may impose export restrictions on certain critical technologies, including semiconductors and which can limit the availability of Logic ICs for manufacturers around the world.

Geopolitical conflicts can create economic uncertainty, impacting consumer and business confidence and this uncertainty can affect the demand for electronic devices, which, in turn, affects the demand for Logic ICs. Companies in the Logic ICs industry may reevaluate their supply chain strategies, considering alternative sources for critical components to reduce geopolitical risks.

Key Developments

- In June 2021, Jack Kilby's project resulted in the creation of the initial integrated circuits that would later be used in space missions, marking the beginning of advancements in space electronics and these digital logic ICs replaced the SN502 with a tenfold increase in speed while consuming only a fraction of the power, aligning with NASA's objective to enhance computing power and reduce weight in its space modules.

- In October 2020, the announcement made on October 20th regarding U.S. chipmaker Intel's sale of its NAND flash memory business to South Korea's SK Hynix for USD 9 billion signifies a potential consolidation within the industry and marks a shift for Intel from an integrated device manufacturing SK hynix is set to acquire Intel's NAND memory and storage business for USD 9 billion.

Why Purchase the Report?

- To visualize the global logic integrated circuits market segmentation based on type, product, application, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of logic integrated circuits market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global logic integrated circuits market report would provide approximately 69 tables, 69 figures and 202 pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies