Market Size

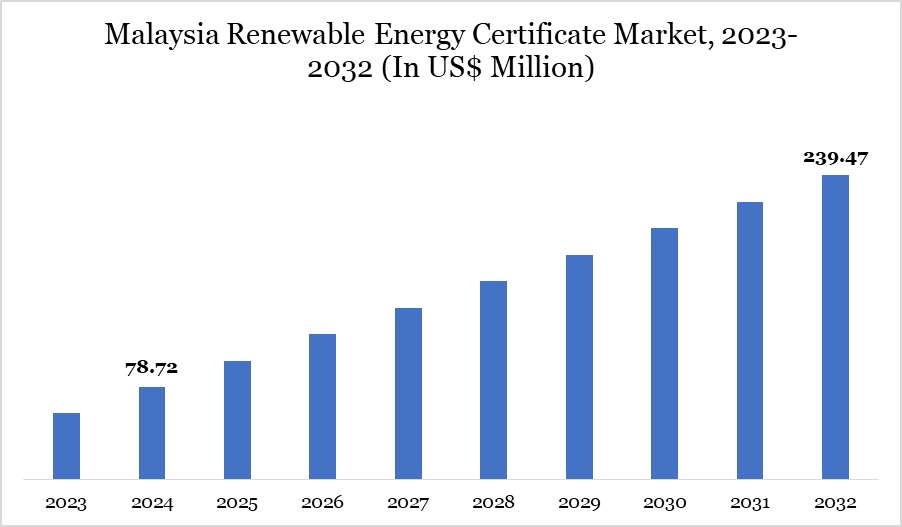

Malaysia's renewable energy certificate (REC) market was valued at US$ 78.72 million in 2024 and is projected to reach US$ 239.47 million by 2032, growing at a CAGR of 10.8% from 2025-2032.

The country holds a significant share in the Asia-Pacific REC market, driven by proactive policies, increasing corporate sustainability commitments, and a growing renewable energy capacity. The National Energy Transition Roadmap targets 70% renewable energy in the primary energy supply by 2050, with solar playing a dominant role. Strong participation from multinational corporations and a robust REC framework, including mGATS and mREC, ensure transparency and market growth.

Market Trends

Corporate Green Power Programme (CGPP) and Virtual PPAs

The Corporate Green Power Programme (CGPP) has become a key market enabler, allowing businesses to sign Virtual Power Purchase Agreements (VPPAs). With an 800MW solar quota and a 30MW cap per developer, CGPP facilitates long-term renewable energy supply agreements. Companies like AirTrunk and ib vogt have already signed Malaysia’s first data center VPPA under this initiative. By increasing REC generation and market liquidity, CGPP fosters stronger corporate participation, aligning Malaysia with global sustainability goals. This trend is expected to accelerate, with more multinational corporations leveraging VPPAs to achieve net-zero targets.

Rising ESG Investments and Regional Collaboration

Environmental, Social, and Governance (ESG) investments are driving demand for RECs, as companies seek to meet sustainability goals. Strong policy support, coupled with growing investor confidence, has positioned Malaysia as a regional renewable energy hub. Collaborations with neighboring countries further strengthen this position. Malaysia’s partnerships in cross-border energy trading enhance its REC market, allowing corporations to access renewable energy from diverse sources. The nation’s commitment to international standards like the Greenhouse Gas Protocol and CDP ensures credibility, attracting more investors and reinforcing its role as a major REC player in the Asia-Pacific region.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details | |

| By Type | I-REC, GEC | |

| By Energy Source | Solar RECs, Wind RECs, Hydro RECs, Biomass, Geothermal | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Expanding Solar Energy Capacity

Malaysia is one of the largest solar panel manufacturers globally, significantly enhancing REC supply. The government’s focus on solar energy, with large-scale solar farms and rooftop installations, boosts REC availability. Companies like Shell Malaysia have committed to installing solar panels across 600+ retail sites, aiming for full solar adoption by 2025. Additionally, Progressture Power plans to expand its renewable energy capacity to 1.5 GW across Southeast Asia. With strong corporate backing, policy incentives, and abundant solar resources, Malaysia’s solar-driven REC growth strengthens investor confidence and positions the country as a key REC hub in Asia.

Regulatory Complexity and Decentralization

Despite rapid growth, regulatory complexity poses a challenge to Malaysia’s REC market. Decentralized governance allows Sabah and Sarawak to regulate their own REC markets, leading to potential inconsistencies in implementation. Varying regulatory frameworks across regions may create barriers for corporate participation and market standardization. While platforms like the Malaysian Green Attribute Tracking System (mGATS) ensure credibility, businesses may face difficulties in navigating multiple compliance requirements. Addressing regulatory fragmentation through streamlined policies and harmonized frameworks will be crucial to ensuring sustained growth and broader REC market adoption in Malaysia.

