Overview

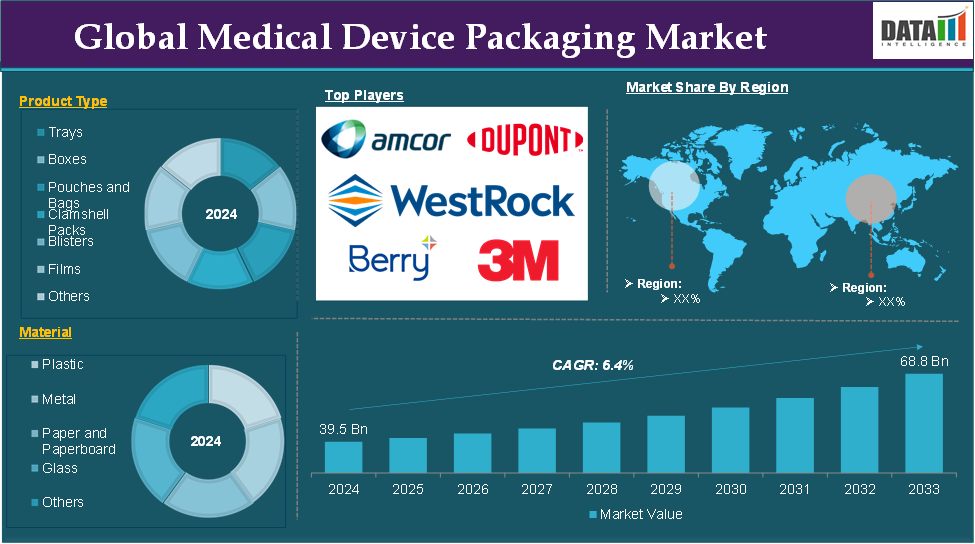

The global medical device packaging market reached US$ 39.5 billion in 2024 and is expected to reach US$ 68.8 billion by 2033, growing at a CAGR of 6.4% during the forecast period 2025-2033.

Medical device packaging refers to the materials, systems, and processes used to enclose and protect medical devices from contamination, damage and deterioration during storage, handling, and transportation. The packaging is designed to ensure the device's safety, sterility (if necessary), integrity and functionality maintaining compliance with regulatory requirements set by organizations such as the FDA, ISO and EU regulations. For devices that require a sterile environment, packaging ensures that the device remains free from contaminants until it is used. This is particularly important for surgical instruments, implantable devices, and diagnostic tools.

The global medical device packaging market is experiencing significant growth, driven by factors such as technological advancements in medical devices, a rising emphasis on patient safety and infection prevention and rising demand for medical devices. For instance, according to the U.S. Food & Drug Administration, it has authorized more than 1,000 AI-enabled devices by the established premarket pathways. These rising medical device approvals boosting the demand for medical device packaging.

Executive Summary

Market Dynamics: Drivers & Restraints

Rising demand for sustainable medical device packaging

The rising demand for sustainable medical device packaging is significantly driving the growth of the Medical Device Packaging market and is expected to drive the market over the forecast period. As environmental concerns intensify, healthcare providers and manufacturers are increasingly adopting eco-friendly packaging solutions to reduce their carbon footprint and meet regulatory requirements. Thus, many market players are focussing on the development of sustainable packaging products.

For instance, in October 2024, Klöckner Pentaplast (kp) introduced kpNext MDR1, a new medical device packaging film that takes the kpNext brand beyond pharmaceutical blister films and into the medical device market. This innovative solution is intended to fulfill the growing demand for sustainable packaging options in healthcare packaging. This new kpNext MDR1 film allows healthcare providers to prioritize sustainability, without compromising on the quality or performance of their packaging materials.

Additionally, governments worldwide are implementing stringent regulations to reduce plastic waste and promote recycling due to rising healthcare packaging waste. For instance, according to the American Medical Association, of the 14,000 tons of waste created daily in US healthcare facilities, around 20% to 25% is plastic. However, 91% of plastics, including those used in health care, are not recycled and end up in landfills or have penetrated natural habitats.

