Global Mainframe Market is segmented By Type (Z Systems, GS Series, Others), By Organization Size (Large Enterprises, Small and Medium Enterprises), By Application (Transaction, ERP, Census Industry, Others), By Offering (Hardware, Software, Services), By End-User (BFSI, IT and Telecom, Healthcare, Government and Public Sector, Retail, Manufacturing, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2024 - 2031

Market Overview

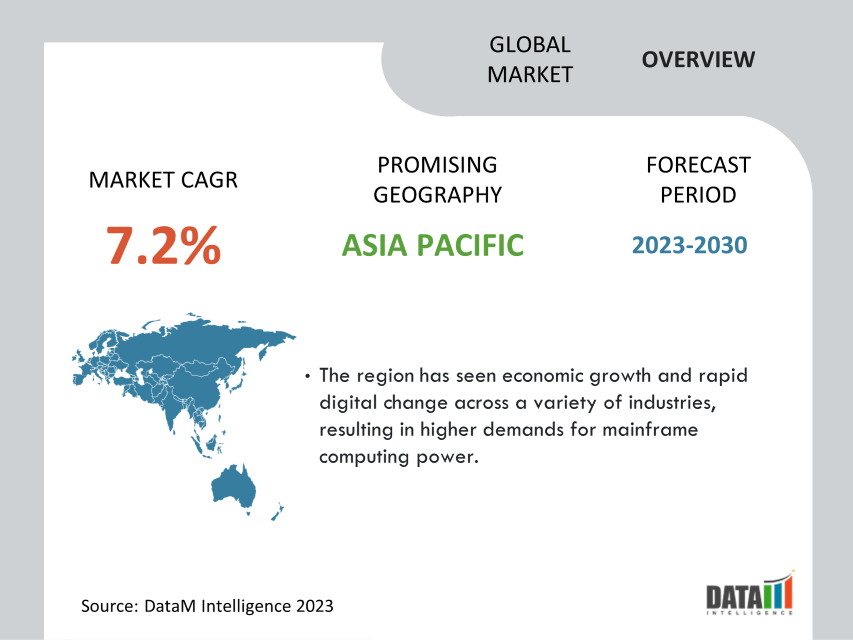

Global Mainframe Market reached USD 2.3 billion in 2022 and is expected to reach USD 3.9 illion by 2030, growing with a CAGR of 7.2% during the forecast period 2023-2030. The global mainframe market is being driven by increased investments in updating current core systems for digital transformation and innovation of applications, process strategies and IT infrastructure.

Aside from that, the introduction of flexible and multipurpose versions capable of dynamically reconfiguring hardware and software resources like as processors, memory and device connections is driving market growth. During the forecast period 2023-2030, BFSI is estimated to account for almost 1/3rd of the global mainframe market.

Given the sensitivity of financial and personal information, data security is of the utmost importance in the BFSI sector. For example, LzLabs delivered their software-defined mainframe technology to North America in 2020, due to the relationship with Microsoft. The LzLabs Software Defined Mainframe will be sold to customers in areas such as banking, telecommunications, insurance and government.

Market Scope

|

Metrics |

Details |

|

CAGR |

7.2% |

|

Size Available for Years |

2022-2031 |

|

Forecast Period |

2024-2031 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Type, Organization Size, Application, Offering, End-User and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle East & Africa |

|

Fastest Growing Region |

Asia-Pacific |

|

Largest Region |

North America |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

To Know More Insights - Download Sample

Market Dynamics

The Growing Demand for High-Performance Computing

Mainframe systems are capable of handling these enormous data sets and providing useful insights to researchers and enterprises. Artificial intelligence and machine learning have significantly increased demand for mainframes. AI and machine learning algorithms necessitate massive amounts of computational power to train and optimize models and mainframe computers provide the capabilities required to accelerate the processes.

Mainframe systems, such as ATMs and POS systems, are often used in financial transactions. It is also used in the healthcare industry to store patient data, invoices and other information. Companies use mainframe systems to handle massive volumes of data and derive insights that can be used to inform business decisions, such as improving supply chains and anticipating customer behavior.

The Rising Adoption of Modernization in Mainframe

Among different business strategies, digital customer experience has emerged as the most suitable for business practice evolution. However, emerging techniques support the total replacement or operation of obsolete mainframe applications. The process of modernizing and modifying legacy mainframe systems is referred to as mainframe modernization.

In October 2022, Atos announced its accreditation as a Leader in mainframe services and solutions by the 2022 Information Services Group (ISG) Provider LensTM, focusing on the company's strong hyperscaler alliances to better support all clients' mainframe modernisation needs. It describes Atos' leadership in U.S., which includes mainframe modernization services, Mainframe-as-a-Service, mainframe operations and mainframe application modernization and transformation services.

Complexity in Development Tools

Mainframe systems are related with user interfaces because users must locate the user interfaces in order to use the mainframe or gain access to the systems. It has been designed responsibly and is delivered to the analyst in charge of the online system's development. The design team should consult with end users to evaluate their needs and level of competence. Users must stay involved in the overall development once the design process has begun to guarantee that the end result meets their needs.

Despite this, the user interface built for the mainframe was discovered to be very advanced and even the developers constructed the system in a complex manner. Furthermore, this difficulty might be met by consistently implementing extremely advanced technology developed by various organizations. As a result, a greater emphasis on R&D will aid in overcoming user interface and development tool issues, creating an obstacle to market growth.

Segmentation Analysis

The global mainframe market is segmented based on type organization size, application, offering, end-user and region.

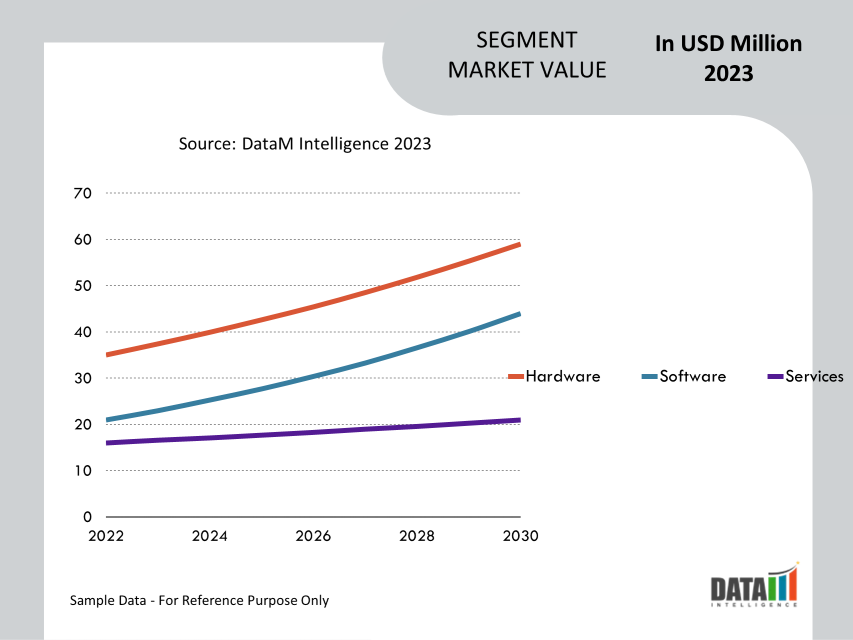

The Rising Demand to Handle Massive Workload drives the Hardware Segment

During the forecast period, hardware is expected to hold more than 1/4th of the global mainframe market. Hardware is built to manage huge workloads, provide high availability and protect data for important applications. Mainframe CPUs are the core processing units in charge of executing instructions and doing calculations. It includes innovative architectures that are designed for parallel processing and fast data handling.