Market Segment Analysis

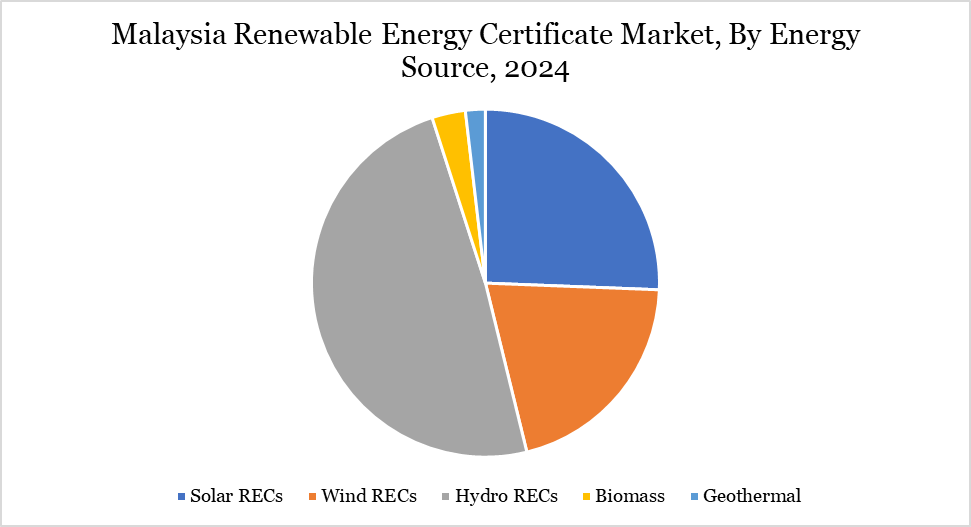

The Malaysia renewable energy certificate market is segmented based on type and energy source.

Dominance of Hydro RECs.

Hydropower holds the largest share in Malaysia’s REC market, accounting for over 45% of total RECs. The Hydro Renewable Energy Certificate (REC) market was valued at approximately US$ 38.46 million in 2024 and is expected to reach US$ 108.37 million by 2032, growing at a CAGR of 10%. The dominance of hydropower is driven by abundant water resources, particularly in Sarawak, which has significant hydroelectric capacity. While solar energy continues to expand, hydropower remains a key contributor to Malaysia’s renewable energy mix, providing a stable and cost-effective REC supply. The market is further divided into voluntary and compliance-based RECs, with voluntary purchases driving significant demand from corporations seeking carbon neutrality.

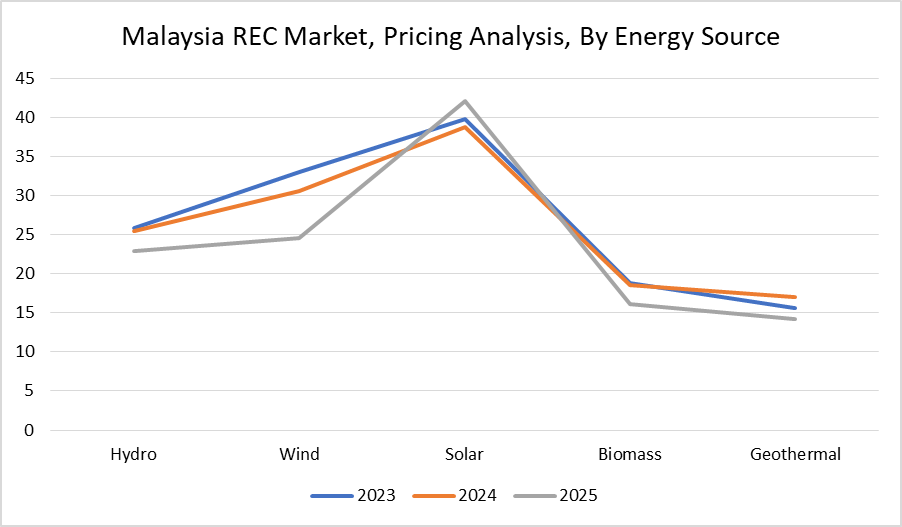

Pricing Analysis

REC pricing in Malaysia is influenced by factors such as energy source, market demand, and international standards. Solar RECs typically command higher prices due to strong corporate demand and Malaysia’s leadership in solar panel manufacturing. Hydropower RECs offer cost-competitive alternatives, particularly in Sabah and Sarawak. The introduction of CGPP and increased VPPA agreements contribute to price stability by securing long-term corporate commitments. Additionally, compliance with international frameworks like the Greenhouse Gas Protocol ensures price competitiveness in the global market. As demand grows, Malaysia’s well-regulated REC framework supports pricing transparency and market confidence.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies