Global Power Tools Market: Industry Outlook

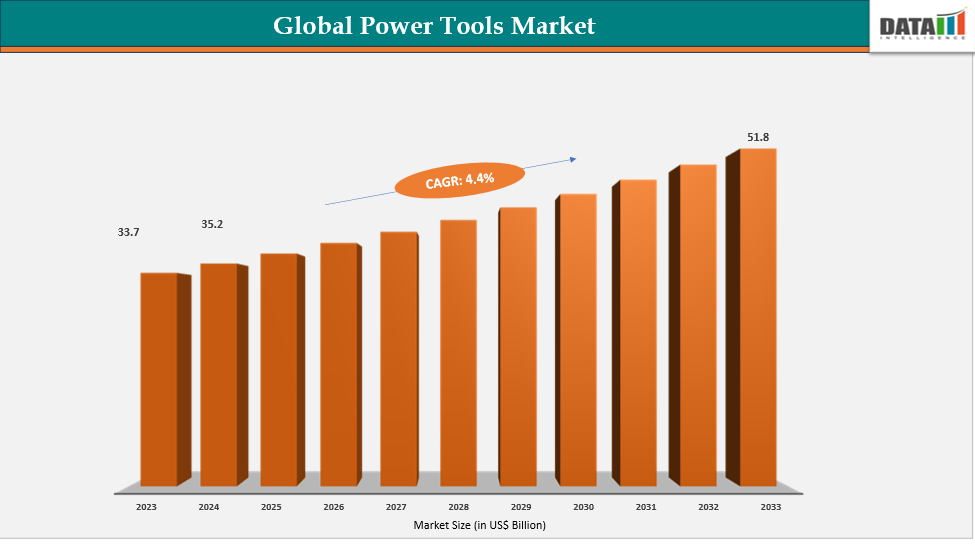

The global power tools market reached US$ 33.7 billion in 2023, with a rise to US$ 35.2 billion in 2024, and is expected to reach US$ 51.8 billion by 2033, growing at a CAGR of 4.4% during the forecast period 2025–2033. The growth of the market is primarily fueled by a surge in global construction activity, particularly in emerging economies, and a rising wave of Do-It-Yourself (DIY) projects among homeowners. The latter trend was accelerated by the COVID-19 pandemic, which spurred investments in home improvement. A significant technological shift is defining the market, that is the relentless transition from corded to cordless tools. Advancements in lithium-ion battery technology, offering greater power and longer runtimes, are making cordless tools the dominant choice, accounting for over 60% of new sales in some regions. This cordless revolution is creating a lucrative ecosystem centered around battery platforms, fostering intense brand loyalty.

Demand is further supported by industrialization and infrastructure development worldwide. For instance, the global construction market is itself expected to reach US$ 14.4 trillion by 2030, directly driving the need for professional-grade power tools. In the DIY segment, online retail channels have become a major driver as consumers seek convenience. Regionally, the Asia-Pacific region is the largest and fastest-growing market, with countries like China and India contributing significantly to demand. Key players like Stanley Black & Decker and Techtronic Industries (TTI) continue to dominate, with TTI's brand MILWAUKEE being a key growth driver. In the United States, a key market, power tool ownership is ubiquitous, with over 90% of professional contractors relying on them daily and a vast majority of households owning at least one cordless drill, underscoring the market's deep penetration.

Key Market Trends & Insights

Asia Pacific holds the largest share owing to factors such as the rising adoption of automation-ready and smart power tools in manufacturing. The region accounted for over 72% of global industrial robot installations in 2023 (International Federation of Robotics), driving complementary tool upgrades.

North America holds the second-largest market share, propelled by factors such as growth in electric vehicle (EV) production, fueling specialized power tool demand. As EV sales in the US surpassed 1.6 million units in 2024 (International Energy Agency), demand for advanced assembly-line power tools is expanding to support this growth.

In Europe, the push toward green construction practices is accelerating cordless and low-emission tool adoption, with the EU pledging to renovate 35 million buildings by 2030 under its Green Deal, significantly expanding demand for energy-efficient power tools.

Market Size & Forecast

2024 Market Size: US$ 35.2 billion

2033 Projected Market Size: US$ 51.8 billion

CAGR (2025–2033): 4.4%

Asia Pacific: Largest and fastest market in 2024

Market Dynamics

Driver: The Rise of the Prosumer and Specialization

A powerful driver energizing the global power tools market is the rapid growth of the "prosumer" segment that are advanced DIY users who demand professional-grade performance. This demographic, which bridges the gap between casual homeowners and full-time tradespeople, seeks specialized tools that offer industrial features such as brushless motors, advanced electronics, and enhanced durability. Their willingness to invest in higher-quality equipment has opened a lucrative new market tier, pushing manufacturers to innovate beyond basic consumer models. This trend is reshaping product lines and marketing strategies across the industry.

Statistics highlight the financial significance of the prosumer segment as it is growing nearly twice as fast as the overall power tools market, with products in this category often priced 30-50% higher than standard DIY tools. Brands such as Festool have built their entire business model on this demand, offering system-based, specialized tools for woodworking that command a premium despite their high cost. Their global success demonstrates the viability of targeting this quality-conscious, performance-driven user base.

The demand is further reflected in the expansion of specialized tool categories. For example, cordless track saws and compact routers, once niche professional products, have seen surging prosumer sales, with some categories growing by over 20% annually. Online communities and social media have amplified this trend, empowering users to research and demand tools specific to projects like fine woodworking or custom furniture making. This has forced brands to create more sophisticated and targeted offerings.

Restraint: High Product Penetration and Market Saturation

A key restraint on the global power tools market is high product penetration and market saturation in developed economies. In regions such as North America and Europe, most professional contractors and a significant majority of households already own essential tools like drills and saws. This limits recurring sales to primarily replacement purchases or upgrades to new battery platforms, rather than first-time buyers. Consequently, growth is heavily reliant on convincing existing users to adopt the latest technology, a slower and more competitive process than expanding into new customer bases, thereby capping the market's expansion potential in these mature regions.

For more details on this report, Request for Sample

Segmentation Analysis

The global power tools market is segmented based on power tool type, mode of operation, distribution channel, end-use, and region.

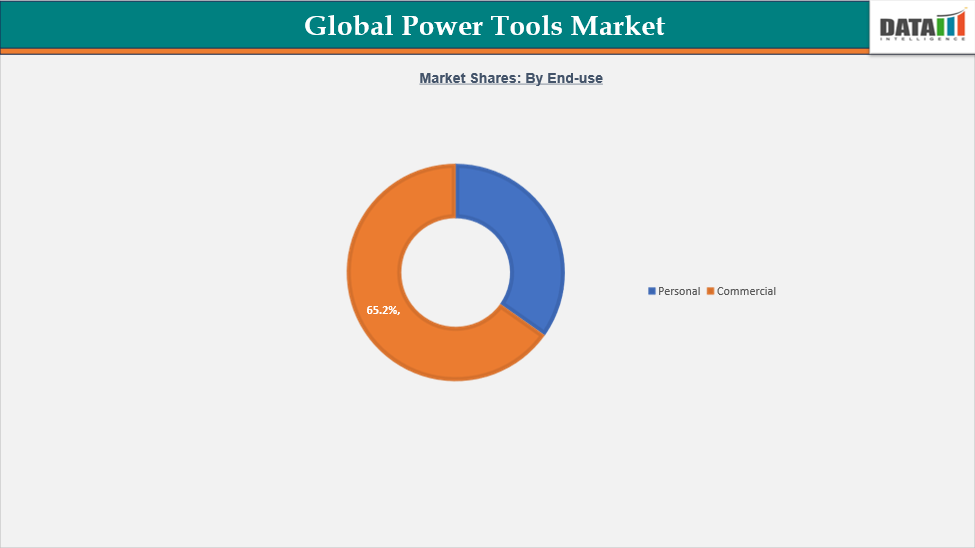

Distribution Channel: The commercial segment is estimated to have 65.2% of the power tools market share.

The commercial segment, encompassing professional trades and industrial users, is the revenue engine of the global power tools market, prized for its demanding specifications and loyalty to high-performance brands. This segment drives innovation, demanding tools that offer exceptional durability, raw power, and reliability for daily use in rigorous environments such as construction sites and manufacturing plants. Professionals prioritize productivity and uptime above all else, making them willing to invest heavily in premium ecosystems that enhance efficiency and reduce user fatigue. This focus on performance over price creates a highly lucrative and competitive landscape for manufacturers.

A key driver is the rapid adoption of cordless technology, with over 75% of professional users now relying primarily on battery-powered platforms for their portability and improved power parity over corded tools. This shift is not merely about convenience but is a strategic investment in workflow efficiency and job site safety, reducing trip hazards and increasing mobility for workers across various trades, from electrical to HVAC.

Hilti Corporation has built a dominant position almost exclusively within the commercial sphere through its unique direct-sales and subscription-like service model. Their Nuron cordless platform is designed as a fully integrated ecosystem, and their fleet management service using SaaS and IoT to track tools on large job sites exemplifies innovation tailored for corporate clients. This approach fosters incredible brand loyalty and creates a recurring revenue stream, insulating them from the volatility of the consumer DIY market and big-box retail competition.

The commercial segment's growth is tethered to global construction and industrial output. With the global construction market itself expected to grow substantially, the demand for professional-grade equipment is assured. Manufacturers succeed by offering complete productivity solutions, including software, services, and unwavering support, directly catering to the commercial user's need for reliability and total cost of ownership over initial purchase price.

Geographical Analysis

The Asia-Pacific power tools market was valued at 35.3% market share in 2024

The Asia-Pacific region is the primary growth engine of the global power tools market, driven by unprecedented urbanization and massive government investments in infrastructure. Megaprojects across China, India, and Southeast Asia are fueling relentless demand for professional-grade equipment from a burgeoning construction sector. This is complemented by a rapidly expanding manufacturing base, which requires industrial tools for production and maintenance, creating a vast and diverse customer base. The region's economic ascent directly translates into booming sales for both domestic and international tool brands.

A key trend is the rapid electrification of tools, with cordless penetration rising by over 20% annually as users leapfrog directly to modern battery platforms. This growth is also fueled by rising disposable incomes, which are expanding the DIY and prosumer segments in metropolitan areas, creating a new tier of demand beyond traditional industrial uses.

A pivotal case study is China's Chervon Group, which evolved from a major OEM to a global brand power. Initially manufacturing for others, Chervon now successfully markets its own brands like Devon and Flex across APAC and beyond, leveraging deep regional manufacturing expertise to offer competitive, high-quality products. Their journey from a component supplier to an innovation leader, challenging established Western brands, exemplifies the region's shifting dynamics and the rise of sophisticated local champions capturing home-field advantage.

This market's future is defined by innovation and localization. Global players must tailor products to local preferences and price points, while domestic manufacturers are increasingly competing on technology, not just cost. The APAC region's combination of industrial might, urban development, and a growing consumer class ensures it will remain the most critical battleground for market share, dictating global strategies for decades to come.

The North America Power Tools market was valued at 31.2% market share in 2024

The North American power tools market is characterized by high penetration, a strong DIY culture, and demand for advanced, premium products from both professionals and prosumers. This mature market is the profitability center for leading brands, where competition revolves around technological innovation, brand loyalty, and ecosystem expansion rather than basic user acquisition. The region's stable construction industry and high disposable incomes create a consistent demand for replacement tools and upgrades to the latest cordless platforms. This environment favors companies that can continuously innovate and capture value through high-margin accessories and batteries.

Despite having a smaller population than APAC, North America holds a significant share, with the professional segment accounting for over 60% of regional revenue. The battery-powered tools constitute over 70% of all professional tool sales in the region. This shift is driven by a willingness to invest in productivity, with professionals spending an average of 15-20% more on new tool acquisitions annually compared to five years ago, prioritizing performance and connectivity.

A defining case study is Techtronic Industries (TTI) and its Milwaukee brand, which has aggressively captured share from legacy players. Milwaukee’s strategy focused exclusively on the professional trades, developing a best-in-class cordless ecosystem around its M18 and M12 platforms. By launching innovative, job-specific solutions such as the M12 FUEL line of compact tools, they addressed unmet needs, fostering intense brand loyalty. This focus allowed Milwaukee to consistently outperform the market growth rate in North America, demonstrating the power of a targeted B2B approach.

Competitive Landscape

The global power tools market features several prominent players, including Stanley Black & Decker, Inc., Techtronic Industries Co. Ltd., Robert Bosch Power Tools GmbH, Makita Corporation, Hilti Corporation, Metabowerke GmbH, Einhell Germany AG, Snap-on Incorporated, Festool GmbH, Apex Tool Group, LLC., among others.

Techtronic Industries Co. Ltd.: Techtronic Industries Co. Ltd. (TTI) is a Hong Kong-based global powerhouse and a leading innovator in the power tools market. Through its strategic portfolio of brands, TTI aggressively targets key segments, that is Milwaukee serves the professional trades with top-tier cordless systems, while RYOBI dominates the DIY sector with its versatile, value-oriented ONE+ platform. Its growth is fueled by relentless innovation in cordless technology and battery ecosystems, driving user loyalty. TTI’s focused strategy has enabled it to effectively challenge and often outperform legacy competitors, making it one of the most dynamic and influential players in the industry worldwide.

Market Scope

Metrics | Details | |

CAGR | 4.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Power Tool Type | Drilling & Fastening, Demolition Tools, Sawing & Cutting Tools, Material Removal Tools, Routing Tools, Others |

Mode of Operation | Electric, Pneumatic and Hydraulic | |

Distribution Channel | Online and Offline | |

End-use | Personal and Commercial | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global power tools market report delivers a detailed analysis with 70 key tables, more than 63 visually impactful figures, and 232 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more related reports, please click here