Stringent regulatory requirements

Stringent regulatory requirements significantly impact the medical device packaging market by imposing rigorous standards that manufacturers must adhere to, thereby influencing market dynamics. The approval process for medical device packaging is time-consuming, involving extensive documentation, testing, and certification. This delays the introduction of new packaging solutions, potentially hindering innovation and responsiveness to market demands. Manufacturers must prepare and submit detailed dossiers, including technical specifications, risk management documentation, and clinical test results, to obtain necessary approvals.

For instance, in the European Union, medical devices must undergo a marketing authorization process to ensure they meet stringent requirements before being marketed. This process includes preparing and submitting a dossier containing specific information, such as the device’s general description, technical specifications, and clinical test results.

Segment Analysis

The global medical device packaging market is segmented based on product type, material, packaging type, application, end-user and region.

Product Type:

The films segment is expected to dominate the medical device packaging market share

Films offer a wide range of properties, including moisture, oxygen, and light barriers, essential for preserving the integrity of medical devices. They can be tailored to specific requirements, such as sterilization compatibility and mechanical strength. Thus, many market players are focussing on the development of films for medical device packaging.

For instance, in November 2023, Coveris, a flexible packaging provider, created a recyclable thermoforming film designed for medical device applications. Formpeel P joins Coveris’ portfolio of sustainable materials, which also includes Formpeel T, Flexopeel T, and Cleerpeel. It offers the same performance and safety as traditional materials while reducing packaging and product waste, according to the business.

Films are generally more affordable compared to other packaging materials like rigid containers, making them a preferred choice for manufacturers aiming to balance quality and cost. Films can be engineered to meet stringent regulatory standards, ensuring safety and efficacy in medical device packaging leading to market dominance.

Geographical Analysis

North America is expected to hold a significant position in the medical device packaging market share

North America especially in the United States boasts a well-developed healthcare system, leading to a high demand for advanced medical devices and, consequently, sophisticated packaging solutions. North America is home to numerous prominent and emerging medical device manufacturers and packaging companies, fostering innovation and competition within the market. Key players in the region include Amcor plc, DuPont, and Berry Global, among others.

The region is at the forefront of adopting new technologies in medical device packaging, such as smart packaging solutions and sustainable materials, enhancing the quality, sterility, functionality and appeal of packaging products. For instance, in April 2024, STEMart launched its packaging solutions for the pharmaceutical and medical device industries to meet the unique needs of the medical device industries. These services are designed to ensure the quality, sterility, and regulatory compliance of medical devices throughout their lifecycle.

Asia-Pacific is growing at the fastest pace in the medical device packaging market

Rising healthcare investments in countries like China, India, and Japan are fueling the growth of the medical device market, which in turn drives demand for packaging solutions. As disposable incomes rise, people are increasingly seeking better healthcare services, which translates to higher consumption of medical devices and their packaging. For instance, the healthcare sector in China and India is rapidly expanding, and both are predicted to lead in the adoption of advanced medical device packaging solutions.

Regulatory agencies in countries like China and India have become stricter in terms of product safety and packaging standards. The imposition of these standards is pushing medical device manufacturers to adopt high-quality and reliable packaging solutions to comply with regulations. The adoption of global standards like ISO and GMP (Good Manufacturing Practices) is also contributing to the growth of the market.

Competitive Landscape

The major global players in the medical device packaging market include Amcor plc, DuPont, Berry Global Inc., WestRock Company, 3M, Sonoco Products Company, Wihuri Group, AptarGroup, Inc., Oliver Healthcare Packaging, Printpack and among others.

Scope

| Metrics | Details | |

| CAGR | 6.4% | |

| Market Size Available for Years | 2018-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Volume (Units) | ||

| Segments Covered | Product Type | Trays, Boxes, Pouches and Bags, Clamshell Packs, Blisters Films and Others |

| Material | Plastic, Metal, Paper and Paperboard, Glass and Others | |

| Packaging Type | Primary Packaging, Secondary Packaging and Tertiary Packaging | |

| Application | Sterile Packaging and Non-Sterile Packaging | |

| End-User | Medical Device Manufacturers and Contract Manufacturing Organizations | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global Medical Device Packaging market report delivers a detailed analysis with 78 key tables, more than 76 visually impactful figures, and 166 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.