To store and retrieve massive amounts of data, mainframes are outfitted with high-capacity and high-speed storage devices such as Direct Access Storage Devices and tape libraries. The great majority of data centers rely on enterprise-class storage arrays from suppliers like IBM, EMC and Hitachi, which are closely associated with mainframe computation technology. IBM's System z mainframe family is well-known in the market for its scalability, security features and support for various applications.

Geographical Shares

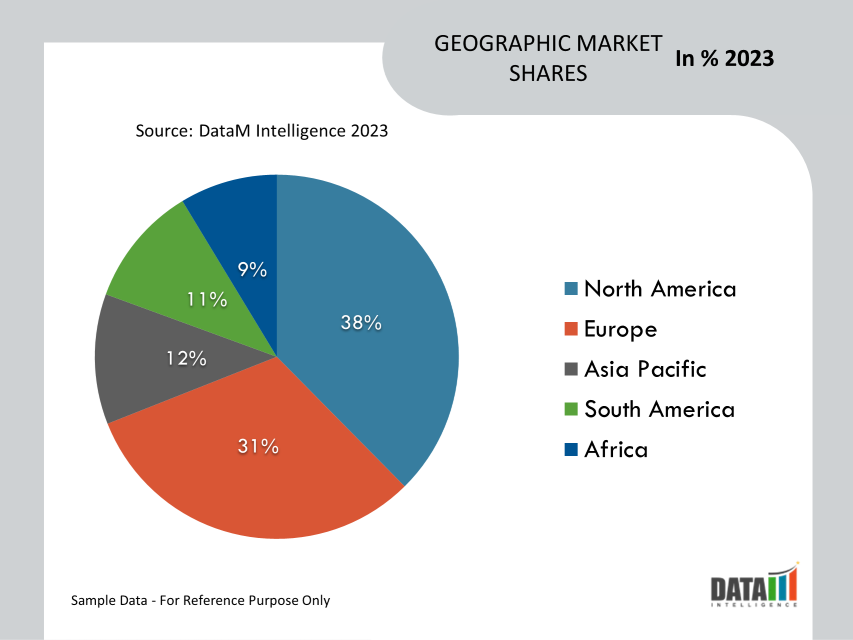

The Increasing Usage of Advanced Technologies in North America

North America mainframe market has witnessed significant growth covering more than 1/3rd of the global market share in 2022. While mainframes continue to be needed for essential workloads, several North American enterprises have also launched modernisation projects. To fully utilize the benefits of both mainframe systems and cloud technology, the corporations have combined mainframes with cloud services and implemented hybrid IT strategies.

Rocket Software (Rocket), a worldwide technology company that creates enterprise software for some of the world's major corporations, has published its 2022 Survey Report: The State of the Mainframe. Based on a poll of over 500 US IT experts working in mainframe organizations about their goals, difficulties and future plans for utilizing their mainframes.

More than half of respondents (56%) think the mainframe is still the most important component of their IT infrastructure, then the private cloud (20%) and distributed (15%). It indicates the mainframe's effectiveness and dependability, as well as its continued importance as an essential tool in IT infrastructures.

Key Players Companies

The major global players include IBM Corporation, Broadcom, DXC Technology Company, Hitachi Vantara LLC, Hewlett-Packard, Accenture, ATOS SE, BMC Software Inc., Cognizant and Dell Inc.

COVID-19 Impact Analysis

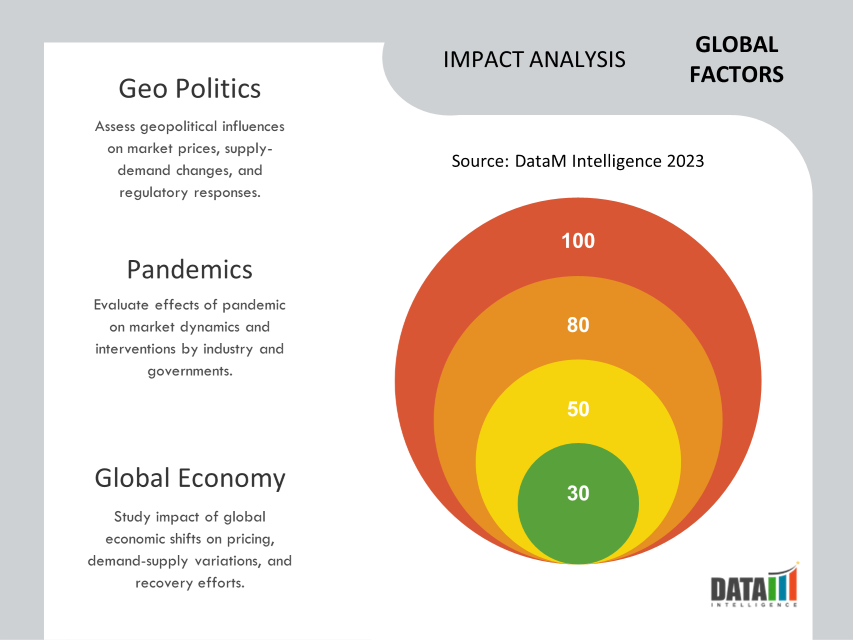

The pandemic has spurred many organizations' and governments' digital transformation efforts, resulting in greater demand for mainframe computer power. Mainframes are well-known for their dependability, security and ability to handle large workloads, making them important for handling critical applications and data amid the pandemic. Companies have been assessing their IT infrastructure since remote work has become the standard in many industries.

According to the 2020 Mainframe Modernization Business Barometer Report, 98% of enterprises planned to migrate standard applications to the cloud in 2020. The capacity to more easily shift workloads to respond to real-time demands, in both cloud environments and within the mainframe, has changed how IT directors view their modernization journey.

Some firms may have considered transferring specific mainframe workloads to the cloud or implementing hybrid cloud techniques to improve remote access and flexibility. The pandemic's economic uncertainty may have pushed some organizations to postpone or cut back mainframe-related projects. Budget constraints may have had an impact on new mainframe acquisitions and upgrades.

Russia- Ukraine War Impact

Geopolitical tensions can increase market uncertainty, causing corporations to postpone or reevaluate investments in large-scale technologies such as mainframes. This uncertainty may have an impact on overall IT spending. Currency fluctuations caused by a geopolitical crisis might affect the expense of imported mainframe hardware and components for diverse countries, thus influencing market demand.

Countries may impose trade restrictions or penalties on each other in response to geopolitical events, potentially hurting the trade of technical products such as mainframe computers. Geopolitical conflicts can have broad economic consequences, influencing GDP growth, consumer spending and business investment. Such economic developments can have an impact on overall IT spending, particularly mainframe system investments.

Key Developments

- In December 2022, IBM, a multinational technology business based in U.S., announced its partnership with AWS to advance mainframe modernization. IBM Ecosystem partners have made it clear that they want to provide the most value to their joint clients. Both firms improved their mainframe product portfolios as a result of this partnership and it had a significant impact on the expansion of the global mainframe market.

- In May 2022, The Open Mainframe Project released the Long Term Support (LTS) V2 release of Zowe, an open source software framework for the mainframe that improves interoperability with modern enterprise applications. The second edition, which will be released two years after the first, will provide vendors and customers with product stability, security, interoperability, as well as easy installation and improved features.

- In June 2020, BMC, a leader in IT solutions for the Autonomous Digital Enterprise, announced the completion of its acquisition of Compuware, a well-known provider of mainframe application development, delivery and performance solutions. The collaboration builds on the achievement of BMC Automated Mainframe Intelligence (AMI) and Compuware's Topaz suite, as well as ISPW technology and product portfolios, for modernizing clients' mainframe environments.

Why Purchase the Report?

- To visualize the global mainframe market segmentation based on type organization size, application, offering, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of mainframe market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global mainframe market report would provide approximately 77 tables, 81 figures and 206 pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies