Market Overview

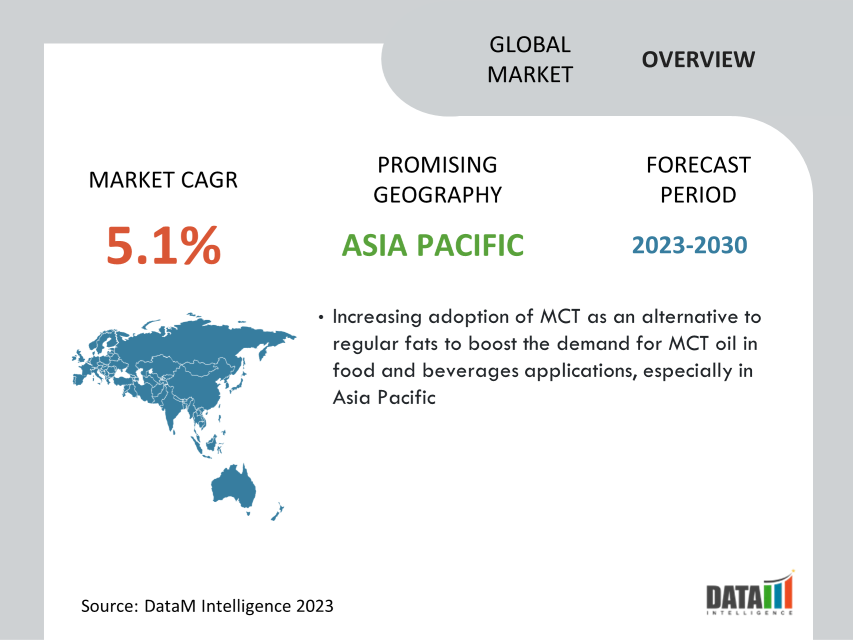

Global MCT Oil Market reached USD 250.5 million in 2022 and is expected to reach USD 372.9 million by 2030 growing with a CAGR of 5.1% during the forecast period 2023-2030. MCT oil is a supplement that has become popular among athletes and body builders. The popularity of coconut oil, high in MCTs, has contributed to its use.

MCT oil is used for a quick energy source, and may support weight loss. It may also fight bacterial growth, and aid in managing certain neurological conditions. This processed oil product is sourced from coconut oil or palm kernel oil. MCTs are also found in other foods, such as dairy products.

MCT oil could potentially help people consume fewer calories across the day. MCT oil has about 10% fewer calories than long-chain triglycerides (LCTs), which are found in foods such as olive oil, nuts, and avocados. MCT oil is 100% MCTs, making it the most concentrated source of MCTs when compared to other oils, like coconut or palm. MCTs are also found in palm kernel oil, butter and other milk products like cheese.

Market Scope

| Metrics | Details |

| CAGR | 5.1% |

| Size Available for Years | 2021-2030 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (US$) |

| Segments Covered | Fatty Acid, Source, Form, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa |

| Fastest Growing Region | Asia Pacific |

| Largest Region | Asia Pacific |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis, and Other key Insights. |

For More Insights about the Market Download Sample

Market Dynamics

Increasing Adoption of MCT as an Alternative to Regular Fats in Diets to Drive the Global Market Trends

MCTs are metabolized differently from long-chain triglycerides (LCTs), and they are quickly converted into energy by the liver. This efficient conversion can increase feelings of fullness and may support weight management efforts. Moreover, MCTs are a key component of ketogenic diets, which have seen growing interest in recent years. According to the Coconut Development Board, the total coconut production globally in 2021 is 66,674 million nuts. As people adopt ketogenic and low-carb diets for various reasons, the demand for MCTs as a dietary supplement has also increased.

MCTs are a source of readily available energy, making them popular in the sports nutrition market. Athletes and fitness enthusiasts often incorporate MCTs into their diets to support endurance, performance, and quick energy supply during workouts. Unlike long-chain fats, MCTs are absorbed more easily and require less bile to break down. This characteristic makes them suitable for individuals with certain digestive issues, such as malabsorption disorders, and has contributed to their adoption as an alternative fat source in the diet of some individuals with gastrointestinal challenges.

Rising Interest in Ketogenic and Low-Carb Diets is Expected to Drive The MCT Oil Market Growth

The ketogenic diet is a high-fat, low-carbohydrate diet that encourages the body to enter a state of ketosis, where it burns fat for energy instead of carbohydrates. MCT oil is a preferred fat source in ketogenic diets because it is quickly converted into ketones by the liver, supporting the diet's objective of maintaining a state of ketosis. According to Wiley Online Library, MCT oil is gradually increased by 10% to achieve seizure control as long as there are no side effects and urine ketones are lower than 16 mmol/L.

Low-carb diets have gained popularity as people seek effective ways to manage weight and improve their overall health. MCT oil's inclusion in low-carb diets stems from its ability to provide a quick and sustained source of energy without raising blood sugar levels. The popularity of MCT oil and its association with ketogenic and low-carb diets have been fueled by social media platforms, health blogs, and influential individuals who promote these diets and share their experiences with MCT oil.

Digestive Issues for Some Consumers is Restraining the MCT Oil Market

Consumers with pre-existing digestive conditions, such as irritable bowel syndrome (IBS) or inflammatory bowel disease (IBD), may find that MCT oil exacerbates their symptoms. As a result, they may be cautious or avoid using MCT oil. For some individuals, their digestive system need time to adapt to the consumption of MCT oil. During this adaptation period, they may experience temporary digestive discomfort, which could deter them from continued use.

MCT oil is a concentrated source of fats, and some consumers may have a low tolerance threshold for high-fat intake. Consuming MCT oil in excessive amounts or too frequently could lead to digestive issues for such individuals. Negative experiences shared by some consumers, especially through reviews and social media, may influence others to avoid trying MCT oil altogether, despite it being generally well-tolerated by most people.

Market Segment Analysis

The global MCT oil market is segmented based on fatty acid type, source, form, application, and region.

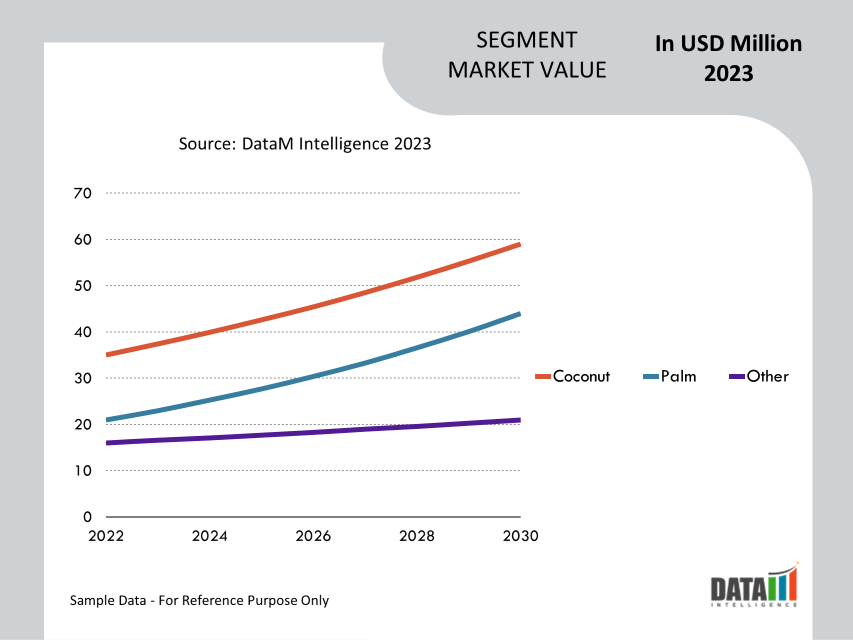

The Coconut Segment Holds the Largest Market Share in the MCT Oil Market

Coconut oil is one of the richest natural sources of MCTs, particularly lauric acid (C12) and caprylic acid (C8). These MCTs make up a substantial portion of the fatty acids present in coconut oil. Coconut oil has gained popularity in the health and wellness industry due to its potential health benefits, culinary versatility, and use in various beauty and personal care products. According to International Coconut Community, during period of January-April 2022, imports of coconut oil by European countries leveled up by 5.7% to 313,513 tons.

At the same time, import of palm kernel oil dropped by 16% compared the volume a year earlier. In total, shipment of lauric oils to European countries lessened by 4.9% during the period. The coconut industry has a well-established supply chain, especially in regions with significant coconut production, such as Southeast Asia, India, and parts of South America. Coconut oil has been used traditionally in many cultures for culinary and medicinal purposes. This cultural acceptance and culinary familiarity have translated into a high demand for coconut-derived MCT oil in these regions.

Market Geographical Share

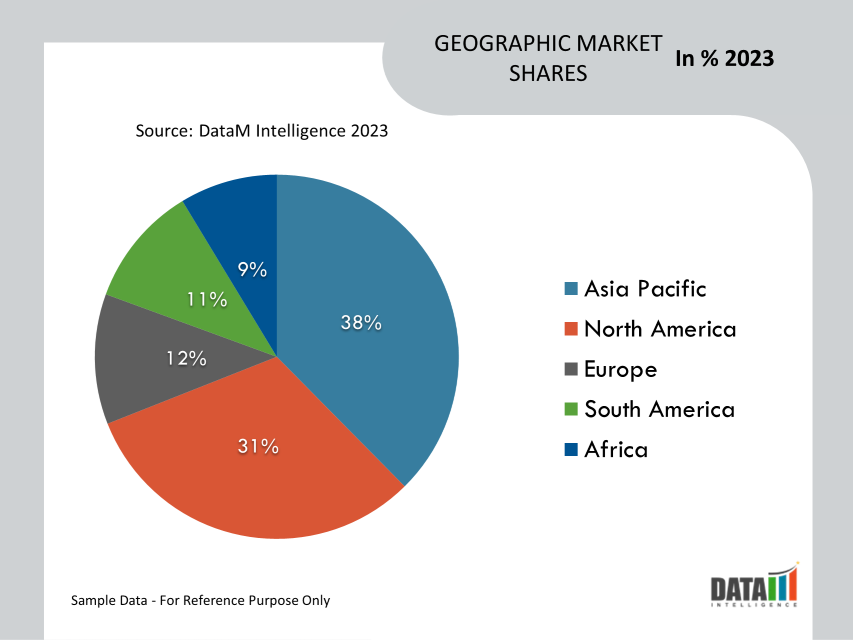

Asia Pacific is Dominating the MCT Oil Market

The Asia Pacific region is one of the world's largest producers of coconuts, which are a primary source of MCTs. Countries like the Philippines, Indonesia, Thailand, and India are major coconut producers, contributing to the availability of coconut-derived MCT oil in the region. According to Coconut Development Board, India produced 20,736 million nuts of coconuts in India. The cultural acceptance and familiarity with coconut oil have translated into a high demand for MCT oil in the region.

The Asia Pacific region has experienced a significant increase in health and wellness awareness, leading consumers to seek healthier food options. MCT oil, particularly coconut-derived MCT oil, is often perceived as a healthier alternative to traditional fats, driving its demand in the region. The Asia Pacific region has witnessed a surge in sports nutrition and fitness trends, with an increasing number of consumers engaging in physical activities and looking for energy-boosting supplements. MCT oil's quick conversion into energy makes it popular in the sports nutrition market.

Market Key Players

The major global players in the market include Wilmar International Ltd, KLK EMMERICH GmbH., Musim Mas, The Nisshin OilliO Group, Ltd., IOI Oleochemical, Barlean's, BASF SE, ConnOils LLC, CREMER OLEO GmbH & Co. KG, and Croda International Plc.

COVID-19 Impact Analysis

Global Recession/Ukraine-Russia War/COVID-19, and Artificial Intelligence Impact Analysis:

Covid-19 Impact:

The pandemic heightened the focus on health and wellness, leading consumers to seek out products that support immune health and overall well-being. MCT oil, with its potential health benefits, was perceived as a beneficial addition to diets during this time. As people spent more time at home due to lockdowns and restrictions, there was a surge in home cooking and interest in nutrition. MCT oil, which can be used in a variety of recipes and diets, saw increased demand from home cooks looking for versatile and healthy cooking ingredients.

By Fatty Acid

- Caprylic Acid

- Capric Acid

- Lauric Acid

- Caproic Acid

By Source

- Coconut

- Palm

- Other

By Form

- Dry

- Liquid

By Application

- Nutritional Supplements

- Personal Care Products

- Pharmaceutical Products

- Sports Drinks

- Infant Formula

- Other

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Germany

- The U.K.

- France

- Italy

- Spain

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In August 2021, Nestlé Health Science announced the successful completion of its acquisition of the core brands of The Bountiful Company, including Nature’s Bounty, Solgar, Osteo Bi-Flex, Puritan’s Pride, Ester-C, and Sundown.

- In October 2020, bulletproof 360, the lifestyle company widely known for innovative food, beverage, and supplements that fuel human performance, announced the release of bold new packaging across their entire portfolio and the launch of two new food and beverage offerings.

- In March 2020, Sternchemie has launched its MCT fats in a powdered version. Both for sports nutrition and weight management, MCT fats are slowly becoming a key ingredient. For good reason – these medium-chain fatty acids with 8 to 12 carbon atoms have important nutritional benefits.

Why Purchase the Report?

- To visualize the global MCT oil market segmentation based on fatty acid, source, form, application, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities in the market by analyzing trends and co-development.

- Excel data sheet with numerous data points of MCT oil market-level with all segments.

- The PDF report consists of cogently put-together market analysis after exhaustive qualitative interviews and in-depth market study.

- Product mapping is available as Excel consists of key products of all the major market players.

The global MCT oil market report would provide approximately 69 tables, 68 figures, and 190 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies